MOSAIC CO0001285785false00012857852024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2025

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-32327 | | 20-1026454 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

| 101 East Kennedy Blvd. | 33602 |

| Suite 2500 |

Tampa, | Florida |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | |

| Securities registered pursuant to Section 12(b) of the Act |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

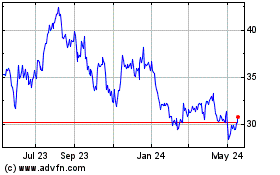

| Common Stock, par value $0.01 per share | MOS | New York Stock Exchange |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. |

| ☐ | Emerging growth company | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

The following information is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing:

Furnished herewith as Exhibit 99.1 and incorporated by reference herein is the text of The Mosaic Company’s (“Mosaic,” and Mosaic and its subsidiaries, individually or in any combination, “we,” “us” or “our”) announcement regarding its earnings and results of operations for the quarter and full year ended December 31, 2024, as presented in a press release issued on February 27, 2025.

Furnished herewith as Exhibit 99.2 and incorporated by reference herein is certain performance data for the period ended December 31, 2024 to be published on Mosaic’s website.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

Reference is made to the Exhibit Index hereto with respect to the exhibits furnished herewith. The following exhibits are being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | | | | |

| Exhibit No. | | Description |

| |

| 99.1 | | |

| |

| 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | THE MOSAIC COMPANY |

| | | |

| Date: February 27, 2025 | | | | | By: | | /s/ Philip E. Bauer |

| | | | | Name: | | Philip E. Bauer |

| | | | | Title: | | Senior Vice President, General Counsel |

| | | | | | | and Corporate Secretary |

Exhibit 99.1

| | | | | | | | | | | | | | |

| | | | |

| | | | The Mosaic Company 101 E. Kennedy Blvd., Suite 2500 Tampa, FL 33602 www.mosaicco.com |

| | | | | | | | | | | | | | |

| For Immediate Release | | | | |

| | | | |

Investors Joan Tong 863-640-0826 joan.tong@mosaicco.com | |

Jason Tremblay 813-775-4226 jason.tremblay@mosaicco.com | | Media Ben Pratt 813-775-4206 benjamin.pratt@mosaicco.com |

| | | | |

THE MOSAIC COMPANY REPORTS FOURTH QUARTER AND FULL YEAR 2024 RESULTS

•Net income of $169 million in the fourth quarter 2024, and full year net income of $175 million,

•Adjusted EBITDA(1) of $594 million in the fourth quarter 2024 and $2.2 billion for the full year;

•Realized approximately half of the $150 million cost savings target.

•Closed the Ma'aden transaction with a $522 million pre-tax gain and signed an agreement to sell Patos de Minas mine in Brazil.

•Returned $506 to shareholders through share repurchases and dividends in 2024.

TAMPA, FL, February 27, 2025 - The Mosaic Company (NYSE: MOS) today reported net income of $175 million and diluted earnings per share (EPS) of $0.55 for full year 2024. Adjusted EBITDA(1) for the year was $2.2 billion and adjusted diluted EPS(1) was $1.98.

The company reported fourth quarter net income of $169 million and diluted EPS of $0.53. Adjusted EBITDA(1) totaled $594 million for the quarter and adjusted diluted EPS(1) was $0.45.

"We delivered our highest quarterly EBITDA of the year with great prospects for all three segments for 2025. Despite a series of operational and weather-related issues, which reduced our phosphate production by over 700,000 tonnes and potash production by about 250,000 tonnes in 2024, we see encouraging signs that we will deliver significant volume recovery in phosphates and potash in 2025 as we progress on projects to restore reliability. We also made significant progress on our cost performance in the Mosaic Fertilizantes business, leading to the prospect of increased margins in 2025.” said Bruce Bodine, President and CEO. “With the conclusion of the Ma’aden deal and the signing of the Patos de Minas sale, we continue to execute our strategy to redeploy capital from non-core assets to our highest returning areas. As a result, Mosaic is well positioned to benefit from improving market conditions in 2025"

Consolidated Results:

| | | | | | | | | | | | | | |

| In millions $ except as noted below | Q4 2024 | Q4 2023 | 2024 | 2023 |

Net Sales (Billions) | $2.8 | $3.2 | $11.1 | $13.7 |

Operating Earnings | $100 | $279 | $622 | $1,338 |

| Selling, General and Administrative expenses | $113 | $123 | $497 | $501 |

| Net Income | $169 | $365 | $175 | $1,165 |

| Equity Earnings from Investments | $9 | $0 | $73 | $60 |

Adjusted EBITDA(1) | $594 | $646 | $2,202 | $2,761 |

(1)See “Non-GAAP Financial Measures” for additional information and reconciliation.

Full year revenues declined 19 percent year-over-year to $11.1 billion, reflecting the impact of lower selling prices in the Potash and Mosaic Fertilizantes segments. The gross margin rate in 2024 was 14 percent, down from 16 percent in 2023.

Net Income in 2024 totaled $175 million, declining 85 percent from 2023. 2024 results reflected the negative after-tax impact of notable items totaling $459 million, mainly from a foreign currency transaction loss, partially offset by a gain on sale associated with the Ma'aden transaction. For other notable items, refer to the "Notable Items" table in the appendix. The notable foreign exchange loss for the year of $642 million was driven mainly by unrealized losses on intercompany loans between the US and Canada and between the US and Brazil, particularly in the fourth quarter when the Brazilian real and the Canadian dollar declined by 14% and 6%, respectively versus the prior quarter.

Adjusted EBITDA(1) in 2024 totaled $2.2 billion, a decline of 20 percent from 2023. Cash flows from operating activities totaled $1.3 billion.

In 2024, the company realized approximately half of its $150 million cost saving target and is on track to achieve the full run rate by the end of 2025. $35 million of the cost reductions realized in 2024 is captured in the Mosaic Fertilizantes segment and $42 million is captured in SG&A.

Full-year selling, general and administrative expenses were $497 million in 2024 compared with $501 million in 2023. SG&A expenses in 2024 include approximately $30 million in bad debt expenses related to a single customer booked in the third quarter and an increase in non-cash costs of $8 million. Most of the bad debt expense is expected to be recovered through an insurance claim.

Mosaic recognized $73 million of equity earnings from investments, primarily reflecting contributions from the company’s share of the MWSPC joint venture in Saudi Arabia prior to the conversion of this investment into shares of Ma’aden.

The reported effective tax rate for 2024 was 59.2 percent. Adjusted effective tax rate(1) was 33.2 percent excluding the one-time net unfavorable impacts from notable items including $103 million in the second quarter for Mosaic’s decision to reverse the permanent reinvestment in Canada. The $103 million is a deferred tax liability that represents the tax impact of the repatriation of retained earnings from Canada to the United States. Cash taxes paid in 2024 were $337 million. See the reconciliation included in the non-GAAP financial measures contained in this press release for a reconciliation of our underlying effective tax rate.

Potash: | | | | | | | | | | | | | | |

| In millions $ except as noted below | Q4 2024 | Q4 2023 | 2024 | 2023 |

Net Sales (Billions) | $0.6 | $0.8 | $2.4 | $3.2 |

| Sales Volumes - million tonnes* | 2.2 | 2.6 | 8.7 | 8.9 |

MOP Selling Price FOB mine | $199 | $243 | $222 | $308 |

| Gross Margin (GAAP) per tonne | $55 | $99 | $74 | $137 |

| | | | |

| Operating Earnings | $123 | $222 | $605 | $1,152 |

Segment Adjusted EBITDA(1) | $212 | $322 | $944 | $1,471 |

Adjusted EBITDA per tonne(1) | $95 | $125 | $108 | $166 |

| | | | |

*Tonnes = finished product tonnes

The Potash segment reported net sales of $2.4 billion in 2024, down from $3.2 billion in 2023, reflecting lower prices and slightly lower sales volumes. Adjusted EBITDA per tonne(1) was $108, down from $166 last year. Sales volumes decreased from 8.9 million tonnes in 2023 to 8.7 million tonnes in 2024, reflecting the production challenges at the Esterhazy and Colonsay mines in the third quarter of 2024. Potash operating earnings were $605 million in 2024, down from $1.2 billion in the prior year.

(1)See “Non-GAAP Financial Measures” for additional information and reconciliation.

Adjusted EBITDA(1) totaled $944 million in 2024, down from $1.5 billion last year. Adjusted EBITDA(1) totaled $212 million in the fourth quarter 2024, down from $322 million in the same period last year. These results reflect lower selling prices.

The electrical issues at Esterhazy and Colonsay that reduced 2024 production levels were largely resolved in the third quarter of 2024. Hoisting at Esterhazy is back to full capacity now. This significantly improves our asset reliability going forward and will continue to provide us with excess hoisting capacity as well as higher production output as the Hydrofloat project completes in 2025. Potash production volumes in 2025 are expected to be in the range of 8.7-9.1 million tonnes.

Sales volumes in the first quarter are expected to be between 2.0 and 2.2 million tonnes with realized mine-gate MOP prices in the range of $200 to $220 per tonne.

Phosphates: | | | | | | | | | | | | | | |

| In millions $ except as noted below | Q4 2024 | Q4 2023 | 2024 | 2023 |

Net Sales (Billions) | $1.2 | $1.1 | $4.5 | $4.7 |

| Sales Volumes - million tonnes* | 1.6 | 1.6 | 6.4 | 7.0 |

DAP Selling Price FOB plant | $593 | $552 | $585 | $573 |

| Gross Margin (GAAP) per tonne | $85 | $88 | $92 | $100 |

| | | | |

| Operating Earnings | $44 | $21 | $225 | $375 |

Segment Adjusted EBITDA(1) | $341 | $259 | $1,191 | $1,227 |

Adjusted EBITDA per tonne(1) | $210 | $164 | $185 | $176 |

| | | | |

| | | | |

*Tonnes = finished product tonnes Net sales in the Phosphate segment decreased to $4.5 billion in 2024, from $4.7 billion in 2023, driven by lower sales volume, partially offset by higher prices. Phosphate operating earnings were $225 million in 2024, compared to $375 million in 2023. Segment results reflect higher prices, elevated stripping margins, and lower sales and production volumes.

Adjusted EBITDA(1) totaled $1.19 billion in 2024, down slightly from $1.23 billion in the prior year. Adjusted EBITDA(1) totaled $341 million in the fourth quarter of 2024, up from $259 million in the same period last year; higher full year prices and elevated stripping margins, offset lower sales and production volumes as conversion costs per tonne stayed flat versus prior year.

Sales volumes decreased from 7.0 million tonnes in 2023 to 6.4 million tonnes in 2024 while production volumes declined from 6.6 million tonnes to 6.4 million tonnes due to approximately 700 thousand tonnes of production lost due to hurricanes and other unusual events. Adjusted EBITDA per tonne(1) was $185 in 2024, compared to $176 in 2023.

After the conclusion of a turnaround at the Bartow facility in the first quarter of 2025, all sulfuric acid plants across Florida and Louisiana will be within the normal cadence with an average of 3-year interval between turnarounds. Mosaic has additional plans in 2025 to further strengthen its asset reliability and this work is expected to be completed by the end of the second quarter. 2025 production volumes are expected to improve throughout the year and revert towards a level of 7.2-7.6 million tonnes.

Sales volumes in the first quarter are expected to be 1.5-1.7 million tonnes with DAP prices on an FOB basis averaging $595 to $615 per tonne. Stripping margins are expected to remain elevated.

(1)See “Non-GAAP Financial Measures” for additional information and reconciliation.

Mosaic Fertilizantes:

| | | | | | | | | | | | | | |

| In millions $ except as noted below | Q4 2024 | Q4 2023 | 2024 | 2023 |

Net Sales (Billions) | $1.1 | $1.2 | $4.4 | $5.7 |

| Sales Volumes - million tonnes* | 2.2 | 2.2 | 9.0 | 9.7 |

| Finished Product Selling Price | $486 | $552 | $490 | $587 |

| Gross Margin (GAAP) per tonne | $46 | $44 | $45 | $22 |

| | | | |

| Operating Earnings | $79 | $50 | $238 | $75 |

Segment Adjusted EBITDA(1) | $82 | $111 | $344 | $327 |

Adjusted EBITDA per tonne(1) | $37 | $51 | $38 | $34 |

| | | | |

| | | | |

| | | | |

*Tonnes = finished product tonnesMosaic Fertilizantes reported net sales of $4.4 billion in 2024, down from $5.7 billion in the prior year, reflecting lower prices and sales volumes. The gross adjusted EBITDA per tonne tonne(1) averaged $38 in 2024, up from $34 in 2023. Mosaic Fertilizantes operating earnings were $238 million in 2024, increasing from $75 million in 2023. Adjusted EBITDA(1) totaled $344 million in 2024, up from $327 million last year.

Adjusted EBITDA(1) totaled $82 million in fourth quarter 2024, down from $111 million in the same period last year. Segment Adjusted EBITDA(1) in the fourth quarter reflects strong underlying operating and cost performance. For example, since early 2024, Mosaic ceased to import phosphate rock and increased its own rock production to be processed in the production facilities in Brazil. This will have reduce production costs by $35 to $40 million a year, with $15 million already realized in 2024. The expected annual cost benefit run rate translates into gross margin of approximately $2 per tonne.

However, these cost improvements were partially offset by a negative $35 million foreign exchange impact in adjusted EBITDA, $28 million of which was related to unfavorable structured payables, with an additional $7 million unfavorable from hedging impacts.

Mosaic Fertilizantes has accounts payable denominated in U.S. dollars. These USD-denominated payables were initially recorded in BRL using prior lower exchange rates, and were settled in the fourth quarter at higher exchange rates, after a 14% weakening of the BRL. This resulted in a $28 million negative impact to adjusted EBITDA.

In the first quarter of 2025, $15-$20 million EBITDA impact is expected on the remaining open payables recorded at lower exchange rates. Distribution margin is expected to be seasonally normal and below the annual normalized $30-$40 per tonne range in the first quarter of 2025. The currency impact and lower distribution margins will likely result in segment gross margins between $35-45 per tonne in the first quarter. Assuming the USD/BRL exchange rate stays at a level of 5.5-6.0 in 2025, EBITDA beyond the first quarter will not be significantly impacted by this type of foreign exchange impact.

(1)See “Non-GAAP Financial Measures” for additional information and reconciliation.

Portfolio and Capital Allocation

•Mosaic has made significant progress on divesting non-core assets and investments

•In December, Mosaic closed the Ma'aden transaction and received approximately $1.5 billion in Ma'aden common shares in exchange for Mosaic's 25% share of the Wa'ad Al Shamal Phosphate Company. Mosaic recorded a gain of $522 million from this transaction in the fourth quarter of 2024.

•In January of 2025, Mosaic signed an agreement to sell the idled phosphate mine Patos de Minas in Brazil for $125 million. The transaction is expected to be close in 2025. Mosaic will receive $35 million upon closing and the remainder of the price through six annual payments of $15 million.

•Mosaic continues to progress on high-returning and low-capital intensity projects

•The Riverview capacity conversion project which added 800 thousand tonnes of MicroEssentials capacity is complete. MicroEssentials volumes are expected to grow 25% in 2025, ramping in 2026 to a goal of about 55% of total phosphates volumes in 2027. In 2024, MicroEssentials products were sold at an average gross margin premium of $30-$40 over the gross margin of MAP.

•The Esterhazy Hydrofloat project is on track to complete by mid-year 2025, with an expected ramp-up by end of 2025. Once fully ramped up, the Hydrofloat project will enable additional production of 400 thousand tonnes of MOP from Esterhazy.

•The construction of a one million tonne blending facility in Palmeirante, Brazil is on track to be completed by mid-2025. Palmeirante will enable Mosaic Fertilizantes to increase overall sales by the same one million tonnes, with intended distribution margins approaching the average for Fertilizantes of $30-40 per tonne.

•2024 capital expenditures of $1.25 billion are within the targeted range and were about $200 million lower than in 2023. 2025 capital expenditures are expected to be in the range of $1.2 to $1.3 billion.

•Mosaic returned $506 million of capital to shareholders in 2024 including share repurchases totaling $235 million.

2025 Market Outlook

Grain and oilseed fundamentals have improved over the past few months, as evidenced by rising corn prices in particular, while most other crops prices remain elevated. This continues to incentivize farmers to apply fertilizers to maximize yields. Demographic changes and government mandates for biofuel usage are expected to provide a long runway for grain and oilseed demand expansion, driving steady growth in fertilizer shipments in 2025 as well as longer term.

Phosphate markets are expected to remain tight driven by continued supply constraints and increasing demand for fertilizer, fuel, and industrial uses. Chinese phosphate exports in 2024 declined 8 percent or over 600,000 tonnes from the prior year, and the long-term outlook remains favorable as Chinese domestic use and industrial needs will continue to be prioritized over fertilizer exports.

Potash markets are improving in the near to medium term driven by output reductions from key producers in Russia, Belarus and China, as well as headwinds to the planned expansions in Laos. The potential impact of tariffs that may be imposed on Canadian potash exports to the U.S. are uncertain, but it is clear that the tariffs, if levied as originally proposed, would cause significant disruptions in global potash trade flows and logistics. It is expected that tariffs would exert further upward pressure on prices, and that U.S. farmers would bear the cost increase. Even so we anticipate that potash would remain affordable, and demand would remain robust, in North America and globally.

The potential resolution of the Russia / Ukraine conflict will likely have minimal impact to the potash and phosphate markets and Mosaic as Russian exports have already returned to pre-war levels. Also, Belarussian exports have already returned to 90% of pre-sanction levels, and it is not clear that a resolution would open up the most critical transit corridor necessary to bring about a full production resumption.

With these market dynamics, the prospects of potash are compelling in 2025 and beyond.

2025 Modeling Assumptions

The Company provides the following modeling assumptions for the full year 2025:

| | | | | |

| Modeling Assumptions | Full Year 2025 |

| Phosphate Production Volumes (million tonnes) | 7.2 - 7.6 |

| Potash Production Volumes (million tonnes) | 8.7 - 9.1 |

| Total Capital Expenditures | $1.2 - 1.3 billion |

| Depreciation, Depletion & Amortization | $1.1- 1.2 billion |

| Selling, General, and Administrative Expense | $470 - $500 million |

| Net Interest Expense | $180 - $200 million |

| Adjusted Effective Tax rate | High 20’s % |

| Cash tax rate | Mid-to-high 20's % |

The Company provides the following modelling assumptions for the first quarter of 2025:

| | | | | |

| Modeling Assumptions | First Quarter 2025 |

| Phosphate Sales Volumes (million tonnes) | 1.5 - 1.7 |

| DAP FOB Plant Prices | $595 - $615 |

| Potash Sales Volumes | 2.0 - 2.2 |

| MOP FOB Mine Prices | $200 - $220 |

Sensitivities Table Using 2024 Cost Structure

The Company provided the following sensitivities to price and foreign exchange rates to help investors anticipate the potential impact of movements in these factors.

| | | | | | | | |

| Sensitivity | Full year adj. EBITDA impact(1) | 2024 Actual |

Average MOP Price / tonne (fob mine)(4) | $10/mt price change = $60 million (4) | $222 |

Average DAP Price / tonne (fob plant)(5) | $10/mt price change = $79 million | $585 |

Average BRL / USD(6) | 0.10 change, unhedged = $10 million(6) | 5.39 |

(4) Includes impact of Canadian Resource Tax

(5) Approximately 20% of DAP price sensitivity impact is expected to be in the Mosaic Fertilizantes segment.; approximately 10% of the MOP price sensitivity impact is expected to be in the Mosaic Fertilizantes segment.

(6) The company hedged about 50 percent of the annual sensitivity. Over longer periods of time, inflation is expected to offset a portion of currency benefits.

About The Mosaic Company

The Mosaic Company is one of the world's leading producers and marketers of concentrated phosphate and potash crop nutrients. Mosaic is a single-source provider of phosphate and potash fertilizers and feed ingredients for the global agriculture industry. More information on the company is available at www.mosaicco.com.

Mosaic will conduct a conference call on Thursday, February 28, 2025, at 11:00 a.m. Eastern Time to discuss fourth quarter and full year 2024 earnings results. A simultaneous webcast of the conference call may be accessed through Mosaic’s website at www.mosaicco.com/investors. This webcast will be available up to one year from the time of the earnings call.

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may include, but are not limited to, statements about share repurchases, future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include, but are not limited to: political and economic instability and changes in government policies in countries in which we have operations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks, including the potential imposition of U.S. tariffs on Canadian potash imports and retaliatory tariffs on phosphate exports by Canada or other countries; and other risks associated with Mosaic’s international operations; a material adverse change in our Ma'aden investment with respect to the financial position, performance, operations or prospects of Ma'aden; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, carbon taxes or other greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of America or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States, Canada or Brazil, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund financial assurance requirements and strategic investments; brine inflows at Mosaic’s potash mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events, sinkholes or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss; as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

###

Non-GAAP Financial Measures

This press release includes the presentation and discussion of non-GAAP diluted net earnings per share guidance, or adjusted EPS, non-GAAP gross margin per tonne, or adjusted gross margin per tonne, non-GAAP adjusted EBITDA, or non-GAAP adjusted effective tax rate, collectively referred to as non-GAAP financial measures. Generally, a non-GAAP financial measure is a supplemental numerical measure of a company's performance, financial position or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with U.S. generally accepted accounting principles, or GAAP. Non-GAAP financial measures should not be considered as substitutes for, or superior to, measures of financial performance prepared in accordance with GAAP. In addition, because non-GAAP measures are not determined in accordance with GAAP, they are thus susceptible to varying interpretations and calculations and may not be comparable to other similarly titled measures of other companies. Adjusted metrics, including adjusted EPS, adjusted gross margin, and adjusted EBITDA are calculated by excluding the impact of notable items from the GAAP measure. Notable items impact on gross margin and EBITDA is pretax. Notable items impact on diluted net earnings per share is calculated as the notable item amount plus income tax effect, based on expected annual effective tax rate, divided by diluted weighted average shares. Management believes that these adjusted measures provide securities analysts, investors, management and others with useful supplemental information regarding our performance by excluding certain items that may not be indicative of, or are unrelated to, our core operating results. Management utilizes these adjusted measures in analyzing and assessing Mosaic’s overall performance and financial trends, for financial and operating decision-making, and to forecast and plan for future periods. These adjusted measures also assist our management in comparing our and our competitors' operating results. We are not providing forward looking guidance for U.S. GAAP reported diluted net earnings per share, gross margin per tonne, or a quantitative reconciliation of forward-looking adjusted EPS, adjusted gross margin and adjusted EBITDA because we

are unable to predict with reasonable certainty our notable items without unreasonable effort. Historically, our notable items have included, but are not limited to, foreign currency transaction gain or loss, unrealized gain or loss on derivatives, acquisition-related fees, discrete tax items, contingencies and certain other gains or losses. These items are uncertain, depend on various factors, and could have a material impact on U.S. GAAP reported results for the guidance period. Reconciliations for Non-GAAP financial measures contained in this press release are found below. Reconciliations for current and historical periods beginning with the quarter ended March 31, 2023 for consolidated adjusted EPS and adjusted EBITDA, as well as segment adjusted EBITDA and adjusted gross margin per tonne are provided in the Selected Calendar Quarter Financial Information performance data for the related periods. This information is being furnished under Exhibit 99.2 of the Form 8-K and available on our website at www.mosaicco.com in the “Financial Information - Quarterly Earnings” section under the “Investors” tab.

For the year ended December 31, 2024, the Company reported the following notable items which, combined, negatively impacted earnings per share by $1.43:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Amount | | Tax effect | | EPS impact |

| Description | | Segment | | Line item | | (in millions) | | (in millions) | | (per share) |

| Foreign currency transaction gain (loss) | | Consolidated | | Foreign currency transaction gain (loss) | | $ | (642) | | | $ | 144 | | | $ | (1.57) | |

| Unrealized gain (loss) on derivatives | | Corporate and Other | | Cost of goods sold | | (101) | | | 21 | | | (0.25) | |

| Closed and indefinitely idled facility costs | | Phosphate | | Other operating income (expense) | | (52) | | | 13 | | | (0.13) | |

| FX functional currency | | Mosaic Fertilizantes | | Cost of goods sold | | 20 | | | (5) | | | 0.03 | |

| Realized gain (loss) on RCRA Trust Securities | | Phosphate | | Other non-operating income (expense) | | 2 | | | (2) | | | 0.01 | |

| ARO Adjustment | | Phosphate | | Other operating income (expense) | | (139) | | | 39 | | | (0.31) | |

| Environmental reserve | | Phosphate | | Other operating income (expense) | | (97) | | | 27 | | | (0.21) | |

| Land reclamation | | Phosphate | | Cost of goods sold | | (15) | | | 4 | | | (0.03) | |

| Pension plan termination | | Corporate and Other | | Other non-operating income (expense) | | 8 | | | (2) | | | 0.02 | |

| Franchise tax reversal | | Phosphate | | Other operating income (expense) | | (15) | | | 4 | | | (0.03) | |

| Discrete tax items | | Consolidated | | (Provision for) benefit from income taxes | | — | | | (103) | | | (0.32) | |

| Hurricane Milton idle costs | | Phosphate | | Cost of goods sold | | (52) | | | 10 | | | (0.13) | |

| Gain on sale of equity investment | | Phosphate | | Other non-operating income (expense) | | 522 | | | (43) | | | 1.51 | |

| Ma'aden mark-to-market | | Corporate and Other | | Other non-operating income (expense) | | 28 | | | (5) | | | 0.07 | |

| ARO Adjustment | | Potash | | Other operating income (expense) | | 7 | | | (1) | | | 0.02 | |

| Arbitration reserve | | Phosphate | | Other Operating Expense/Non Controlling Interest | | (43) | | | 9 | | | (0.11) | |

| | | | | | | | | | |

| Total Notable Items | | | | | | $ | (569) | | | $ | 110 | | | $ | (1.43) | |

For the three months ended December 31, 2024, the Company reported the following notable items which, combined, positively impacted earnings per share by $0.08:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Amount | | Tax effect | | EPS impact |

| Description | | Segment | | Line item | | (in millions) | | (in millions) | | (per share) |

| Foreign currency transaction gain (loss) | | Consolidated | | Foreign currency transaction gain (loss) | | $ | (390) | | | $ | 75 | | | $ | (0.99) | |

| Unrealized gain (loss) on derivatives | | Corporate and Other | | Cost of goods sold | | (80) | | | 15 | | | (0.20) | |

| Closed and indefinitely idled facility costs | | Phosphate | | Other operating income (expense) | | (13) | | | 2 | | | (0.04) | |

| FX functional currency | | Mosaic Fertilizantes | | Cost of goods sold | | 9 | | | (2) | | | 0.02 | |

| Realized gain (loss) on RCRA Trust Securities | | Phosphate | | Other non-operating income (expense) | | (5) | | | 1 | | | (0.01) | |

| ARO Adjustment | | Phosphate | | Other operating income (expense) | | (23) | | | 4 | | | (0.06) | |

| Hurricane Milton idle costs | | Phosphate | | Cost of goods sold | | (52) | | | 10 | | | (0.13) | |

| Gain on sale of equity investment | | Phosphate | | Other non-operating income (expense) | | 522 | | | (43) | | | 1.51 | |

| Ma'aden mark-to-market | | Corporate and Other | | Other non-operating income (expense) | | 28 | | | (5) | | | 0.07 | |

| ARO Adjustment | | Potash | | Other operating income (expense) | | 7 | | | (1) | | | 0.02 | |

| Arbitration reserve | | Phosphate | | Other Operating Expense/Non Controlling Interest | | (43) | | | 9 | | | (0.11) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Notable Items | | | | | | $ | (40) | | | $ | 65 | | | $ | 0.08 | |

For the three months ended December 31, 2023, the Company reported the following notable items which, combined, positively impacted earnings per share by $0.40:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Amount | | Tax effect | | EPS impact |

| Description | | Segment | | Line item | | (in millions) | | (in millions) | | (per share) |

| Foreign currency transaction gain (loss) | | Consolidated | | Foreign currency transaction gain (loss) | | $ | 79 | | | $ | (16) | | | $ | 0.20 | |

| Unrealized gain (loss) on derivatives | | Corporate and Other | | Cost of goods sold | | 40 | | | (7) | | | 0.10 | |

| Closed and indefinitely idled facility costs | | Phosphate | | Other operating income (expense) | | (9) | | | 2 | | | (0.03) | |

| FX functional currency | | Mosaic Fertilizantes | | Cost of goods sold | | (3) | | | 1 | | | (0.01) | |

| Realized gain (loss) on RCRA Trust Securities | | Phosphate | | Other non-operating income (expense) | | (7) | | | 2 | | | (0.02) | |

| ARO Adjustment | | Phosphate | | Other operating income (expense) | | (4) | | | 1 | | | (0.01) | |

| Environmental reserve | | Phosphate | | Other operating income (expense) | | (64) | | | 11 | | | (0.16) | |

| Land reclamation | | Phosphate | | Cost of goods sold | | (28) | | | 5 | | | (0.07) | |

| ARO adjustment | | Potash | | Other operating income (expense) | | (10) | | | 2 | | | (0.02) | |

| Tax law change | | Mosaic Fertilizantes | | (Provision for) benefit from income taxes | | — | | | 136 | | | 0.42 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total Notable Items | | | | | | $ | (6) | | | $ | 137 | | | $ | 0.40 | |

Condensed Consolidated Statements of Earnings

(in millions, except per share amounts)

| | | | | | | | |

| | |

| The Mosaic Company | | (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended December 31, | | Years ended

December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | | $ | 2,815.9 | | | $ | 3,149.5 | | | $ | 11,122.8 | | | $ | 13,696.1 | |

| Cost of goods sold | | 2,514.0 | | | 2,590.0 | | | 9,610.9 | | | 11,485.5 | |

| Gross margin | | 301.9 | | | 559.5 | | | 1,511.9 | | | 2,210.6 | |

| Selling, general and administrative expenses | | 113.5 | | | 123.0 | | | 496.9 | | | 500.5 | |

| | | | | | | | |

| Other operating expenses | | 88.5 | | | 158.0 | | | 393.5 | | | 372.0 | |

| Operating earnings | | 99.9 | | | 278.5 | | | 621.5 | | | 1,338.1 | |

| Interest expense, net | | (46.7) | | | (34.9) | | | (182.8) | | | (129.4) | |

| Foreign currency transaction (loss) gain | | (418.5) | | | 91.0 | | | (685.8) | | | 194.0 | |

| Gain on sale of equity investment | | 522.2 | | | — | | | 522.2 | | | — | |

| Other income (expense) | | 33.5 | | | (10.7) | | | 40.3 | | | (76.8) | |

| Earnings from consolidated companies before income taxes | | 190.4 | | | 323.9 | | | 315.4 | | | 1,325.9 | |

| Provision for (benefit from) income taxes | | 33.8 | | | (43.8) | | | 186.7 | | | 177.0 | |

| Earnings from consolidated companies | | 156.6 | | | 367.7 | | | 128.7 | | | 1,148.9 | |

| Equity in net earnings of nonconsolidated companies | | 9.1 | | | 0.3 | | | 73.3 | | | 60.3 | |

| Net earnings including noncontrolling interests | | 165.7 | | | 368.0 | | | 202.0 | | | 1,209.2 | |

| Less: Net earnings attributable to noncontrolling interests | | (3.3) | | | 2.7 | | | 27.1 | | | 44.3 | |

| Net earnings attributable to Mosaic | | $ | 169.0 | | | $ | 365.3 | | | $ | 174.9 | | | $ | 1,164.9 | |

| Diluted net earnings per share attributable to Mosaic | | $ | 0.53 | | | $ | 1.06 | | | $ | 0.55 | | | $ | 3.50 | |

| Diluted weighted average number of shares outstanding | | 318.5 | | | 343.8 | | | 320.7 | | | 333.2 | |

Condensed Consolidated Balance Sheets

(in millions, except per share amounts)

| | | | | | | | |

| The Mosaic Company | | (unaudited) |

| | | | | | | | | | | | | | |

| | | December 31, 2024 | | December 31, 2023 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 272.8 | | | $ | 348.8 | |

| Receivables, net | | 1,113.3 | | | 1,269.2 | |

| Inventories | | 2,548.4 | | | 2,523.2 | |

| Other current assets | | 563.8 | | | 603.8 | |

| Total current assets | | 4,498.3 | | | 4,745.0 | |

| Property, plant and equipment, net | | 13,352.6 | | | 13,585.4 | |

| Equity securities and investments in nonconsolidated companies | | 1,533.4 | | | 909.0 | |

| Goodwill | | 1,061.1 | | | 1,138.6 | |

| Deferred income taxes | | 958.3 | | | 1,079.2 | |

| Other assets | | 1,520.3 | | | 1,575.6 | |

| Total assets | | $ | 22,924.0 | | | $ | 23,032.8 | |

| Liabilities and Equity | | | | |

| Current liabilities: | | | | |

| Short-term debt | | $ | 847.1 | | | $ | 399.7 | |

| Current maturities of long-term debt | | 45.3 | | | 130.1 | |

| Structured accounts payable arrangements | | 402.3 | | | 399.9 | |

| Accounts payable | | 1,156.5 | | | 1,166.9 | |

| Accrued liabilities | | 1,720.1 | | | 1,777.1 | |

| | | | |

| Total current liabilities | | 4,171.3 | | | 3,873.7 | |

| Long-term debt, less current maturities | | 3,332.3 | | | 3,231.6 | |

| Deferred income taxes | | 942.8 | | | 1,065.5 | |

| Other noncurrent liabilities | | 2,862.9 | | | 2,429.2 | |

| Equity: | | | | |

| Preferred stock, $0.01 par value, 15,000,000 shares authorized, none issued and outstanding as of December 31, 2024 and 2023 | | — | | | — | |

| Common stock, $0.01 par value, 1,000,000,000 shares authorized, 394,648,654 shares issued and 316,932,047 shares outstanding as of December 31, 2024, 393,875,241 shares issued and 324,103,141 shares outstanding as of December 31, 2023 | | 3.2 | | | 3.2 | |

| Capital in excess of par value | | 2.1 | | | — | |

| Retained earnings | | 13,926.1 | | | 14,241.9 | |

| Accumulated other comprehensive loss | | (2,449.0) | | | (1,954.9) | |

| Total Mosaic stockholders’ equity | | 11,482.4 | | | 12,290.2 | |

| Non-controlling interests | | 132.3 | | | 142.6 | |

| Total equity | | 11,614.7 | | | 12,432.8 | |

| Total liabilities and equity | | $ | 22,924.0 | | | $ | 23,032.8 | |

Condensed Consolidated Statements of Cash Flows

(in millions, except per share amounts)

| | | | | | | | |

| The Mosaic Company | | (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended December 31, | | Years ended

December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Cash Flows from Operating Activities: | | | | |

| Net cash provided by operating activities | | $ | 219.3 | | | $ | 538.1 | | | $ | 1,299.2 | | | $ | 2,407.2 | |

| Cash Flows from Investing Activities: | | | | | | | | |

| Capital expenditures | | (294.1) | | | (358.9) | | | (1,251.8) | | | (1,402.4) | |

| Purchases of available-for-sale securities - restricted | | (367.7) | | | (201.1) | | | (1,529.7) | | | (1,240.8) | |

| Proceeds from sale of available-for-sale securities - restricted | | 382.0 | | | 197.4 | | | 1,501.1 | | | 1,209.1 | |

| Proceeds from sale of business | | — | | | — | | | — | | | 158.4 | |

| Acquisition of business | | — | | | — | | | — | | | (41.0) | |

| Other | | 3.3 | | | 0.4 | | | 19.4 | | | (0.5) | |

| Net cash used in investing activities | | (276.5) | | | (362.2) | | | (1,261.0) | | | (1,317.2) | |

| Cash Flows from Financing Activities: | | | | | | | | |

| Payments of short-term debt | | (4,358.3) | | | (3,070.1) | | | (16,779.6) | | | (9,832.0) | |

| Proceeds from issuance of short-term debt | | 4,460.0 | | | 3,170.0 | | | 17,032.8 | | | 10,007.1 | |

| Payments from inventory financing arrangement | | (399.9) | | | — | | | (1,805.0) | | | (601.4) | |

| Proceeds from inventory financing arrangement | | 399.4 | | | — | | | 2,004.5 | | | 601.4 | |

| Payments of structured accounts payable arrangements | | (232.7) | | | (422.3) | | | (755.0) | | | (1,432.9) | |

| Proceeds from structured accounts payable arrangements | | 227.1 | | | 214.2 | | | 737.3 | | | 1,048.2 | |

| Payments of long-term debt | | (12.0) | | | (950.5) | | | (67.2) | | | (995.3) | |

| Proceeds from issuance of long-term debt | | 70.3 | | | 900.0 | | | 70.3 | | | 900.0 | |

| Collections of transferred receivables | | 95.4 | | | — | | | 425.5 | | | 1,468.6 | |

| Payments of transferred receivables | | (96.9) | | | — | | | (425.5) | | | (1,468.6) | |

| Repurchases of stock | | (25.0) | | | (150.0) | | | (235.4) | | | (756.0) | |

| Cash dividends paid | | (66.5) | | | (65.1) | | | (270.7) | | | (351.6) | |

| Dividends paid to non-controlling interest | | (14.3) | | | (17.8) | | | (31.9) | | | (41.5) | |

| Other | | (9.9) | | | (19.1) | | | (32.0) | | | (26.5) | |

| Net cash used in financing activities | | 36.7 | | | (410.7) | | | (131.9) | | | (1,480.5) | |

| Effect of exchange rate changes on cash | | (6.6) | | | (6.2) | | | 37.9 | | | (2.8) | |

| Net change in cash, cash equivalents and restricted cash | | (27.1) | | | (241.0) | | | (55.8) | | | (393.3) | |

| Cash, cash equivalents and restricted cash—beginning of year | | 332.1 | | | 601.8 | | | 360.8 | | | 754.1 | |

| Cash, cash equivalents and restricted cash—end of year | | $ | 305.0 | | | $ | 360.8 | | | $ | 305.0 | | | $ | 360.8 | |

| | | | | | | | | | | | |

| Years ended December 31, | |

| 2024 | | 2023 | |

|

| Reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets to the consolidated statements of cash flows: | | | | |

| Cash and cash equivalents | $ | 272.8 | | | $ | 348.8 | | |

| Restricted cash in other current assets | 14.9 | | | 8.6 | | |

| Restricted cash in other assets | 17.3 | | | 3.4 | | |

| Total cash, cash equivalents and restricted cash shown in the statement of cash flows | $ | 305.0 | | | $ | 360.8 | | |

Reconciliation of Non-GAAP Financial Measures

Earnings Per Share Calculation

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended

December 31, | | Years ended

December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Net earnings attributed to Mosaic | | $ | 169.0 | | | $ | 365.3 | | | $ | 174.9 | | | $ | 1,164.9 | |

| Basic weighted average number of shares outstanding | | 317.4 | | | 326.1 | | | 319.8 | | | 331.3 | |

| Dilutive impact of share-based awards | | 1.1 | | | 1.6 | | | 0.9 | | | 1.9 | |

| Diluted weighted average number of shares outstanding | | 318.5 | | | 327.7 | | | 320.7 | | | 333.2 | |

| Basic net earnings per share | | $ | 0.53 | | | $ | 1.12 | | | $ | 0.55 | | | $ | 3.52 | |

| Diluted net earnings per share | | $ | 0.53 | | | $ | 1.11 | | | $ | 0.55 | | | $ | 3.50 | |

| | | | | | | | |

| Notable items impact on earnings per share | | $ | (0.08) | | | $ | (0.40) | | | $ | 1.43 | | | $ | 0.07 | |

| Adjusted earnings per share | | $ | 0.45 | | | $ | 0.71 | | | $ | 1.98 | | | $ | 3.57 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated Earnings (in millions) | | Three months ended

December 31, | | Year ended

December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Consolidated net earnings attributable to Mosaic | | $ | 169 | | | $ | 365 | | | $ | 175 | | | $ | 1,165 | |

| Less: Consolidated interest expense, net | | (47) | | | (35) | | | (183) | | | (129) | |

| Plus: Consolidated depreciation, depletion and amortization | | 283 | | | 257 | | | 1,025 | | | 960 | |

| Plus: Accretion expense | | 31 | | | 27 | | | 112 | | | 96 | |

| Plus: Share-based compensation expense | | 7 | | | 6 | | | 33 | | | 33 | |

| Plus: Consolidated provision for (benefit from) income taxes | | 34 | | | (44) | | | 187 | | | 176 | |

| Less: Equity in net earnings of nonconsolidated companies, net of dividends | | 9 | | | — | | | 58 | | | 35 | |

| Plus: Notable items not included above | | 32 | | | — | | | 545 | | | 237 | |

| Adjusted EBITDA | | $ | 594 | | | $ | 646 | | | $ | 2,202 | | | $ | 2,761 | |

| | | | | | | | |

Reconciliation of Non-GAAP Financial Measures

| | | | | | | | |

Income Tax Effective Tax Rate (in millions) | | Year ended

December 31, |

| | 2024 |

| Income Tax Expense | | $ | 187 | |

| Earnings Before Tax | | $ | 316 | |

| Effective Tax Rate | | 59.2 | % |

| | |

| Income Tax Expense | | $ | 187 | |

| Canada Permanent Reinvestment Decision | | (103) | |

| Tax Expense on All Other Notable Items (see notable items table for details of these items) | | 213 | |

| Adjusted Income Tax Expense | | $ | 297 | |

| | |

| Earnings Before Tax | | $ | 315 | |

| Earnings Impact of All Notable Items (net of non-controlling interest) | | 579 | |

| Adjusted Earnings Before Tax | | $ | 894 | |

| | |

| Adjusted Effective Tax Rate | | 33.2 | % |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Years ended December 31, |

Potash Earnings (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Operating Earnings | | $ | 123 | | | $ | 222 | | | $ | 604 | | | $ | 1,152 | |

| Plus: Depreciation, Depletion and Amortization | | 93 | | | 89 | | | 338 | | | 299 | |

| Plus: Accretion Expense | | 2 | | | 3 | | | 9 | | | 9 | |

| Plus: Foreign Exchange Gain (Loss) | | (185) | | | 41 | | | (180) | | | 41 | |

| Plus: Other Non Operating Income | | 1 | | | (2) | | | 1 | | | (45) | |

| Plus: Notable Items | | 178 | | | (31) | | | 172 | | | 15 | |

| Adjusted EBITDA | | $ | 212 | | | $ | 322 | | | $ | 944 | | | $ | 1,471 | |

| | | | | | | | |

| Sales Volumes of Finished Goods | | 2,239 | | 2,577 | | 8,744 | | 8,870 |

| Adjusted EBITDA / tonne | | $ | 95 | | | $ | 125 | | | $ | 108 | | $ | 166 | | $ | 166 | |

Reconciliation of Non-GAAP Financial Measures

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Years ended December 31, |

Phosphate Earnings (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Operating Earnings | | $ | 44 | | | $ | 21 | | | $ | 225 | | | $ | 375 | |

| Plus: Depreciation, Depletion and Amortization | | 143 | | | 124 | | | 506 | | | 486 | |

| Plus: Accretion Expense | | 25 | | | 19 | | | 85 | | | 67 | |

| Plus: Foreign Exchange Gain (Loss) | | (4) | | | (1) | | | (5) | | | (1) | |

| Plus: Other Non Operating Income (Expense) | | 517 | | | (9) | | | 519 | | | (16) | |

| Plus: Dividends from equity investments | | — | | | — | | | 15 | | | 25 | |

| Less: Earnings (Loss) from Consolidated Noncontrolling Interests | | (4) | | | 2 | | | 25 | | | 47 | |

| Plus: Notable Items | | (388) | | | 107 | | | (129) | | | 338 | |

| Adjusted EBITDA | | $ | 341 | | | $ | 259 | | | $ | 1,191 | | | $ | 1,227 | |

| | | | | | | | |

| Sales Volumes of Finished Goods | | 1,622 | | 1,582 | | 6,437 | | 6,991 |

| Adjusted EBITDA / tonne | | $ | 210 | | | $ | 164 | | | $ | 185 | | $ | 166 | | $ | 176 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Years ended December 31, |

Mosaic Fertilizantes (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Operating Earnings | | $ | 79 | | | $ | 50 | | | $ | 238 | | | $ | 75 | |

| Plus: Depreciation, Depletion and Amortization | | 40 | | | 41 | | | 159 | | | 165 | |

| Plus: Accretion Expense | | 4 | | | 5 | | | 18 | | | 20 | |

| Plus: Foreign Exchange Gain (Loss) | | (84) | | | 32 | | | (256) | | | 80 | |

| Plus: Other Non Operating Income (Expense) | | (2) | | | (1) | | | (8) | | | (4) | |

| Less: Earnings (Loss) from Consolidated Noncontrolling Interests | | 1 | | | — | | | 1 | | | (2) | |

| Plus: Notable Items | | 46 | | | (16) | | | 194 | | | (11) | |

| Adjusted EBITDA | | $ | 82 | | | $ | 111 | | | $ | 344 | | | $ | 327 | |

| | | | | | | | |

| Sales Volumes of Finished Goods | | 2,240 | | 2,158 | | 9,030 | | 9,683 |

| Adjusted EBITDA / tonne | | $ | 37 | | | $ | 51 | | | $ | 38 | | $ | 166 | | $ | 34 | |

Exhibit 99.2

The Mosaic Company

Selected Calendar Quarter Financial Information

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

Consolidated data (in millions, except per share) | | | | | | | | |

| Diluted net earnings (loss) per share | $ | 1.28 | | $ | 1.11 | | $ | (0.01) | | $ | 1.11 | | $ | 0.14 | | $ | (0.50) | | $ | 0.38 | | $ | 0.53 | |

Notable items impact on earnings per share(a) | 0.14 | | 0.07 | | (0.69) | | 0.40 | | (0.51) | | (1.04) | | 0.04 | | 0.08 | |

Adjusted diluted net earnings per share(a) | $ | 1.14 | | $ | 1.04 | | $ | 0.68 | | $ | 0.71 | | $ | 0.65 | | $ | 0.54 | | $ | 0.34 | | $ | 0.45 | |

| Diluted weighted average # of shares outstanding | 338.7 | | 333.7 | | 332.0 | | 327.7 | | 323.5 | | 321.2 | | 319.4 | | 318.5 | |

| | | | | | | | |

| Total Net Sales | $ | 3,604 | | $ | 3,395 | | $ | 3,548 | | $ | 3,149 | | $ | 2,679 | | $ | 2,817 | | $ | 2,811 | | $ | 2,816 | |

| Cost of goods sold | 2,934 | | 2,824 | | 3,139 | | 2,589 | | 2,280 | | 2,423 | | 2,395 | | 2,514 | |

| Gross Margin | $ | 670 | | $ | 571 | | $ | 409 | | $ | 560 | | $ | 399 | | $ | 394 | | $ | 416 | | $ | 302 | |

| SG&A | 127 | | 130 | | 120 | | 123 | | 107 | | 128 | | 149 | | 113 | |

Other operating (income) expense(p) | (2) | | 72 | | 144 | | 158 | | 119 | | 33 | | 153 | | 89 | |

| Operating earnings | $ | 545 | | $ | 369 | | $ | 145 | | $ | 279 | | $ | 173 | | $ | 233 | | $ | 115 | | $ | 100 | |

| Interest expense, net | (41) | | (36) | | (17) | | (35) | | (48) | | (46) | | (42) | | (47) | |

| Consolidated foreign currency gain/(loss) | 51 | | 149 | | (97) | | 91 | | (100) | | (268) | | 101 | | (419) | |

| Earnings from consolidated companies before income taxes | 546 | | 474 | | (19) | | 324 | | 25 | | (74) | | 174 | | 191 | |

| Provision for (benefit from) income taxes | 118 | | 108 | | (6) | | (44) | | 6 | | 99 | | 48 | | 34 | |

| Earnings (loss) from consolidated companies | $ | 428 | | $ | 366 | | $ | (13) | | $ | 368 | | $ | 19 | | $ | (173) | | $ | 126 | | $ | 157 | |

| Equity in net earnings (loss) of nonconsolidated companies | 31 | | 13 | | 16 | | — | | 37 | | 22 | | 5 | | 9 | |

| Less: Net earnings (loss) attributable to noncontrolling interests | 24 | | 10 | | 7 | | 3 | | 11 | | 11 | | 9 | | (3) | |

| Net earnings (loss) attributable to Mosaic | $ | 435 | | $ | 369 | | $ | (4) | | $ | 365 | | $ | 45 | | $ | (162) | | $ | 122 | | $ | 169 | |

| After tax Notable items included in earnings | $ | 46 | | $ | 22 | | $ | (231) | | $ | 131 | | $ | (165) | | $ | (334) | | $ | 15 | | $ | 25 | |

| | | | | | | | |

| Gross Margin Rate | 19 | % | 17 | % | 12 | % | 18 | % | 15 | % | 14 | % | 15 | % | 11 | % |

| | | | | | | | |

| Effective Tax Rate (including discrete tax) | 22 | % | 23 | % | 32 | % | (14) | % | 24 | % | (133) | % | 28 | % | 18 | % |

| Discrete Tax benefit (expense) | $ | 14 | | $ | 10 | | $ | 17 | | $ | 2 | | $ | 1 | | $ | (120) | | $ | 4 | | $ | (11) | |

| | | | | | | | |

| Depreciation, Depletion and Amortization | $ | 220 | | $ | 244 | | $ | 239 | | $ | 257 | | $ | 241 | | $ | 264 | | $ | 238 | | $ | 283 | |

| Accretion Expense | $ | 23 | | $ | 23 | | $ | 23 | | $ | 27 | | $ | 27 | | $ | 28 | | $ | 26 | | $ | 31 | |

| Share-Based Compensation Expense | $ | 12 | | $ | 9 | | $ | 6 | | $ | 6 | | $ | 9 | | $ | 12 | | $ | 5 | | $ | 7 | |

| Notable Items | $ | (66) | | $ | (32) | | $ | 335 | | $ | — | | $ | 222 | | $ | 319 | | $ | (28) | | $ | 32 | |

Adjusted EBITDA(b) | $ | 777 | | $ | 744 | | $ | 594 | | $ | 646 | | $ | 576 | | $ | 584 | | $ | 448 | | $ | 594 | |

| | | | | | | | |

| Net cash provided by (used in) operating activities | $ | 149 | | $ | 1,073 | | $ | 647 | | $ | 538 | | $ | (80) | | $ | 847 | | $ | 313 | | $ | 219 | |

| Cash paid for interest (net of amount capitalized) | 8 | | 80 | | 5 | | 76 | | 17 | | 77 | | 20 | | 72 | |

| Cash paid for income taxes (net of refunds) | 226 | | 147 | | 49 | | (36) | | 99 | | 74 | | 111 | | 53 | |

| Net cash used in investing activities | $ | (221) | | $ | (312) | | $ | (422) | | $ | (362) | | $ | (388) | | $ | (349) | | $ | (248) | | $ | (277) | |

| Capital expenditures | (322) | | (310) | | (412) | | (359) | | (383) | | (334) | | (241) | | (294) | |

| Net cash (used in) provided by financing activities | $ | (209) | | $ | (607) | | $ | (254) | | $ | (411) | | $ | 458 | | $ | (489) | | $ | (138) | | $ | 37 | |

| Cash dividends paid | (152) | | (68) | | (66) | | (65) | | (70) | | (68) | | (67) | | (67) | |

| Effect of exchange rate changes on cash | $ | 4 | | $ | 9 | | $ | (10) | | $ | (6) | | $ | (4) | | $ | (6) | | $ | 55 | | $ | (7) | |

| | | | | | | | |

| Net change in cash and cash equivalents | $ | (277) | | $ | 164 | | $ | (39) | | $ | (241) | | $ | (14) | | $ | 3 | | $ | (18) | | $ | (27) | |

| | | | | | | | |

| Short-term debt | $ | 855 | | $ | 229 | | $ | 300 | | $ | 400 | | $ | 1,204 | | $ | 882 | | $ | 752 | | $ | 847 | |

| Long-term debt (including current portion) | 3,389 | | 3,393 | | 3,357 | | 3,362 | | 3,350 | | 3,319 | | 3,313 | | 3,378 | |

| Cash & cash equivalents | 465 | | 626 | | 591 | | 349 | | 337 | | 322 | | 302 | | 273 | |

| Net debt | $ | 3,779 | | $ | 2,996 | | $ | 3,066 | | $ | 3,413 | | $ | 4,217 | | $ | 3,879 | | $ | 3,763 | | $ | 3,952 | |

| | | | | | | | |

Segment Contributions (in millions) | | | | | | | | |

| Phosphates | $ | 1,382 | | $ | 1,286 | | $ | 986 | | $ | 1,070 | | $ | 1,169 | | $ | 1,180 | | $ | 1,005 | | $ | 1,165 | |

| Potash | 907 | | 849 | | 720 | | 758 | | 643 | | 663 | | 526 | | 557 | |

| Mosaic Fertilizantes | 1,343 | | 1,419 | | 1,731 | | 1,192 | | 886 | | 1,049 | | 1,399 | | 1,088 | |

Corporate and Other(c) | (28) | | (159) | | 111 | | 129 | | (19) | | (75) | | (119) | | 6 | |

| Total net sales | $ | 3,604 | | $ | 3,395 | | $ | 3,548 | | $ | 3,149 | | $ | 2,679 | | $ | 2,817 | | $ | 2,811 | | $ | 2,816 | |

| | | | | | | | |

| Phosphates | $ | 266 | | $ | 146 | | $ | (58) | | $ | 21 | | $ | 40 | | $ | 133 | | $ | 8 | | $ | 44 | |

| Potash | 402 | | 328 | | 200 | | 222 | | 198 | | 174 | | 109 | | 123 | |

| Mosaic Fertilizantes | (32) | | (20) | | 77 | | 50 | | 42 | | 61 | | 56 | | 79 | |

Corporate and Other(c) | (91) | | (85) | | (74) | | (14) | | (107) | | (135) | | (58) | | (146) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated operating earnings (loss) | $ | 545 | | $ | 369 | | $ | 145 | | $ | 279 | | $ | 173 | | $ | 233 | | $ | 115 | | $ | 100 | |

| | | | | | | | |

Phosphates(d) | 1,836 | | 1,922 | | 1,651 | | 1,582 | | 1,644 | | 1,696 | | 1,475 | | 1,622 | |

Potash(d) | 1,910 | | 2,163 | | 2,220 | | 2,577 | | 2,163 | | 2,346 | | 1,996 | | 2,239 | |

| Mosaic Fertilizantes | 2,080 | | 2,385 | | 3,060 | | 2,158 | | 1,715 | | 2,196 | | 2,879 | | 2,240 | |

| Corporate and Other | 420 | | 359 | | 482 | | 618 | | 333 | | 316 | | 297 | | 432 | |

Total finished product tonnes sold ('000 tonnes) | 6,246 | | 6,829 | | 7,413 | | 6,935 | | 5,855 | | 6,554 | | 6,647 | | 6,533 | |

Sales of Performance Products (third party) ('000 tonnes) (e) | 819 | | 977 | | 1,305 | | 1,044 | | 787 | | 839 | | 1,001 | | 1,135 | |

| | | | | | | | |

| | | | | | | | |

The Mosaic Company - Phosphates Segment

Selected Calendar Quarter Financial Information

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

Net Sales and Gross Margin (in millions, except per tonne) | | | | | | | | |

| Segment income statement | | | | | | | | |

| Net Sales | $ | 1,382 | | $ | 1,286 | | $ | 986 | | $ | 1,070 | | $ | 1,169 | | $ | 1,180 | | $ | 1,005 | | $ | 1,165 | |

| Cost of Goods Sold | 1,123 | | 1,070 | | 899 | | 931 | | 1,010 | | 1,026 | | 863 | | 1,027 | |

| Gross Margin | $ | 259 | | $ | 216 | | $ | 87 | | $ | 139 | | $ | 159 | | $ | 154 | | $ | 142 | | $ | 138 | |

| Notable Items Included in Gross Margin | — | | (31) | | — | | (28) | | — | | (15) | | — | | (53) | |

Adjusted Gross Margin(b) | $ | 259 | | $ | 247 | | $ | 87 | | $ | 167 | | $ | 159 | | $ | 169 | | $ | 142 | | $ | 191 | |

| | | | | | | | |

| SG&A | 10 | | 11 | | 10 | | 11 | | 13 | | 10 | | 12 | | 10 | |

| Other operating (income) expense | (17) | | 59 | | 135 | | 107 | | 106 | | 11 | | 123 | | 84 | |

| | | | | | | | |

| Operating Earnings | $ | 266 | | $ | 146 | | $ | (58) | | $ | 21 | | $ | 40 | | $ | 133 | | $ | 8 | | $ | 44 | |

| Plus: Depreciation, Depletion and Amortization | 116 | | 129 | | 117 | | 124 | | 117 | | 128 | | 118 | | 143 | |

| Plus: Accretion Expense | 16 | | 16 | | 16 | | 19 | | 20 | | 20 | | 20 | | 25 | |

| Plus: Foreign Exchange Gain (Loss) | (2) | | (2) | | 4 | | (1) | | 2 | | 2 | | (5) | | (4) | |

| Plus: Other Non operating Income (Expense) | — | | (1) | | (6) | | (9) | | 3 | | (2) | | 1 | | 517 | |

| Plus: Dividends from equity investments | 25 | | — | | — | | — | | 15 | | — | | — | | — | |

| Less: Earnings (loss) from Consolidated Noncontrolling Interests | 25 | | 12 | | 8 | | 2 | | 10 | | 11 | | 8 | | (4) | |

| Plus: Notables Items | (14) | | 109 | | 136 | | 107 | | 90 | | 38 | | 131 | | (388) | |

Adjusted EBITDA(b) | $ | 382 | | $ | 385 | | $ | 201 | | $ | 259 | | $ | 277 | | $ | 308 | | $ | 265 | | $ | 341 | |

| | | | | | | | |

| Capital expenditures | $ | 142 | | $ | 119 | | $ | 157 | | $ | 208 | | $ | 197 | | $ | 177 | | $ | 127 | | $ | 160 | |

| Gross Margin $ / tonne of finished product | $ | 141 | | $ | 112 | | $ | 53 | | $ | 88 | | $ | 97 | | $ | 91 | | $ | 96 | | $ | 85 | |

| Adjusted Gross Margin $ / tonne of finished product | $ | 141 | | $ | 129 | | $ | 53 | | $ | 106 | | $ | 97 | | $ | 100 | | $ | 96 | | $ | 118 | |

| Gross margin as a percent of sales | 19 | % | 17 | % | 9 | % | 13 | % | 14 | % | 13 | % | 14 | % | 12 | % |

| | | | | | | | |

| Freight included in finished goods (in millions) | $ | 96 | | $ | 102 | | $ | 92 | | $ | 105 | | $ | 103 | | $ | 104 | | $ | 79 | | $ | 83 | |

| Idle/Turnaround costs (excluding notable items) | $ | 42 | | $ | 34 | | $ | 25 | | $ | 32 | | $ | 56 | | $ | 36 | | $ | 7 | | $ | 24 | |

| | | | | | | | |

| Operating Data | | | | | | | | |

Sales volumes ('000 tonnes)(d) | | | | | | | | |

| DAP/MAP | 1,022 | | 928 | | 913 | | 762 | | 900 | | 828 | | 656 | | 749 | |

Performance products(f) | 740 | | 919 | | 673 | | 741 | | 673 | | 794 | | 750 | | 814 | |

Other products(i) | 74 | | 75 | | 65 | | 79 | | 71 | | 74 | | 69 | | 59 | |

Total Finished Product(d) | 1,836 | | 1,922 | | 1,651 | | 1,582 | | 1,644 | | 1,696 | | 1,475 | | 1,622 | |

| | | | | | | | |

DAP selling price (fob plant)(r) | $ | 660 | | $ | 585 | | $ | 487 | | $ | 552 | | $ | 598 | | $ | 575 | | $ | 569 | | $ | 593 | |

Average finished product selling price (destination)(g) | $ | 717 | | $ | 634 | | $ | 569 | | $ | 658 | | $ | 677 | | $ | 667 | | $ | 651 | | $ | 690 | |

| | | | | | | | |

Production Volumes ('000 tonnes) | | | | | | | | |

Total tonnes produced(h) | 1,836 | | 1,660 | | 1,593 | | 1,479 | | 1,577 | | 1,675 | | 1,625 | | 1,569 | |

| Operating Rate | 74 | % | 67 | % | 64 | % | 60 | % | 64 | % | 68 | % | 66 | % | 58 | % |

| | | | | | | | |

| Raw Materials | | | | | | | | |

| Ammonia used in production (tonnes) | 274 | | 240 | | 234 | | 209 | | 246 | | 243 | | 238 | | 228 | |

| % manufactured ammonia used in production | 29 | % | 44 | % | 32 | % | 53 | % | 1 | % | 41 | % | 33 | % | 20 | % |

| Sulfur used in production | 840 | | 771 | | 735 | | 549 | | 725 | | 778 | | 739 | | 694 | |

| % prilled sulfur used in production | 7 | % | 11 | % | 5 | % | 6 | % | 1 | % | 8 | % | 8 | % | 7 | % |

| | | | | | | | |

Realized costs ($/tonne) | | | | | | | | |

Ammonia (tonne)(j) | $ | 605 | | $ | 441 | | $ | 353 | | $ | 366 | | $ | 404 | | $ | 424 | | $ | 482 | | $ | 435 | |

Sulfur (long ton)(k) | $ | 236 | | $ | 195 | | $ | 156 | | $ | 152 | | $ | 142 | | $ | 138 | | $ | 126 | | $ | 127 | |

| Blended rock | $ | 77 | | $ | 79 | | $ | 81 | | $ | 77 | | $ | 81 | | $ | 86 | | $ | 87 | | $ | 87 | |

| | | | | | | | |

Phosphates cash conversion costs / production tonne(s) | $ | 96 | | $ | 105 | | $ | 105 | | $ | 118 | | $ | 110 | | $ | 100 | | $ | 101 | | $ | 118 | |

Cash costs of U.S. mined rock / production tonne(t) | $ | 58 | | $ | 56 | | $ | 56 | | $ | 56 | | $ | 57 | | $ | 54 | | $ | 56 | | $ | 52 | |

| | | | | | | | |

| ARO cash spending (in millions) | $ | 41 | | $ | 41 | | $ | 42 | | $ | 41 | | $ | 40 | | $ | 59 | | $ | 54 | | $ | 72 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| MWSPC equity earnings (loss) | $ | 31 | | $ | 10 | | $ | 17 | | $ | — | | $ | 37 | | $ | 22 | | $ | 5 | | $ | 9 | |

| MWSPC total sales tonnes (DAP/MAP/NPK) | 762 | | 649 | | 771 | | 722 | | 671 | | 688 | | 689 | | 698 | |

| | | | | | | | |

| Miski Mayo external sales revenue | $ | 41 | | $ | 47 | | $ | 33 | | $ | 18 | | $ | 37 | | $ | 34 | | $ | 28 | | $ | 28 | |

| | | | | | | | |

The Mosaic Company - Potash Segment

Selected Calendar Quarter Financial Information

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

Net Sales and Gross Margin (in millions, except per tonne) | | | | | | | | |

| Segment income statement | | | | | | | | |

| Net Sales | $ | 907 | | $ | 849 | | $ | 720 | | $ | 758 | | $ | 643 | | $ | 663 | | $ | 526 | | $ | 557 | |

| Cost of Goods Sold | 494 | | 513 | | 510 | | 503 | | 431 | | 477 | | 404 | | 434 | |

| Gross Margin | $ | 413 | | $ | 336 | | $ | 210 | | $ | 255 | | $ | 212 | | $ | 186 | | $ | 122 | | $ | 123 | |

| Notable Items Included in Gross Margin | — | | — | | — | | — | | — | | — | | — | | — | |

Adjusted Gross Margin(b) | $ | 413 | | $ | 336 | | $ | 210 | | $ | 255 | | $ | 212 | | $ | 186 | | $ | 122 | | $ | 123 | |

| | | | | | | | |

| SG&A | 8 | | 7 | | 6 | | 8 | | 9 | | 7 | | 7 | | 8 | |

Other operating (income) expense (p) | 3 | | 1 | | 4 | | 25 | | 5 | | 5 | | 6 | | (8) | |

| | | | | | | | |

| Operating Earnings | $ | 402 | | $ | 328 | | $ | 200 | | $ | 222 | | $ | 198 | | $ | 174 | | $ | 109 | | $ | 123 | |

| Plus: Depreciation, Depletion and Amortization | 70 | | 74 | | 66 | | 89 | | 82 | | 94 | | 69 | | 93 | |

| Plus: Accretion Expense | 2 | | 2 | | 2 | | 3 | | 2 | | 3 | | 2 | | 2 | |

| Plus: Foreign Exchange Gain (Loss) | 3 | | 23 | | (26) | | 41 | | (31) | | (12) | | 48 | | (185) | |

| Plus: Other Non operating Income (Expense) | — | | — | | (43) | | (2) | | — | | — | | — | | 1 | |

| Plus: Notable Items | (3) | | (19) | | 68 | | (31) | | 30 | | 12 | | (48) | | 178 | |

Adjusted EBITDA(b) | $ | 474 | | $ | 408 | | $ | 267 | | $ | 322 | | $ | 281 | | $ | 271 | | $ | 180 | | $ | 212 | |

| | | | | | | | |

| Capital expenditures | $ | 93 | | $ | 74 | | $ | 85 | | $ | 105 | | $ | 97 | | $ | 75 | | $ | 61 | | $ | 65 | |

| Gross Margin $ / tonne of finished product | $ | 216 | | $ | 155 | | $ | 95 | | $ | 99 | | $ | 98 | | $ | 79 | | $ | 61 | | $ | 55 | |

| Adjusted Gross Margin $ / tonne of finished product | $ | 216 | | $ | 155 | | $ | 95 | | $ | 99 | | $ | 98 | | $ | 79 | | $ | 61 | | $ | 55 | |

| Gross margin as a percent of sales | 46 | % | 40 | % | 29 | % | 34 | % | 33 | % | 28 | % | 23 | % | 22 | % |

| | | | | | | | |

| Supplemental Cost Information | | | | | | | | |

| Canadian resource taxes | $ | 121 | | $ | 95 | | $ | 86 | | $ | 102 | | $ | 62 | | $ | 67 | | $ | 45 | | $ | 56 | |

| Royalties | $ | 19 | | $ | 13 | | $ | 9 | | $ | 13 | | $ | 10 | | $ | 10 | | $ | 9 | | $ | 10 | |

Freight(l) | $ | 80 | | $ | 94 | | $ | 99 | | $ | 78 | | $ | 86 | | $ | 94 | | $ | 87 | | $ | 60 | |

| Idle/Turnaround costs (excluding notable items) | $ | 22 | | $ | 35 | | $ | 37 | | $ | 3 | | $ | 9 | | $ | 18 | | $ | 23 | | $ | 6 | |

| | | | | | | | |

| Operating Data | | | | | | | | |

Sales volumes ('000 tonnes)(d) | | | | | | | | |

| MOP | 1,696 | | 1,883 | | 2,031 | | 2,359 | | 1,927 | | 2,113 | | 1,775 | | 2,064 | |

Performance products(m) | 201 | | 270 | | 177 | | 207 | | 225 | | 225 | | 211 | | 168 | |

Other products(i) | 13 | | 10 | | 12 | | 11 | | 11 | | 8 | | 10 | | 7 | |

Total Finished Product(d) | 1,910 | | 2,163 | | 2,220 | | 2,577 | | 2,163 | | 2,346 | | 1,996 | | 2,239 | |

| | | | | | | | |

| Crop Nutrients North America | 739 | | 881 | | 1,129 | | 773 | | 838 | | 970 | | 647 | | 779 | |

| Crop Nutrients International | 1,053 | | 1,144 | | 1,007 | | 1,666 | | 1,195 | | 1,260 | | 1,255 | | 1,341 | |

| Non-Agricultural | 118 | | 138 | | 84 | | 138 | | 130 | | 116 | | 94 | | 119 | |

Total Finished Product(d) | 1,910 | | 2,163 | | 2,220 | | 2,577 | | 2,163 | | 2,346 | | 1,996 | | 2,239 | |

| | | | | | | | |

MOP selling price (fob mine)(o) | $ | 421 | | $ | 326 | | $ | 266 | | $ | 243 | | $ | 241 | | $ | 224 | | $ | 215 | | $ | 199 | |

Average finished product selling price (destination)(g) | $ | 475 | | $ | 392 | | $ | 324 | | $ | 294 | | $ | 297 | | $ | 283 | | $ | 263 | | $ | 249 | |

| | | | | | | | |

Production Volumes ('000 tonnes) | | | | | | | | |

| Production Volume | 1,944 | | 1,921 | | 1,854 | | 2,527 | | 2,338 | | 2,224 | | 1,904 | | 2,332 | |

| Operating Rate | 69 | % | 69 | % | 66 | % | 90 | % | 81 | % | 78 | % | 66 | % | 81 | % |

| | | | | | | | |

MOP cash costs of production excluding brine / production tonne(n) | $ | 81 | | $ | 74 | | $ | 73 | | $ | 66 | | $ | 72 | | $ | 64 | | $ | 74 | | $ | 73 | |

ARO cash spending (in millions) | $ | 3 | | $ | 3 | | $ | 3 | | $ | 2 | | $ | 1 | | $ | 2 | | $ | 2 | | $ | 3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Average CAD / USD | $ | 1.352 | | $ | 1.343 | | $ | 1.342 | | $ | 1.361 | | $ | 1.348 | | $ | 1.368 | | $ | 1.364 | | $ | 1.399 | |

The Mosaic Company - Mosaic Fertilizantes Segment

Selected Calendar Quarter Financial Information

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

Net Sales and Gross Margin (in millions, except per tonne) | | | | | | | | |

| Segment income statement | | | | | | | | |

| Net Sales | $ | 1,343 | | $ | 1,419 | | $ | 1,731 | | $ | 1,192 | | $ | 886 | | $ | 1,049 | | $ | 1,399 | | $ | 1,088 | |

| Cost of Goods Sold | 1,344 | | 1,406 | | 1,625 | | 1,098 | | 811 | | 947 | | 1,271 | | 986 | |

| Gross Margin | $ | (1) | | $ | 13 | | $ | 106 | | $ | 94 | | $ | 75 | | $ | 102 | | $ | 128 | | $ | 102 | |

| Notable Items Included in Gross Margin | — | | (13) | | (2) | | (3) | | 1 | | 4 | | 6 | | 9 | |

Adjusted Gross Margin(b) | $ | (1) | | $ | 26 | | $ | 108 | | $ | 97 | | $ | 74 | | $ | 98 | | $ | 122 | | $ | 93 | |

| | | | | | | | |

| SG&A | 26 | | 29 | | 26 | | 29 | | 30 | | 27 | | 62 | | 16 | |

| Other operating (income) expense | 5 | | 4 | | 3 | | 15 | | 3 | | 14 | | 10 | | 7 | |

| | | | | | | | |

| Operating Earnings | $ | (32) | | $ | (20) | | $ | 77 | | $ | 50 | | $ | 42 | | $ | 61 | | $ | 56 | | $ | 79 | |

| Plus: Depreciation, Depletion and Amortization | 32 | | 38 | | 54 | | 41 | | 40 | | 40 | | 39 | | 40 | |

| Plus: Accretion Expense | 5 | | 5 | | 5 | | 5 | | 5 | | 5 | | 4 | | 4 | |

| Plus: Foreign Exchange Gain (Loss) | 23 | | 73 | | (48) | | 32 | | (45) | | (144) | | 17 | | (84) | |

| Plus: Other Non operating Income (Expense) | (1) | | (1) | | (1) | | (1) | | (2) | | (2) | | (2) | | (2) | |

| Less: Earnings from Consolidated Noncontrolling Interests | — | | (2) | | — | | — | | 1 | | (1) | | — | | 1 | |

| Plus: Notable Items | (24) | | (31) | | 60 | | (16) | | 44 | | 135 | | (31) | | 46 | |

Adjusted EBITDA(b) | $ | 3 | | $ | 66 | | $ | 147 | | $ | 111 | | $ | 83 | | $ | 96 | | $ | 83 | | $ | 82 | |

| | | | | | | | |

| Capital expenditures | $ | 87 | | $ | 63 | | $ | 118 | | $ | 68 | | $ | 82 | | $ | 46 | | $ | 51 | | $ | 64 | |

| Gross Margin $ / tonne of finished product | $ | (1) | | $ | 5 | | $ | 35 | | $ | 44 | | $ | 44 | | $ | 46 | | $ | 44 | | $ | 46 | |

| Adjusted Gross Margin $ / tonne of finished product | $ | (1) | | $ | 11 | | $ | 35 | | $ | 45 | | $ | 43 | | $ | 45 | | $ | 42 | | $ | 42 | |

| Gross margin as a percent of sales | — | % | 1 | % | 6 | % | 8 | % | 8 | % | 10 | % | 9 | % | 9 | % |

| Idle/Turnaround costs (excluding notable items) | $ | 11 | | $ | 30 | | $ | 28 | | $ | 26 | | $ | 15 | | $ | 24 | | $ | 40 | | $ | 18 | |

| | | | | | | | |

| Operating Data | | | | | | | | |

Sales volumes ('000 tonnes) | | | | | | | | |

| Phosphate produced in Brazil | 510 | | 611 | | 622 | | 492 | | 324 | | 433 | | 521 | | 423 | |

| Potash produced in Brazil | 44 | | 44 | | 62 | | 45 | | 32 | | 34 | | 100 | | 35 | |

Purchased nutrients for distribution(q) | 1,526 | | 1,730 | | 2,376 | | 1,621 | | 1,359 | | 1,729 | | 2,258 | | 1,782 | |

| Total Finished Product | 2,080 | | 2,385 | | 3,060 | | 2,158 | | 1,715 | | 2,196 | | 2,879 | | 2,240 | |

| | | | | | | | |

Sales of Performance Products ('000 tonnes)(e) | $ | 211 | | $ | 283 | | $ | 660 | | $ | 341 | | $ | 123 | | $ | 215 | | $ | 462 | | $ | 307 | |

| | | | | | | | |

| Brazil MAP price (Brazil production delivered price to third party) | $ | 669 | | $ | 653 | | $ | 533 | | $ | 580 | | $ | 581 | | $ | 596 | | $ | 601 | | $ | 632 | |

Average finished product selling price (destination)(g) | $ | 646 | | $ | 595 | | $ | 566 | | $ | 552 | | $ | 517 | | $ | 478 | | $ | 486 | | $ | 486 | |

| | | | | | | | |

Production Volumes ('000 tonnes) | | | | | | | | |

| MAP | 235 | | 219 | | 160 | | 256 | | 241 | | 212 | | 194 | | 238 | |

| TSP | 106 | | 88 | | 131 | | 50 | | 99 | | 95 | | 127 | | 73 | |

| SSP | 283 | | 240 | | 321 | | 316 | | 278 | | 273 | | 364 | | 315 | |

| DCP | 108 | | 133 | | 133 | | 120 | | 124 | | 128 | | 83 | | 135 | |

| NPK | 45 | | 56 | | 62 | | 32 | | 51 | | 44 | | 11 | | 20 | |

| Total phosphate tonnes produced | 777 | | 736 | | 807 | | 774 | | 793 | | 752 | | 779 | | 781 | |

| MOP | 82 | | 61 | | 106 | | 114 | | 104 | | 79 | | 105 | | 108 | |

| | | | | | | | |

| Phosphate operating rate | 78 | % | 74 | % | 81 | % | 77 | % | 79 | % | 75 | % | 78 | % | 78 | % |

| Potash operating rate | 65 | % | 49 | % | 85 | % | 91 | % | 83 | % | 63 | % | 85 | % | 88 | % |

| | | | | | | | |

| Realized Costs ($/tonne) | | | | | | | | |

Ammonia/tonne(j) | $ | 1,150 | | $ | 912 | | $ | 667 | | $ | 655 | | $ | 705 | | $ | 623 | | $ | 572 | | $ | 628 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Sulfur (long ton)(k) | $ | 278 | | $ | 258 | | $ | 219 | | $ | 179 | | $ | 173 | | $ | 174 | | $ | 170 | | $ | 177 | |

| Blended rock | $ | 124 | | $ | 128 | | $ | 117 | | $ | 117 | | $ | 115 | | $ | 107 | | $ | 105 | | $ | 109 | |

| | | | | | | | |

Purchases ('000 tonnes) | | | | | | | | |

| DAP/MAP from Mosaic | 146 | | 117 | | 20 | | 58 | | 68 | | 30 | | 43 | | 54 | |

| MicroEssentials® from Mosaic | 277 | | 427 | | 152 | | 163 | | 169 | | 289 | | 337 | | 195 | |

| Potash from Mosaic/Canpotex | 235 | | 756 | | 672 | | 404 | | 358 | | 736 | | 682 | | 419 | |

| | | | | | | | |

Phosphate cash conversion costs in BRL, Production / tonne(s) | R$538 | R$540 | R$495 | R$546 | R$502 | R$521 | R$486 | R$499 |

| Potash cash conversion costs in BRL, production / tonne | R$1,455 | R$1,701 | R$1,143 | R$1,064 | R$970 | R$1,084 | R$970 | R$884 |

| Mined rock costs in BRL, cash produced / tonne | R$606 | R$533 | R$498 | R$548 | R$597 | R$509 | R$584 | R$542 |

| ARO cash spending (in millions) | $ | 3 | | $ | 4 | | $ | 6 | | $ | 7 | | $ | 2 | | $ | 5 | | $ | 6 | | $ | 5 | |

| | | | | | | | |

| Average BRL / USD | $ | 5.196 | | $ | 4.954 | | $ | 4.880 | | $ | 4.953 | | $ | 4.952 | | $ | 5.216 | | $ | 5.546 | | $ | 5.842 | |

The Mosaic Company - Corporate and Other Segment

Selected Calendar Quarter Financial Information

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

Net Sales and Gross Margin (in millions) | | | | | | | | |

| Segment income statement | | | | | | | | |

| Net Sales | $ | (28) | | $ | (159) | | $ | 111 | | $ | 129 | | $ | (19) | | $ | (75) | | $ | (119) | | $ | 6 | |

| Cost of Goods Sold | (27) | | (165) | | 105 | | 57 | | 28 | | (27) | | (143) | | 67 | |

| Gross Margin (Loss) | $ | (1) | | $ | 6 | | $ | 6 | | $ | 72 | | $ | (47) | | $ | (48) | | $ | 24 | | $ | (61) | |