Timbercreek Financial (TSX: TF) (the “Company”) announced today its

financial results for the three and six months ended June 30, 2024

(“Q2 2024”).

Q2 2024 Highlights1

- The net mortgage investment portfolio increased by $25.8

million to $1,003.4 million at the end of Q2 2024 from

$977.5 million at the end of Q1 2024 (Q2 2023 –

$1,123.7 million).

- Net investment income of $26.4 million compared to $31.5

million in Q2 2023.

- Net income and comprehensive income of $15.4 million (Q2

2023 – $16.9 million) or basic earnings per share of $0.19 (Q2

2023 – $0.20).

- Distributable income of $16.3 million (Q2 2023 –

$17.8 million) or distributable income per share of $0.20 (Q2

2023 – $0.21 per share).

- Declared a total of $14.3 million in dividends to

shareholders, or $0.17 per share, reflecting a distributable income

payout ratio of 87.8% (Q2 2023 - 81.1%).

- The quarterly weighted average interest rate on net mortgage

investments was 9.8% in Q2 2024, compared to 9.9% in Q1 2024 (Q2

2023 – 9.8%). Interest rate exposure in the net mortgage investment

portfolio was well protected at the end of Q2 2024, floating rate

loans with rate floors representing 78.3% (Q2 2023 – 88.3%) of net

mortgage investment portfolio.

- Maintained conservative portfolio risk composition focused on

income-producing commercial real estate:

- 62.3% weighted average loan-to-value;

- 85.6% first mortgages in mortgage investment portfolio;

and

- 83.4% of mortgage investment portfolio is invested in

cash-flowing properties.

- The Company continues to focus on the resolution of its staged

loans, utilizing active asset management strategies and continues

to make significant progress. The Company's management team is very

experienced in navigating these situations and is well positioned

to strategically work through these loans to ensure the best

outcomes in light of the current economic environment.

“The overall portfolio performed solidly in the

second quarter, as we reported improved sequential results and

demonstrated our ability to generate consistent healthy cash flows

and dividends with a conservative payout ratio, despite a

transitioning commercial real estate backdrop,” said Blair Tamblyn,

CEO of Timbercreek Financial. “We continue to have success

redeploying capital into high-quality loans as we expand the

portfolio back to historical levels. The positive macro backdrop

from recent Bank of Canada rate cuts is further enhancing the deal

flow pipeline, and we expect to see increased financing

opportunities as transaction activity in most asset classes grows.

We believe these conditions are key factors to support a recovery

in commercial real estate fundamentals, and the company is well

positioned to deploy capital in this environment and grow the

portfolio through the balance of the year.”

Mr. Tamblyn added: “During the quarter, our team

also continued to focus on resolving the remaining staged loans

through highly active asset management efforts. We are making good

progress on these select situations and remain confident both in

the underlying value of the assets and our ability to navigate

these situations to ensure the best outcomes for our

shareholders.”

- Refer to non-IFRS measures section below for net mortgages,

enhanced return portfolio investments, adjusted net income and

comprehensive income, distributable income and adjusted

distributable income.

Quarterly Comparison

| $

millions |

Q2 2024 |

|

|

Q2 2023 |

|

Q1 2024 |

| |

|

|

|

|

|

|

|

Net Mortgage Investments1 |

$ |

1,003.4 |

|

|

|

$ |

1,123.7 |

|

|

$ |

977.5 |

|

| Enhanced Return Portfolio

Investments1 |

$ |

62.0 |

|

|

|

$ |

58.7 |

|

|

$ |

63.4 |

|

| Real Estate land

Inventory |

$ |

30.6 |

|

|

|

$ |

30.3 |

|

|

$ |

30.6 |

|

| Real Estate held for sale, net

of collateral liability |

$ |

62.2 |

|

|

|

$ |

— |

|

|

$ |

62.2 |

|

| |

|

|

|

|

|

|

| Net Investment Income |

$ |

26.4 |

|

|

|

$ |

31.5 |

|

|

$ |

24.6 |

|

| Income from Operations |

$ |

23.5 |

|

|

|

$ |

26.3 |

|

|

$ |

20.9 |

|

| Net Income and comprehensive

Income |

$ |

15.4 |

|

|

|

$ |

16.9 |

|

|

$ |

14.4 |

|

| --Adjusted Net Income and

comprehensive Income |

$ |

15.7 |

|

|

|

$ |

17.0 |

|

|

$ |

14.2 |

|

| Distributable income1 |

$ |

16.3 |

|

|

|

$ |

17.8 |

|

|

$ |

15.8 |

|

| Dividends declared to

Shareholders2 |

$ |

14.3 |

|

|

|

$ |

14.4 |

|

|

$ |

14.3 |

|

| |

|

|

|

|

|

|

| $ per

share |

Q2 2024 |

|

|

Q2 2023 |

|

Q1 2024 |

| |

|

|

|

|

|

|

| Dividends per share |

$ |

0.17 |

|

|

|

$ |

0.17 |

|

|

$ |

0.17 |

|

| Distributable income per

share1 |

$ |

0.20 |

|

|

|

$ |

0.21 |

|

|

$ |

0.19 |

|

| Earnings per share |

$ |

0.19 |

|

|

|

$ |

0.20 |

|

|

$ |

0.17 |

|

| --Adjusted Earnings per

share |

$ |

0.19 |

|

|

|

$ |

0.20 |

|

|

$ |

0.17 |

|

| |

|

|

|

|

|

|

| Payout Ratio on Distributable

Income1 |

|

87.8 |

% |

|

|

|

81.1 |

% |

|

|

90.6 |

% |

| Payout Ratio on Earnings per

share |

|

93.2 |

% |

|

|

|

85.5 |

% |

|

|

99.7 |

% |

| --Payout Ratio on Adjusted

Earnings per share |

|

91.1 |

% |

|

|

|

85.1 |

% |

|

|

100.8 |

% |

| |

|

|

|

|

|

|

| Net Mortgage

Investments |

Q2 2024 |

|

|

Q2 2023 |

|

Q1 2024 |

| |

|

|

|

|

|

|

| Weighted Average

Loan-to-Value |

|

62.3 |

% |

|

|

|

68.3 |

% |

|

|

64.4 |

% |

| Weighted Average Remaining

Term to Maturity |

1.0 yr |

|

|

|

0.8 yr |

|

|

0.8 yr |

|

| First Mortgages |

|

85.6 |

% |

|

|

|

91.4 |

% |

|

|

85.7 |

% |

| Cash-Flowing Properties |

|

83.4 |

% |

|

|

|

87.7 |

% |

|

|

85.7 |

% |

| Multi-family residential |

|

51.2 |

% |

|

|

|

50.1 |

% |

|

|

54.6 |

% |

| Floating Rate Loans with rate

floors (at quarter end) |

|

78.3 |

% |

|

|

|

88.3 |

% |

|

|

88.6 |

% |

| |

|

|

|

|

|

|

| Weighted Average Interest

Rate |

|

|

|

|

|

|

|

For the quarter ended |

|

9.8 |

% |

|

|

|

9.8 |

% |

|

|

9.9 |

% |

| Weighted Average Lender

Fee |

|

|

|

|

|

|

|

New and Renewed |

|

0.9 |

% |

|

|

|

1.1 |

% |

|

|

0.8 |

% |

|

New Net Mortgage Investment Only |

|

1.0 |

% |

|

|

|

1.2 |

% |

|

|

0.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

- Refer to non-IFRS measures section below for net mortgages,

enhanced return portfolio investments, adjusted net income and

comprehensive income, distributable income and adjusted

distributable income.

- Dividends declared exclude 2023 year-end special dividends paid

in March 2024.

Quarterly Conference Call

Interested parties are invited to participate in

a conference call with management on Thursday, August 1, 2024

at 1:00 p.m. (ET) which will be followed by a question and answer

period with analysts.

To join the Zoom Webinar:

If you are a Guest, please click the link below

to join:

https://us02web.zoom.us/j/82594185755?pwd=M2NmRHYrMnJoK3A3blpSeTNreE9SUT09

Webinar ID: 825 9418

5755

Passcode: 1234

Or Telephone:Dial

(for higher quality, dial a number based on your current

location):Canada: +1 647 374 4685, +1 647 558 0588, +1 778

907 2071, +1 780 666 0144, +1 204 272 7920, +1 438 809 7799, +1 587

328 1099International numbers available:

https://us02web.zoom.us/u/kBj4jLpCU

Speakers will receive a separate link to the

Webinar.

The playback of the conference call will also be

available on www.timbercreekfinancial.com following the call.

About the Company

Timbercreek Financial is a leading non-bank,

commercial real estate lender providing shorter-duration,

structured financing solutions to commercial real estate

professionals. Our sophisticated, service-oriented approach allows

us to meet the needs of borrowers, including faster execution and

more flexible terms that are not typically provided by Canadian

financial institutions. By employing thorough underwriting, active

management and strong governance, we are able to meet these needs

while generating strong risk-adjusted yields for investors. Further

information is available on our website,

www.timbercreekfinancial.com.

Non-IFRS Measures

The Company prepares and releases financial

statements in accordance with IFRS. As a complement to results

provided in accordance with IFRS, the Company discloses certain

financial measures not recognized under IFRS and that do not have

standard meanings prescribed by IFRS (collectively the "non-IFRS

measures"). These non-IFRS measures are further described in

Management's Discussion and Analysis ("MD&A") available on

SEDAR+. Certain non-IFRS measures relating to net mortgages,

adjusted net income and comprehensive income and adjusted

distributable income have been shown below. The Company has

presented such non-IFRS measures because the Manager believes they

are relevant measures of the Company’s ability to earn and

distribute cash dividends to shareholders and to evaluate its

performance. The following non-IFRS financial measures should not

be construed as alternatives to total net income and comprehensive

income or cash flows from operating activities as determined in

accordance with IFRS as indicators of the Company’s

performance.

Certain statements contained in this news

release may contain projections and "forward looking statements"

within the meaning of that phrase under Canadian securities laws.

When used in this news release, the words "may", "would", "should",

"could", "will", "intend", "plan", "anticipate", "believe",

"estimate", "expect", "objective" and similar expressions may be

used to identify forward looking statements. By their nature,

forward looking statements reflect the Company's current views,

beliefs, assumptions and intentions and are subject to certain

risks and uncertainties, known and unknown, including, without

limitation, those risks disclosed in the Company's public filings.

Many factors could cause actual results, performance or

achievements to be materially different from any future results,

performance or achievements that may be expressed or implied by

these forward looking statements. The Company does not intend to

nor assumes any obligation to update these forward looking

statements whether as a result of new information, plans, events or

otherwise, unless required by law.

OPERATING RESULTS1

| |

Three months

endedJune 30, |

|

Six months endedJune 30, |

|

Year endedDecember 31, |

|

|

NET INCOME AND COMPREHENSIVE INCOME |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

Net investment income on financial assets measured at amortized

cost |

$ |

26,441 |

|

$ |

31,471 |

|

$ |

51,031 |

|

$ |

64,180 |

|

$ |

124,205 |

|

|

Fair value gain and other income on financial assets measured at

FVTPL |

|

235 |

|

|

306 |

|

|

572 |

|

|

588 |

|

|

1,282 |

|

|

Net rental gain (loss) |

|

389 |

|

|

(293 |

) |

|

863 |

|

|

(652 |

) |

|

(595 |

) |

|

Fair value gain on real estate properties |

|

— |

|

|

— |

|

|

— |

|

|

63 |

|

|

63 |

|

|

Expenses |

|

(3,599 |

) |

|

(5,139 |

) |

|

(8,097 |

) |

|

(9,582 |

) |

|

(19,140 |

) |

| Income from operations |

$ |

23,466 |

|

$ |

26,345 |

|

$ |

44,369 |

|

$ |

54,597 |

|

$ |

105,815 |

|

| |

|

|

|

|

|

| Financing costs: |

|

|

|

|

|

|

Financing cost on credit facility |

|

(5,571 |

) |

|

(7,208 |

) |

|

(9,856 |

) |

|

(15,106 |

) |

|

(30,396 |

) |

|

Financing cost on convertible debentures |

|

(2,535 |

) |

|

(2,249 |

) |

|

(4,785 |

) |

|

(4,499 |

) |

|

(8,998 |

) |

| Net income and comprehensive income |

$ |

15,360 |

|

$ |

16,888 |

|

$ |

29,728 |

|

$ |

34,992 |

|

$ |

66,421 |

|

| Payout ratio on earnings per share |

|

93.2 |

% |

|

85.5 |

% |

|

96.3 |

% |

|

82.5 |

% |

|

86.7 |

% |

| |

|

|

|

|

|

| ADJUSTED

NET INCOME AND COMPREHENSIVE INCOME |

|

|

|

| Net income and comprehensive income |

|

15,360 |

|

|

16,888 |

|

|

29,728 |

|

|

34,992 |

|

|

66,421 |

|

|

Add: Net unrealized gain (loss) on financial assets measured at

FVTPL |

|

357 |

|

|

68 |

|

|

191 |

|

|

11 |

|

|

(342 |

) |

| Adjusted net

income and comprehensive income1 |

$ |

15,717 |

|

$ |

16,956 |

|

$ |

29,919 |

|

$ |

35,003 |

|

$ |

66,078 |

|

| Payout ratio on adjusted earnings per share1 |

|

91.1 |

% |

|

85.1 |

% |

|

95.7 |

% |

|

82.5 |

% |

|

87.2 |

% |

| |

|

|

|

|

|

|

DISTRIBUTABLE INCOME |

|

|

|

|

|

| Adjusted net income and comprehensive income1 |

$ |

15,717 |

|

$ |

16,956 |

|

$ |

29,919 |

|

$ |

35,003 |

|

$ |

66,078 |

|

|

Less: Amortization of lender fees |

|

(1,678 |

) |

|

(2,181 |

) |

|

(3,083 |

) |

|

(4,646 |

) |

|

(8,279 |

) |

|

Add: Lender fees received and receivable |

|

1,828 |

|

|

1,672 |

|

|

3,007 |

|

|

3,381 |

|

|

6,597 |

|

|

Add: Amortization of financing costs, credit facility |

|

200 |

|

|

172 |

|

|

616 |

|

|

425 |

|

|

953 |

|

|

Add: Amortization of financing costs, convertible debentures |

|

285 |

|

|

242 |

|

|

528 |

|

|

486 |

|

|

972 |

|

|

Add: Accretion expense, convertible debentures |

|

136 |

|

|

114 |

|

|

249 |

|

|

227 |

|

|

454 |

|

|

Add: Unrealized fair value (gain) loss on DSU |

|

(88 |

) |

|

(48 |

) |

|

65 |

|

|

27 |

|

|

(67 |

) |

|

Add: Expected credit (recovery) loss |

|

(97 |

) |

|

875 |

|

|

815 |

|

|

1,175 |

|

|

3,649 |

|

| Distributable income1 |

$ |

16,303 |

|

$ |

17,802 |

|

$ |

32,116 |

|

$ |

36,078 |

|

$ |

70,357 |

|

| Payout ratio on distributable income1 |

|

87.8 |

% |

|

81.1 |

% |

|

89.2 |

% |

|

80.1 |

% |

|

81.9 |

% |

| |

|

|

|

|

|

| PER SHARE

INFORMATION |

|

|

|

|

|

| Dividends declared to shareholders |

$ |

14,319 |

|

$ |

14,434 |

|

$ |

28,638 |

|

$ |

28,885 |

|

$ |

57,603 |

|

| Weighted average common shares (in thousands) |

|

83,010 |

|

|

83,737 |

|

|

83,010 |

|

|

83,760 |

|

|

83,509 |

|

| Dividends per share |

$ |

0.17 |

|

$ |

0.17 |

|

$ |

0.35 |

|

$ |

0.35 |

|

$ |

0.69 |

|

| Earnings per share (basic) |

$ |

0.19 |

|

$ |

0.20 |

|

$ |

0.36 |

|

$ |

0.42 |

|

$ |

0.80 |

|

| Earnings per share (diluted) |

$ |

0.18 |

|

$ |

0.20 |

|

$ |

0.36 |

|

$ |

0.41 |

|

$ |

0.78 |

|

| Adjusted earnings per share (basic)1 |

$ |

0.19 |

|

$ |

0.20 |

|

$ |

0.36 |

|

$ |

0.42 |

|

$ |

0.79 |

|

| Adjusted earnings per share (diluted)1 |

$ |

0.19 |

|

$ |

0.20 |

|

$ |

0.36 |

|

$ |

0.41 |

|

$ |

0.78 |

|

| Distributable income

per share1 |

$ |

0.20 |

|

$ |

0.21 |

|

$ |

0.39 |

|

$ |

0.43 |

|

$ |

0.84 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Refer to non-IFRS measures section.

Net mortgage investments(In thousands of

Canadian dollars, except units, per unit amounts and where

otherwise noted)

The Company’s exposure to the financial returns

is related to the net mortgage investments as mortgage syndication

liabilities are non-recourse mortgages with periodic variance

having no impact on Company's financial performance. Reconciliation

of gross and net mortgage investments balance is as follows:

|

Net Mortgage Investments |

June 30, 2024 |

|

|

December 31, 2023 |

|

|

Mortgage investments, excluding mortgage syndications |

$ |

996,025 |

|

|

$ |

943,488 |

|

|

Mortgage syndications |

|

480,277 |

|

|

|

601,624 |

|

| Mortgage investments,

including mortgage syndications |

|

1,476,302 |

|

|

|

1,545,112 |

|

|

Mortgage syndication liabilities |

|

(480,277 |

) |

|

|

(601,624 |

) |

| |

|

996,025 |

|

|

|

943,488 |

|

|

Interest receivable |

|

(11,106 |

) |

|

|

(14,585 |

) |

|

Unamortized lender fees |

|

5,408 |

|

|

|

5,226 |

|

|

Expected credit loss |

|

13,093 |

|

|

|

12,093 |

|

|

Net mortgage investments |

$ |

1,003,420 |

|

|

$ |

946,222 |

|

| |

|

|

|

|

|

|

|

Enhanced return portfolio

|

As at |

June 30, 2024 |

|

December 31, 2023 |

|

Other loan investments, net of expected credit loss |

$ |

48,422 |

|

$ |

47,033 |

| Finance lease receivable,

measured at amortized cost |

|

6,020 |

|

|

6,020 |

| Investment in participating

debentures, measured at FVTPL |

|

2,335 |

|

|

4,380 |

| Joint venture investment in

indirect real estate development |

|

2,225 |

|

|

2,225 |

| Investment in equity

instrument |

|

3,000 |

|

|

3,000 |

|

Total Enhanced Return Portfolio |

$ |

62,002 |

|

$ |

62,658 |

|

|

|

|

|

|

|

Real estate held for sale, net of collateral

liability

| As at |

June 30, 2024 |

|

|

December 31, 2023 |

|

|

Real estate held for sale |

|

130,987 |

|

|

|

130,987 |

|

| Real

estate held for sale collateral liability |

|

(68,787 |

) |

|

|

(69,008 |

) |

|

Total Real Estate held for sale, net of collateral

liability |

$ |

62,200 |

|

|

$ |

61,979 |

|

| |

|

|

|

|

|

|

|

SOURCE: Timbercreek Financial

For further information, please contact:

Timbercreek FinancialBlair

Tamblyn, CEOTracy Johnston, CFO

416-923-9967www.timbercreekfinancial.com

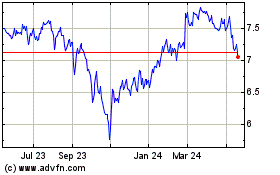

Timbercreek Financial (TSX:TF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Timbercreek Financial (TSX:TF)

Historical Stock Chart

From Jan 2024 to Jan 2025