Rio Tinto releases third quarter production results

16 October 2024 - 8:24AM

Business Wire

Rio Tinto Chief Executive Jakob Stausholm said: “We continue to

strengthen our operations, with the roll-out of the Safe Production

System delivering consistent production at our Pilbara iron ore

business and a step change from our Australian bauxite mines. We

are building on this, with more work to do across our global

portfolio.

“We progressed our major projects to deliver profitable organic

growth. We are on track for first production from our Simandou

high-grade iron ore project next year and first lithium from the

Rincon starter plant by the end of this year. Meanwhile the ramp-up

of copper production continues at the Oyu Tolgoi underground

mine.

“We announced the acquisition of Arcadium Lithium, bringing a

world-class lithium business alongside our leading aluminium and

copper operations to supply materials needed for the energy

transition. This is aligned with our strategy and our disciplined

capital allocation framework, increasing our exposure to a

high-growth, attractive market at the right point in the cycle.

“The decarbonisation of our business remains a priority and is

progressing well. We took another important step in securing a

long-term future for the Boyne Smelter, announcing a partnership

with the Queensland Government to support investment in renewable

energy projects.

“Our long-term pathway to deliver profitable growth and create

shareholder value remains clear, as we progress our business in

line with our four objectives.”

Production1

Quarter 3

2024

vs Q3

2023

vs Q2

2024

9 months

2024

vs 9 m

2023

Pilbara iron ore shipments

(100% basis) (Mt)

84.5

+1%

+5%

242.9

-1%

Pilbara iron ore production

(100% basis) (Mt)

84.1

+1%

+6%

241.5

-1%

Bauxite (Mt)

15.1

+8%

+3%

43.2

+9%

Aluminium2 (kt)

809

-2%

-2%

2,459

+1%

Mined Copper (consolidated

basis) (kt)

168

-1%

-2%

495

+8%

Titanium dioxide slag

(kt)

263

+7%

+11%

755

-10%

IOC3 iron ore pellets &

concentrate (Mt)

2.1

-11%

-3%

6.9

-1%

1 Rio Tinto share unless otherwise

stated

2 Includes primary aluminium

only

3 Iron Ore Company of Canada

Q3 2024 operational highlights and other key

announcements

- Our all injury frequency rate (AIFR) for the third quarter was

0.40, an increase from the second quarter of this year (0.31) and

the third quarter of 2023 (0.35). We continue to prioritise

learning from safety incidents to improve the effectiveness of our

critical controls. The health, safety and wellbeing of our people

and partners remains at the heart of everything we do.

- We are on track to deliver our ambition to grow overall copper

equivalent production (based on long-term consensus pricing) by

around 3% of compound annual growth from 2024 to 2028 from our

existing portfolio and projects already in execution.

- In the Pilbara, we produced 84.1 million tonnes (Rio Tinto

share 71.0 million tonnes) in the third quarter, 1% higher than the

corresponding period of 2023. Productivity gains continue to offset

ore depletion. Shipments of 84.5 million tonnes (Rio Tinto share

72.5 million tonnes) were also 1% higher than the third quarter of

2023.

- Bauxite production of 15.1 million tonnes was 8% higher than

the third quarter of 2023. The improvement continues to be driven

by higher plant availability and utilisation rates owing to the

implementation of the Safe Production System, especially at our

Amrun mine at Weipa, which is operating above nameplate

capacity.

- Aluminium production of 0.8 million tonnes was 2% lower than

the third quarter of 2023. Production at our New Zealand Aluminium

Smelter (NZAS) was impacted by a call from Meridian Energy to

reduce its electricity usage by 185 MW from early August. The call

for reduced usage, for which we are compensated, has now ended and

the smelter ramp-up commenced in late September. The ramp-up is

expected to run through to the second quarter of 2025.

- Mined copper production of 168 thousand tonnes (consolidated

basis) was 1% lower than the third quarter of 2023.

- Kennecott was 44% lower than the third quarter of 2023. As we

identified in our second quarter operations review, highwall

movement was monitored along two major faults during that period.

This movement has limited our ability to access the primary ore

face on the south wall and is increasing the need to supplement

feed to the concentrator with lower grade stockpile ore, impacting

mined copper production by approximately 50 thousand tonnes in

2024. A group of experts, both internal and external, reworked

Kennecott’s mine plan and the results were assessed during the

quarter. The highwall movement will continue to restrict ore

deliveries from the primary ore face and impact mined copper

production in 2025 and 2026. We are working through this change in

mining sequence and will provide a further update at our Investor

Seminar in December.

- Escondida was 15% higher than the third quarter of 2023 due to

higher ore grades being fed to the concentrators (1.00% versus

0.85%) in line with the mining sequence, together with increased

recovery.

- Oyu Tolgoi was 19% higher than the third quarter of 2023 due to

the ramp-up in production and higher grade from the underground

mine. However, production was 5% lower than the previous quarter

mainly due to planned maintenance at the concentrator and adverse

weather impacting open pit operations. Production from the

underground mine was marginally impacted by a minor delay to the

start of commissioning of the conveyor to surface, with first ore

on belt now expected in the second half of October. The underground

mine delivered a copper head grade of 2.05% (vs 1.73% in the third

quarter of 2023) with an overall copper head grade of 0.67% (vs

0.52%).

- Titanium dioxide slag production was 7% higher than the third

quarter of 2023 due to improved smelter stability and performance.

A furnace reconstruction continues at our RTIT Quebec Operations,

and we continue to operate six out of nine furnaces in Quebec and

three out of four at Richards Bay Minerals (RBM).

- IOC production was 11% lower than the third quarter of 2023 due

to an 11-day site-wide shutdown following forest fires in mid-July.

This resulted in a revised mine plan and maintenance schedule,

leading to a reduction in our full year iron ore pellets and

concentrate production guidance to 9.1 to 9.6 million tonnes

(previously 9.8 to 11.5 million tonnes).

- In the third quarter, deployment of the Safe Production System

(SPS) continued, now reaching 28 sites (an increase of two from the

second quarter). We continue to deepen the maturity of SPS and are

on track to deliver a 5 million tonne year-on-year production

uplift at Pilbara Iron Ore.

- On 17 July, we announced the appointment of Katie Jackson to

lead the Copper business, succeeding Bold Baatar, who as of 1

September, has moved to the role of Chief Commercial Officer.

- We hosted a site visit for the financial community to our

Aluminium and Iron & Titanium operations in Quebec, Canada

during September. In the management presentation, we set out a

clear pathway to raise both the EBITDA margin and Return on Capital

Employed (ROCE) for our Aluminium business by five percentage

points by 2030. We also set out a targeted increase in ROCE at our

Iron & Titanium business of nine percentage points by 2030 and

a pathway to reach concentrate capacity of 23 million tonnes (100%

basis) of high-grade iron ore at IOC. Presentations by management

also covered technology, decarbonisation and markets.

- Subsequent to the end of the quarter, we announced a definitive

agreement to acquire Arcadium Lithium plc (Arcadium) in an all-cash

transaction for US$5.85 per share. This transaction will bring

Arcadium’s world-class, complementary lithium business into our

portfolio, establishing a global leader in energy transition

commodities. Subject to satisfaction of the outstanding conditions,

the transaction is expected to close in mid-2025.

All figures in this report are unaudited. All currency figures

in this report are US dollars, and comments refer to Rio Tinto’s

share of production, unless otherwise stated.

The full third quarter production results are available here

This announcement is authorised for release to the market by

Andy Hodges, Rio Tinto’s Group Company Secretary.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015413534/en/

Please direct all enquiries to

media.enquiries@riotinto.com

Media Relations, United Kingdom Matthew

Klar M +44 7796 630 637 David Outhwaite M

+44 7787 597 493

Media Relations, Australia Matt Chambers

M +61 433 525 739 Michelle Lee M +61 458 609

322 Rachel Pupazzoni M +61 438 875 469

Media Relations, Canada Simon Letendre

M +1 514 796 4973 Malika Cherry M +1 418 592

7293 Vanessa Damha M +1 514 715 2152

Media Relations, US Jesse Riseborough

M +1 202 394 9480

Investor Relations, United Kingdom David

Ovington M +44 7920 010 978 Laura Brooks M

+44 7826 942 797 Wei Wei Hu M +44 7825 907 230

Investor Relations, Australia Tom Gallop

M +61 439 353 948 Amar Jambaa M +61 472 865

948

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No.

719885

Rio Tinto Limited Level 43, 120 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in Australia ABN

96 004 458 404

riotinto.com

Category: General

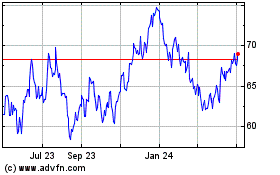

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

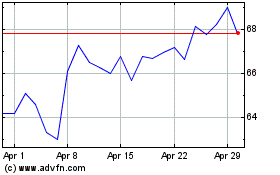

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024