The FTSE 100 closed up 1.8% on Tuesday, with banking stocks

rising and fears of a full-blown crisis receding, AJ Bell head of

financial analysis Danni Hewson says in a note. "London's FTSE 100

enjoyed its best rally of the year so far, closing up almost 2%

buoyed by gains from high street banking stalwarts NatWest,

Barclays and Lloyds," Hewson says. Rolls-Royce Holdings ended the

day as the biggest gainer, up 6.4%, while Fresnillo was the biggest

faller, ending down 3.9%.

Companies News:

Pearson to Sell POLS Business to US Private-Equity Firm Regent

LP

Pearson PLC said Tuesday that it will sell its international

online program management business Pearson Online Learning Services

to Californian private-equity firm Regent LP.

---

Staffline Swung to 2022 Pretax Profit; Says Uncertainty Will

Persist Through 2023

Staffline Group PLC said Tuesday that it swung to a pretax

profit for 2022 after booking lower costs, and that it expected the

current uncertainty to persist through 2023.

---

Kingfisher FY 2023 Pretax Profit Fell on Higher Costs

Kingfisher PLC reported on Tuesday a fall in pretax profit for

fiscal 2023 on the back of higher costs, but said that performance

was in line with the board expectations against strong prior year

comparatives.

---

React Group Sees Contract Win Momentum, Views Future With

Cautious Optimism

React Group PLC said Tuesday that it is enjoying good contract

win momentum with sales growth across all three divisions of its

business, and it views the future with cautious optimism.

---

Trustpilot Eyes Profitability in 2023; CEO to Step Down

Trustpilot AS said Tuesday that it expects to report positive

adjusted earnings in 2023 as it posted a narrower pretax loss for

2022, and that its chief executive is stepping down.

---

SThree 1Q Net Fees Rose, Boosted By Increase in Contract

Fees

SThree PLC said Tuesday that net fees rose in the first quarter

of fiscal 2023 as contract fees increased in almost all its

markets.

---

Pebble Group Pretax Profit, Revenue Rose Above Market Views in

2022

Pebble Group PLC said Tuesday that pretax profit and revenue

rose in 2022, with results slightly ahead of market

expectations.

---

SThree 1Q Net Fees Rose, Boosted By Increase in Contract

Fees

SThree PLC said Tuesday that net fees rose in the first quarter

of fiscal 2023 as contract fees increased in almost all its

markets.

---

SpaceandPeople 2H Performance Was Strong; 2022 Revenue in Line

With Views

SpaceandPeople PLC said Tuesday that its performance in the

second half of 2022 was strong and that revenue for the year was in

line with market expectations.

---

ScS Group 1H Pretax Loss Widened, Sees In-Line FY 2023 Pretax

Profit

ScS Group PLC said Tuesday that pretax loss for the first half

of fiscal 2023 widened on the back of higher costs, but it expects

full-year pretax profit to be in line with market expectations.

---

Fintel 2022 Pretax Profit Fell; Names New Chair

Fintel PLC on Tuesday reported a fall in pretax profit for 2022

and appointed Phil Smith a its new chair.

---

Brand Architekts 1H Pretax Loss Widened on Higher Costs; Focuses

on Strategy

Brand Architekts Group PLC said its pretax loss for the first

half of fiscal 2023 widened after booking higher costs stemming

from an acquisition, and that its attention will remain on

delivering its strategy and returning to group profitability.

---

Henry Boot 2022 Profit, Revenue Rose on Strong Sales; Confident

in Midterm Targets

Henry Boot PLC said Tuesday that 2022 pretax profit and revenue

both significantly rose on strong land, development and house sales

activity, and while the company remains cautious near term, it

expects to meet medium-term targets.

---

YouGov Pretax Profit, Revenue Rose on Growth; Backs FY 2023

Views

YouGov PLC said Tuesday that pretax profit and revenue rose in

the first half of fiscal 2023 as it benefited from growth in all

regions, especially the U.S., and said that it expects to meet

full-year market forecasts.

---

Manx Financial 2022 Pretax Profit Rose on Interest Income

Boost

Manx Financial Group PLC on Tuesday reported a rise in pretax

profit for 2022, boosted by higher interest revenue.

---

Pressure Technologies Sees Wider FY 2022 Loss on Accounting

Correction

Pressure Technologies PLC said Tuesday that it expects to report

a wider adjusted operating loss in fiscal 2022 due to an accounting

correction, though there will be a corresponding profit increase in

future years.

---

Scottish Mortgage Investment Trust Says Chair Fiona McBain to

Step Down

Scottish Mortgage Investment Trust PLC said Tuesday that Chair

Fiona McBain will step down and that Justin Dowley will succeed her

with effect from the conclusion of its 2023 annual general

meeting.

---

Gamma Communications 2022 Pretax Profit Fell on Impairments;

Increases Dividends

Gamma Communications PLC said Tuesday that pretax profit fell in

2022 due to impairment charges, but revenue and earnings rose, and

that it increased dividends.

---

AB Dynamics Sees Encouraging 1H Performance, Backs Full-year

Views

AB Dynamics PLC said Tuesday that performance in the first six

months of fiscal 2023 was encouraging and in line with management

expectations, and back its full-year views.

---

Wynnstay Group Starts Fiscal 2023 in Line With Expectations

Wynnstay Group PLC said Tuesday that it has performed broadly in

line with management expectations in the first four months of

fiscal 2023.

---

Kape Technologies 2022 Profit, Revenue Surged on Strong Organic

Growth

Kape Technologies PLC said Tuesday that its 2022 pretax profit

almost tripled along with revenue, driven by significant organic

growth across digital privacy, security, and content divisions and

strong market tailwinds.

Market Talk:

BOE Looks Likely to Raise Rates by 25Bps, But Rates Are Near

Their Peak

0936 GMT - The Bank of England, likely relieved that it isn't

British banks that are making the headlines, is expected to proceed

with a 25 basis-point interest-rate rise on Thursday, says Steven

Bell, EMEA chief economist at Columbia Threadneedle Investments in

a note. U.K. interest rates are already close to their peak,

however, he says. "Falling energy prices mean that U.K. inflation

is set to tumble and fears of recession have receded," he says. The

recent budget will have added to these trends, while wage pressures

have already eased and the headwinds from higher mortgage rates are

strong, Bell says. Markets are pricing in a 14 basis-point rate

rise this week, according to Refinitiv, suggesting the decision

will be a close call between a rise and unchanged rates.

(emese.bartha@wsj.com)

Pound May Fall But Only Marginally if BOE Keeps Rates Steady

0934 GMT - The pound could fall as there's a strong case for the

Bank of England to leave interest rates unchanged Thursday,

although any declines may be limited, MUFG Bank says. "Even prior

to the recent pick-up in fears over the health of the banking

system, the BOE was already much more cautious than the European

Central Bank and Federal Reserve over the need for further rate

hikes," MUFG currency analyst Lee Hardman says in a note. Leaving

rates on hold would pose "some downside risk" for the pound but its

recent resilience to risk aversion suggests it could continue to

perform better than expected in the near-term, he says. GBP/USD

falls 0.3% to 1.2235 and EUR/GBP rises 0.4% to 0.8772.

(renae.dyer@wsj.com)

AB Dynamics Delivers Strong 1H Update With Upbeat Outlook

0928 GMT - AB Dynamics has issued a strong first-half update,

highlighting encouraging business and good momentum in line with

its expectations, Shore Capital says. The automotive testing

systems and measurement products provider has a solid order book

providing good visibility, and despite noting supply-chain

disruption and wider economic uncertainty, it remains confident in

further strategic and financial progress, Shore analyst Akhil Patel

says in a research note. "The group's future growth prospects

remain supported by long-term structural and regulatory growth

drivers, [including] population growth, urbanization, increasing

health and safety regulation and automotive manufacturers

developing electric vehicles with protected advanced

driver-assistance system budgets," the investment group says. Shore

retains its buy rating on the stock. Shares are up 1.5% at 1,645.0

pence. (joseph.hoppe@wsj.com)

Kingfisher FY Profit Falls; Gets February Trading Boost

0927 GMT - Kingfisher shares rise 0.7% as the home-improvement

retail group reported lower annual sales and adjusted pretax

profit, but flagged upbeat February trading. Profits have fallen

back from last year's highs, but the group--which owns the U.K.'s

B&Q, France's Castorama and trade-counter business

Screwfix--said like-for-like sales had risen in double-digits on a

three-year basis, Hargreaves Lansdown says. "The group is pointing

to a stronger performance in the current financial year, with

like-for-like sales in February inching back into positive

territory," HL head of equity funds Steve Clayton writes.

"Screwfix's international expansion is being accelerated, with 25

store openings in France planned. The market took the messaging

positively, pushing the stock up almost 3% in early trading."

(philip.waller@wsj.com)

Trustpilot's Lowered Growth Guidance Could Disappoint

0913 GMT - Trustpilot is feeling the toll of macro uncertainties

as it lowered growth guidance for 2023, which could disappoint,

Goodbody says in a note after the review website posted in-line

2022 results and said it expects positive adjusted Ebitda for the

year ahead. "Top-line guidance for FY23 has been pulled back to

'mid-teens' growth (Goodbody estimate: +20%) on the back of the

uncertain macro environment, which is impacting new business and

retention bookings," says analyst Patrick O'Donnell, adding that

the CEO Peter Holten Muhlmann's intention to transition into a

founder and nonexecutive director role may disappoint further.

Goodbody has a buy rating on the stock. (elena.vardon@wsj.com)

UK Government Can Take Comfort in Interest Bill Fall as February

Borrowing Ballooned

0904 GMT - The U.K. government in February borrowed GBP16.7

billion, the highest figure for that month since records began, as

cushioning households from the impact of sky-high energy costs came

with a huge price tag, AJ Bell says. But the silver lining from

February's economic grey clouds is that the cost of servicing all

that debt fell GBP1.3 billion compared with last year, thanks to

the vagaries of index-linked gilts, Danni Hewson, AJ Bell head of

financial analysis, says in a note. Still, the debt-to-GDP ratio

has climbed over the 99% mark, hitting levels last seen in the

early 1960s, which will focus minds in a treasury tasked with

bringing debt levels under control, she adds.

(edward.frankl@wsj.com)

Contact: London NewsPlus; paul.larkins@wsj.com

(END) Dow Jones Newswires

March 21, 2023 13:45 ET (17:45 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

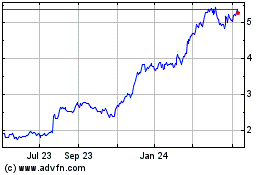

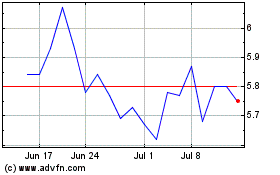

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Dec 2023 to Dec 2024