CTO Realty Growth Originates a First Mortgage Loan for Whole Foods Market Anchored Development Neighboring The Collection at Forsyth

08 November 2024 - 8:05AM

CTO Realty Growth, Inc. (NYSE: CTO) (the “Company” or “CTO”) today

announced the origination of a $40.2 million first mortgage loan

with an initial term of thirty months and an initial fixed interest

rate of 12.15%. The loan is for the development of an approximately

80,000 square foot retail center on approximately 26.6 acres

located in Forsyth County, Georgia, a growing and affluent suburb

of Atlanta. The development is anchored by a 35,500 square foot

Whole Foods Market with the remainder of the development consisting

of small shop space and pad sites.

The Whole Foods Market anchored retail

development neighbors the Company’s 561,000 square foot shopping

center known as The Collection at Forsyth. Further, the Company has

a right of first refusal to purchase this new retail center. The

Company funded approximately $3.2 million of the loan at closing

and, while the loan provides for borrowings of up to a maximum of

$40.2 million, the borrower anticipates that the potential timing

of certain outparcel sales could reduce the borrower’s needs for

loan proceeds to approximately $25 million.

"We believe this Whole Foods Market development

will further solidify The Collection at Forsyth as the dominant

retail center in Georgia’s wealthiest county,” said John P.

Albright, President and Chief Executive Officer of CTO Realty

Growth, Inc. "Our long-term relationship with the developer was

essential in securing this loan opportunity and the related right

of first refusal to purchase the Whole Foods Market. We see this as

a strategic investment that we hope will significantly benefit The

Collection at Forsyth.”

About CTO Realty Growth,

Inc.

CTO Realty Growth, Inc. owns and operates

high-quality, open-air shopping centers located in the higher

growth Southeast and Southwest markets of the United States. CTO

also externally manages and owns a meaningful interest in Alpine

Income Property Trust, Inc. (NYSE: PINE).

We encourage you to review our most recent

investor presentation and supplemental financial information, which

is available on our website at www.ctoreit.com.

Safe Harbor

Certain statements contained in this press

release (other than statements of historical fact) are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements can typically be identified by words such as “believe,”

“estimate,” “expect,” “intend,” “anticipate,” “will,” “could,”

“may,” “should,” “plan,” “potential,” “predict,” “forecast,”

“project,” and similar expressions, as well as variations or

negatives of these words. Examples of forward-looking statements in

this press release include, without limitation, statements

regarding the potential timing of certain outparcel sales that

could reduce the borrower’s needs for loan proceeds to

approximately $25 million, the Whole Foods Market development

further solidifying The Collection at Forsyth as the dominant

retail center in Georgia’s wealthiest county, and the anticipated

benefit to The Collection at Forsyth from the loan.

Although forward-looking statements are made

based upon management’s present expectations and beliefs concerning

future developments and their potential effect upon the Company, a

number of factors could cause the Company’s actual results to

differ materially from those set forth in the forward-looking

statements. Such factors may include, but are not limited to: the

Company’s ability to remain qualified as a REIT; the Company’s

exposure to U.S. federal and state income tax law changes,

including changes to the REIT requirements; general adverse

economic and real estate conditions; macroeconomic and geopolitical

factors, including but not limited to inflationary pressures,

interest rate volatility, distress in the banking sector, global

supply chain disruptions, and ongoing geopolitical war; credit risk

associated with the Company investing in structured investments;

the ultimate geographic spread, severity and duration of pandemics

such as the COVID-19 pandemic and its variants, actions that may be

taken by governmental authorities to contain or address the impact

of such pandemics, and the potential negative impacts of such

pandemics on the global economy and the Company’s financial

condition and results of operations; the inability of major tenants

to continue paying their rent or obligations due to bankruptcy,

insolvency or a general downturn in their business; the loss or

failure, or decline in the business or assets of PINE; the

completion of 1031 exchange transactions; the availability of

investment properties that meet the Company’s investment goals and

criteria; the uncertainties associated with obtaining required

governmental permits and satisfying other closing conditions for

planned acquisitions and sales; and the uncertainties and risk

factors discussed in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2023 and other risks and

uncertainties discussed from time to time in the Company’s filings

with the U.S. Securities and Exchange Commission.

There can be no assurance that future

developments will be in accordance with management’s expectations

or that the effect of future developments on the Company will be

those anticipated by management. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. The Company undertakes

no obligation to update the information contained in this press

release to reflect subsequently occurring events or

circumstances.

Contact:Investor

Relationsir@ctoreit.com

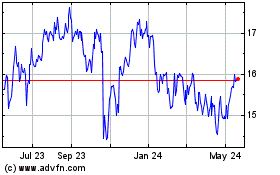

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

From Nov 2023 to Nov 2024