Imperial Completes Rights Offering

27 June 2022 - 5:10PM

Imperial Metals Corporation (the “Company”)

(TSX:III) is pleased to announce the completion of its previously

announced rights offering (the “Rights Offering”), which expired at

2:00 p.m. (Pacific Time) Friday, June 24, 2022. The Company will

issue a total of 13,475,400 common shares in the Rights Offering

for gross proceeds of approximately $41.0 million.

The Company will issue a total of 9,948,611

common shares under basic subscription privileges in the Rights

Offering and a total of 3,526,789 common shares under additional

subscription privileges. To the knowledge of the Company, no person

will become an insider as a result of the Rights Offering. The

total number of issued and outstanding common shares of the Company

upon completion of the Rights Offering will be 154,871,341.

The proceeds of the Rights Offering will be used

as set out in the Company’s Rights Offering circular dated May 19,

2022.

Shareholdings of N. Murray

Edwards

As a result of the Rights Offering, N. Murray

Edwards beneficially will own and control 69,375,775 common shares

of the Company, representing 44.80% of the Company’s issued and

outstanding common shares as of the date hereof. Prior to the

Rights Offering, Mr. Edwards owned and controlled 59,622,910 common

shares, representing 42.17% of the Company’s issued and outstanding

common shares. The common shares were acquired by Mr. Edwards for

investment purposes and he may acquire or dispose of securities of

the Company in the future depending on market conditions,

reformulation of plans and/or other relevant factors, in each case

in accordance with applicable securities laws. This portion of the

news release is issued pursuant to National Instrument 62-103 – The

Early Warning System and Related Take-Over Bid and Insider

Reporting Issues, which requires a report to be filed on SEDAR

(www.sedar.com) by Mr. Edwards containing additional information

with respect to the foregoing matters. A copy of the early warning

report may be obtained directly from the Company upon request at

the telephone number below.

This news release does not constitute an offer

for sale or the solicitation of an offer to buy any securities in

the United States. The Company registered the offer and sale of the

shares issuable on exercise of the rights on a Form F-7

registration statement (File No. 333-256267) under the U.S.

Securities Act of 1933, as amended, a copy of which can be found at

www.sec.gov and may also be obtained by contacting the Chief

Financial Officer at 604.488.2658 or by email at

darb.dhillon@imperialmetals.com.

About Imperial

Imperial is a Vancouver based exploration, mine development and

operating company. The Company, through its subsidiaries, owns a

30% interest in the Red Chris mine, and a 100% interest in both the

Mount Polley and Huckleberry copper mines in British Columbia.

Imperial also holds a portfolio of 23 greenfield exploration

properties in British Columbia.

Company Contacts

Brian Kynoch | President

| 604.669.8959Darb Dhillon |

Chief Financial Officer | 604.488.2658

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

"forward-looking" statements. Forward-looking statements relate to

future events or future performance and reflect Company

management's expectations or beliefs regarding future events and

include, but are not limited to, specific statements regarding the

Rights Offering and the intended use of proceeds raised under the

Rights Offering. In certain cases, forward-looking statements can

be identified by the use of words such as “plans”, “expects” or

“does not expect”, “is expected”, “outlook”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates” or “does not

anticipate”, or “believes”, or variations of such words and phrases

or statements that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative of these terms or comparable terminology.

In this document certain forward-looking statements are identified

by words including “guidance”, “expectations”, “targeted”, “plan”,

“planned”, “estimated”, “calls for” and “expected”. Forward-looking

information is not based on historical facts, but rather on then

current expectations, beliefs, assumptions, estimates and forecasts

about the business and the industry and markets in which the

Company operates, including assumptions that: the Company will

receive all necessary regulatory, stock exchange and third party

approvals in respect of the Rights Offering; the timing of the

Rights Offering will meet the Company’s expectations based on its

business and operational requirements; and the Rights Offering will

provide sufficient liquidity to support the Company’s intended use

of the proceeds therefrom. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations. We can give no assurance that the forward-looking

information will prove to be accurate.

By their very nature forward-looking statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others,

risks that the Rights Offering will not provide the expected

liquidity or benefits to the Company’s business or operations;

risks that required consents and approvals will not be received in

order to advance or complete the Rights Offering; uncertainties

relating to the cost of completing the Rights Offering; risks that

could cause the Company to allocate the proceeds of the Rights

Offering in a manner other than as disclosed, including all of the

risks related to the Company's business, financial condition,

result of operations and cash flows; and other risks of the mining

industry as well as those factors detailed from time to time in the

Company's interim and annual financial statements and management's

discussion and analysis of those statements, all of which are filed

and available for review on sedar.com. Although the Company has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking statements.

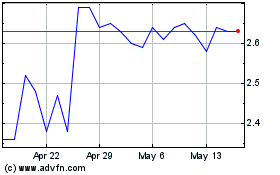

Imperial Metals (TSX:III)

Historical Stock Chart

From Nov 2024 to Dec 2024

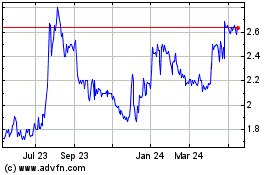

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2023 to Dec 2024