UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of May 2024

Commission File Number 001-34244

HUDBAY MINERALS INC.

(Translation of registrant’s name into English)

25 York Street, Suite 800

Toronto, Ontario

M5J 2V5, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F x

Exhibit 99.1 of this Form 6-K is incorporated

by reference as an additional exhibit to the registrant’s Registration Statement on Form F-10 (File No. 333-278311)

EXPLANATORY NOTE

On

May 22, 2024, Hudbay Minerals Inc. (“Hudbay”) filed on the SEDAR website at www.sedarplus.ca the following

documents: (1) News Release dated May 22, 2024 and (2) Revised term sheet dated May 22, 2024.

Copies of the filings are attached to this Form 6-K and incorporated

herein by reference, as follows:

| ● | News release dated May 22, 2024; and |

| ● | Revised term sheet dated May 22, 2024 |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

HUDBAY MINERALS INC. |

| |

|

| |

By: |

/s/ Patrick Donnelly |

| |

Name: Patrick Donnelly |

| |

Title: Senior Vice President, Legal and Organizational

Effectiveness |

| Date: May 22, 2024 |

|

EXHIBIT INDEX

Exhibit 99.1

| TSX, NYSE – HBM

2024 No. 8

|

| | |

|  |

| | |

Hudbay Announces Upsize to Bought Deal Equity

Offering to US$350 Million

Toronto, Ontario, May 22, 2024 –

Hudbay Minerals Inc. (“Hudbay” or the “Company”) (TSX, NYSE: HBM) announced that the Company has agreed with

the syndicate of underwriters led by RBC Capital Markets and BMO Capital Markets (collectively, the “Underwriters”) to increase

the size of its previously announced equity offering. The Underwriters have agreed to purchase, on a bought deal basis from the Company,

a total of 36,840,000 common shares of Hudbay (“Common Shares”) at a price of US$9.50 per Common Share for aggregate gross

proceeds of US$349,980,000 (the “Offering”).

Hudbay has also granted the Underwriters an over-allotment

option (the “Over-Allotment Option”) to purchase, on the same terms and conditions of the Offering, up to an additional 15%

of the Common Shares issued in connection with the Offering. The Over-Allotment Option is exercisable, in whole or in part, by the Underwriters

at any time until and including 30 days after closing of the Offering. The maximum gross proceeds raised under the Offering will be US$402,477,000

in the event the Over-Allotment Option is fully exercised.

In all other respects, the terms of the Offering

and the use of proceeds therefrom will remain as previously disclosed in the original press release dated May 21, 2024.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any province, state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any

such province, state or jurisdiction.

Forward-Looking Information

This news release and the previously announced

press release dated May 21, 2024 contains “forward-looking information” and “forward-looking statements”

within the meaning of applicable Canadian and United States securities legislation (collectively herein referred to as “forward-looking

information”). All forward-looking information in news release is qualified by this cautionary note. Often, but not always, forward-looking

information can be identified by the use of words such as “plans”, “expects”, “budget”, “guidance”,

“scheduled” “estimates”, “forecasts”, “strategy”, “target”, “intends”,

“objective”, “goal”, “understands”, “anticipates” and “believes” (and variations

of these or similar words) and statements that certain actions, events or results “may”, “could”, “would”,

“should”, “might” “occur” or “be achieved” or “will be taken” (and variations

of these or similar expressions).

Forward-looking information herein includes, but

is not limited to, statements related to the terms of the Offering, the potential for the Underwriters to exercise the Over-Allotment

Option, and Hudbay’s business, objectives, strategies, and intentions. Forward-looking information is not, and cannot be, a guarantee

of future results or events.

| TSX, NYSE – HBM

2024 No. 8

|

| | |

Forward-looking information is based on,

among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by the Company at the date the

forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors

that may cause actual results and events to be materially different from those expressed or implied by the forward-looking

information. Prospective purchasers should refer to the Prospectus Supplement, Prospectus, and the documents incorporated by

reference in the press release dated May 21, 2024 for further disclosures in respect of the risks, uncertainties, contingencies and

other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information

herein. Subject to applicable securities law requirements, Hudbay undertakes no obligation to update or revise any forward-looking

information after the date of any forward-looking information whether as a result of new information, future events or otherwise or

to explain any material difference between subsequent actual events and any forward-looking information.

About Hudbay

Hudbay (TSX, NYSE: HBM) is a copper-focused mining

company with three long-life operations and a world-class pipeline of copper growth projects in tier-one mining-friendly jurisdictions

of Canada, Peru and the United States.

Hudbay’s operating portfolio includes the

Constancia mine in Cusco (Peru), the Snow Lake operations in Manitoba (Canada) and the Copper Mountain mine in British Columbia (Canada).

Copper is the primary metal produced by the company, which is complemented by meaningful gold production. Hudbay’s growth pipeline

includes the Copper World project in Arizona (United States), the Mason project in Nevada (United States), the Llaguen project in La Libertad

(Peru) and several expansion and exploration opportunities near its existing operations.

The value Hudbay creates and the impact it has

is embodied in its purpose statement: “We care about our people, our communities and our planet. Hudbay provides the metals the

world needs. We work sustainably, transform lives and create better futures for communities.” Hudbay’s mission is to create

sustainable value and strong returns by leveraging its core strengths in community relations, focused exploration, mine development and

efficient operations.

For further information, please contact:

Candace Brûlé

Vice President, Investor Relations

(416) 814-4387

investor.relations@hudbay.com

1381-7614-3372

Exhibit 99.2

Hudbay Minerals Inc.

Bought Deal Treasury Offering of Common Shares

Revised Term Sheet

May 22, 2024

A final base shelf prospectus containing important

information relating to the securities described in this document has been filed with the securities regulatory authorities in each of

the provinces and territories of Canada and included in the registration statement on Form F-10 filed with the U.S. Securities and

Exchange Commission in the United States. A copy of the final base shelf prospectus, any amendment to the final base shelf prospectus

and any applicable prospectus supplement that has been filed, is required to be delivered with this document.

This document does not provide full disclosure

of all material facts relating to the securities offered. Investors should read the final base shelf prospectus, any amendment thereto

and any applicable prospectus supplement for disclosure of those facts, especially risk factors relating to the securities offered, before

making an investment decision.

| Issuer: |

Hudbay Minerals Inc. (“Hudbay” or the “Company”). |

| Offering: |

Treasury offering of 36,840,000 common shares (the “Common Shares”) of the Company. |

| Offering Size: |

US$349,980,000, before giving effect to the over-allotment option. |

| Offering Price: |

US$9.50 per Common Share. |

| Over-Allotment Option: |

The Company has granted to the Underwriters an option exercisable in whole or in part at the sole discretion of the Underwriters at any time up to 30 days after Closing, to purchase from treasury up to an additional 15% of the Offering at the Offering Price and on the same terms and conditions as set forth above, to cover over-allotments, if any, and for market stabilization purposes. |

| Use of Proceeds: |

The net proceeds from the Offering will be used by the Company to fund near-term growth initiatives, including acceleration of mine pre-stripping activities and mill optimization initiatives at Copper Mountain, to enhance balance sheet flexibility through debt repayments as part of its "3P" plan for a sanctioning decision on Copper World, to evaluate mill throughput enhancement opportunities at Constancia and New Britannia, and for general corporate purposes. |

| Form of Offering: |

Bought deal by way of a prospectus supplement (the “Prospectus Supplement”) to the Company’s short form base shelf prospectus dated March 28, 2024 (the “Prospectus”) to be filed in all provinces and territories of Canada, except Quebec, and in the United States pursuant to the multi-jurisdictional disclosure system. In jurisdictions outside of Canada and the United States in accordance with applicable laws provided that no prospectus, registration statement or similar document is required to be filed in such jurisdictions in connection with the Offering. |

| Standstill: |

The Company and its executive officers and directors have agreed not to issue or sell any equity securities for a period of 90 days following closing of the Offering, subject to customary exceptions. |

| Listing: |

The existing Common Shares trade on the Toronto Stock Exchange (the “TSX”) and New York Stock Exchange (the “NYSE”) under the symbol “HBM”. Applications will be made to list the Common Shares sold under the Offering on the TSX and NYSE. |

| Eligibility: |

Eligible for RRSPs, RRIFs, RESPs, RDSPs, TFSAs, DPSPs and FHSAs. |

| Joint Bookrunners: |

RBC Capital Markets and BMO Capital Markets. |

| Commission: |

Cash commission equal to 4.0% of the gross proceeds of the Offering (and over-allotment option as applicable) payable on Closing to the Underwriters. |

| Closing: |

May 24, 2024, or such other date as may be mutually agreed to by the Company and the Joint Bookrunners, on behalf of the Underwriters. |

Before investing, prospective purchasers should

read the Prospectus Supplement, the Prospectus and the documents incorporated by reference therein for more complete information about

the Company and the Offering. A copy of the Prospectus is, and a copy of the Prospectus Supplement will be, available free of charge

on SEDAR+ (http://www.sedarplus.ca) and on the SEC website (http://www.sec.gov). Alternatively, copies may be obtained

upon request in Canada by contacting RBC Capital Markets, Attn: Distribution Centre, RBC Wellington Square, 8th Floor, 180 Wellington

St. W., Toronto, Ontario, M5J 0C2 at Phone: 416-842-5349; E-mail: Distribution.RBCDS@rbccm.com and in the United States from RBC

Capital Markets, LLC, 200 Vesey Street, 8th Floor, New York, NY 10281-8098; Attention: Equity Syndicate; Phone: 877-822-4089; Email:

equityprospectus@rbccm.com. Additionally, copies of these documents may be obtained upon request in Canada by contacting BMO Capital

Markets by mail at Brampton Distribution Centre c/o The Data Group of Companies, 9195 Torbram Road, Brampton, ON, L6S 6H2, by telephone

at 905-791-3151 Ext 4312, or by email at torbramwarehouse@datagroup.ca, and in the United States by contacting BMO Capital Markets

Corp. by mail at 151 W 42nd Street, 32nd Floor, New York, NY 10036, Attn: Equity Syndicate Department, by telephone at 1-800-414-3627,

or by email at bmoprospectus@bmo.com.

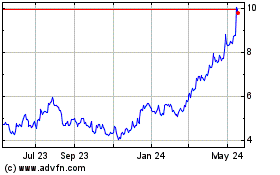

HudBay Minerals (NYSE:HBM)

Historical Stock Chart

From Dec 2024 to Jan 2025

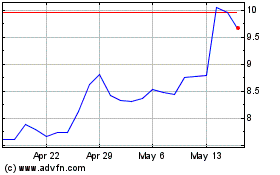

HudBay Minerals (NYSE:HBM)

Historical Stock Chart

From Jan 2024 to Jan 2025