Halitron, Inc. - HAON Q4 Revenue $342,000 Up 110% - Up List to OTCQB

16 January 2018 - 10:44PM

InvestorsHub NewsWire

Miami, FL -- January 16, 2018 -- InvestorsHub

NewsWire -- EmergingGrowth.com, a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies, reports on Halitron, Inc. (OTC

Pink: HAON).

HAON

may not be at these levels much longer.

See the Press Release and more on Halitron, Inc. (OTC

Pink: HAON) at EmergingGrowth.com

http://emerginggrowth.com/?s=haon

Halitron, Inc. (OTC

Pink: HAON) just announced that it booked $342,000 in revenue

for the fourth quarter 2017 which represents a 110% increase in

sales over the third quarter 2017.

The company stated in its press release… “With a market cap

of only approximately $1,324,000, Management is excited to announce

that its sales for the three months ended December 31, 2017, have

been recorded at approximately $342,000, which represents an

increase of 110% over its previous quarter sales of approximately

$163,000, for the three months ended September 30, 2017.”

If sales continue at only half this pace throughout 2018, the

company could be looking at over $3 million in sales for

2018.

The current market cap of Halitron, Inc. (OTC

Pink: HAON) is approximately $1.3 million, its shares can have

a dramatic upside.

Previously the company announced that margins are also expected to

increase due to its reduction of a manufacturing cell expenses by

65% after a move from Newton CT, to New Hide Park NY.

Halitron, Inc. (OTC

Pink: HAON) is also currently completing its audit which will

allow it to qualify for an up list to the OTCQB in the early part

of 2018.

During the two previous quarters, HAON has posted assets for 56

million Restricted LTCP Common Shares and 80 million LTCP Preferred

Stock C shares. The LTCP Preferred Stock C is entitled to a

dividend payment in 2020 in the form of cash or LTCP common shares

in 2020 valued at $3 million.

LTCP Management has planned to pay the $3 million payment due on

the holder of the LTCP Preferred Stock C shares upon LTCP either

completing a sufficient fundraising or generating cash flow, which

may be earlier than the planned 2020 dividend date.

HAON

may not be at these levels much longer.

See the Press Release and more on Halitron, Inc. (OTC

Pink: HAON) at EmergingGrowth.com

http://emerginggrowth.com/?s=haon

Other Companies in the news and featured on EmergingGrowth.com

Andiamo Corp.

EmergingGrowth.com picked

(OTC

Pink: ANDI) on December 18th, at .0003. The

company was recently the subject of a reverse acquisition by Utopya

Innovations who is promising to “take the world by storm” by

introducing inexpensive smart phones to emerging markets. The

stock closed Friday at .0095, down from its high for the day of

.012.

Have a look at Halitron, Inc. (OTC

Pink: HAON)

Infrax Systems, Inc.

Shares of Infrax Systems, Inc. (OTC:

IFXY) closed down 11% on Friday after its 700% run over the

past few weeks. Bollinger Bands and Candlesticks are pointing

down, however still above the 50-day moving average. We’ll

wait and see what comes from the company in the coming weeks if

anything.

ProTek Capital, Inc.

ProTek Capital, Inc. (OTC:

PRPM) is one of those companies that trades at “trip one” offer

with no bid. If you buy any of it, you can’t sell it.

That being said, lots of players play these in hopes that it will

go trip one to trip to and they can at the least double up on the

offer of trip two. There are hundreds of these out there and

they all come with a rumor. The question is, is ProTek, with

no news or financials since October 2015, one of them. Well

have to wait and see.

In the meantime, have a look at Halitron,

Inc. (OTC

Pink: HAON). Here’s a trip one with a market cap of

$1,324,000 that just released a 110% increase in Q4 revenue

over Q3 to $342,000.00, and an up and coming up list to the

QB.

About EmergingGrowth.com

EmergingGrowth.com is a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a

niche in identifying companies that can be overlooked by the

markets due to, among other reasons, trading price or market

capitalization. We look for strong management, innovation,

strategy, execution, and the overall potential for long- term

growth. Aside from being a trusted resource for the Emerging

Growth info-seekers, we are well known for discovering undervalued

companies and bringing them to the attention of the investment

community. Through our parent Company, we also have the

ability to facilitate road shows to present your products and

services to the most influential investment banks in the

space.

Disclosure:

All information contained herein as

well as on the EmergingGrowth.com website is

obtained from sources believed to be reliable but not guaranteed to

be accurate or all-inclusive. All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should

not be construed as an offer or solicitation to buy or sell

securities. The information may include certain forward-looking

statements, which may be affected by unforeseen circumstances and /

or certain risks. This report is not without bias.

EmergingGrowth.com has motivation by means of either self-marketing

or EmergingGrowth.com has been compensated by or for a company or

companies discussed in this article. Full details about which can

be found in our full disclosure, which can be found

here, http://www.emerginggrowth.com/disclosure-4266/.

Please consult an investment professional before investing in

anything viewed within. When EmergingGrowth.com is long shares

it will sell those shares. In addition, please make sure you read

and understand the Terms of Use, Privacy Policy and the Disclosure

posted on the EmergingGrowth.com website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact Email: info@EmergingGrowth.com

SOURCE: EmergingGrowth.com

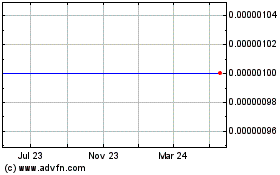

Andiamo (CE) (USOTC:ANDI)

Historical Stock Chart

From Dec 2024 to Jan 2025

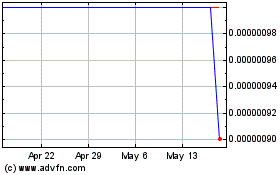

Andiamo (CE) (USOTC:ANDI)

Historical Stock Chart

From Jan 2024 to Jan 2025