AIM Schedule One - AdvancedAdvT Limited (6739X)

22 December 2023 - 7:00PM

UK Regulatory

TIDMADVT

RNS Number : 6739X

AIM

22 December 2023

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

AdvancedAdvT Limited

(the "Company", and its subsidiaries from time to time being

the "Group") (AIM: ADVT)

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

Commerce House

Wickhams Cay 1

P.O. Box 3140, Road Town

VG1110

Tortola

British Virgin Islands

11 Buckingham Street

London

WC2N 6DF

United Kingdom

COUNTRY OF INCORPORATION:

British Virgin Islands

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

www.advancedadvt.com

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

The Company was incorporated on 31 July 2020 in accordance

with the laws of the British Virgin Islands with an indefinite

life and is domiciled in the United Kingdom (i.e. the Company

is tax resident in the United Kingdom by virtue of being centrally

managed and controlled in the United Kingdom). The Company

was admitted to trading on the standard listing segment of

the Official List of the London Stock Exchange on 4 December

2020.

The Group's strategy is centred around backing sectors characterised

by long term digitisation trends, that are in early stages

of adoption and set to transform the workplace for professionals

for the next few decades. Embracing a long-term perspective,

the aim is to build a lasting and thriving business. This thinking

shapes how investment is deployed on both M&A and within the

platform businesses, in order to develop relationships with

clients and partners and with a strategy centred around business

and digital transformation and continuous improvement.

This strategy revolves around evaluating high-quality businesses

in the pipeline, based on a set of key characteristics. These

characteristics align with the management team's vision and

will enable businesses to consistently generate long-term value.

The Company seeks businesses with:

-- high recurring revenue streams and good forward visibility;

-- sticky customer retention;

-- mission critical products and services;

-- sectors with high barriers to entry;

-- opportunities for both organic and inorganic growth;

-- strong cash generation; and

-- highly fragmented industries with opportunities for consolidation.

On 8 June 2023, the Company announced the conditional agreement

to acquire 5 companies from Capita plc for a combined enterprise

value of approximately GBP33 million in cash. In addition to

organic growth, the Board believes that the acquisitions will

create a platform to develop the Company by exploring growth

opportunities in synergistic sectors and by targeted investment

and M&A activities. On 31 July 2023, the acquisitions had completed.

On 21 November 2023, ADV Holding Group Limited, a subsidiary

of the Company, entered into an agreement for the sale of one

of the five companies acquired, Synaptic Software Ltd, to Fintel

IQ Limited in order to enable the business to have a more strategically

aligned owner. The disposal is conditional upon, inter alia,

the approval of the change of ownership by the FCA.

Subsequent to the disposal, the four companies operate across

two fundamental business transformational areas: business solutions

and human capital management. Through these core specialisms,

the Group delivers innovative software solutions and a platform

that enables businesses and organisations to succeed in today's

dynamic landscape whilst providing an enabler for digital transformation.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

Name and nominal value of the securities: ordinary shares of

no par value in the capital of the Company ("Ordinary Shares").

Number of Ordinary Shares on Admission: 133,200,000

Issue price per Ordinary Share: The Ordinary Shares were suspended

from trading on 8 June 2023 at a price of 82 pence

There are no restrictions as to the transfer of the Ordinary

Shares.

No Ordinary Shares will be held in treasury on Admission.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

Total capital to be raised on Admission: Nil

Anticipated market capitalisation on Admission: c. GBP109 million

(based on the pre suspension price of 82 pence per Ordinary

Share)

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

43.57%

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

Not applicable.

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Vinodka ("Vin") Murria OBE (Executive Chairperson)

Gavin John Hugill (Chief Financial Officer)

Karen Louise Chandler (Chief Operating Officer)

Mark Irvine John Brangstrup Watts (Non-Executive Director)

Paul David Gibson (Independent Non-Executive Director)

Barbara Ann Firth (Senior Independent Non-Executive Director)

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Shareholder % of issued % of issued

share capital share capital

prior to Admission on Admission

Marwyn Investment Management 15.41% 15.41%

-------------------- ---------------

BGF Investment Management Limited 15.02% 15.02%

-------------------- ---------------

Vin Murria OBE & Sunil Bhalla 13.14% 13.14%

-------------------- ---------------

Artemis Investment Management 8.07% 8.07%

-------------------- ---------------

CRUX Asset Management 6.19% 6.19%

-------------------- ---------------

Amati Global Investors Limited 6.01% 6.01%

-------------------- ---------------

Investec Wealth & Investment 5.30% 5.30%

-------------------- ---------------

Gresham House Asset Management

Limited 5.06% 5.06%

-------------------- ---------------

Chelverton Asset Management

Limited 4.50% 4.50%

-------------------- ---------------

Canaccord Genuity Group Inc 3.34% 3.29%

-------------------- ---------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

None.

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 30 June, but to be changed to 28 February from Admission

(first period will be to 29 February 2024)

(ii) 30 June 2023

(iii) 31 March 2024 (unaudited interim results for the 6 months

to 31 December 2023)

31 August 2024 (audited consolidated annual report for the

eight months to 29 February 2024)

30 November 2024 (unaudited interim results for the 6 months

ended 31 August 2024)

EXPECTED ADMISSION DATE:

10 January 2024

NAME AND ADDRESS OF NOMINATED ADVISER:

Singer Capital Markets Advisory LLP

1 Bartholomew Lane

London

EC2N 2AX

NAME AND ADDRESS OF BROKER:

Singer Capital Markets Securities Limited

1 Bartholomew Lane

London

EC2N 2AX

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

A copy of the Admission Document containing full details about

the applicant and the admission of its securities will be available

on the Company's website at:

https://advancedadvt.com

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

The Quoted Companies Alliance (QCA) Corporate Governance Code.

DATE OF NOTIFICATION:

22 December 2023

NEW/ UPDATE:

NEW

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAAPPGGWPUPWGAG

(END) Dow Jones Newswires

December 22, 2023 03:00 ET (08:00 GMT)

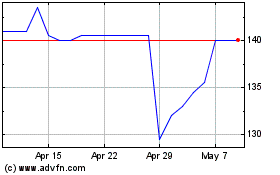

Advancedadvt (LSE:ADVT)

Historical Stock Chart

From Jan 2025 to Feb 2025

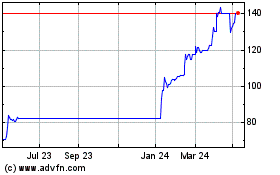

Advancedadvt (LSE:ADVT)

Historical Stock Chart

From Feb 2024 to Feb 2025