UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-38638

NIO Inc.

(Registrant’s Name)

Building 19, No. 1355, Caobao Road, Minhang

District

Shanghai, People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

By |

: |

/s/ Yu Qu |

| |

Name |

: |

Yu Qu |

| |

Title |

: |

Chief Financial Officer |

Date:

September 5, 2024

Exhibit

99.1

NIO Inc. Reports Unaudited Second Quarter 2024

Financial Results

Quarterly Total Revenues reached RMB17,446.0

million (US$2,400.6 million)i

Quarterly Vehicle Deliveries were 57,373 units

SHANGHAI, China, September 5, 2024 (GLOBE

NEWSWIRE) -- NIO Inc. (NYSE: NIO; HKEX: 9866; SGX: NIO) (“NIO” or the “Company”), a pioneer and a leading company

in the global smart electric vehicle market, today announced its unaudited financial results for the second quarter ended June 30,

2024.

Operating Highlights for the Second Quarter

of 2024

| · | Vehicle deliveries were 57,373 in the second quarter of 2024, consisting of 32,562 premium smart

electric SUVs and 24,811 premium smart electric sedans, representing an increase of 143.9% from the second quarter of 2023, and an increase

of 90.9% from the first quarter of 2024. |

Key Operating Results

| | |

2024 Q2 | | |

2024 Q1 | | |

2023 Q4 | | |

2023 Q3 | |

| Deliveries | |

| 57,373 | | |

| 30,053 | | |

| 50,045 | | |

| 55,432 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

2023 Q2 | | |

2023 Q1 | | |

2022 Q4 | | |

2022 Q3 | |

| Deliveries | |

| 23,520 | | |

| 31,041 | | |

| 40,052 | | |

| 31,607 | |

Financial Highlights for the Second Quarter

of 2024

| · | Vehicle sales were RMB15,679.6 million (US$2,157.6 million) in the second quarter of 2024, representing

an increase of 118.2% from the second quarter of 2023 and an increase of 87.1% from the first quarter of 2024. |

| · | Vehicle marginii

was 12.2% in the second quarter of 2024, compared with 6.2% in the second quarter of 2023 and 9.2% in the first quarter

of 2024. |

| · | Total revenues were RMB17,446.0 million (US$2,400.6 million) in the second quarter of 2024, representing

an increase of 98.9% from the second quarter of 2023 and an increase of 76.1% from the first quarter of 2024. |

| · | Gross profit was RMB1,688.7 million (US$232.4 million) in the second quarter of 2024, representing

an increase of 1,841.0% from the second quarter of 2023 and an increase of 246.3% from the first quarter of 2024. |

| · | Gross margin was 9.7% in the second quarter of 2024, compared with 1.0% in the second quarter of

2023 and 4.9% in the first quarter of 2024. |

| · | Loss from operations was RMB5,209.3 million (US$716.8 million) in the second quarter of 2024, representing

a decrease of 14.2% from the second quarter of 2023 and a decrease of 3.4% from the first quarter of 2024. Excluding share-based compensation

expenses, adjusted loss from operations (non-GAAP) was RMB4,698.5 million (US$646.5 million) in the second quarter of 2024, representing

a decrease of 14.0% from the second quarter of 2023 and a decrease of 8.1% from the first quarter of 2024. |

| · | Net loss was RMB5,046.0 million (US$694.4 million) in the second quarter of 2024, representing

a decrease of 16.7% from the second quarter of 2023 and a decrease of 2.7% from the first quarter of 2024. Excluding share-based compensation

expenses, adjusted net loss (non-GAAP) was RMB4,535.2 million (US$624.1 million) in the second quarter of 2024, representing a decrease

of 16.7% from the second quarter of 2023 and a decrease of 7.5% from the first quarter of 2024. |

| · | Cash and cash equivalents, restricted cash, short-term investment and long-term time deposits were

RMB41.6 billion (US$5.7 billion) as of June 30, 2024. |

Key Financial Results for the Second Quarter of 2024

(in RMB million, except for percentage)

| | |

2024 Q2 | | |

2024 Q1 | | |

2023 Q2 | | |

% Changeiii | |

| | |

| | |

| | |

| | |

QoQ | | |

YoY | |

| Vehicle Sales | |

| 15,679.6 | | |

| 8,381.3 | | |

| 7,185.2 | | |

| 87.1 | % | |

| 118.2 | % |

| Vehicle Margin | |

| 12.2 | % | |

| 9.2 | % | |

| 6.2 | % | |

| 300 | bp | |

| 600 | bp |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Revenues | |

| 17,446.0 | | |

| 9,908.6 | | |

| 8,771.7 | | |

| 76.1 | % | |

| 98.9 | % |

| Gross Profit | |

| 1,688.7 | | |

| 487.7 | | |

| 87.0 | | |

| 246.3 | % | |

| 1,841.0 | % |

| Gross Margin | |

| 9.7 | % | |

| 4.9 | % | |

| 1.0 | % | |

| 480 | bp | |

| 870 | bp |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss from Operations | |

| (5,209.3 | ) | |

| (5,394.1 | ) | |

| (6,074.1 | ) | |

| -3.4 | % | |

| -14.2 | % |

| Adjusted Loss from Operations (non-GAAP) | |

| (4,698.5 | ) | |

| (5,112.7 | ) | |

| (5,464.1 | ) | |

| -8.1 | % | |

| -14.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| (5,046.0 | ) | |

| (5,184.6 | ) | |

| (6,055.8 | ) | |

| -2.7 | % | |

| -16.7 | % |

| Adjusted Net Loss (non-GAAP) | |

| (4,535.2 | ) | |

| (4,903.2 | ) | |

| (5,445.7 | ) | |

| -7.5 | % | |

| -16.7 | % |

Recent Developments

Deliveries in July and August 2024

| · | NIO delivered 20,498 and 20,176 vehicles in July and August 2024, respectively. As of August 31,

2024, cumulative deliveries of NIO vehicles reached 577,694. |

Power Up Counties Plan

| · | On August 20, 2024, NIO announced its “Power Up Counties” plan to strengthen its charging

and swapping network across all county-level administrative divisions in China, providing a more convenient and efficient power solution

for NIO, ONVO and all the EV users. |

Share Issuance for Share Incentive Plans

| · | On July 12, 2024, NIO issued 30,000,000 Class A ordinary shares to Deutsche Bank Trust Company

Americas, the depositary of the Company’s ADS program, to facilitate future exercise of options and other share incentive awards

under the share incentive plans of the Company. |

CEO and CFO Comments

“In the second quarter of 2024, NIO achieved

a record-breaking delivery of 57,373 premium smart electric vehicles, securing over 40% of the market share in the battery electric vehicle

segment priced above RMB 300,000 in China,” said William Bin Li, founder, chairman and chief executive officer of NIO, “NIO’s

core competitive advantages in technology, product, service and community are earning increasing recognition from users, driving the continued

strong vehicle sales performance. In July and August 2024, NIO delivered 20,498 and 20,176 vehicles, respectively. The total

delivery volume for the third quarter is expected to set another record, further solidifying and expanding market share.”

“At the AI-themed NIO IN 2024, we unveiled

major technological breakthroughs across multiple domains, including the in-house developed intelligent driving chip, full-domain vehicle

operating system, smart system and intelligent driving. Through sustained and dedicated investment in technological research and development,

NIO has positioned itself at the forefront of product and technological innovation, while achieving long-term cost competitiveness. Additionally,

on September 1, 105 ONVO brand stores opened simultaneously. The brand’s inaugural model, L60 has commenced its initial presentations

and is expected to be officially launched and begin deliveries within this month. L60 has been widely embraced by the market since its

debut and we expect the new brand to secure a strong position for us in the mass market,” added William Bin Li.

“Due to ongoing cost optimizations, our

vehicle gross margin increased to 12.2% in the second quarter,” added Stanley Yu Qu, NIO’s chief financial officer, “We

will continue to focus on efficient R&D and infrastructure investment, leverage the growth potential in the mass market, adopt flexible

market strategies and continuously optimize our product portfolio. We are confident that these efforts will result in steady improvements

in gross profit and cost efficiency in the future.”

Financial Results for the Second Quarter

of 2024

Revenues

| · | Total revenues in the second quarter of 2024 were RMB17,446.0 million (US$2,400.6 million), representing

an increase of 98.9% from the second quarter of 2023 and an increase of 76.1% from the first quarter of 2024. |

| · | Vehicle sales in the second quarter of 2024 were RMB15,679.6 million (US$2,157.6 million), representing

an increase of 118.2% from the second quarter of 2023 and an increase of 87.1% from the first quarter of 2024. The increase in vehicle

sales over the second quarter of 2023 was mainly due to the increase in delivery volume, partially offset by the lower average selling

price as a result of changes in product mix and user rights adjustments since June 2023. The increase in vehicle sales over the first

quarter of 2024 was mainly attributable to an increase in delivery volume. |

| · | Other sales in the second quarter of 2024 were RMB1,766.3 million (US$243.1 million), representing

an increase of 11.3% from the second quarter of 2023 and an increase of 15.6% from the first quarter of 2024. The increase in other sales

over the second quarter of 2023 was mainly due to the increase in sales of parts, accessories and after-sales vehicle services, and provision

of power solutions, as a result of the continued growth in the number of users, and partially offset by a decrease in revenue from sales

of used cars. The increase in other sales over the first quarter of 2024 was mainly due to (i) the increase in sales of parts, accessories

and after-sales vehicle services, provision of power solutions and other products, as a result of the increased sales of embedded products

and services offered together with vehicle sales, and continued growth in the number of users; and (ii) the increase in sales from

rendering of technical research and development services. |

Cost of Sales and Gross Margin

| · | Cost of sales in the second quarter of 2024 was RMB15,757.3 million

(US$2,168.3 million), representing an increase of 81.4% from the second quarter of 2023 and an increase of 67.3% from the first quarter

of 2024. The increase in cost of sales over the second quarter of 2023 was mainly attributable to an increase in delivery volume, and

partially offset by the decreased material cost per vehicle. The increase in cost of sales over the first quarter of 2024 was mainly attributable

to an increase in delivery volume. |

| · | Gross profit in the second quarter of 2024 was RMB1,688.7 million (US$232.4 million), representing

an increase of 1,841.0% from the second quarter of 2023 and an increase of 246.3% from the first quarter of 2024. |

| · | Gross margin in the second quarter of 2024 was 9.7%, compared with 1.0% in the second quarter of

2023 and 4.9% in the first quarter of 2024. The increase of gross margin over the second quarter of 2023 and the first quarter of 2024

was mainly attributable to the increased vehicle margin. |

| · | Vehicle margin in the second quarter of 2024 was 12.2%, compared with 6.2% in the second quarter

of 2023 and 9.2% in the first quarter of 2024. The increase in vehicle margin from the second quarter of 2023 was mainly attributable

to decreased material cost per unit, and partially offset by lower average selling price as a result of the user rights adjustments since

June 2023. The increase in vehicle margin from the first quarter of 2024 was mainly due to the decreased material cost per unit. |

Operating Expenses

| · | Research and development expenses in the second quarter of 2024 were RMB3,218.5 million (US$442.9

million), representing a decrease of 3.8% from the second quarter of 2023 and an increase of 12.4% from the first quarter of 2024. Excluding

share-based compensation expenses, research and development expenses (non-GAAP) were RMB2,888.4 million (US$397.5 million), representing

a decrease of 1.9% from the second quarter of 2023 and an increase of 8.7% from the first quarter of 2024. Research and development expenses

remained relatively stable compared with the second quarter of 2023. The increase in research and development expenses over the first

quarter of 2024 was mainly due to the incremental design and development costs for new products and technologies as well as the increased

personnel costs in research and development functions. |

| · | Selling, general and administrative expenses in the second quarter of 2024 were RMB3,757.5 million

(US$517.0 million), representing an increase of 31.5% from the second quarter of 2023 and an increase of 25.4% from the first quarter

of 2024. Excluding share-based compensation expenses, selling, general and administrative expenses (non-GAAP) were RMB3,595.5 million

(US$494.8 million), representing an increase of 34.6% from the second quarter of 2023 and an increase of 22.7% from the first quarter

of 2024. The increase in selling, general and administrative expenses over the second quarter of 2023 and the first quarter of 2024 was

mainly attributable to (i) the increase in personnel costs related to sales functions, and (ii) the increase in sales and marketing

activities. |

Loss from Operations

| · | Loss from operations in the second quarter of 2024 was RMB5,209.3

million (US$716.8 million), representing a decrease of 14.2% from the second quarter of 2023 and a decrease of 3.4% from the first quarter

of 2024. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB4,698.5 million (US$646.5 million)

in the second quarter of 2024, representing a decrease of 14.0% from the second quarter of 2023 and a decrease of 8.1% from first quarter

of 2024. |

Net Loss and Earnings Per Share/ADS

| · | Net loss in the second quarter of 2024 was RMB5,046.0 million (US$694.4 million), representing

a decrease of 16.7% from the second quarter of 2023 and a decrease of 2.7% from the first quarter of 2024. Excluding share-based compensation

expenses, adjusted net loss (non-GAAP) was RMB4,535.2 million (US$624.1 million) in the second quarter of 2024, representing a decrease

of 16.7% from the second quarter of 2023 and a decrease of 7.5% from the first quarter of 2024. |

| · | Net loss attributable to NIO’s ordinary shareholders in the second quarter of 2024 was RMB5,126.4

million (US$705.4 million), representing a decrease of 16.3% from the second quarter of 2023 and a decrease of 2.5% from the first quarter

of 2024. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted

net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB4,532.6 million (US$623.7 million) in the second quarter

of 2024. |

| · | Basic and diluted net loss per ordinary share/ADS in the second quarter of 2024 were both RMB2.50

(US$0.34), compared with RMB3.70 in the second quarter of 2023 and RMB2.57 in the first quarter of 2024. Excluding share-based compensation

expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per share/ADS

(non-GAAP) were both RMB2.21 (US$0.30), compared with RMB3.28 in the second quarter of 2023 and RMB2.39 in the first quarter of 2024. |

Balance Sheet

| · | Balance of cash and cash equivalents, restricted cash, short-term investment and long-term time deposits

was RMB41.6 billion (US$5.7 billion) as of June 30, 2024. |

Business Outlook

For the third quarter of 2024, the Company expects:

| · | Deliveries of vehicles to be between 61,000 and 63,000 units,

representing an increase of approximately 10.0% to 13.7% from the same quarter of 2023. |

| · | Total revenues to be between RMB19,109 million (US$2,630

million) and RMB19,669 million (US$2,707 million), representing an increase of approximately 0.2% to 3.2% from the same quarter of 2023. |

This business outlook reflects the Company’s

current and preliminary view on the business situation and market condition, which is subject to change.

Conference Call

The Company’s management will host an earnings

conference call at 8:00 AM U.S. Eastern Time on September 5, 2024 (8:00 PM Beijing/Hong Kong/Singapore Time on September 5,

2024).

A live and archived webcast of the conference

call will be available on the Company’s investor relations website at https://ir.nio.com/news-events/events.

For participants who wish to join the conference

using dial-in numbers, please register in advance using the link provided below and dial in 10 minutes prior to the call. Dial-in numbers,

passcode and unique access PIN would be provided upon registering.

https://s1.c-conf.com/diamondpass/10041542-rfivqj.html

A replay of the conference call will be accessible

by phone at the following numbers, until September 12, 2024:

| United States: |

+1-855-883-1031 |

| Hong Kong, China: |

+852-800-930-639 |

| Mainland, China: |

+86-400-1209-216 |

| Singapore: |

+65-800-1013-223 |

| International: |

+61-7-3107-6325 |

| Replay PIN: |

10041542 |

About NIO Inc.

NIO Inc. is a pioneer and a leading company in

the global smart electric vehicle market. Founded in November 2014, NIO aspires to shape a sustainable and brighter future with

the mission of “Blue Sky Coming”. NIO envisions itself as a user enterprise where innovative technology meets experience

excellence. NIO designs, develops, manufactures and sells smart electric vehicles, driving innovations in next-generation core technologies.

NIO distinguishes itself through continuous technological breakthroughs and innovations, exceptional products and services, and a community

for shared growth. NIO provides premium smart electric vehicles under the NIO brand, and family-oriented smart electric vehicles through

the ONVO brand.

Safe Harbor Statement

This press release contains statements that may

constitute “forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,”

“anticipates,” “aims,” “future,” “intends,” “plans,” “believes,”

“estimates,” “likely to” and similar statements. NIO may also make written or oral forward-looking statements

in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders,

in announcements, circulars or other publications made on the websites of each of The Stock Exchange of Hong Kong Limited (the “SEHK”)

and the Singapore Exchange Securities Trading Limited (the “SGX-ST”), in press releases and other written materials and in

oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements

about NIO’s beliefs, plans and expectations, are forward-looking statements. Forward-looking statements involve inherent risks

and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement,

including but not limited to the following: NIO’s strategies; NIO’s future business development, financial condition and

results of operations; NIO’s ability to develop and manufacture vehicles of sufficient quality and appeal to customers on schedule

and on a large scale; its ability to ensure and expand manufacturing capacities including establishing and maintaining partnerships with

third parties; its ability to provide convenient and comprehensive power solutions to its customers; the viability, growth potential

and prospects of the battery swapping, BaaS, and NIO Assisted and Intelligent Driving and its subscription services; its ability to improve

the technologies or develop alternative technologies in meeting evolving market demand and industry development; NIO’s ability

to satisfy the mandated safety standards relating to motor vehicles; its ability to secure supply of raw materials or other components

used in its vehicles; its ability to secure sufficient reservations and sales of its vehicles; its ability to control costs associated

with its operations; its ability to build its current and future brands; general economic and business conditions globally and in China

and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in NIO’s

filings with the SEC and the announcements and filings on the websites of each of the SEHK and SGX-ST. All information provided in this

press release is as of the date of this press release, and NIO does not undertake any obligation to update any forward-looking statement,

except as required under applicable law.

Non-GAAP Disclosure

The Company uses non-GAAP measures, such as adjusted

cost of sales (non-GAAP), adjusted research and development expenses (non-GAAP), adjusted selling, general and administrative expenses

(non-GAAP), adjusted loss from operations (non-GAAP), adjusted net loss (non-GAAP), adjusted net loss attributable to ordinary shareholders

(non-GAAP) and adjusted basic and diluted net loss per share/ADS (non-GAAP), in evaluating its operating results and for financial and

operational decision-making purposes. The Company defines adjusted cost of sales (non-GAAP), adjusted research and development expenses

(non-GAAP), adjusted selling, general and administrative expenses (non-GAAP) and adjusted loss from operations (non-GAAP) and adjusted

net loss (non-GAAP) as cost of sales, research and development expenses, selling, general and administrative expenses, loss from operations

and net loss excluding share-based compensation expenses. The Company defines adjusted net loss attributable to ordinary shareholders

(non-GAAP), adjusted basic and diluted net loss per share/ADS (non-GAAP) as net loss attributable to ordinary shareholders and basic

and diluted net loss per share/ADS excluding share-based compensation expenses and accretion on redeemable non-controlling interests

to redemption value. By excluding the impact of share-based compensation expenses and accretion on redeemable non-controlling interests

to redemption value, the Company believes that the non-GAAP financial measures help identify underlying trends in its business and enhance

the overall understanding of the Company’s past performance and future prospects. The Company also believes that the non-GAAP financial

measures allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational

decision-making.

The non-GAAP financial measures are not presented

in accordance with U.S. GAAP and may be different from non-GAAP methods of accounting and reporting used by other companies. The non-GAAP

financial measures have limitations as analytical tools and when assessing the Company’s operating performance, investors should

not consider them in isolation, or as a substitute for net loss or other consolidated statements of comprehensive loss data prepared

in accordance with U.S. GAAP. The Company encourages investors and others to review its financial information in its entirety and not

rely on a single financial measure.

The Company mitigates these limitations by reconciling

the non-GAAP financial measures to the most comparable U.S. GAAP performance measures, all of which should be considered when evaluating

the Company’s performance.

For more information on the non-GAAP financial

measures, please see the table captioned “Unaudited Reconciliation of GAAP and Non-GAAP Results” set forth at the end of

this press release.

Exchange Rate

This announcement contains translations of certain

Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations

from Renminbi to U.S. dollars were made at the rate of RMB7.2672 to US$1.00, the noon buying rate in effect on June 28, 2024 in

the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the Renminbi or U.S. dollars amounts

referred could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

For more information, please visit: http://ir.nio.com.

Investor Relations

ir@nio.com

Media Relations

global.press@nio.com

Source: NIO

NIO INC.

Unaudited Condensed Consolidated Balance Sheets

(All amounts in thousands)

| | |

As of | |

| | |

December 31, 2023 | | |

June 30, 2024 | | |

June 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | |

| | |

| |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 32,935,111 | | |

| 24,652,488 | | |

| 3,392,295 | |

| Restricted cash | |

| 5,542,271 | | |

| 3,689,287 | | |

| 507,663 | |

| Short-term investments | |

| 16,810,107 | | |

| 11,616,175 | | |

| 1,598,439 | |

| Trade and notes receivables | |

| 4,657,652 | | |

| 1,939,329 | | |

| 266,861 | |

| Amounts due from related parties | |

| 1,722,603 | | |

| 3,696,187 | | |

| 508,612 | |

| Inventory | |

| 5,277,726 | | |

| 4,885,743 | | |

| 672,301 | |

| Prepayments and other current assets | |

| 3,434,763 | | |

| 5,032,716 | | |

| 692,525 | |

| Total current assets | |

| 70,380,233 | | |

| 55,511,925 | | |

| 7,638,696 | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Long-term restricted cash | |

| 144,125 | | |

| 100,118 | | |

| 13,777 | |

| Property, plant and equipment, net. | |

| 24,847,004 | | |

| 24,517,864 | | |

| 3,373,770 | |

| Intangible assets, net | |

| 29,648 | | |

| 29,648 | | |

| 4,080 | |

| Land use rights, net | |

| 207,299 | | |

| 204,647 | | |

| 28,160 | |

| Long-term investments | |

| 5,487,216 | | |

| 5,375,958 | | |

| 739,756 | |

| Right-of-use assets - operating lease | |

| 11,404,116 | | |

| 11,563,603 | | |

| 1,591,205 | |

| Other non-current assets | |

| 4,883,561 | | |

| 3,212,052 | | |

| 441,993 | |

| Total non-current assets | |

| 47,002,969 | | |

| 45,003,890 | | |

| 6,192,741 | |

| Total assets | |

| 117,383,202 | | |

| 100,515,815 | | |

| 13,831,437 | |

| LIABILITIES | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Short-term borrowings | |

| 5,085,411 | | |

| 5,302,326 | | |

| 729,624 | |

| Trade and notes payable | |

| 29,766,134 | | |

| 24,585,433 | | |

| 3,383,068 | |

| Amounts due to related parties | |

| 561,625 | | |

| 320,146 | | |

| 44,054 | |

| Taxes payable | |

| 349,349 | | |

| 691,051 | | |

| 95,092 | |

| Current portion of operating lease liabilities | |

| 1,743,156 | | |

| 1,748,419 | | |

| 240,590 | |

| Current portion of long-term borrowings | |

| 4,736,087 | | |

| 4,211,017 | | |

| 579,455 | |

| Accruals and other liabilities | |

| 15,556,354 | | |

| 13,295,715 | | |

| 1,829,551 | |

| Total current liabilities | |

| 57,798,116 | | |

| 50,154,107 | | |

| 6,901,434 | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Long-term borrowings | |

| 13,042,861 | | |

| 11,614,644 | | |

| 1,598,228 | |

| Non-current operating lease liabilities | |

| 10,070,057 | | |

| 10,247,541 | | |

| 1,410,109 | |

| Deferred tax liabilities | |

| 212,347 | | |

| 211,317 | | |

| 29,078 | |

| Amounts due to related parties | |

| - | | |

| 282,733 | | |

| 38,905 | |

| Other non-current liabilities | |

| 6,663,805 | | |

| 7,289,020 | | |

| 1,003,004 | |

| Total non-current liabilities | |

| 29,989,070 | | |

| 29,645,255 | | |

| 4,079,324 | |

| Total liabilities | |

| 87,787,186 | | |

| 79,799,362 | | |

| 10,980,758 | |

NIO INC.

Unaudited Condensed Consolidated Balance Sheets

(All amounts in thousands)

| |

|

As of | |

| | |

December 31, 2023 | | |

June 30, 2024 | | |

June 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| MEZZANINE EQUITY | |

| | | |

| | | |

| | |

| Redeemable non-controlling interests | |

| 3,860,384 | | |

| 4,461,563 | | |

| 613,932 | |

| Total mezzanine equity | |

| 3,860,384 | | |

| 4,461,563 | | |

| 613,932 | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Total NIO Inc. shareholders’ equity | |

| 25,546,233 | | |

| 16,074,652 | | |

| 2,211,945 | |

| Non-controlling interests | |

| 189,399 | | |

| 180,238 | | |

| 24,802 | |

| Total shareholders’ equity | |

| 25,735,632 | | |

| 16,254,890 | | |

| 2,236,747 | |

| Total liabilities, mezzanine equity and shareholders’ equity | |

| 117,383,202 | | |

| 100,515,815 | | |

| 13,831,437 | |

NIO INC.

Unaudited Condensed Consolidated Statements of Comprehensive Loss

(All amounts in thousands, except for share and per share/ADS data)

| | |

Three Months Ended | |

| | |

June 30, 2023 | | |

March 31, 2024 | | |

June 30, 2024 | | |

June 30, 2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | |

| Revenues: | |

| | |

| | |

| | |

| |

| Vehicle sales | |

| 7,185,214 | | |

| 8,381,318 | | |

| 15,679,623 | | |

| 2,157,588 | |

| Other sales | |

| 1,586,521 | | |

| 1,527,318 | | |

| 1,766,345 | | |

| 243,057 | |

| Total revenues | |

| 8,771,735 | | |

| 9,908,636 | | |

| 17,445,968 | | |

| 2,400,645 | |

| Cost of sales: | |

| | | |

| | | |

| | | |

| | |

| Vehicle sales | |

| (6,738,344 | ) | |

| (7,613,242 | ) | |

| (13,773,438 | ) | |

| (1,895,288 | ) |

| Other sales | |

| (1,946,435 | ) | |

| (1,807,663 | ) | |

| (1,983,815 | ) | |

| (272,982 | ) |

| Total cost of sales | |

| (8,684,779 | ) | |

| (9,420,905 | ) | |

| (15,757,253 | ) | |

| (2,168,270 | ) |

| Gross profit | |

| 86,956 | | |

| 487,731 | | |

| 1,688,715 | | |

| 232,375 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| (3,344,572 | ) | |

| (2,864,216 | ) | |

| (3,218,522 | ) | |

| (442,883 | ) |

| Selling, general and administrative | |

| (2,856,603 | ) | |

| (2,996,798 | ) | |

| (3,757,458 | ) | |

| (517,043 | ) |

| Other operating income/(losses) | |

| 40,104 | | |

| (20,790 | ) | |

| 77,967 | | |

| 10,729 | |

| Total operating expenses | |

| (6,161,071 | ) | |

| (5,881,804 | ) | |

| (6,898,013 | ) | |

| (949,197 | ) |

| Loss from operations | |

| (6,074,115 | ) | |

| (5,394,073 | ) | |

| (5,209,298 | ) | |

| (716,822 | ) |

| Interest and investment income | |

| 247,180 | | |

| 350,793 | | |

| 362,731 | | |

| 49,913 | |

| Interest expenses | |

| (82,440 | ) | |

| (170,875 | ) | |

| (176,141 | ) | |

| (24,238 | ) |

| Loss on extinguishment of debt | |

| — | | |

| (11,326 | ) | |

| — | | |

| — | |

| Share of income/(losses) of equity investees | |

| 10,641 | | |

| (19,482 | ) | |

| (73,607 | ) | |

| (10,129 | ) |

| Other (losses)/income, net | |

| (138,345 | ) | |

| 67,376 | | |

| 52,351 | | |

| 7,204 | |

| Loss before income tax expense | |

| (6,037,079 | ) | |

| (5,177,587 | ) | |

| (5,043,964 | ) | |

| (694,072 | ) |

| Income tax expense | |

| (18,671 | ) | |

| (6,990 | ) | |

| (2,019 | ) | |

| (278 | ) |

| Net loss | |

| (6,055,750 | ) | |

| (5,184,577 | ) | |

| (5,045,983 | ) | |

| (694,350 | ) |

| Accretion on redeemable non-controlling interests to redemption value | |

| (74,772 | ) | |

| (79,524 | ) | |

| (83,022 | ) | |

| (11,424 | ) |

| Net loss attributable to non-controlling interests | |

| 8,586 | | |

| 6,183 | | |

| 2,635 | | |

| 363 | |

| Net loss attributable to ordinary shareholders of NIO Inc. | |

| (6,121,936 | ) | |

| (5,257,918 | ) | |

| (5,126,370 | ) | |

| (705,411 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (6,055,750 | ) | |

| (5,184,577 | ) | |

| (5,045,983 | ) | |

| (694,350 | ) |

| Other comprehensive income | |

| | | |

| | | |

| | | |

| | |

| Change in unrealized gains on cash flow hedges | |

| 1,329 | | |

| — | | |

| — | | |

| — | |

| Foreign currency translation adjustment, net of nil tax | |

| 327,472 | | |

| 7,468 | | |

| 89,483 | | |

| 12,313 | |

| Total other comprehensive income | |

| 328,801 | | |

| 7,468 | | |

| 89,483 | | |

| 12,313 | |

| Total comprehensive loss | |

| (5,726,949 | ) | |

| (5,177,109 | ) | |

| (4,956,500 | ) | |

| (682,037 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Accretion on redeemable non-controlling interests to redemption value | |

| (74,772 | ) | |

| (79,524 | ) | |

| (83,022 | ) | |

| (11,424 | ) |

| Net loss attributable to non-controlling interests | |

| 8,586 | | |

| 6,183 | | |

| 2,635 | | |

| 363 | |

| Comprehensive loss attributable to ordinary shareholders of NIO Inc. | |

| (5,793,135 | ) | |

| (5,250,450 | ) | |

| (5,036,887 | ) | |

| (693,098 | ) |

| Weighted average number of ordinary shares/ADS used in computing net loss per share/ADS | |

| | |

| | |

| | |

| |

| Basic and diluted | |

| 1,652,857,917 | | |

| 2,044,151,465 | | |

| 2,049,836,045 | | |

| 2,049,836,045 | |

| Net loss per share/ADS attributable to ordinary shareholders | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| (3.70 | ) | |

| (2.57 | ) | |

| (2.50 | ) | |

| (0.34 | ) |

NIO INC.

Unaudited Condensed Consolidated Statements of Comprehensive Loss

(All amounts in thousands, except for share and per share/ADS data)

| | |

Six Months Ended | |

| | |

June 30, 2023 | | |

June 30, 2024 | | |

June 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Revenues: | |

| | |

| | |

| |

| Vehicle sales | |

| 16,409,697 | | |

| 24,060,941 | | |

| 3,310,896 | |

| Other sales | |

| 3,038,509 | | |

| 3,293,663 | | |

| 453,223 | |

| Total revenues | |

| 19,448,206 | | |

| 27,354,604 | | |

| 3,764,119 | |

| Cost of sales: | |

| | | |

| | | |

| | |

| Vehicle sales | |

| (15,495,751 | ) | |

| (21,386,680 | ) | |

| (2,942,905 | ) |

| Other sales | |

| (3,703,210 | ) | |

| (3,791,478 | ) | |

| (521,725 | ) |

| Total cost of sales | |

| (19,198,961 | ) | |

| (25,178,158 | ) | |

| (3,464,630 | ) |

| Gross profit | |

| 249,245 | | |

| 2,176,446 | | |

| 299,489 | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Research and development | |

| (6,420,183 | ) | |

| (6,082,738 | ) | |

| (837,013 | ) |

| Selling, general and administrative | |

| (5,302,531 | ) | |

| (6,754,256 | ) | |

| (929,416 | ) |

| Other operating income | |

| 287,506 | | |

| 57,177 | | |

| 7,868 | |

| Total operating expenses | |

| (11,435,208 | ) | |

| (12,779,817 | ) | |

| (1,758,561 | ) |

| Loss from operations | |

| (11,185,963 | ) | |

| (10,603,371 | ) | |

| (1,459,072 | ) |

| Interest and investment income | |

| 553,942 | | |

| 713,524 | | |

| 98,184 | |

| Interest expenses | |

| (151,103 | ) | |

| (347,016 | ) | |

| (47,751 | ) |

| Loss on extinguishment of debt | |

| — | | |

| (11,326 | ) | |

| (1,559 | ) |

| Share of income/(losses) of equity investees | |

| 24,240 | | |

| (93,089 | ) | |

| (12,809 | ) |

| Other (losses)/income, net | |

| (10,055 | ) | |

| 119,727 | | |

| 16,475 | |

| Loss before income tax expense | |

| (10,768,939 | ) | |

| (10,221,551 | ) | |

| (1,406,532 | ) |

| Income tax expense | |

| (26,345 | ) | |

| (9,009 | ) | |

| (1,240 | ) |

| Net loss | |

| (10,795,284 | ) | |

| (10,230,560 | ) | |

| (1,407,772 | ) |

| Accretion on redeemable non-controlling interests to redemption value | |

| (147,237 | ) | |

| (162,546 | ) | |

| (22,367 | ) |

| Net loss attributable to non-controlling interests | |

| 16,956 | | |

| 8,818 | | |

| 1,213 | |

| Net loss attributable to ordinary shareholders of NIO Inc. | |

| (10,925,565 | ) | |

| (10,384,288 | ) | |

| (1,428,926 | ) |

| | |

| | | |

| | | |

| | |

| Net loss | |

| (10,795,284 | ) | |

| (10,230,560 | ) | |

| (1,407,772 | ) |

| Other comprehensive income | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment, net of nil tax | |

| 272,867 | | |

| 96,951 | | |

| 13,341 | |

| Total other comprehensive income | |

| 272,867 | | |

| 96,951 | | |

| 13,341 | |

| Total comprehensive loss | |

| (10,522,417 | ) | |

| (10,133,609 | ) | |

| (1,394,431 | ) |

| Accretion on redeemable non-controlling interests to redemption value | |

| (147,237 | ) | |

| (162,546 | ) | |

| (22,367 | ) |

| Net loss attributable to non-controlling interests | |

| 16,956 | | |

| 8,818 | | |

| 1,213 | |

| Comprehensive loss attributable to ordinary shareholders of NIO Inc. | |

| (10,652,698 | ) | |

| (10,287,337 | ) | |

| (1,415,585 | ) |

| Weighted average number of ordinary shares/ADS used in computing net loss per share/ADS | |

| | |

| | |

| |

| Basic and diluted | |

| 1,651,113,461 | | |

| 2,047,257,903 | | |

| 2,047,257,903 | |

| Net loss per share/ADS attributable to ordinary shareholders | |

| | | |

| | | |

| | |

| Basic and diluted | |

| (6.62 | ) | |

| (5.07 | ) | |

| (0.70 | ) |

NIO INC.

Unaudited Reconciliation of GAAP and Non-GAAP Results

| (All amounts in thousands, except for share and per share/ADS data) |

| |

| | |

Three Months Ended June 30, 2024 | |

| | |

| GAAP Result | | |

| Share-based

compensation | | |

| Accretion on redeemable

non-controlling interests

to redemption value | | |

| Adjusted Result (Non-GAAP) | |

| | |

| RMB | | |

| RMB | | |

| RMB | | |

| RMB | |

| Cost of sales | |

| (15,757,253 | ) | |

| 18,698 | | |

| — | | |

| (15,738,555 | ) |

| Research and development expenses | |

| (3,218,522 | ) | |

| 330,110 | | |

| — | | |

| (2,888,412 | ) |

| Selling, general and administrative expenses | |

| (3,757,458 | ) | |

| 161,945 | | |

| — | | |

| (3,595,513 | ) |

| Total | |

| (22,733,233 | ) | |

| 510,753 | | |

| — | | |

| (22,222,480 | ) |

| Loss from operations | |

| (5,209,298 | ) | |

| 510,753 | | |

| — | | |

| (4,698,545 | ) |

| Net loss | |

| (5,045,983 | ) | |

| 510,753 | | |

| — | | |

| (4,535,230 | ) |

| Net loss attributable to ordinary shareholders of NIO Inc. | |

| (5,126,370 | ) | |

| 510,753 | | |

| 83,022 | | |

| (4,532,595 | ) |

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (RMB) | |

| (2.50 | ) | |

| 0.25 | | |

| 0.04 | | |

| (2.21 | ) |

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (USD) | |

| (0.34 | ) | |

| 0.03 | | |

| 0.01 | | |

| (0.30 | ) |

| (All amounts in thousands, except for share and per share/ADS data) |

| |

| | |

Three Months Ended March 31, 2024 | |

| | |

| GAAP Result | | |

| Share-based

compensation | | |

| Accretion on redeemable

non-controlling interests

to redemption value | | |

| Adjusted Result (Non-GAAP) | |

| | |

| RMB | | |

| RMB | | |

| RMB | | |

| RMB | |

| Cost of sales | |

| (9,420,905 | ) | |

| 9,753 | | |

| — | | |

| (9,411,152 | ) |

| Research and development expenses | |

| (2,864,216 | ) | |

| 205,983 | | |

| — | | |

| (2,658,233 | ) |

| Selling, general and administrative expenses | |

| (2,996,798 | ) | |

| 65,675 | | |

| — | | |

| (2,931,123 | ) |

| Total | |

| (15,281,919 | ) | |

| 281,411 | | |

| — | | |

| (15,000,508 | ) |

| Loss from operations | |

| (5,394,073 | ) | |

| 281,411 | | |

| — | | |

| (5,112,662 | ) |

| Net loss | |

| (5,184,577 | ) | |

| 281,411 | | |

| — | | |

| (4,903,166 | ) |

| Net loss attributable to ordinary shareholders of NIO Inc. | |

| (5,257,918 | ) | |

| 281,411 | | |

| 79,524 | | |

| (4,896,983 | ) |

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (RMB) | |

| (2.57 | ) | |

| 0.14 | | |

| 0.04 | | |

| (2.39 | ) |

| | |

Three Months Ended June 30, 2023 | |

| | |

| GAAP Result | | |

| Share-based

compensation | | |

| Accretion on redeemable

non-controlling interests

to redemption value | | |

| Adjusted Result (Non-GAAP) | |

| | |

| RMB | | |

| RMB | | |

| RMB | | |

| RMB | |

| Cost of sales | |

| (8,684,779 | ) | |

| 23,887 | | |

| — | | |

| (8,660,892 | ) |

| Research and development expenses | |

| (3,344,572 | ) | |

| 401,689 | | |

| — | | |

| (2,942,883 | ) |

| Selling, general and administrative expenses | |

| (2,856,603 | ) | |

| 184,462 | | |

| — | | |

| (2,672,141 | ) |

| Total | |

| (14,885,954 | ) | |

| 610,038 | | |

| — | | |

| (14,275,916 | ) |

| Loss from operations | |

| (6,074,115 | ) | |

| 610,038 | | |

| — | | |

| (5,464,077 | ) |

| Net loss | |

| (6,055,750 | ) | |

| 610,038 | | |

| — | | |

| (5,445,712 | ) |

| Net loss attributable to ordinary shareholders of NIO Inc. | |

| (6,121,936 | ) | |

| 610,038 | | |

| 74,772 | | |

| (5,437,126 | ) |

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (RMB) | |

| (3.70 | ) | |

| 0.37 | | |

| 0.05 | | |

| (3.28 | ) |

| |

|

Six Months Ended June 30, 2024 |

|

| |

|

|

GAAP

Result |

|

|

|

Share-based

compensation |

|

|

|

Accretion on redeemable

non-controlling interests

to redemption value |

|

|

|

Adjusted

Result

(Non-GAAP) |

|

| |

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

| Cost of sales |

|

|

(25,178,158 |

) |

|

|

28,451 |

|

|

|

— |

|

|

|

(25,149,707 |

) |

| Research and development expenses |

|

|

(6,082,738 |

) |

|

|

536,093 |

|

|

|

— |

|

|

|

(5,546,645 |

) |

| Selling, general and administrative expenses |

|

|

(6,754,256 |

) |

|

|

227,620 |

|

|

|

— |

|

|

|

(6,526,636 |

) |

| Total |

|

|

(38,015,152 |

) |

|

|

792,164 |

|

|

|

— |

|

|

|

(37,222,988 |

) |

| Loss from operations |

|

|

(10,603,371 |

) |

|

|

792,164 |

|

|

|

— |

|

|

|

(9,811,207 |

) |

| Net loss |

|

|

(10,230,560 |

) |

|

|

792,164 |

|

|

|

— |

|

|

|

(9,438,396 |

) |

| Net loss attributable to ordinary shareholders of NIO Inc. |

|

|

(10,384,288 |

) |

|

|

792,164 |

|

|

|

162,546 |

|

|

|

(9,429,578 |

) |

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (RMB) |

|

|

(5.07 |

) |

|

|

0.39 |

|

|

|

0.08 |

|

|

|

(4.60 |

) |

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (USD) |

|

|

(0.70 |

) |

|

|

0.05 |

|

|

|

0.02 |

|

|

|

(0.63 |

) |

| |

|

Six Months Ended June 30, 2023 |

|

| |

|

|

GAAP

Result |

|

|

|

Share-based

compensation |

|

|

|

Accretion on redeemable

non-controlling interests

to redemption value |

|

|

|

Adjusted

Result

(Non-GAAP) |

|

| |

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

|

|

RMB |

|

| Cost of sales |

|

|

(19,198,961 |

) |

|

|

42,655 |

|

|

|

— |

|

|

|

(19,156,306 |

) |

| Research and development expenses |

|

|

(6,420,183 |

) |

|

|

765,656 |

|

|

|

— |

|

|

|

(5,654,527 |

) |

| Selling, general and administrative expenses |

|

|

(5,302,531 |

) |

|

|

391,132 |

|

|

|

— |

|

|

|

(4,911,399 |

) |

| Total |

|

|

(30,921,675 |

) |

|

|

1,199,443 |

|

|

|

— |

|

|

|

(29,722,232 |

) |

| Loss from operations |

|

|

(11,185,963 |

) |

|

|

1,199,443 |

|

|

|

— |

|

|

|

(9,986,520 |

) |

| Net loss |

|

|

(10,795,284 |

) |

|

|

1,199,443 |

|

|

|

— |

|

|

|

(9,595,841 |

) |

| Net loss attributable to ordinary shareholders of NIO Inc. |

|

|

(10,925,565 |

) |

|

|

1,199,443 |

|

|

|

147,237 |

|

|

|

(9,578,885 |

) |

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (RMB) |

|

|

(6.62 |

) |

|

|

0.73 |

|

|

|

0.09 |

|

|

|

(5.80 |

) |

i

All translations from RMB to USD for three months and six months ended June 28, 2024 were made at the rate of RMB7.2672 to US$1.00, the

noon buying rate in effect on June 28, 2024 in the H.10 statistical release of the Federal Reserve Board.

ii Vehicle margin is the margin of

new vehicle sales, which is calculated based on revenues and cost of sales derived from new vehicle sales only.

iii Except for gross margin and vehicle

margin, where absolute changes instead of percentage changes are calculated.

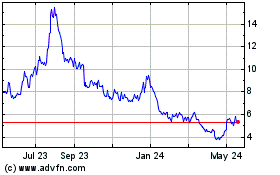

NIO (NYSE:NIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

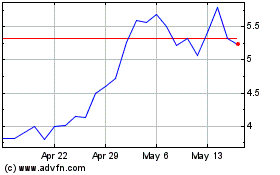

NIO (NYSE:NIO)

Historical Stock Chart

From Dec 2023 to Dec 2024