Revenue of $1.5 billion, up 69% year-over-year

in 2024

Net income of $126 million; Adjusted EBITDA of

$177 million in 2024

Subscribers grew to 2.2 million, up 45%

year-over-year in 2024

Provides Q1 and full year 2025 guidance, with

full year 2025 revenue in the range of $2.3 billion to $2.4 billion

and Adjusted EBITDA in the range of $270 million to $320

million

Hims & Hers Health, Inc. (“Hims & Hers” or the

“Company”, NYSE: HIMS), the leading health and wellness platform,

today announced financial results for the fourth quarter and full

year ended December 31, 2024 in a shareholder letter that is posted

at investors.hims.com.

“2024 was a fantastic year at Hims and Hers as we continue to

build a platform that leverages personalization and technology

unlike any traditional healthcare system,” said Andrew Dudum,

co-founder and CEO. “Over 2 million subscribers now entrust Hims

& Hers to aid them in their journey to better health - with

thousands more joining daily. In the coming years, we expect to

further transform how individuals can improve their health with

more comprehensive treatments, technologies that normalize

unlimited follow up support, and tools that can eventually be

exported beyond Hims and Hers, enabling even more Americans to

access this care. We believe an ongoing focus in these areas will

allow every household in the country to access high quality,

precision care that is convenient and affordable and expect 2025

will be another exciting step toward our vision of this

next-generation of healthcare.”

Yemi Okupe, CFO, stated, “The success we are experiencing is a

direct reflection of our improving ability to democratize access to

high quality, personalized care across each of our specialties.

Revenue excluding our GLP-1 offering increased 43% year-over-year

to over $1.2 billion in 2024, meeting our previous 2025 revenue

target a year early. Consolidated revenue increased 69%

year-over-year to nearly $1.5 billion as our weight loss offering

continues to offer an accelerant to these trends. We believe this

signifies our platform's growing ability to enter new specialties

and scale rapidly, further establishing confidence that we are

building a set of core capabilities that can scale with tremendous

efficiency. This evolution is positioning us to serve tens of

millions of individuals over time while simultaneously progressing

toward our long-term profitability targets.”

Key Business Metrics

(In Thousands, Except for Monthly Online

Revenue per Average Subscriber and AOV, Unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

% Change

2024

2023

% Change

Subscribers (end of period)

2,229

1,537

45

%

2,229

1,537

45

%

Monthly Online Revenue per Average

Subscriber

$

73

$

53

38

%

$

64

$

54

19

%

Net Orders

2,807

2,298

22

%

10,459

8,676

21

%

AOV

$

168

$

103

63

%

$

137

$

97

41

%

Revenue

(In Thousands, Unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

% Change

2024

2023

% Change

Online Revenue

$

470,760

$

237,363

98

%

$

1,437,937

$

842,381

71

%

Wholesale Revenue

10,379

9,256

12

%

38,577

29,619

30

%

Total revenue

$

481,139

$

246,619

95

%

$

1,476,514

$

872,000

69

%

Fourth Quarter 2024 Financial Highlights

- Revenue was $481.1 million for the fourth quarter of

2024 compared to $246.6 million for the fourth quarter of 2023, an

increase of 95% year-over-year.

- Gross margin was 77% for the fourth quarter of 2024

compared to 83% for the fourth quarter of 2023.

- Net income was $26.0 million for the fourth quarter of

2024 compared to $1.2 million for the fourth quarter of 2023.

- Adjusted EBITDA was $54.1 million for the fourth quarter

of 2024 compared to $20.6 million for the fourth quarter of

2023.

- Net cash provided by operating activities was $86.4

million for the fourth quarter of 2024 compared to $22.0 million

for the fourth quarter of 2023.

- Free Cash Flow was $59.5 million for the fourth quarter

of 2024 compared to $10.8 million for the fourth quarter of

2023.

Full Year 2024 Financial Highlights

- Revenue was $1,476.5 million for the year ended December

31, 2024 compared to $872.0 million for the year ended December 31,

2023, an increase of 69% year-over-year.

- Gross margin was 79% for the year ended December 31,

2024 compared to 82% for the year ended December 31, 2023.

- Net income was $126.0 million for the year ended

December 31, 2024, which was impacted by the change in valuation

allowance of $68.0 million due to the full release of the valuation

allowance on our domestic deferred tax assets. The benefit from the

change in valuation allowance was partially offset by current

period tax activity. This compared to a net loss of $(23.5) million

for the year ended December 31, 2023.

- Adjusted EBITDA was $176.9 million for the year ended

December 31, 2024 compared to $49.5 million for the year ended

December 31, 2023.

- Net cash provided by operating activities was $251.1

million for the year ended December 31, 2024 compared to $73.5

million for the year ended December 31, 2023.

- Free Cash Flow was $198.3 million for the year ended

December 31, 2024 compared to $47.0 million for the year ended

December 31, 2023.

Reconciliations of Adjusted EBITDA and Free Cash Flow, non-GAAP

measures, to net income (loss) and net cash provided by operating

activities, respectively, their most comparable financial measures

under generally accepted accounting principles in the United States

(“U.S. GAAP”), have been provided in this press release in the

accompanying tables. Additional information about Adjusted EBITDA

and Free Cash Flow is also included below under the heading

“Non-GAAP Financial Measures”.

Financial Outlook

Hims & Hers is providing the following guidance:

For the first quarter 2025, we expect:

- Revenue of $520 million to $540 million.

- Adjusted EBITDA of $55 million to $65 million, reflecting an

Adjusted EBITDA margin of 11% to 12%.

For the full year 2025, we expect:

- Revenue of $2.3 billion to $2.4 billion.

- Adjusted EBITDA of $270 million to $320 million, reflecting an

Adjusted EBITDA margin of 12% to 13%.

The guidance provided above constitutes forward-looking

statements and actual results may differ materially. Refer to the

“Cautionary Note Regarding Forward-Looking Statements” safe harbor

section below for information on the factors that could cause our

actual results to differ materially from these forward-looking

statements.

We have relied upon the exception in Item 10(e)(1)(i)(B) of

Regulation S-K and have not reconciled forward-looking Adjusted

EBITDA to its most directly comparable U.S. GAAP measure, net

income (loss), because we cannot predict with reasonable certainty

the ultimate outcome of certain components of such reconciliations,

including market-related assumptions that are not within our

control, or others that may arise, without unreasonable effort. For

these reasons, we are unable to assess the probable significance of

the unavailable information, which could materially impact the

amount of future net income (loss). See “Non-GAAP Financial

Measures” for additional important information regarding Adjusted

EBITDA.

Conference Call

Hims & Hers will host a conference call to review the fourth

quarter and full year 2024 results on February 24, 2025, at 5:00

p.m. ET. The conference call can be accessed by dialing +1 (888)

510-2630 for U.S. participants and +1 (646) 960-0137 for

international participants, and referencing conference ID #1704296.

A live audio webcast will be available online at

investors.hims.com. A replay of the call will be available via

webcast for on-demand listening shortly after the completion of the

call at the same link.

About Hims & Hers Health, Inc.

Hims & Hers is the leading health and wellness platform on a

mission to help the world feel great through the power of better

health.

We believe how you feel in your body and mind transforms how you

show up in life. That’s why we’re building a future where nothing

stands in the way of harnessing this power. Hims & Hers

normalizes health & wellness challenges—and innovates on their

solutions—to make feeling happy and healthy easy to achieve. No two

people are the same, so the Company provides access to personalized

care designed for results.

For more information, please visit investors.hims.com.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements can be identified by the

use of forward-looking terminology, including the words “believe,”

“estimate,” “anticipate,” “expect,” “assume,” “imply,” “intend,”

“plan,” “may,” “will,” “potential,” “project,” “predict,”

“continue,” “could,” “confident,” “confidence,” or “should,” or, in

each case, their plural, their negative or other variations or

comparable terminology. There can be no assurance that actual

results will not materially differ from expectations. Such

statements include, but are not limited to, any statements relating

to our financial outlook and guidance, including our mission to

drive top-line growth and profitability and our ability to attain

our medium- and long-term financial and operational targets; our

expected future financial and business performance, including with

respect to the Hims & Hers platform, our marketing campaigns,

investments in innovation, the solutions accessible on our

platform, and our infrastructure, and the underlying assumptions

with respect to the foregoing; statements relating to events and

trends relevant to us, including with respect to our regulatory

environment, financial condition, results of operations, short- and

long-term business operations, objectives, and financial needs;

expectations regarding our mobile applications, market acceptance,

user experience, customer retention, brand development, our ability

to invest and generate a return on any such investment, customer

acquisition costs, operating efficiencies and leverage (including

our fulfillment capabilities), the effect of any pricing decisions,

changes in our product or offering mix, the timing and market

acceptance of any new products or offerings, the timing and

anticipated effect of any pending or recently completed

acquisitions, the success of our business model, our market

opportunity, our ability to scale our business, the growth of

certain of our specialties, our ability to innovate on and expand

the scope of our offerings and experiences, including through the

use of data analytics and artificial intelligence, our ability to

reinvest into the customer experience, our ability to comply with

the extensive, complex and evolving legal and regulatory

requirements applicable to our business, including without

limitation state and federal healthcare, privacy and consumer

protection laws and regulations, and the effect or outcome of

litigation or governmental actions in relation to any such legal

and regulatory requirements. These statements are based on

management’s current expectations, but actual results may differ

materially due to various factors.

The forward-looking statements contained in this press release

are based on our current expectations and beliefs concerning future

developments and their potential effects on us. Future developments

affecting us may not be those that we have anticipated. These

forward-looking statements involve a number of risks, uncertainties

(some of which are beyond our control) and other assumptions that

may cause actual results or performance to be materially different

from those expressed or implied by these forward-looking

statements. These risks and uncertainties include, but are not

limited to, those factors described in the “Risk Factors” section

of each of our most recently filed Quarterly Report on Form 10-Q,

our most recently filed Annual Report on Form 10-K, and any of our

subsequent filings with the Securities and Exchange Commission (the

“Commission”).

Should one or more of these risks or uncertainties materialize,

or should any of our assumptions prove incorrect, actual results

may vary in material respects from those projected in these

forward-looking statements. We undertake no obligation (and

expressly disclaim any obligation) to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws. These risks and others described in the

“Risk Factors” section of each of our most recently filed Quarterly

Report on Form 10-Q, our most recently filed Annual Report on Form

10-K, and any of our subsequent filings with the Commission may not

be exhaustive.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. We caution

you that forward-looking statements are not guarantees of future

performance and that our actual results of operations, financial

condition and liquidity, and developments in the industry in which

we operate may differ materially from those made in or suggested by

the forward-looking statements contained in reports we have filed

or will file with the Commission, including our most recently filed

Annual Report on Form 10-K, our most recently filed Quarterly

Report on Form 10-Q, and any of our subsequent filings with the

Commission. In addition, even if our results of operations,

financial condition and liquidity, and developments in the industry

in which we operate are consistent with the forward-looking

statements contained in such reports, those results or developments

may not be indicative of results or developments in subsequent

periods.

Key Business Metrics

“Online Revenue” represents the sales of products and

services on our platform, net of refunds, credits, and chargebacks,

and includes revenue recognition adjustments recorded pursuant to

U.S. GAAP, primarily relating to deferred revenue and returns

reserve. Online Revenue is generated by selling directly to

consumers through our websites and mobile applications. Our Online

Revenue consists of products and services purchased by customers

directly through our online platform. The majority of our Online

Revenue is subscription-based, where customers agree to be billed

on a recurring basis to have products and services automatically

delivered to them.

“Wholesale Revenue” represents non-prescription product

sales to retailers through wholesale purchasing agreements.

Wholesale Revenue also includes non-prescription product sales to

third-party platforms through consignment arrangements. In addition

to being revenue generative and profitable, wholesale partnerships

and consignment arrangements have the added benefit of generating

brand awareness with new customers in physical environments and on

third-party platforms.

“Subscribers” are customers who have one or more

“Subscriptions” pursuant to which they have agreed to be

automatically billed on a recurring basis at a defined cadence. The

Subscription billing cadence is typically defined as a number of

days (for example, billed every 30 days or every 90 days), which

are excluded from our reporting when payment has not occurred at

the contracted billing cadence. Subscribers can cancel or snooze

Subscriptions in between billing periods to stop receiving

additional products and/or services and can reactivate

Subscriptions to continue receiving additional products and/or

services.

“Monthly Online Revenue per Average Subscriber” is

defined as Online Revenue divided by “Average Subscribers”, which

amount is then further divided by the number of months in a period.

“Average Subscribers” are calculated as the sum of the

Subscribers at the beginning and end of a given period divided by

2.

“Net Orders” are defined as the number of online customer

orders minus transactions related to refunds, credits, chargebacks,

and other negative adjustments. Net Orders represent transactions

made on our platform during a defined period of time and exclude

revenue recognition adjustments recorded pursuant to U.S. GAAP.

Average Order Value (“AOV”) is defined as Online Revenue

divided by Net Orders.

CONSOLIDATED BALANCE

SHEETS

(In Thousands, Except Share and

Per Share Data)

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

220,584

$

96,663

Short-term investments

79,667

124,318

Inventory

64,427

22,464

Prepaid expenses and other current

assets

31,153

21,608

Total current assets

395,831

265,053

Restricted cash

856

856

Goodwill

112,728

110,881

Property, equipment, and software, net

82,083

36,143

Intangible assets, net

43,410

18,574

Operating lease right-of-use assets

10,881

9,588

Deferred tax assets, net

61,603

—

Other long-term assets

147

91

Total assets

$

707,539

$

441,186

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

$

91,180

$

43,070

Accrued liabilities

53,013

28,972

Deferred revenue

75,285

7,733

Earn-out payable

—

7,412

Operating lease liabilities

1,889

1,281

Total current liabilities

221,367

88,468

Operating lease liabilities

9,456

8,667

Other long-term liabilities

—

22

Total liabilities

230,823

97,157

Commitments and contingencies

Stockholders' equity:

Common stock – Class A shares, par value

$0.0001, 2,750,000,000 shares authorized and 212,459,586 and

205,104,120 shares issued and outstanding as of December 31, 2024

and 2023, respectively; Class V shares, par value $0.0001,

10,000,000 shares authorized and 8,377,623 shares issued and

outstanding as of December 31, 2024 and 2023

22

21

Additional paid-in capital

719,155

712,307

Accumulated other comprehensive loss

(324

)

(124

)

Accumulated deficit

(242,137

)

(368,175

)

Total stockholders' equity

476,716

344,029

Total liabilities and stockholders'

equity

$

707,539

$

441,186

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(In Thousands, Except Share and

Per Share Data)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Revenue

$

481,139

$

246,619

$

1,476,514

$

872,000

Cost of revenue

111,598

42,561

303,379

157,051

Gross profit

369,541

204,058

1,173,135

714,949

Gross margin %

77

%

83

%

79

%

82

%

Operating expenses:(1)

Marketing

221,085

125,895

678,844

446,435

Operations and support

58,083

32,839

185,802

119,857

Technology and development

23,749

13,405

78,819

48,227

General and administrative

48,028

32,319

167,767

129,883

Total operating expenses

350,945

204,458

1,111,232

744,402

Income (loss) from operations

18,596

(400

)

61,903

(29,453

)

Other income (expense):

Change in fair value of liabilities

—

(19

)

—

(1,075

)

Other income, net

3,695

2,615

9,808

8,957

Total other income, net

3,695

2,596

9,808

7,882

Income (loss) before taxes

22,291

2,196

71,711

(21,571

)

Benefit (provision) for income taxes

3,734

(951

)

54,327

(1,975

)

Net income (loss)

26,025

1,245

126,038

(23,546

)

Other comprehensive (loss) income

(553

)

9

(200

)

153

Total comprehensive income (loss)

$

25,472

$

1,254

$

125,838

$

(23,393

)

Net income (loss) per share attributable

to common stockholders:

Basic

$

0.12

$

0.01

$

0.58

$

(0.11

)

Diluted

$

0.11

$

0.01

$

0.53

$

(0.11

)

Weighted average shares outstanding:

Basic

219,027,485

211,584,915

215,939,037

209,344,712

Diluted

240,725,350

221,850,856

236,808,876

209,344,712

______________

(1) Includes stock-based compensation

expense as follows (in thousands):

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Marketing

$

2,637

$

1,559

$

9,392

$

5,477

Operations and support

2,743

1,920

10,205

6,815

Technology and development

3,824

1,921

12,534

7,126

General and administrative

15,145

12,391

60,191

46,662

Total stock-based compensation expense

$

24,349

$

17,791

$

92,322

$

66,080

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In Thousands)

Years Ended December

31,

2024

2023

Operating activities

Net income (loss)

$

126,038

$

(23,546

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities

Depreciation and amortization

17,088

9,515

Stock-based compensation

92,322

66,080

Change in fair value of liabilities

—

1,075

Net accretion on securities

(4,355

)

(5,686

)

Benefit for deferred taxes

(61,649

)

(13

)

Impairment of long-lived assets

114

429

Non-cash operating lease cost

2,546

1,922

Non-cash acquisition-related costs

—

2,691

Non-cash other

357

195

Changes in operating assets and

liabilities:

Inventory

(41,612

)

(902

)

Prepaid expenses and other current

assets

(9,494

)

(6,395

)

Other long-term assets

(56

)

(58

)

Accounts payable

43,710

7,324

Accrued liabilities

23,791

16,524

Deferred revenue

67,552

6,261

Operating lease liabilities

(2,443

)

(1,933

)

Earn-out payable

(2,825

)

—

Net cash provided by operating

activities

251,084

73,483

Investing activities

Purchases of investments

(160,564

)

(157,239

)

Maturities of investments

208,940

170,051

Proceeds from sales of investments

725

1,574

Investment in website development and

internal-use software

(11,095

)

(9,272

)

Purchases of property, equipment, and

intangible assets

(41,655

)

(17,220

)

Acquisition of business, net of cash

acquired

(15,399

)

—

Net cash used in investing activities

(19,048

)

(12,106

)

Financing activities

Proceeds from exercise of vested stock

options

26,651

2,322

Payments for taxes related to net share

settlement of equity awards

(52,501

)

(14,096

)

Repurchases of common stock

(83,039

)

(1,999

)

Payments for acquisition-related earn-out

consideration

(3,190

)

—

Proceeds from employee stock purchase

plan

3,901

2,298

Proceeds from exercise of Class A common

stock warrants

333

—

Net cash used in financing activities

(107,845

)

(11,475

)

Foreign currency effect on cash and cash

equivalents

(270

)

(11

)

Increase in cash, cash equivalents, and

restricted cash

123,921

49,891

Cash, cash equivalents, and restricted

cash at beginning of period

97,519

47,628

Cash, cash equivalents, and restricted

cash at end of period

$

221,440

$

97,519

Reconciliation of cash, cash

equivalents, and restricted cash

Cash and cash equivalents

$

220,584

$

96,663

Restricted cash

856

856

Total cash, cash equivalents, and

restricted cash

$

221,440

$

97,519

Supplemental disclosures of cash flow

information

Cash paid for taxes

$

7,916

$

1,109

Non-cash investing and financing

activities

Purchases of property and equipment

included in accounts payable and accrued liabilities

$

7,781

$

3,383

Right-of-use asset obtained in exchange

for lease liability

2,593

6,270

Issuance of common stock for

acquisition-related earn-out consideration

1,396

—

Issuance of common stock and liabilities

assumed in connection with acquisition of business

16,000

—

Non-GAAP Financial Measures

In addition to our financial results determined in accordance

with U.S. GAAP, we present Adjusted EBITDA (which is a non-GAAP

financial measure), Adjusted EBITDA margin (which is a non-GAAP

ratio), and Free Cash Flow (which is a non-GAAP financial measure)

each as defined below. We use Adjusted EBITDA, Adjusted EBITDA

margin, and Free Cash Flow to evaluate our ongoing operations and

for internal planning and forecasting purposes. We believe that

Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow, when

taken together with the corresponding U.S. GAAP financial measures,

provide meaningful supplemental information regarding our

performance by excluding certain items that may not be indicative

of our business, results of operations, or outlook. We consider

Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow to be

important measures because they help illustrate underlying trends

in our business and our historical operating performance on a more

consistent basis. We believe that the use of Adjusted EBITDA,

Adjusted EBITDA margin, and Free Cash Flow is helpful to our

investors as they are used by management in assessing the health of

our business, our operating performance, and our liquidity.

However, non-GAAP financial information is presented for

supplemental informational purposes only, has limitations as an

analytical tool, and should not be considered in isolation or as a

substitute for financial information presented in accordance with

U.S. GAAP. In addition, other companies, including companies in our

industry, may calculate similarly-titled non-GAAP financial

measures or ratios differently or may use other financial measures

or ratios to evaluate their performance, all of which could reduce

the usefulness of Adjusted EBITDA, Adjusted EBITDA margin, and Free

Cash Flow as tools for comparison. Reconciliations are provided

below to the most directly comparable financial measures stated in

accordance with U.S. GAAP. Investors are encouraged to review our

U.S. GAAP financial measures and not to rely on any single

financial measure to evaluate our business.

Adjusted EBITDA is a key performance measure that our management

uses to assess our operating performance. Because Adjusted EBITDA

facilitates internal comparisons of our historical operating

performance on a more consistent basis, we use this measure for

business planning purposes. “Adjusted EBITDA” is defined as net

income (loss) before stock-based compensation, depreciation and

amortization, acquisition and transaction-related costs (which

includes (i) consideration paid for employee compensation with

vesting requirements incurred directly as a result of acquisitions,

inclusive of revaluation of earn-out consideration recorded in

general and administrative expenses prior to 2024, and (ii)

transaction professional services), legal settlement expenses that

are considered non-recurring, impairment of long-lived assets,

change in fair value of liabilities, interest income, and income

taxes. “Adjusted EBITDA margin” is defined as Adjusted EBITDA

divided by revenue.

Some of the limitations of Adjusted EBITDA include (i) Adjusted

EBITDA does not properly reflect capital commitments to be paid in

the future, and (ii) although depreciation and amortization are

non-cash charges, the underlying assets may need to be replaced and

Adjusted EBITDA does not reflect these capital expenditures. In

evaluating Adjusted EBITDA, you should be aware that in the future

we will incur expenses similar to the adjustments in this

presentation. Our presentation of Adjusted EBITDA should not be

construed as an inference that our future results will be

unaffected by these expenses or any unusual or non-recurring items.

We compensate for these limitations by providing specific

information regarding the U.S. GAAP items excluded from Adjusted

EBITDA. When evaluating our performance, you should consider

Adjusted EBITDA in addition to, and not as a substitute for, other

financial performance measures, including our net income (loss) and

other U.S. GAAP results.

Net Income (Loss) to

Adjusted EBITDA Reconciliation

(In Thousands, Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Revenue

$

481,139

$

246,619

$

1,476,514

$

872,000

Net income (loss)

26,025

1,245

126,038

(23,546

)

Stock-based compensation

24,349

17,791

92,322

66,080

Depreciation and amortization

6,061

2,658

17,088

9,515

Acquisition and transaction-related

costs

2,155

507

3,979

3,016

Legal settlement

2,008

—

2,008

—

Impairment of long-lived assets

—

—

114

429

Change in fair value of liabilities

—

19

—

1,075

Interest income

(2,741

)

(2,601

)

(10,349

)

(9,029

)

(Benefit) provision for income taxes

(3,734

)

951

(54,327

)

1,975

Adjusted EBITDA

$

54,123

$

20,570

$

176,873

$

49,515

Net income (loss) as a % of revenue

5

%

1

%

9

%

(3

)%

Adjusted EBITDA margin

11

%

8

%

12

%

6

%

Free Cash Flow is a key performance measure that our management

uses to assess our liquidity. Because Free Cash Flow facilitates

internal comparisons of our historical liquidity on a more

consistent basis, we use this measure for business planning

purposes. “Free Cash Flow” is defined as net cash provided by

operating activities, less purchases of property, equipment, and

intangible assets and investment in website development and

internal-use software in investing activities.

Some of the limitations of Free Cash Flow include (i) Free Cash

Flow does not represent our residual cash flow for discretionary

expenditures and our non-discretionary commitments, and (ii) Free

Cash Flow includes capital expenditures, the benefits of which may

be realized in periods subsequent to those in which the

expenditures took place. In evaluating Free Cash Flow, you should

be aware that in the future we will have cash outflows similar to

the adjustments in this presentation. Our presentation of Free Cash

Flow should not be construed as an inference that our future

results will be unaffected by these cash outflows or any unusual or

non-recurring items. When evaluating our performance, you should

consider Free Cash Flow in addition to, and not as a substitute

for, other financial performance measures, including our net cash

provided by operating activities and other U.S. GAAP results.

Net Cash Provided By Operating

Activities to Free Cash Flow Reconciliation

(In Thousands, Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net cash provided by operating

activities

$

86,385

$

21,983

$

251,084

$

73,483

Less: purchases of property, equipment,

and intangible assets in investing activities

(24,520

)

(8,631

)

(41,655

)

(17,220

)

Less: investment in website development

and internal-use software in investing activities

(2,365

)

(2,567

)

(11,095

)

(9,272

)

Free Cash Flow

$

59,500

$

10,785

$

198,334

$

46,991

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224659899/en/

Investor Relations Bill Newby Investors@forhims.com

Media Relations Abby Reisinger Press@forhims.com

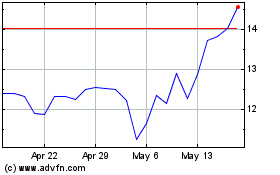

Hims and Hers Health (NYSE:HIMS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hims and Hers Health (NYSE:HIMS)

Historical Stock Chart

From Feb 2024 to Feb 2025