This news release constitutes a “designated news release” for

the purposes of Emera’s prospectus supplement dated November 14,

2023, to its short form base shelf prospectus dated October 3,

2023.

Emera Inc. (“Emera”) (TSX:EMA) today announced a strategic

update driving long term value for shareholders and enabling the

company to pursue compelling growth opportunities across its

portfolio. As a reflection of this growth profile, Emera is

introducing new three-year average target EPS growth of 5-7 per

cent through 2027(1) and extending its previously discussed

rate-base growth guidance of 7-8 per cent over the next five years

through 2029. As part of a broader strategic initiative to

reallocate capital towards investing in these high-growth

opportunities, beginning today, Emera is adjusting its dividend

growth rate to 1 to 2 per cent per year. This will have the effect

of reducing Emera’s dividend payout ratio of adjusted net income(2)

(payout ratio) to approximately 80 per cent by the end of 2027 with

continued improvement in the following years. This decision

underscores the company’s commitment to driving long-term

shareholder value through focused investments in the robust and

high growth jurisdictions in which it operates.

“We see substantial growth opportunities within our regulated

businesses, and our capital allocation and portfolio optimization

decisions will position Emera to deliver increased value to

shareholders,” said Scott Balfour, Emera Inc. CEO. “By targeting an

average EPS growth rate of 5 to 7 per cent over the next three

years and adjusting our dividend growth rate, we are on a course to

meaningfully reduce our payout ratio over the next five years.”

“Several fundamental trends, including the need to increase

resilience against climate-related challenges as well as

decarbonization and electrification, make this a pivotal time for

regulated utilities. With a stronger balance sheet, a disciplined

capital investment plan, and a premium portfolio of assets, the

majority of which are located in high quality jurisdictions in

North America, Emera is very well positioned to meet this moment,”

Mr. Balfour said.

Strategic Growth and Investment

Approximately 75 per cent of Emera’s capital investments are

planned to be directed towards its two Florida utilities, Tampa

Electric and Peoples Gas. The state represents a dynamic and

rapidly growing market, and its investments are aimed at supporting

a growing customer base, meeting increasing demand from ongoing

electrification trends, as well as customer-focused investments in

reliability and resilience. In addition, Emera will continue to

invest significant investments focused on customer reliability and

government-mandated decarbonization initiatives at Nova Scotia

Power.

The adjustment to its dividend growth rate will free up more

capital for investment in projects that benefit customers in

markets that continue to grow. Emera will provide five-year capital

investment and rate base growth forecasts with its next annual

update later in 2024.

Commitment to Sustainable Dividends

Emera aims to continue to deliver consistent and attractive

returns to investors. The dividend growth rate adjustment will not

affect the current dividend. Emera remains committed to delivering

dependable and growing dividends to its shareholders while

exercising capital allocation discipline in support of investment

and robust growth opportunities to deliver ongoing earnings growth

for shareholders.

Asset Sales

Earlier this month, Emera achieved an important milestone by

concluding the transaction to transfer its equity interest in the

Labrador Island Link (LIL) to KKR, with proceeds to Emera of

CAD$1.19 billion(3) . This transaction will support the company’s

$8.8 billion capital investment plan over the 2024-2026 period,

which will be funded primarily through internally generated cash

flows, debt raised at the operating company level consistent with

regulated capital structures, and common equity sourced from its

Dividend Reinvestment Plan and at-the-market equity program.

In November 2023, Emera committed to funding up to 15 per cent

of its capital plan through asset sales. The transfer of its equity

interest in the LIL, which successfully closed on June 4, 2024,

satisfies this funding objective.

“The successful Labrador Island Link transaction highlights our

dedication to optimizing our asset portfolio, strengthening our

financial position, and funding a pipeline of attractive capital

investment opportunities,” Mr. Balfour said. “Emera proceeds with

asset sales when transactions meet clear return thresholds, align

with our business strategy and will deliver value to shareholders.

The LIL transaction met these criteria well.”

The company will maintain its disciplined approach to capital

allocation and portfolio optimization on an ongoing basis, as it

continues to focus on growth investments and maximizing shareholder

value.

Hybrid Offering

In another move to strengthen its financial position, Emera

announced on June 18, 2024, that it completed a $500 million USD

issuance of hybrid notes. The net proceeds were used to repay its

US$300 million notes that matured on June 15, 2024, and for general

corporate purposes. This financing further reduces holding company

leverage and improves 2024 cash flow to debt metrics by 20 basis

points.

Teleconference Call

Emera will host a teleconference today, Friday, June 28, at 9:30

a.m. Atlantic (8:30 a.m. Eastern) to discuss this announcement.

Analysts and other interested parties in North America are

invited to participate by dialing 1-800-717-1738. International

parties are invited to participate by dialing 1-289-514-5100.

Participants should dial in at least 10 minutes prior to the start

of the call. No pass code is required.

A live and archived audio webcast of the teleconference will be

available on the company's website, www.emera.com. A replay of the

teleconference will be available on the company’s website two hours

after the conclusion of the call.

About Emera

Emera is a geographically diverse energy and services company

headquartered in Halifax, Nova Scotia with approximately $39

billion in assets and 2023 revenues of $7.6 billion. The company

primarily invests in regulated electricity generation and

electricity and gas transmission and distribution, with a strategic

focus on transformation from high carbon to low carbon energy

sources. Emera has investments in Canada, the United States and the

Caribbean. Emera’s common and preferred shares are listed on the

Toronto Stock Exchange and trade respectively under the symbol EMA,

EMA.PR.A, EMA.PR.B, EMA.PR.C, EMA.PR.E, EMA.PR.F, EMA.PR.H,

EMA.PR.J and EMA.PR.L. Depositary receipts representing common

shares of Emera are listed on the Barbados Stock Exchange under the

symbol EMABDR and on The Bahamas International Securities Exchange

under the symbol EMAB. Additional information can be accessed at

www.emera.com or at www.sedarplus.ca.

(1) Based on current consensus for 2024.

(2) Non-GAAP Financial Measures and Ratios Emera uses

financial measures that do not have standardized meaning under

USGAAP and may not be comparable to similar measures presented by

other entities. Emera calculates the non-GAAP measures and ratios

by adjusting certain GAAP measures for specific items. Management

believes excluding these items better distinguishes the ongoing

operations of the business. For further information on the non-GAAP

financial ratios “dividend payout ratio of adjusted net income” and

“adjusted EPS – basic”, refer to the "Non-GAAP Financial Measures

and Ratios" section of the Emera’s Q1 2024 MD&A which is

incorporated herein by reference and can be found on SEDAR+ at

www.sedarplus.ca.

Other

Rate base is a financial measure specific to rate-regulated

utilities that is not intended to represent any financial measure

as defined by GAAP. The measure is required by the regulatory

authorities in the jurisdictions where Emera's rate-regulated

subsidiaries or equity investments operate, a summary of which can

be found in our MD&A. The calculation of this measure as

presented may not be comparable to similarly titled measures used

by other companies.

(3) $1.19 billion CAD, made up of $957 million CAD in cash and

$235 million CAD for assuming Emera’s obligation to fund the

remaining initial capital investment

Forward Looking Information

This news release contains forward‐looking information within

the meaning of applicable securities laws, including, without

limitation, statements concerning Emera’s: plan to adjust its

future annual dividend growth rate to 1 to 2 percent; capital

reallocation for high-growth opportunities; commitment to enhancing

long-term shareholder value; plans to invest in growth

jurisdictions; expectations for growth opportunities within its

regulated businesses; future capital allocation and portfolio

optimization decisions; plans to target an average adjusted EPS (1)

growth rate of 5 to 7 per cent through 2027; plans to reduce its

dividend payout ratio of adjusted net income (1) to approximately

80 per cent by the end of 2027 with continued improvement in the

following years; plans to direct approximately 75 per cent of its

capital investments towards its two Florida utilities; expectations

that Florida continues to be a growth market with investments that

support a growing customer base, increased electrification demand,

reliability and resilience; views on fundamental industry trends,

including decarbonization, electrification and increased

climate-related resilience; plans to continue to make significant

investments focused on reliability and government-mandated

decarbonization initiatives at Nova Scotia Power; plans to continue

to deliver consistent and attractive returns to investors;

expectations of a 7-8 per cent rate base growth rate; expectations

that rate base growth will be sustained over the next five years

through 2029; intention to provide its five-year capital investment

and rate base growth forecasts with its next annual update later in

2024; commitment to delivering stable and dependable dividends to

its shareholders; continuing approach to prudent financial

management and capital allocation discipline for investment and

business growth opportunities; continuing approach to asset

dispositions that meet clear return thresholds, align with its

business strategy and will deliver value to shareholders;

commitment to maintaining its disciplined approach to capital

allocation and portfolio optimization; and future financial

performance. Undue reliance should not be placed on this

forward-looking information, which applies only as of the date

hereof. By its nature, forward‐looking information requires Emera

to make assumptions and is subject to inherent risks and

uncertainties. These statements reflect Emera management’s current

beliefs and are based on information currently available to Emera

management. There is a risk that predictions, forecasts,

conclusions and projections that constitute forward‐looking

information will not prove to be accurate, that Emera’s assumptions

may not be correct and that actual results may differ materially

from such forward‐looking information. Additional detailed

information about these assumptions, risks and uncertainties is

included in Emera’s securities regulatory filings, including under

the heading “Business Risks and Risk Management” in Emera’s annual

Management’s Discussion and Analysis, and under the heading

“Principal Risks and Uncertainties” in the notes to Emera’s annual

and interim financial statements, which can be found on SEDAR+ at

www.sedarplus.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240628776387/en/

Media Dina Bartolacci Seely media@emera.com

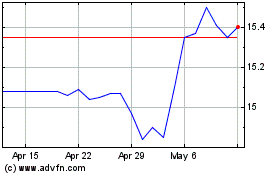

Emera (TSX:EMA.PR.A)

Historical Stock Chart

From Oct 2024 to Nov 2024

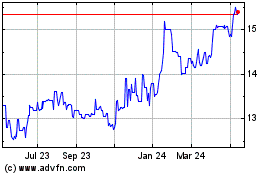

Emera (TSX:EMA.PR.A)

Historical Stock Chart

From Nov 2023 to Nov 2024