Rithm Property Trust Announces Pricing of Public Offering of 9.875% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

27 February 2025 - 11:30PM

Business Wire

Rithm Property Trust Inc. (formerly known as Great Ajax Corp.)

(NYSE: RPT, “RPT” or the “Company”) announced today the pricing of

a public offering of 2,000,000 shares of its 9.875% Series C

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock (the

“Series C Preferred Stock”) with a $25.00 per share liquidation

preference, for gross proceeds of $50,000,000, before deducting

underwriting discounts and offering expenses. The Company has

granted the underwriters an option for a period of 30 days to

purchase up to an additional 300,000 shares of the Series C

Preferred Stock to cover over-allotments, if any. The offering

is subject to customary closing conditions and is expected to close

on March 4, 2025. The Company intends to use the net proceeds from

the offering for investments and general corporate and working

capital purposes.

The Company intends to file an application to list the Series C

Preferred Stock on the New York Stock Exchange under the symbol

“RPTP.”

Janney Montgomery Scott LLC, BTIG, LLC and Piper Sandler &

Co. acted as book-running managers for the offering, and Lucid

Capital Markets, LLC, JonesTrading Institutional Services LLC and

Wedbush Securities Inc. acted as co-managers for the offering.

The offering is being made pursuant to the Company’s effective

shelf registration statement filed with the Securities and Exchange

Commission (the “SEC”). The offering is being made only by means of

a prospectus and a related prospectus supplement. Prospective

investors should read the prospectus supplement and the prospectus

in that registration statement and other documents the Company has

filed or will file with the SEC for more complete information about

the Company and the offering. You may obtain these documents for

free by visiting EDGAR on the SEC’s website at

www.sec.gov. Alternatively, copies of the prospectus

supplement and the prospectus may be obtained from Janney

Montgomery Scott, Attention: Syndicate Department, 60 State Street,

Boston, Massachusetts 02109, by telephone at (617) 557-2975 or by

emailing prospectus@janney.com; BTIG, Attention: Debt

Capital Markets, 65 East 55th Street, New York, New York 10022, by

telephone at (212) 593-7555 or by emailing

BTIG-IBD-DebtCapitalMarkets@btig.com or Piper Sandler, Attention:

DCM/Syndicate, 1251 Avenue of the Americas, 6th Floor, New York,

New York 10020, by telephone at (866) 805-4128 or by emailing

fsg-dcm@psc.com.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such

jurisdiction.

ABOUT RITHM PROPERTY TRUST

Rithm Property Trust is a real estate investment platform

externally managed by an affiliate of Rithm Capital Corp. (NYSE:

RITM). Rithm Property Trust has historically focused on acquiring,

investing in and managing re-performing loans and non-performing

loans secured by single-family residences and commercial

properties. In connection with its recent strategic transaction

with Rithm Capital Corp., the Company is transitioning to a

flexible commercial real estate focused investment strategy. Rithm

Property Trust is a Maryland corporation that is organized and

conducts its operations to qualify as a real estate investment

trust (REIT) for federal income tax purpose.

FORWARD-LOOKING STATEMENTS

This press release contains certain information which

constitutes “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Words such as

“may,” “will,” “seek,” “believes,” “intends,” “expects,”

“projects,” “anticipates,” “plans” and “future” or similar

expressions are intended to identify forward-looking statements.

Examples of forward-looking statements in this press release

include, without limitation, statements regarding the proposed

offering of the Series C Preferred Stock, the expected use of the

net proceeds from the offering, the listing of the shares of Series

C Preferred Stock sold in this offering on the New York Stock

Exchange and the Company’s expectations concerning market

conditions for an offering of the Series C Preferred Stock.

These statements are not historical facts. These forward-looking

statements represent management’s current expectations regarding

future events and are subject to the inherent uncertainties in

predicting future results and conditions, many of which are beyond

our control. Accordingly, you should not place undue reliance on

any forward-looking statements contained herein. No assurance can

be given that the offering discussed above will be consummated, or

that the net proceeds of the offering will be used as indicated.

Consummation of the offering and the application of the net

proceeds of the offering are subject to numerous possible events,

factors and conditions, many of which are beyond the control of the

Company and not all of which are known to it, including, without

limitation, market conditions and those described under the heading

“Risk Factors” in the prospectus supplement relating to the

offering and in the Company’s most recent annual and quarterly

reports filed with the SEC. The Company undertakes no

obligation to update the information contained in this press

release to reflect subsequently occurring events or circumstances

and expressly disclaims any obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227087258/en/

Investor Relations 646-868-5483

ir@rithmpropertytrust.com

Rithm Property (NYSE:RPT)

Historical Stock Chart

From Feb 2025 to Mar 2025

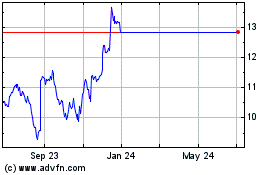

Rithm Property (NYSE:RPT)

Historical Stock Chart

From Mar 2024 to Mar 2025