Velocity Financial, Inc. Announces Issuance of $75 Million of Senior Secured Notes

07 February 2024 - 12:30AM

Business Wire

Velocity Financial, Inc. (NYSE: VEL), (“Velocity” or the

“Company”), a leader in business purpose loans, today announced the

issuance of $75 million principal amount of five-year senior

secured notes (the ”Notes”) by Velocity Commercial Capital, LLC, a

wholly-owned subsidiary of Velocity. The Notes will bear interest

at 9.875% per annum and will mature on February 15, 2029. Interest

on the notes will be payable semi-annually on May 15 and November

15 of each year, beginning on May 15, 2024. The Notes are secured

on a pari passu basis with Velocity’s $215,000,000 outstanding

principal amount of 7.125% Senior Secured Notes due 2027.

The Notes settled on February 5, 2024, and the net proceeds will

be used to originate new investments and for general corporate and

other working capital purposes.

Piper Sandler & Co. acted as placement agent for the

offering.

Mark R. Szczepaniak, CFO, stated, “This transaction marks

another successful corporate debt offering, made possible by the

Company’s continued strong financial performance and growth in our

investment portfolio. We expect this capital to be accretive to

earnings as we work to attain our '5x25' goal ($5 billion portfolio

by 2025). The Notes are structured with flexibility to continue

issuing additional series of similar notes, allowing us to continue

building a laddered corporate debt maturity schedule. I would like

to thank the Piper Sandler team for leading another successful

transaction for Velocity.”

The Notes have not been and will not be registered under the

United States Securities Act of 1933, as amended (the “Securities

Act”), or any state securities laws and may not be offered or sold

in the United States absent registration or an applicable exemption

from the registration requirements of the Securities Act and

applicable state laws. This news release does not constitute an

offer to sell, or a solicitation of an offer to buy, any securities

of the Company in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

Forward-Looking

Statements

Some of the statements contained in this press release may

constitute forward-looking statements within the meaning of the

federal securities laws. Forward-looking statements relate to

anticipated results, expectations, projections, plans and

strategies, anticipated events or trends, and similar expressions

concerning matters that are not historical facts. In some cases,

you can identify forward-looking statements by the use of

forward-looking terminology such as “may,” “will,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “goal,” or “potential” or the negative of these words

and phrases or similar words or phrases that are predictions of or

indicate future events or trends and which do not relate solely to

historical matters. You can also identify forward-looking

statements by discussions of strategy, plans, or intentions.

The forward-looking statements contained in this press release

reflect our current views about future events and are subject to

numerous known and unknown risks, uncertainties, assumptions, and

changes in circumstances that may cause actual results to differ

significantly from those expressed or contemplated in any

forward-looking statement. While forward-looking statements reflect

our good faith projections, assumptions, and expectations, they are

not guarantees of future results. Furthermore, we disclaim any

obligation to publicly update or revise any forward-looking

statement to reflect changes in underlying assumptions or factors,

new information, data or methods, future events, or other changes,

except as required by applicable law. Factors that could cause our

results to differ materially include, but are not limited to, (1)

the continued course and severity of the COVID-19 pandemic and its

direct and indirect impacts, (2) general economic and real estate

market conditions, including the risk of recession, (3) regulatory

and/or legislative changes, (4) our customers' continued interest

in loans and doing business with us, (5) market conditions and

investor interest in our future securitizations, (6) the continued

conflict in Ukraine and (7) changes in federal government fiscal

and monetary policies.

Additional information relating to these and other factors that

could cause future results to differ materially from those

expressed or contemplated in any forward-looking statements can be

found in the section titled ‘‘Risk Factors” in our Form 10-Q filed

with the SEC on May 14, 2020, as well as other cautionary

statements we make in our current and periodic filings with the

SEC. Such filings are available publicly on our Investor Relations

web page at www.velfinance.com.

About Velocity Financial,

Inc.

Based in Westlake Village, California, Velocity is a vertically

integrated real estate finance company that primarily originates

and manages investor loans secured by 1-4 unit residential rental

and commercial properties. Velocity originates loans nationwide

across an extensive network of independent mortgage brokers built

and refined over 20 years.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240206491942/en/

Investors and Media: Chris Oltmann (818) 532-3708

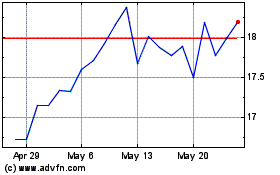

Velocity Financial (NYSE:VEL)

Historical Stock Chart

From Nov 2024 to Dec 2024

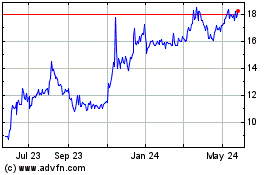

Velocity Financial (NYSE:VEL)

Historical Stock Chart

From Dec 2023 to Dec 2024