Latin Metals Inc. (

“Latin Metals”

or the

“Company”) -

(TSXV: LMS)

(OTCQB: LMSQF) announces the acquisition by

staking of an additional 400-hectare claim (the

“

Extension”), contiguous with its 100% owned

Auquis Project (“

Auquis” or the

“

Project”). The Extension is located south of the

Rose copper porphyry target area, which has potential to host an

extension of the Rose porphyry system. Potential to the south is

supported by anomalous soils geochemistry samples taken by the

Company prior to staking the property (Figure 1). Within the Rose

porphyry zone, early-stage soil samples have correlated well with

rock chip sampling anomalies over a 3km x 1.5km area.

Future exploration at Auquis is planned to

include additional sampling at the Rose zone as well as additional

work at the Blanco skarn target where skarn mineralization includes

anomalous rock samples up 9.3% zinc, 6.1% lead, 2.8% copper and

176g/t silver at surface.

Figure 1: Location of the Auquis Project

Extension relative to the existing Project and the Rose

Zone

The Company also announces that it has entered

into a loan agreement with a trust controlled by a director of the

Company (the “Lender”) pursuant to which the

Lender has agreed to provide an unsecured and non-interest-bearing

loan to the Company in the aggregate principal amount of up to USD

100,000 (the “July 2024 Loan”) repayable by the Company on demand.

The Company intends to use the proceeds of the July 2024 Loan to

fund its resource properties option payment requirements and to

meet its short-term corporate and working capital needs. The

Company also announces that on April 28, 2024, it received an

unsecured and non-interest-bearing loan (the “April 2024 Loan”;

together with the July 2024 Loan, the “Loans”) in the principal

amount of USD 100,000 from the Lender. The April 2024 Loan was

repaid in May 2024. Neither of the Loans are convertible into

or repayable in securities of the Company, and no bonus is payable

to the Lender in connection with the Loans.

As the Lender is a

trust controlled by a director of the Company, each of the Loans

constitute a related party transaction pursuant to Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions (“MI 61-101”). The Company is

relying on Sections 5.5(a) and 5.7(1)(a) of MI 61-101 for

exemptions from the formal valuation and minority shareholder

approval requirements, respectively, of MI 61-101, as, at the time

the loan agreements for the respective Loans were entered into by

the Company with the Lender, neither the fair market value of the

subject matter of, nor the fair market value of either of the Loans

exceeded 25% of the Company’s market capitalization.

About Latin Metals

Latin Metals is a mineral exploration company

acquiring a diversified portfolio of assets in South America. The

Company operates with a Prospect Generator model focusing on the

acquisition of prospective exploration properties at minimum cost,

completing initial evaluation through cost-effective exploration to

establish drill targets, and ultimately securing joint venture

partners to fund drilling and advanced exploration. Shareholders

gain exposure to the upside of a significant discovery without the

dilution associated with funding the highest-risk drill-based

exploration. For more information, please get in touch with Latin

Metals Investor Relations at 604-638-3456 or via email at

info@latin-metals.com.

Stay up to date on Latin Metals developments by

joining our online communities through LinkedIn, Facebook, X and

Instagram.

QA/QC

The work program at

Auquis was designed and supervised by Eduardo Leon, the Company's

Exploration Manager. He is responsible for all aspects of the work,

including the quality control/quality assurance program. On-site

personnel at the project rigorously collect and track samples which

are then security sealed and shipped to the ALS laboratory in Lima.

Samples used for the results described herein are prepared and

analyzed by multi-element analysis using an inductively coupled

mass spectrometer in compliance with industry standards.

Soil samples were

extracted from prospecting pits measuring 40cm x 40cm, where the

uppermost A horizon was removed to collect the underlying B

horizon. A total of 1.5 to 2.0 kg of B Horizon material was

collected at each sampling site, before the sampling pit was

reclaimed. A total of 10 samples were added to the previous grid of

200m north-south and 400m east-west orientation.

Qualified Person

Keith J. Henderson, P.Geo., is the Company's

qualified person as defined by NI 43-101 and has reviewed the

scientific and technical information that forms the basis for

portions of this news release. He has approved the disclosure

herein. Mr. Henderson is not independent of the Company, as he is

an employee of the Company and holds securities of the Company.

On Behalf of the Board

of Directors ofLATIN METALS INC.“Keith

Henderson”President & CEO

For further details on the Company readers are

referred to the Company’s web site (www.latin-metals.com) and its

Canadian regulatory filings on SEDAR+ at www.sedarplus.ca.

For further information, please contact:

Keith Henderson

Suite 890999 West Hastings StreetVancouver, BC, V6C 2W2

Phone: 604-638-3456E-mail: info@latin-metals.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

Cautionary Note Regarding

Forward-Looking Statements

This news release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

Canadian and U.S. securities legislation. All statements, other

than statements of historical fact, included herein including,

without limitation, statements regarding the anticipated content,

commencement and timing of exploration programs in respect of the

Project, anticipated exploration program results from exploration

activities, and the Company's expectation that it will be able to

enter into agreements to acquire interests in additional mineral

properties, the discovery and delineation of mineral

deposits/resources/reserves on the Project, statements regarding

the Loans and the use of proceeds from the July 2024 Loan, are

forward-looking statements. Although the Company believes that such

statements are reasonable, it can give no assurance that such

expectations will prove to be correct. Forward-looking statements

are typically identified by words such as: “believes”, “expects”,

“anticipates”, “intends”, “estimates”, “plans”, “may”, “should”,

“would”, “will”, “potential”, “scheduled” or variations of such

words and phrases and similar expressions, which, by their nature,

refer to future events or results that may, could, would, might or

will occur or be taken or achieved. Forward-looking statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to differ materially from any future results,

performance or achievements expressed or implied by the

forward-looking information. Such risks and other factors include,

among others, requirements for additional capital, actual results

of exploration activities, including on the Company’s projects, the

estimation or realization of mineral reserves and mineral

resources, future prices of copper, changes in general economic

conditions, changes in the financial markets and in the demand and

market price for commodities, lack of investor interest in future

financings, accidents, labour disputes and other risks of the

mining industry, delays in obtaining governmental approvals

(including TSX Venture Exchange acceptance), permits or financing

or in the completion of development or construction activities,

risks relating to epidemics or pandemics, including the impact of

epidemics or pandemics on the Company’s business, financial

condition and results of operations, changes in laws, regulations

and policies affecting mining operations, title disputes, the

timing and possible outcome of any pending litigation,

environmental issues and liabilities, as well as the risk factors

described in the Company’s annual and quarterly management’s

discussion and analysis and in other filings made by the Company

with Canadian securities regulatory authorities under the Company’s

profile at www.sedarplus.ca.

Readers are cautioned not to place undue

reliance on forward-looking statements. The Company does not

undertake any obligation to update any of the forward-looking

statements in this news release or incorporated by reference

herein, except as otherwise required by law.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5b66425b-80e8-4f1a-bbc2-021068c3f228

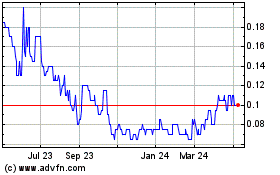

Latin Metals (TSXV:LMS)

Historical Stock Chart

From Nov 2024 to Dec 2024

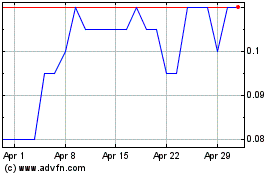

Latin Metals (TSXV:LMS)

Historical Stock Chart

From Dec 2023 to Dec 2024