Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) (“Liberty Gold” or the

“Company”) is pleased to announce the identification of a

high-grade antimony (“Sb”) mineralizing system that outcrops along

the eastern extension of the Goldstrike Oxide Gold deposit

(“Goldstrike”), Southwest, Utah.

The Company has completed a staking program to

the east of the main Goldstrike claim block to include all areas

with potential for this mineralized system. Approximately 3.2

square kilometers of new ground has been acquired. See Figure 2

below.

The Antimony Ridge prospect is a known gold

mineralized zone that was left under-explored by Liberty Gold due

to its focus on drilling out the main oxide gold discovery area to

the west at Goldstrike. Recent recognition of antimony as a

critical mineral in the USA prompted the Company to re-assess its

historic metals databases and the significant potential of the

Antimony Ridge mineralization was identified. Additionally,

elevated antimony levels were noted in drill hole assays on the

Goldstrike Oxide deposit, up to 650 parts per million (0.065%)

Sb.

The mineralization at Antimony Ridge occurs as

exceptionally large, bladed to massive stibiconite in a jasperoid

breccia with gold. Stibiconite,

(Sb3O6[OH]), is an antimony oxide

formed from the in-situ oxidation of stibnite (Sb2S3), the primary

antimony sulfide mineral. See images in Figure 1 below:

FIGURE 1: STIBICONITE CRYSTALS

The stibiconite occurs in a large,

bedding-parallel jasperoid breccia with a sampled strike length of

450 meters (“m”). This mineral contact has been identified at

multiple locations throughout the property and current field work

has identified additional zones of antimony mineralization along

fault offsets of this contact.

Limited gold-focused surface sampling by the

Company in 2015, followed the exposed jasperoid breccia body and

identified surface antimony values up to 2.2% Sb, with gold grades

up to 0.85 grams per tonne. The apparent thickness of the

mineralized zone is up to 12 m, and it remains open along the

east-west strike and down dip to the north. The jasperoid can be

traced along this contact for more than 2 kilometres and there is

no record of any exploration drilling along the mineralized

jasperoid zone in this eastern area.

The Antimony Ridge mineralization occurs higher

in the stratigraphy than at the main gold zone, along an easily

traceable contact, which is currently being mapped & sampled

within these newly acquired lands.

Historic records indicate small-scale production

of 10 tons of antimony ore in the 1970s from the Lejaiv Unite Mine

located on Antimony Ridge. Material was mined from two small open

pits. Anecdotal evidence indicates the material mined was stibnite

ore and contained 10% Sb.

Cal Everett, CEO and Director

commented, “It is the nature of the exploration business to find

what you were not looking for in plain sight, simply due to

retention of archives that suddenly become relevant.”

FIGURE 2: GOLDSTRIKE NEW CLAIMS STAKING MAP

QUALIFIED PERSON

Peter Shabestari, P.Geo., Vice-President

Exploration, Liberty Gold, is the Company's designated Qualified

Person for this news release within the meaning of National

Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") and has reviewed and validated that the information

contained in the release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and

developing open pit oxide deposits in the Great Basin of the United

States, home to large-scale gold projects that are ideal for

open-pit mining. This region is one of the most prolific

gold-producing regions in the world and stretches across Nevada and

into Idaho and Utah. We know the Great Basin and are driven to

discover and advance big gold deposits that can be mined profitably

in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations Phone:

604-632-4677 or Toll Free 1-877-632-4677 info@libertygold.ca

All statements in this press release, other than

statements of historical fact, are “forward-looking information”

with respect to Liberty Gold within the meaning of applicable

securities laws, and the potential quantity and/or grade of

minerals and Liberty Gold’s mineral resources. Forward-looking

information is often, but not always, identified by the use of

words such as “seek”, “anticipate”, “plan”, “continue”, “planned”,

“expect”, “project”, “predict”, “potential”, “targeting”,

“intends”, “believe”, “potential”, and similar expressions, or

describes a “goal”, or variation of such words and phrases or state

that certain actions, events or results “may”, “should”, “could”,

“would”, “might” or “will” be taken, occur or be achieved.

Forward-looking information is not a guarantee of future

performance and is based upon a number of estimates and assumptions

of management at the date the statements are made including, among

others, assumptions about future prices of gold and other metal

prices, currency exchange rates and interest rates, favourable

operating conditions, political stability, obtaining governmental

approvals and financing on time, obtaining renewals for existing

licenses and permits and obtaining required licenses and permits,

labour stability, stability in market conditions, the timing and

success of future plans and objectives in the areas of sustainable

development, health, safety, environment, community development;

successful resolution of disputes and anticipated costs and

expenditures and the timing of regulatory approvals. Many

assumptions are based on factors and events that are not within the

control of Liberty Gold and there is no assurance they will prove

to be correct.

Such forward-looking information, involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to

the interpretation of results and/or the reliance on technical

information provided by third parties as related to the Company’s

mineral property interests; changes in project parameters as plans

continue to be refined; current economic conditions; future prices

of commodities; possible variations in grade or recovery rates; the

costs and timing of the development of new deposits; failure of

equipment or processes to operate as anticipated; the failure of

contracted parties to perform; the timing and success of

exploration activities generally; delays in permitting; possible

claims against the Company; labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals, the

completion of exploration as well as those factors discussed in the

Annual Information Form of the Company dated March 28, 2024 in the

section entitled "Risk Factors", under Liberty Gold’s SEDAR+

profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements.

Liberty Gold disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise.

Photos accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/9bce4277-19a7-4c9e-8bd5-a8d7999c78b7

https://www.globenewswire.com/NewsRoom/AttachmentNg/37da9f05-ac7b-4100-b486-186585f4d636

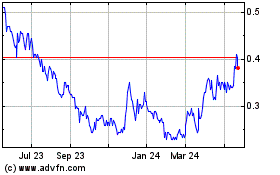

Liberty Gold (TSX:LGD)

Historical Stock Chart

From Feb 2025 to Mar 2025

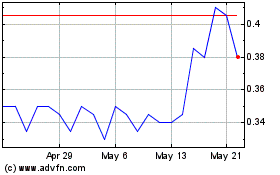

Liberty Gold (TSX:LGD)

Historical Stock Chart

From Mar 2024 to Mar 2025