Strong operating performance and cash flow

generation in challenging environment

Third Quarter 2024 Highlights

- Net sales of $915 million in the third quarter, down 5%

year-over-year

- Net income of $36 million, or $1.39 per diluted share, in the

third quarter, up 38% from the third quarter of 2023

- EBITDA of $85 million in the third quarter, or 9.3% of net

sales, up 8% year-over-year

- Operating profit margin of 5.9% in the third quarter, up from

4.8% in the third quarter of 2023

- Quarterly dividend of $1.05 per share paid, totaling $27

million in the third quarter

- Cash flows provided by operations of $402 million for the LTM

period ended September 30, 2024

- Strong liquidity position with $161 million of cash and cash

equivalents and $383 million of availability on revolving credit

facility at September 30, 2024

LCI Industries (NYSE: LCII), a leading supplier of engineered

components to the recreation and transportation markets, today

reported third quarter 2024 results.

"Despite a challenging RV and Marine industry backdrop, we

delivered a strong quarter with continued market share expansion,

increased operating margins, and robust operating cash flow which

has reached $402 million over the last twelve months. Share gains

were particularly strong across appliances, awnings, chassis,

furniture, and windows, which together represent more than 70% of

our total North American RV OEM business. These gains were fueled

by innovative products like the new line of CURT towing and

suspension products we showcased at the September Open House,”

commented Jason Lippert, LCI Industries’ President and Chief

Executive Officer. “As a result, our key customers have maintained

and increased the amount of Lippert content across their 2025 RV

models. At the same time, we believe our commitment to operational

excellence, including product quality and supply chain improvement

initiatives, drove further margin expansion. Looking ahead, we

believe we’re positioned to outperform as demand rebounds, powered

by our cutting-edge innovation and a prioritization of strategic

M&A to further enhance our diversification and long-term growth

potential.”

“I’d like to thank our team members for their dedication to

driving our business forward this quarter while working through a

challenging environment,” commented Ryan Smith, LCI Industries'

Group President - North America. “We remain focused on leveraging

our operational expertise and culture of innovation to support

long-term growth for Lippert.”

Third Quarter 2024 Results

Consolidated net sales for the third quarter of 2024 were $915.5

million, a decrease of 5% from 2023 third quarter net sales of

$959.3 million. Net income in the third quarter of 2024 was $35.6

million, or $1.39 per diluted share, compared to $25.9 million, or

$1.02 per diluted share, in the third quarter of 2023. EBITDA in

the third quarter of 2024 was $85.2 million, compared to EBITDA of

$78.9 million in the third quarter of 2023. Additional information

regarding EBITDA, as well as reconciliations of this non-GAAP

financial measure to the most directly comparable GAAP financial

measure of net income, is provided in the "Supplementary

Information - Reconciliation of Non-GAAP Measures" section

below.

The decrease in year-over-year net sales for the third quarter

of 2024 was primarily driven by lower sales to North American

marine and utility trailer OEMs and declines in wholesale shipments

of motorhome RV units, partially offset by increased North American

RV wholesale shipments of travel trailers and fifth-wheels and

market share gains in the automotive aftermarket.

October 2024 Results

October 2024 consolidated net sales were approximately $330

million, down 4% from October 2023, primarily due to an approximate

12% decline in marine sales and an approximate 3% decrease in North

American RV production compared to October 2023.

OEM Segment - Third Quarter Performance

OEM net sales for the third quarter of 2024 were $684.5 million,

a decrease of $44.0 million compared to the same period of 2023. RV

OEM net sales for the third quarter of 2024 were $422.0 million,

down 2% compared to the same prior year period, driven by a shift

in unit mix towards lower content single axle travel trailers and a

25% decrease in motorhome wholesale shipments, partially offset by

an 11% increase in North American travel trailer and fifth-wheel

wholesale shipments and market share gains. Adjacent Industries OEM

net sales for the third quarter of 2024 were $262.4 million, down

12% year-over-year, primarily due to lower sales to North American

marine and utility trailers OEMs, driven by current dealer

inventory levels, inflation, and elevated interest rates impacting

retail consumers. North American marine OEM net sales in the third

quarter of 2024 were $60.8 million, down 16% year-over-year.

Operating profit of the OEM Segment was $21.8 million in the

third quarter of 2024, or 3.2% of net sales, compared to $11.2

million, or 1.5% of net sales, in the same period in 2023. The

operating profit expansion of the OEM Segment for the quarter was

primarily driven by operational improvements, partially offset by

the impact of fixed costs spread over decreased sales.

Aftermarket Segment - Third Quarter Performance

Aftermarket net sales for the third quarter of 2024 were $231.0

million, in line with the same period in 2023. Resiliency in the

Aftermarket Segment was primarily driven by market share gains in

the automotive aftermarket, partially offset by lower volumes

within the RV aftermarket, which has been negatively impacted by

lower consumer discretionary spending. Operating profit of the

Aftermarket Segment was $32.1 million in the third quarter of 2024,

or 13.9% of net sales, compared to $34.4 million, or 14.9% of net

sales, in the same period in 2023. The operating profit contraction

of the Aftermarket Segment for the quarter was primarily driven by

increased labor costs due to product mix and increased facility

costs resulting from investments to expand capacity within the

automotive aftermarket, partially offset by decreased material

costs.

“Our automotive aftermarket business has continued to

outperform, delivering a 7.3% increase in sales to help offset

softness in the RV and Marine aftermarkets. We’re also capitalizing

on the growing demand for replacement and repair parts by providing

innovative content coupled with high quality service, setting us

apart for both dealers and consumers,” commented Jamie Schnur, LCI

Industries’ Group President – Aftermarket. “We look forward to

further expanding our presence in premium markets to support

Lippert’s long-term, profitable growth.”

Income Taxes

The Company's effective tax rate was 24.8% for the quarter ended

September 30, 2024, compared to 26.6% for the quarter ended

September 30, 2023. The decrease in the effective tax rate was

primarily due to a discrete tax benefit related to an increase in

the cash surrender value of company-owned life insurance policies

compared to the prior year period.

Balance Sheet and Other Items

At September 30, 2024, the Company's cash and cash equivalents

balance was $161.2 million, compared to $66.2 million at December

31, 2023. The Company used $80.2 million for dividend payments to

shareholders, $31.4 million for capital expenditures, and $20.0

million for an acquisition in the nine months ended September 30,

2024.

The Company's outstanding long-term indebtedness, including

current maturities, was $822.5 million at September 30, 2024, and

the Company was in compliance with its debt covenants. As of

September 30, 2024, the Company had $383.1 million of borrowing

availability under the revolving credit facility.

Conference Call & Webcast

LCI Industries will host a conference call to discuss its third

quarter results on Thursday, November 7, 2024, at 8:30 a.m. Eastern

time, which may be accessed by dialing (833) 470-1428 for

participants in the U.S. and (929) 526-1599 for participants

outside the U.S. using the required conference ID 630651. Due to

the high volume of companies reporting earnings at this time,

please be prepared for hold times of up to 15 minutes when dialing

in to the call. In addition, an online, real-time webcast, as well

as a supplemental earnings presentation, can be accessed on the

Company's website, www.investors.lci1.com.

A replay of the conference call will be available for two weeks

by dialing (866) 813-9403 for participants in the U.S. and (44)

204-525-0658 for participants outside the U.S. and referencing

access code 625624. A replay of the webcast will be available on

the Company’s website immediately following the conclusion of the

call.

About LCI Industries

LCI Industries (NYSE: LCII), through its Lippert subsidiary, is

a global leader in supplying engineered components to the outdoor

recreation and transportation markets. We believe our innovative

culture, advanced manufacturing capabilities, and dedication to

enhancing the customer experience have established Lippert as a

reliable partner for both OEM and aftermarket customers. For more

information, visit www.lippert.com.

Forward-Looking Statements

This press release contains certain "forward-looking statements"

with respect to our financial condition, results of operations,

profitability, margins, business strategies, operating efficiencies

or synergies, competitive position, growth opportunities,

acquisitions, plans and objectives of management, markets for the

Company's common stock, the impact of legal proceedings, and other

matters. Statements in this press release that are not historical

facts are "forward-looking statements" for the purpose of the safe

harbor provided by Section 21E of the Securities Exchange Act of

1934, as amended, and Section 27A of the Securities Act of 1933, as

amended, and involve a number of risks and uncertainties.

Forward-looking statements, including, without limitation, those

relating to production levels, future business prospects, net

sales, expenses and income (loss), capital expenditures, tax rate,

cash flow, financial condition, liquidity, covenant compliance,

retail and wholesale demand, integration of acquisitions, R&D

investments, commodity prices, addressable markets, and industry

trends, whenever they occur in this press release are necessarily

estimates reflecting the best judgment of the Company's senior

management at the time such statements were made. There are a

number of factors, many of which are beyond the Company's control,

which could cause actual results and events to differ materially

from those described in the forward-looking statements. These

factors include, in addition to other matters described in this

press release, the impacts of future pandemics, geopolitical

tensions, armed conflicts, or natural disasters on the global

economy and on the Company's customers, suppliers, employees,

business and cash flows, pricing pressures due to domestic and

foreign competition, costs and availability of, and tariffs on, raw

materials (particularly steel and aluminum) and other components,

seasonality and cyclicality in the industries to which we sell our

products, availability of credit for financing the retail and

wholesale purchase of products for which we sell our components,

inventory levels of retail dealers and manufacturers, availability

of transportation for products for which we sell our components,

the financial condition of our customers, the financial condition

of retail dealers of products for which we sell our components,

retention and concentration of significant customers, the costs,

pace of and successful integration of acquisitions and other growth

initiatives, availability and costs of production facilities and

labor, team member benefits, team member retention, realization and

impact of expansion plans, efficiency improvements and cost

reductions, the disruption of business resulting from natural

disasters or other unforeseen events, the successful entry into new

markets, the costs of compliance with environmental laws, laws of

foreign jurisdictions in which we operate, other operational and

financial risks related to conducting business internationally, and

increased governmental regulation and oversight, information

technology performance and security, the ability to protect

intellectual property, warranty and product liability claims or

product recalls, interest rates, oil and gasoline prices, and

availability, the impact of international, national and regional

economic conditions and consumer confidence on the retail sale of

products for which we sell our components, and other risks and

uncertainties discussed more fully under the caption "Risk Factors"

in the Company's Annual Report on Form 10-K for the year ended

December 31, 2023, and in the Company's subsequent filings with the

Securities and Exchange Commission. Readers of this press release

are cautioned not to place undue reliance on these forward-looking

statements, since there can be no assurance that these

forward-looking statements will prove to be accurate. The Company

disclaims any obligation or undertaking to update forward-looking

statements to reflect circumstances or events that occur after the

date the forward-looking statements are made, except as required by

law.

LCI INDUSTRIES

OPERATING RESULTS

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

Last Twelve

2024

2023

2024

2023

Months

(In thousands, except per share

amounts)

Net sales

$

915,497

$

959,315

$

2,938,070

$

2,947,264

$

3,775,614

Cost of sales

695,539

748,367

2,227,761

2,332,125

2,904,254

Gross profit

219,958

210,948

710,309

615,139

871,360

Selling, general and administrative

expenses

166,070

165,358

508,206

494,332

666,636

Operating profit

53,888

45,590

202,103

120,807

204,724

Interest expense, net

6,516

10,325

23,799

30,968

33,255

Income before income taxes

47,372

35,265

178,304

89,839

171,469

Provision for income taxes

11,760

9,378

44,984

23,267

40,526

Net income

$

35,612

$

25,887

$

133,320

$

66,572

$

130,943

Net income per common share:

Basic

$

1.40

$

1.02

$

5.24

$

2.63

$

5.15

Diluted

$

1.39

$

1.02

$

5.23

$

2.62

$

5.14

Weighted average common shares

outstanding:

Basic

25,480

25,340

25,436

25,293

25,420

Diluted

25,558

25,504

25,477

25,405

25,498

Depreciation

$

17,390

$

18,857

$

53,911

$

55,974

$

72,630

Amortization

$

13,882

$

14,412

$

42,089

$

42,844

$

56,320

Capital expenditures

$

10,062

$

15,978

$

31,390

$

50,060

$

43,539

LCI INDUSTRIES

SEGMENT RESULTS

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

Last Twelve

2024

2023

2024

2023

Months

(In thousands)

Net sales:

OEM Segment:

RV OEMs:

Travel trailers and fifth-wheels

$

369,212

$

363,573

$

1,186,324

$

1,032,866

$

1,508,843

Motorhomes

52,800

65,669

185,258

206,404

248,210

Adjacent Industries OEMs

262,449

299,225

867,315

1,006,378

1,139,938

Total OEM Segment net sales

684,461

728,467

2,238,897

2,245,648

2,896,991

Aftermarket Segment:

Total Aftermarket Segment net sales

231,036

230,848

699,173

701,616

878,623

Total net sales

$

915,497

$

959,315

$

2,938,070

$

2,947,264

$

3,775,614

Operating profit:

OEM Segment

$

21,825

$

11,165

$

105,223

$

29,086

$

93,498

Aftermarket Segment

32,063

34,425

96,880

91,721

111,226

Total operating profit

$

53,888

$

45,590

$

202,103

$

120,807

$

204,724

Depreciation and amortization:

OEM Segment depreciation

$

13,270

$

14,835

$

41,038

$

43,840

$

55,596

Aftermarket Segment depreciation

4,120

4,022

12,873

12,134

17,034

Total depreciation

$

17,390

$

18,857

$

53,911

$

55,974

$

72,630

OEM Segment amortization

$

9,996

$

10,550

$

30,426

$

31,204

$

40,802

Aftermarket Segment amortization

3,886

3,862

11,663

11,640

15,518

Total amortization

$

13,882

$

14,412

$

42,089

$

42,844

$

56,320

LCI INDUSTRIES

BALANCE SHEET

INFORMATION

(unaudited)

September 30,

December 31,

2024

2023

(In thousands)

ASSETS

Current assets

Cash and cash equivalents

$

161,184

$

66,157

Accounts receivable, net

319,166

214,707

Inventories, net

705,439

768,407

Prepaid expenses and other current

assets

59,084

67,599

Total current assets

1,244,873

1,116,870

Fixed assets, net

443,349

465,781

Goodwill

593,882

589,550

Other intangible assets, net

412,818

448,759

Operating lease right-of-use assets

233,225

245,388

Other long-term assets

96,817

92,971

Total assets

$

3,024,964

$

2,959,319

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities

Current maturities of long-term

indebtedness

$

222

$

589

Accounts payable, trade

193,636

183,697

Current portion of operating lease

obligations

39,035

36,269

Accrued expenses and other current

liabilities

199,081

174,437

Total current liabilities

431,974

394,992

Long-term indebtedness

822,322

846,834

Operating lease obligations

207,937

222,680

Deferred taxes

28,631

32,345

Other long-term liabilities

115,778

107,432

Total liabilities

1,606,642

1,604,283

Total stockholders' equity

1,418,322

1,355,036

Total liabilities and stockholders'

equity

$

3,024,964

$

2,959,319

LCI INDUSTRIES

SUMMARY OF CASH FLOWS

(unaudited)

Nine Months Ended

September 30,

2024

2023

(In thousands)

Cash flows from operating activities:

Net income

$

133,320

$

66,572

Adjustments to reconcile net income to

cash flows provided by operating activities:

Depreciation and amortization

96,000

98,818

Stock-based compensation expense

13,961

14,027

Other non-cash items

4,927

4,611

Changes in assets and liabilities, net of

acquisitions of businesses:

Accounts receivable, net

(102,127

)

(121,914

)

Inventories, net

81,166

246,155

Prepaid expenses and other assets

(1,491

)

31,237

Accounts payable, trade

8,333

54,817

Accrued expenses and other liabilities

29,599

(5,060

)

Net cash flows provided by operating

activities

263,688

389,263

Cash flows from investing activities:

Capital expenditures

(31,390

)

(50,060

)

Acquisitions of businesses

(19,957

)

(25,851

)

Other investing activities

781

4,284

Net cash flows used in investing

activities

(50,566

)

(71,627

)

Cash flows from financing activities:

Vesting of stock-based awards, net of

shares tendered for payment of taxes

(9,120

)

(9,591

)

Proceeds from revolving credit

facility

86,248

248,900

Repayments under revolving credit

facility

(87,766

)

(414,554

)

Repayments under term loan and other

borrowings

(26,357

)

(45,767

)

Payment of dividends

(80,191

)

(79,744

)

Payment of contingent consideration and

holdbacks related to acquisitions

(2

)

(31,857

)

Other financing activities

—

(834

)

Net cash flows used in financing

activities

(117,188

)

(333,447

)

Effect of exchange rate changes on cash

and cash equivalents

(907

)

(446

)

Net increase (decrease) in cash and cash

equivalents

95,027

(16,257

)

Cash and cash equivalents at beginning of

period

66,157

47,499

Cash and cash equivalents at end of

period

$

161,184

$

31,242

LCI INDUSTRIES

SUPPLEMENTARY

INFORMATION

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

Last Twelve

2024

2023

2024

2023

Months

Industry Data(1) (in thousands of

units):

Industry Wholesale Production:

Travel trailer and fifth-wheel RVs

68.5

61.5

224.0

195.8

287.4

Motorhome RVs

7.7

10.3

26.9

35.8

37.0

Industry Retail Sales:

Travel trailer and fifth-wheel RVs

84.1

(2)

92.0

248.1

(2)

273.0

301.8

(2)

Impact on dealer inventories

(15.6

)

(2)

(30.5

)

(24.1

)

(2)

(77.2

)

(14.4

)

(2)

Motorhome RVs

10.2

(2)

11.7

31.8

(2)

37.3

39.8

(2)

Twelve Months Ended

September 30,

2024

2023

Lippert Content Per Industry Unit

Produced:

Travel trailer and fifth-wheel RV

$

5,147

$

5,191

Motorhome RV

$

3,768

$

3,705

September 30,

December 31,

2024

2023

2023

Balance Sheet Data (debt availability in

millions):

Remaining availability under the revolving

credit facility (3)

$

383.1

$

178.5

$

245.3

Days sales in accounts receivable, based

on last twelve months

30.6

29.2

30.1

Inventory turns, based on last twelve

months

3.9

3.3

3.5

2024

Estimated Full Year Data:

Capital expenditures

$35 - $45 million

Depreciation and amortization

$125 - $135 million

Stock-based compensation expense

$17 - $22 million

Annual tax rate

24% - 26%

(1)

Industry wholesale production data for

travel trailer and fifth-wheel RVs and motorhome RVs provided by

the Recreation Vehicle Industry Association. Industry retail sales

data provided by Statistical Surveys, Inc.

(2)

September 2024 retail sales data for RVs

has not been published yet, therefore 2024 retail data for RVs

includes an estimate for September 2024 retail units. Retail sales

data have historically been revised upwards in future months as

various states report.

(3)

Remaining availability under the revolving

credit facility is subject to covenant restrictions.

LCI INDUSTRIES

SUPPLEMENTARY

INFORMATION

RECONCILIATION OF NON-GAAP

MEASURES

(unaudited)

The following table reconciles net income

to EBITDA and net income as a percentage of net sales to EBITDA as

a percentage of net sales.

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In thousands)

Net income

$

35,612

$

25,887

$

133,320

$

66,572

Interest expense, net

6,516

10,325

23,799

30,968

Provision for income taxes

11,760

9,378

44,984

23,267

Depreciation expense

17,390

18,857

53,911

55,974

Amortization expense

13,882

14,412

42,089

42,844

EBITDA

$

85,160

$

78,859

$

298,103

$

219,625

Net sales

$

915,497

$

959,315

$

2,938,070

$

2,947,264

Net income as a percentage of net

sales

3.9

%

2.7

%

4.5

%

2.3

%

EBITDA as a percentage of net sales

9.3

%

8.2

%

10.1

%

7.5

%

In addition to reporting financial results in accordance with

U.S. GAAP, the Company has provided the non-GAAP performance

measures of EBITDA and EBITDA as a percentage of net sales to

illustrate and improve comparability of its results from period to

period. EBITDA is defined as net income before interest expense,

net, provision for income taxes, depreciation expense, and

amortization expense during the three and nine month periods ended

September 30, 2024 and 2023. The Company considers these non-GAAP

measures in evaluating and managing the Company's operations and

believes that discussion of results adjusted for these items is

meaningful to investors because it provides a useful analysis of

ongoing underlying operating trends. These measures are not in

accordance with, nor are they substitutes for, GAAP measures, and

they may not be comparable to similarly titled measures used by

other companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107937464/en/

Lillian D. Etzkorn, CFO Phone: (574) 535-1125 E

Mail: LCII@lci1.com

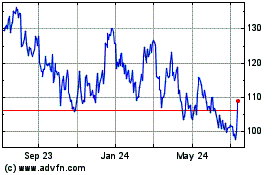

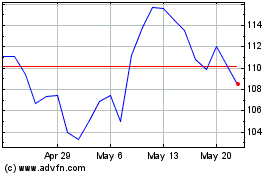

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Nov 2024 to Dec 2024

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Dec 2023 to Dec 2024