UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: June 12, 2023

Commission File Number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

TIM S.A.

Publicly-Held Company

CNPJ/MF 02.421.421/0001-11

NIRE 333.0032463-1

MINUTES OF THE BOARD OF DIRECTORS’ MEETING

HELD ON JUNE 12TH, 2023

DATE, TIME AND PLACE: June 12th, 2023,

at 12.40 p.m., at the head office of TIM S.A. (“Company”), domiciled at Avenida João Cabral de Mello Neto, 850, Torre

Sul, 13° floor, Barra da Tijuca, in the city and State of Rio de Janeiro.

PRESENCE: The Board of Directors’ Meeting

of the Company was held at the date, time and place mentioned above, with the presence of Messrs. Nicandro Durante, Adrian Calaza, Alberto

Mario Griselli, Claudio Giovanni Ezio Ongaro, Flavia Maria Bittencourt, Gesner José de Oliveira Filho, Herculano Aníbal

Alves, Michele Valensise and Michela Mossini, either in person or by means of audio or videoconference, as provided in the 2nd

paragraph of Section 25, of the Company’s By-laws. Justified absence of Mrs. Elisabetta Paola Romano.

BOARD: Mr. Nicandro Durante – Chairman; and

Mrs. Fabiane Reschke – Secretary.

AGENDA: (1) To acknowledge on the activities

carried out by the Statutory Audit Committee; (2) To acknowledge on the activities carried out by the Control and Risks Committee;

(3) To acknowledge on the activities carried out by the Compensation Committee; (4) To acknowledge on the status of the

Adjustment of Conduct Term between the Company and ANATEL – National Agency of Telecommunications; (5) To resolve on the

Independent Auditors’ Annual Work Plan; (6) To resolve on the payment proposal of the Company’s interest on shareholders’

equity (“JSCP”); (7) To resolve on the proposal of the Share Repurchase Plan; and (8) To resolve on the proposal

of the Company’s Management by Objectives (“MBO”) program for the year 2023.

RESOLUTIONS: Upon the review of the material presented

and filed at the Company’s head office, and based on the information provided and discussions of the subjects included on the Agenda,

the Board Members, unanimously by those present and with the abstention of the legally restricted, decided to register the discussions

as follows:

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF

TIM S.A.

June 12th, 2023

(1) Acknowledged on the activities carried out

by the Statutory Audit Committee (“CAE”) at its meetings held on June 12th, 2023, as per Mr. Gesner José

de Oliveira Filho’s report, Coordinator of the CAE.

(2) Acknowledged on the activities carried out

by the Control and Risks Committee (“CCR”) at its meeting held on June 12th, 2023, as per Mr. Herculano Aníbal

Alves’ report, Chairman of the CCR.

(3) Acknowledged on the activities carried out

by the Compensation Committee (“CR”) at its meeting held on June 12th, 2023, as per Mr. Nicandro Durante’s

report, Chairman of the CR

(4) Acknowledged on the compliance with certain

obligations derived from the Adjustment of Conduct Term nº 1/2020 – TAC, executed between the Company and the National Agency

of Telecommunications – ANATEL, considering the topics related to the 1st and 2nd year still under evaluation

by the regulatory body and the progress of the 3rd year of execution, under the terms and conditions approved by this Board

at its meeting held on June 19th, 2020.

(5) Approved the Annual Work Plan of the Independent

Auditors of the Company, Ernst & Young Auditores Independentes S/S (“EY”), for 2023, based on the favorable evaluation

of the CAE, registered at its meeting held on June 12th, 2023.

(6) Approved based on the Section 46, 3rd

paragraph, of the Company’s By-laws, and on the favorable opinion of the Fiscal Council, the distribution of R$ 290,000,000.00 (two

hundred and ninety million reais) as Interest on Shareholders’ Equity ("IE"), at R$ 0.119795497 (zero, point, one, one,

nine, seven, nine, five, four, nine, seven cents) of gross value per share. The payment will be made until July 25th, 2023,

without the application of any monetary restatement index, considering the date of June 22nd, 2023, as the date for identification

of shareholders entitled to receive such values. Therefore, the shares acquired after said date will be traded ex-direito of IE

distribution. The withholding of Income Tax will be of 15% (fifteen percent) on the occasion of the credit of the IE, except for the shareholders

who have differentiated taxation or who are exempt from said taxation. The gross amount per share may be modified due to the variation

in the number of treasury shares, in order to comply with the Company's Long-Term Incentive Plan.

(7) The Board members acknowledged on the

results of the last Repurchase of Shares Program, approved by the Company's Board of Directors’ at its meeting held on May 5th,

2021 (“Program 5”) and approved the opening of a new Repurchase of Shares Program ("Program 6"), pursuant

to Section 22,

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF

TIM S.A.

June 12th, 2023

v, of the Company's By-laws and Section 6 of CVM Resolution No.

77 of March 29th, 2022 ("CVM Resolution 77/2022"), with the following conditions:

(7.1) Purpose: to support the stock-based compensation

under the Long Term Incentive Plan - LTI or for eventual cancellation, without reducing the capital stock;

(7.2) Number of shares that may be acquired: up to five

million, three hundred and twelve thousand, nine hundred and twelve (5,312,912) common shares of the Company ("Shares") may

be acquired, without reduction of the capital stock, corresponding to zero, point, twenty-two percent (0.22%) of the total common shares

of the Company or zero point sixty-six percent (0.66%) of the free float shares. The Board of Officers may decide the best moment, within

the term of the Program, to carry out the Shares acquisitions, and perform one or several acquisitions;

(7.3) The Program shall begin on the date of the Board

of Directors' resolution, remaining in force until December 12th, 2024, with the acquisitions carried out on the Stock Exchange

(B3 S.A. - Brasil, Bolsa e Balcão) at market prices, observing applicable legal and regulatory limits;

(7.4) Intermediary financial institution: BTG PACTUAL

CORRETORA DE TÍTULOS E VALORES MOBILIÁRIOS S.A., established at Rua Praia de Botafogo, 501 – Botafogo, Rio de Janeiro/RJ,

CEP 22250-911.

(7.5) Resources to be used: the resources of the capital

and profit reserves, which total seven billion, nine hundred and fifty-four million, three hundred and thirty-six thousand, ninety-one

reais and sixty cents (R$7,954,336,091.60) will be used according to the Interim Financial Statements, dated as of March 31st,

2023, except for the reserves referred in the Section 8, paragraph 1, of CVM Resolution 77/2022; and

(7.6) Pursuant to Section 6 of CVM Resolution 77/2022,

the members of the Company's Board of Directors provided the information contained in Appendix I to these minutes and authorized the Company's

Officers to perform all necessary acts to complete the transaction.

(8) Approved the proposal of the Company’s

MBO Program for the year of 2023, according to the material presented, based on the favorable assessment of the CR, at its meeting held

on June 12th, 2023.

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF

TIM S.A.

June 12th, 2023

CLOSING: With no further issues to discuss, the

meeting was adjourned, and these minutes drafted as summary, read, approved and signed by all attendees Board Members.

I herein certify that these minutes are the faithful copy of the

original version duly recorded in the respective corporate book.

Rio de Janeiro (RJ), June 12th, 2023.

FABIANE RESCHKE

Secretary

APPENDIX I

ANNEX G TO CVM RESOLUTION No. 80 OF MARCH 29, 2022

Trading of Own Issued Shares

| 1. | Justify in detail the objective and expected economic effects of the operation: |

The purpose of the Share Buyback Program is to support the stock-based

compensation of the Long- Term Incentive Plan – LTI or for eventual cancellation, without reducing the capital stock.

| 2. | Inform the number of shares (i) for free float and (ii) already held in treasury: |

There are currently 808,822,205 (eight hundred and eight million,

eight hundred and twenty-two thousand, two hundred and five) common shares on free float and 12,247 (twelve thousand two hundred and forty

seven) common shares held in treasury.

| 3. | Inform the number of shares that may be acquired or sold: |

Up to 5,312,912 (five million, three hundred and twelve thousand,

nine hundred and twelve) common shares of the Company ("Shares") may be acquired, without reduction of the capital stock, which

correspond to 0.22% (zero point twenty-two percent) of the total common shares of the Company or 0.66% (zero point sixty-six percent)

of the total free float shares. The Company’s Board of Statutory Officers may decide the best moment, within the term of the Program,

to accomplish the acquisitions of the Shares, and may accomplish one or several acquisitions.

| 4. | Describe the main characteristics of the derivative instruments that the company may use, if any: |

Not applicable.

| 5. | Describe, if any, any agreements or voting guidelines that exist between the company and the counterpart

of the: |

Not applicable.

| 6. | In the case of transactions carried out outside organized securities markets, inform: a. the maximum (minimum)

price by which the shares will be acquired (sold); and b. if applicable, the reasons which justify the operation at prices higher than

10% (ten percent), in the case of acquisition, or more than 10% (ten percent) lower, in the case of |

sale, to the average of the quoted price, weighted

by the volume, in the previous ten (10) trading sessions:

Not applicable.

| 7. | Inform, if any, the impacts that the negotiation will have on the composition of the shareholder control

or the administrative structure of the company: |

Not applicable.

| 8. | Identify the counterparties, if known, and, in the case of a related party to the company, as defined

by the accounting rules applicable to this subject, also provide the information required by art. 9 of CVM Resolution No. 81, of March

29, 2022. |

Not applicable.

| 9. | Indicate the allocation of resources received, if applicable: |

In the event of the sale of shares acquired in the context of

the Program, the allocation of funds will be decided in due time, when there will be appropriate communication to the market.

| 10. | Indicate the maximum period for the settlement of authorized transactions: |

Beginning on the date of the Board of Directors' resolution,

remaining in force until December 12th, 2024, with the acquisitions being carried out on Stock Exchange (B3 S.A. – Brasil,

Bolsa e Balcão), at market prices, observing the applicable legal and regulatory limits.

| 11. | Identify the institutions that will act as intermediaries, if any: |

BTG PACTUAL CORRETORA DE TÍTULOS E VALORES MOBILIÁRIOS

S.A., with office at Rua Praia de Botafogo, 501 – Botafogo; Rio de Janeiro/RJ, CEP 22250-911.

| 12. | Specify the resources available to be used, in the form of art. 8, paragraph 1, of CVM Resolution No.

77, of March 29, 2022: |

The resources to be used are comprised of the balances of capital

and profit reserves, which total R$7,954,336,091.60 (seven billion, nine hundred and fifty-four million, three hundred and thirty-six

thousand, ninety-one reais and sixty cents), net of funding costs, as per the Interim Financial

Statements dated as of March 31st, 2023, except for

the reserves pursuant to Section 8, paragraph 1, of CVM Resolution No. 77/22.

| 13. | Specify the reasons why the members of the Board of Directors feel comfortable that the buyback of shares

will not affect the fulfillment of the obligations assumed with creditors nor the payment of mandatory, fixed or minimum dividends: |

Taking into account that the buyback’s objective is to

cover the exercise of stock options under the Long Term Incentive Plan, limiting the acquisition up to 5,312,912 (five million, three

hundred and twelve thousand, nine hundred and twelve) Shares that, quoted as of June 9th, 2023, amount to R$ 77,674,776.09

(seventy-seven million, six hundred and seventy-four thousand, seven hundred and seventy-six reais and nine cents), the Members of the

Board of Directors of the Company understand that the Share Buyback Program will not affect the fulfillment of the obligations assumed

with creditors nor the payment of mandatory, fixed or minimum dividends, since, according to the Interim Financial Statements as of March

31st, 2023, the Company's cash position is of R$ 3,133,255,915.99 (three billion, one hundred and thirty-three million, two

hundred and fifty-five thousand, nine hundred and fifteen reais and ninety-nine cents).

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

TIM S.A. |

| Date:

June 12, 2023 |

|

By: |

/s/ Alberto

Mario Griselli |

| |

|

|

Alberto

Mario Griselli |

| |

|

|

Chief

Executive Officer, Chief Financial Officer and Investor Relations Officer |

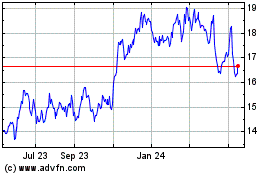

TIM (NYSE:TIMB)

Historical Stock Chart

From Oct 2024 to Nov 2024

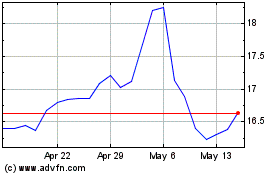

TIM (NYSE:TIMB)

Historical Stock Chart

From Nov 2023 to Nov 2024