Today Emera Inc. (“Emera”) (TSX: EMA) reported financial results

for the second quarter and year-to-date 2024.

Highlights

- Growth in Reported Net Income Per Share (“EPS”)(1):

Reported EPS saw a substantial increase of $0.35 to $0.45 in Q2

2024, compared to $0.10 in Q2 2023. This improvement was driven by

a gain on the strategic sale of the Labrador Island Link

(“LIL”).

- Decrease in Adjusted EPS: Adjusted EPS decreased $0.07

to $0.53 compared to adjusted EPS of $0.60 in Q2 2023. The decline

was primarily driven by:

- Higher corporate costs resulting from increased interest

expenses, and unrealized foreign exchange (“FX”) losses on the

translation of short-term debt balances;

- A decrease in earnings at Nova Scotia Power (“NSPI”) resulting

from higher investment in reliability and customer experience

initiatives impacting operating costs;

- A decrease in earnings at New Mexico Gas Company (“NMGC”) due

to higher operating costs.

- Strong Performance in Florida Businesses: Tampa Electric

(“TEC”) and Peoples Gas (“PGS”) reported higher earnings due to

robust customer growth and new base rates, affirming the

significant potential of our Florida operations.

- Strengthening the Balance Sheet: We took definitive

measures to enhance our financial position, improving our balance

sheet and key credit metrics. The strategic sale of Emera’s

interest in the LIL reduced holding company debt by $957 million

and the replacement of US $500 million of holding company debt with

hybrid capital, further optimized the capital structure and

improved credit metrics. The announced sale of NMGC to Bernhard

Capital Partners for an enterprise value of US$1.252 billion will

additionally strengthen the balance sheet when closed in late 2025.

These actions demonstrate our commitment to financial strength and

flexibility.

- Capital Deployment on Track: Emera is on course to

deploy $2.9 billion in capital in 2024, with $1.4 billion already

invested in the first half of the year.

“While our adjusted earnings were lower for the quarter and for

the year to date, we expect stronger results for the balance of the

year. We saw strong operational performance and customer growth in

our utilities, particularly Tampa Electric and Peoples Gas, which

underscores the significance of our Florida operations and

reinforces the strategic decision to reallocate capital to invest

in our strongest businesses” said Scott Balfour, President and CEO

of Emera Inc. “Our commitment to deploying $2.9 billion in capital

this year, as part of our three-year $8.8 billion capital

investment plan, not only highlights our dedication to enhancing

infrastructure and delivering reliable energy to our customers but

is also expected to deliver strong results for shareholders.”

Q2 2024 Financial Results

Q2 2024 reported net income was $129 million, or $0.45 per

common share, compared with net income of $28 million, or $0.10 per

common share, in Q2 2023, driven by the LIL gain on sale, higher

earnings in Tampa Electric and Peoples Gas, both of which

benefitted from customer growth and new base rates.

Reported net income for the quarter included a $107 million

gain, after tax and transaction costs, on the sale of Emera’s LIL

equity interest, and a $129 million mark-to-market (“MTM”)

after-tax loss, primarily at Emera Energy Services (“EES”) compared

to a $134 million MTM after-tax loss in Q2 2023. The recently

announced sale of New Mexico Gas Company will result in a non-cash

impairment of goodwill in subsequent periods.

Q2 2024 adjusted net income(1) was $151 million, or $0.53 per

common share, compared with $162 million, or $0.60 per common

share, in Q2 2023. The decrease was primarily due to decreased

earnings at NMGC and NSPI, higher Corporate interest expense and

unrealized FX losses on translation of USD short term debt

balances. These were partially offset by increased earnings at PGS

and TEC and increased Corporate income tax recovery due to

increased losses before provision for income taxes.

Year-to-date Financial Results

Year-to-date reported net income was $336 million or $1.17 per

common share, compared with net income of $588 million or $2.17 per

common share year-to-date in 2023. Year-to-date reported net income

included a $107 million gain, after tax and transaction costs, on

the sale of Emera’s LIL equity interest and a $138 million MTM

loss, after-tax, compared to a $158 million MTM gain, after-tax,

primarily at EES in 2023.

Year-to-date adjusted net income(1) was $367 million or $1.28

per common share, compared with $430 million or $1.58 per common

share year-to-date in 2023.

Year-to-date adjusted net income decreased primarily due to

decreased earnings at NMGC, NSPI, TEC and EES, increased Corporate

interest expense, higher operating, maintenance and general

expenses (“OM&G”) in the Corporate segment due to the timing of

long-term compensation hedges and realized FX losses. These were

partially offset by increased earnings at PGS and increased

Corporate income tax recovery.

The translation impact of a weaker Canadian dollar on US

denominated earnings was more than offset by the losses on FX

hedges used to mitigate translation risk of US dollar earnings

which, combined, decreased net income by $11 million in Q2 2024 and

$13 million year-to-date, compared to the same periods in 2023.

Weakening of the Canadian dollar increased adjusted net income by

$2 million in Q2 2024 and $1 million year-to-date compared to the

same period in 2023.

(1) See “Non-GAAP Financial Measures and Ratios” noted below and

“Segment Results and Non-GAAP Reconciliation” below for

reconciliation to nearest USGAAP measure.

Segment Results and Non-GAAP Reconciliation

For the

Three months ended

June 30

Six Months ended

June 30

millions of Canadian dollars (except per

share amounts)

2024

2023

2024

2023

Adjusted net income 1,2

Florida Electric Utility

$

187

$

177

272

284

Canadian Electric Utilities

42

49

129

141

Gas Utilities and Infrastructure

44

38

142

132

Other Electric Utilities

8

10

17

14

Other 3

(130)

(112)

(193)

(141)

Adjusted net income1,2

$

151

$

162

367

430

Gain on sale, after-tax and transaction

costs4

107

-

107

-

MTM (loss) gain, after-tax5

(129)

(134)

(138)

158

Net income attributable to common

shareholders

$

129

$

28

336

588

EPS (basic)

$

0.45

$

0.10

1.17

2.17

Adjusted EPS (basic) 1,2

$

0.53

$

0.60

1.28

1.58

1 See “Non-GAAP Financial Measures and Ratios” noted below. 2

Excludes the gain on sale, after tax and transaction costs of

Emera’s LIL equity interest and the effect of after-tax MTM

adjustments. 3 Lower earnings quarter-over-quarter, primarily due

to increased interest expense, realized FX loss on translation of

foreign currency bank balances, partially offset by increased

income tax recovery. Year-over-year change primarily due to

increased interest expense and operating expense and lower

contributions from EES. 4 Net of income tax expense of $75 million

for the three and six months ended June 30, 2024 (2023 – nil). 5

Net of income tax recovery of $52 million for the three months

ended June 30, 2024 (2023 – $55 million recovery) and $56 million

income tax recovery for the six months ended June 30, 2024 (2023 –

$64 million expense).

Consolidated Financial Review

The following table highlights significant changes in adjusted

net income attributable to common shareholders from 2023 to

2024.

For the

Three months ended

Six months ended

millions of Canadian dollars

June 30

June 30

Adjusted net income – 2023 1,2

$

162

$

430

Operating Unit Performance

Decreased earnings at NMGC due to

increased OM&G and higher interest, partially offset by lower

income tax expense. Year-over-year earnings also decreased due to

lower asset optimization revenues

(5)

(19)

Decreased earnings at NSPI due to

increased OM&G primarily due to investment in reliability

initiatives and increased income tax expense, partially offset by

higher revenues due to higher residential sales volumes

(5)

(16)

Decreased earnings at EES year-over-year

due to less favourable market conditions

-

(10)

Increased earnings at PGS due to higher

revenue from new base rates, customer growth, and favourable

weather, partially offset by higher interest expense, OM&G and

depreciation expense

11

32

Increased earnings quarter-over-quarter at

TEC due to higher revenues as a result of customer growth and new

base rates, and lower income tax expense, partially offset by

higher OM&G due to higher generation and transmission and

distribution costs, and higher depreciation. Year-over-year

earnings decreased due to higher OM&G and depreciation, and

unfavourable weather, partially offset by higher revenue from

customer growth and new base rates, and lower income tax

expense

10

(12)

Corporate

Increased interest expense, pre-tax, due

to increased interest rates and increased average total debt

(14)

(23)

FX losses on the translation of USD

short-term debt balances

(6)

(5)

Increased income tax recovery, primarily

due to increased losses before provision for income taxes

7

15

Decreased/(increased) OM&G pre-tax,

primarily due to the timing of long-term compensation hedges

2

(17)

Other Variances

(11)

(8)

Adjusted net income – 2024 1,2

$

151

$

367

1 See “Non-GAAP Financial Measures and Ratios” noted below and

“Segment Results and Non-GAAP Reconciliation" for reconciliation to

nearest GAAP measure. 2 Excludes gain on sale, after-tax and

transaction costs of Emera’s LIL equity interest and the effect of

MTM adjustments, after- tax.

1 Non-GAAP Financial Measures and Ratios

Emera uses financial measures that do not have standardized

meaning under USGAAP and may not be comparable to similar measures

presented by other entities. Emera calculates the non-GAAP measures

and ratios by adjusting certain GAAP measures for specific items.

Management believes excluding these items better distinguishes the

ongoing operations of the business. For further information on the

non-GAAP financial measure, adjusted net income, and the non-GAAP

ratio, adjusted EPS – basic, refer to the "Non-GAAP Financial

Measures and Ratios" section of the Emera’s Q2 2024 MD&A which

is incorporated herein by reference and can be found on SEDAR+ at

www.sedarplus.ca. Reconciliation to the nearest GAAP measure is

included in “Segment Results and Non-GAAP Reconciliation”

above.

Forward-Looking Information

This news release contains forward-looking information within

the meaning of applicable securities laws. By its nature,

forward-looking information requires Emera to make assumptions and

is subject to inherent risks and uncertainties. These statements

reflect Emera management’s current beliefs and are based on

information currently available to Emera management. There is a

risk that predictions, forecasts, conclusions and projections that

constitute forward-looking information will not prove to be

accurate, that Emera’s assumptions may not be correct and that

actual results may differ materially from such forward-looking

information. Additional detailed information about these

assumptions, risks and uncertainties is included in Emera’s

securities regulatory filings, including under the heading

“Business Risks and Risk Management” in Emera’s annual Management’s

Discussion and Analysis, and under the heading “Principal Risks and

Uncertainties” in the notes to Emera’s annual and interim financial

statements, which can be found on SEDAR+ at www.sedarplus.ca.

Teleconference Call

The company will be hosting a teleconference today, Friday,

August 9, at 9:30 a.m. Atlantic (8:30 a.m. Eastern) to discuss the

Q2 2024 financial results.

Analysts and other interested parties in North America are

invited to participate by dialing 1-800-717-1738. International

parties are invited to participate by dialing 1-289-514-5100.

Participants should dial in at least 10 minutes prior to the start

of the call. No pass code is required.

A live and archived audio webcast of the teleconference will be

available on the Company's website, www.emera.com. A replay of the

teleconference will be available on the Company’s website two hours

after the conclusion of the call.

About Emera

Emera is a geographically diverse energy and services company

headquartered in Halifax, Nova Scotia with approximately $40

billion in assets and 2023 revenues of $7.6 billion. The company

primarily invests in regulated electricity generation and

electricity and gas transmission and distribution, with a strategic

focus on transformation from high carbon to low carbon energy

sources. Emera has investments in Canada, the United States and the

Caribbean. Emera’s common and preferred shares are listed on the

Toronto Stock Exchange and trade respectively under the symbol EMA,

EMA.PR.A, EMA.PR.B, EMA.PR.C, EMA.PR.E, EMA.PR.F, EMA.PR.H,

EMA.PR.J and EMA.PR.L. Depositary receipts representing common

shares of Emera are listed on the Barbados Stock Exchange under the

symbol EMABDR and on The Bahamas International Securities Exchange

under the symbol EMAB. Additional information can be accessed at

www.emera.com or at www.sedarplus.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240809526501/en/

Emera Inc. Investor Relations Dave Bezanson, VP,

Investor Relations & Pensions 902-474-2126

dave.bezanson@emera.com

Media 902-222-2683 media@emera.com

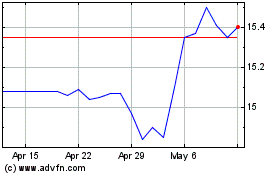

Emera (TSX:EMA.PR.A)

Historical Stock Chart

From Oct 2024 to Nov 2024

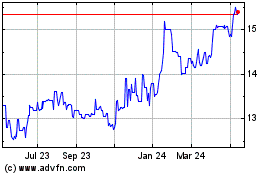

Emera (TSX:EMA.PR.A)

Historical Stock Chart

From Nov 2023 to Nov 2024