Raven Down to Strong Sell - Analyst Blog

21 March 2014 - 7:00AM

Zacks

On March 20, Zacks Investment Research downgraded Raven

Industries Inc. (RAVN), manufacturer of industrial goods,

to a Zacks Rank #5 (Strong Sell).

Why the Downgrade?

Raven has witnessed sharp downward estimate revisions after

reporting disappointing fourth-quarter fiscal 2014 results on March

12. The stock also fell around 11% in the trading session after the

earnings release.

In the quarter, Raven’s earnings declined 23% year over year to 23

cents per share. The reported figure fell short of the Zacks

Consensus Estimate of 32 cents. Increased raw material costs in the

Engineered Films segment, increased investments in research and

development (R&D) for Aerostar and lower sales volume in

Applied Technology led to the year-over-year decline.

Sales increased 3% year over year to $92.6 million in the quarter

but missed the Zacks Consensus Estimate.

For the full year 2014, earnings per share fell 19% year over year

to $1.17, lagging the Zacks Consensus Estimate of $1.26. Revenues

fell 3% to $395 million from $406 million in the previous fiscal,

missing the Zacks Consensus Estimate.

For first-quarter fiscal 2015, Raven expects solid sales growth in

Engineered Films from agriculture, along with higher OEM deliveries

in Applied Technology. However, contract manufacturing declines and

the uncertain agricultural aftermarket will pose challenges.

In the first quarter, Raven expects profits to be flat to slightly

down. Thereafter, the company is expected to deliver increased

profits in the balance of the year. Nevertheless, delay in

contracts, pricing pressure, general market softness and volatile

raw-material costs will hurt Raven’s earnings.

Following the fourth-quarter earnings announcement, the Zacks

Consensus Estimate for Raven declined 14% to $1.21 per share for

2015 and 15.9% to $1.32 per share for 2016.

Other Stocks to Consider

Some better-ranked stocks in the same industry include

Federal Signal Corp. (FSS), Noble Group

Limited (NOBGY) and Sumitomo Corporation

(SSUMY). All these of these carry a Zacks Rank #1 (Strong Buy).

FED SIGNAL CP (FSS): Free Stock Analysis Report

NOBLE GROUP LTD (NOBGY): Get Free Report

RAVEN INDS INC (RAVN): Free Stock Analysis Report

SUMITOMO CORP (SSUMY): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

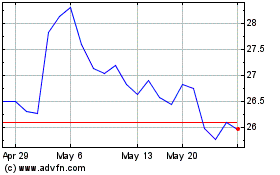

Sumitomo (PK) (USOTC:SSUMY)

Historical Stock Chart

From Jan 2025 to Feb 2025

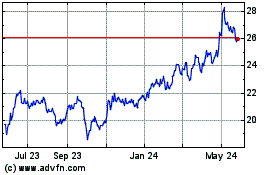

Sumitomo (PK) (USOTC:SSUMY)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Sumitomo Corp (PK) (OTCMarkets): 0 recent articles

More Sumitomo Corp. (PC) News Articles