TIDMAURR

RNS Number : 5966T

Aurrigo International PLC

15 November 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA, THE

REPUBLIC OF IRELAND, SINGAPORE, HONG KONG OR JAPAN OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL. PLEASE SEE THE IMPORTANT NOTICES AT THE OF THIS

ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE EU REGULATION 596/2014 ("MAR") AND ARTICLE 7 OF

MAR AS INCORPORATED INTO UK DOMESTIC LAW PURSUANT TO THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018) ("UK MAR"). IN ADDITION, MARKET

SOUNDINGS (AS DEFINED IN UK MAR) WERE TAKEN IN RESPECT OF CERTAIN

OF THE MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE RESULT THAT

CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE INFORMATION, AS

PERMITTED BY UK MAR. UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION

OF INSIDE INFORMATION.

15 November 2023

Aurrigo International plc

("Aurrigo" or the "Company")

Confirmation of successful Placing to raise GBP3.84 million

Aurrigo International plc (AIM: AURR), a leading international

provider of transport technology solutions, is pleased to announce

that further to the Company's announcement earlier today, the

Company has successfully completed its Placing to raise GBP3.84

million through the placing of an aggregate of 3,840,000 new

ordinary shares of GBP0.002 each in the Company (the "Placing

Shares") with certain existing and new institutional and other

investors at a price of 100 pence per Placing Share (the "Issue

Price").

The Issue Price represents a discount of approximately 32% per

cent. to the middle market closing price of an ordinary share of

GBP0.002 each in the Company ("Ordinary Shares") on 14 November

2023. The Placing Shares, in aggregate, represent approximately

9.22% per cent. of the issued share capital of the Company prior to

the Placing.

The Board are grateful for the support it has received from both

existing and new shareholders to provide the Company with the

ability to deliver its objectives in 2024.

Singer Capital Markets Advisory LLP is acting as nominated

adviser and Singer Capital Markets Securities Limited is sole

bookrunner in respect of the Placing.

Related Party Transaction

Certain Directors (the "Participating Directors") and Unicorn

AIM VCT and Amati Global Investors Limited, as "substantial

shareholders" (as defined in the AIM Rules for Companies) in the

Company have participated in the Placing and such participation

constituted related party transactions under Rule 13 of the AIM

Rules.

The Independent Directors (being those who are not Participating

Directors, being David Keene, Graham Keene and Joe Elliott)

consider, having consulted with the Company's nominated adviser,

Singer Capital Markets Advisory LLP, that the terms of the

participation in the Placing by the Participating Directors and by

each of Unicorn AIM VCT and Amati Global Investors Limited. are

fair and reasonable insofar as the Shareholders are concerned.

The details of the Participating Directors' participation in the

Placing are as follows:

Director Number of Ordinary Number of Resulting number Resulting

Shares held Capital Raising of Ordinary Shares holding as

as at the date Shares subscribed held immediately a percentage

of this Announcement for following Admission of the Enlarged

Share Capital

Penny Coates 312,500 47,500 360,000 0.79%

Andrew Cornish 210,000 20,000 230,000 0.51%

Lewis Girdwood 104,167 115,833 220,000 0.48%

Ian Grubb 5,000 12,000 17,000 0.04%

First Admission and Total Voting Rights

An application has been made to London Stock Exchange plc for

the Placing Shares to be admitted to trading on AIM ("First

Admission"). It is expected that First Admission will become

effective and dealings in the First Placing Shares will commence at

8.00 a.m. on 20 November 2023. The issue and allotment of the First

Placing Shares is conditional upon, among other things, Admission

becoming effective and the placing agreement entered into between

the Company and Singer ("Placing Agreement") not being terminated

in accordance with its terms.

Following First Admission, the Company's enlarged issued

ordinary share capital will be 45,506,667. This figure may be used

by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

A further announcement will be made in relation to total voting

rights in the Company's share capital following the completion of

the Retail Offer.

Unless otherwise defined, the definitions in the announcement

released earlier today apply herein.

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section below.

For further enquiries:

Aurrigo International plc aurrigo@instinctif.com

David Keene, Chief Executive Officer

Graham Keene, Director of Corporate Development

Ian Grubb, Chief Financial Officer

Singer Capital Markets (Nominated Adviser

and Sole Broker)

Phil Davies, Rick Thompson, Angus Campbell,

Jalini Kalaravy +44 (0)20 7496 3000

Instinctif Partners (Financial Communications) +44 (0)20 7457 2020

Rozi Morris, Isadora Pegler aurrigo@instinctif.com

About Aurrigo

Aurrigo is a leading international provider of transport

technology solutions. Headquartered in Coventry, UK, it designs,

engineers, manufactures and supplies autonomous vehicles and OEM

products to the automotive and transport industries, particularly

focusing on aviation. It is highly regarded as a specialist in

autonomous and semi-autonomous technology solutions for the

aviation, ground handling and cargo industries. Aurrigo has

developed six types of autonomous vehicle to date, which can be

utilised to reduce costs, resolve operational issues and tackle

labour shortages, whilst also improving sustainability. Aurrigo has

three divisions, Automotive Technology, Autonomous Technology and

Aviation Technology.

IMPORTANT NOTICES

Neither this announcement ("Announcement"), nor any copy of it,

may be taken or transmitted, published or distributed, directly or

indirectly, in whole or in part, in or into the United States,

Australia, Canada, Japan, New Zealand or the Republic of South

Africa or to any persons in any of those jurisdictions or any other

jurisdiction where to do so would constitute a violation of the

relevant securities laws of such jurisdiction (each, a "Restricted

Jurisdiction"). This Announcement is for information purposes only

and neither it, nor the information contained in it, shall

constitute an offer to sell or issue, or the solicitation of an

offer to buy, acquire or subscribe for any shares in the capital of

the Company in the United States, Australia, Canada, Japan, New

Zealand or the Republic of South Africa or any other state or

jurisdiction in which such offer or solicitation is not authorised

or to any person to whom it is unlawful to make such offer or

solicitation. Any failure to comply with these restrictions may

constitute a violation of securities laws of such

jurisdictions.

The Placing Shares have not been and will not be registered

under the U.S. Securities Act of 1933, as amended (the "Securities

Act"), or with any securities regulatory authority or under any

securities laws of any state or other jurisdiction of the United

States and may not be offered, sold, resold, pledged, transferred

or delivered, directly or indirectly, in or into the United States

except pursuant to an applicable exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and in compliance with the securities laws of any

state or other jurisdiction of the United States.

No action has been taken by the Company, Singer Capital Markets,

or any of their respective directors, officers, partners, agents,

employees, affiliates, advisors, consultants or, in the case of

Singer Capital Markets, persons connected with them as defined in

the Financial Services and Markets Act 2000, as amended ("FSMA")

(together, "Affiliates") that would permit an offer of the Placing

Shares or possession or distribution of this Announcement or any

other publicity material relating to such Placing Shares in any

jurisdiction where action for that purpose is required. Persons

receiving this Announcement are required to inform themselves about

and to observe any restrictions contained in this Announcement.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

This Announcement has not been approved by the Financial Conduct

Authority or the London Stock Exchange.

Singer Capital Markets, which is authorised and regulated in the

United Kingdom by the Financial Conduct Authority (the "FCA") and

is a member of the London Stock Exchange, is acting as the

Company's Bookrunner and as Broker. Singer Capital Markets is not

acting for any other person in connection with the matters referred

to in this Announcement and will not be responsible to anyone other

than the Company for providing the protections afforded to clients

of Singer Capital Markets or for giving advice in relation to the

matters referred to in this Announcement. Singer Capital Markets

has not authorised the contents of this Announcement and, without

limiting the statutory rights of any person to whom this

Announcement is issued, no representation or warranty, express or

implied, is made by Singer Capital Markets as to any of the

contents or the completeness of this Announcement and Singer

Capital Markets does not accept responsibility for this

Announcement and accordingly disclaims all and any liability,

whether arising in tort, contract or otherwise, which it might

otherwise be found to have in respect of this Announcement.

Singer Capital Markets Advisory LLP ("SCM Advisory"), which is

authorised and regulated in the United Kingdom by the FCA, is

acting as the Company's Nominated Adviser for the purposesof the

AIM Rules for Companies. SCM Advisory is not acting for any other

person in connection with the matters referred to in this

Announcement and will not be responsible to anyone other than the

Company for providing the protections afforded to clients of SCM

Advisory or for giving advice in relation to the matters referred

to in this Announcement. SCM Advisory has not authorised the

contents of this Announcement and, without limiting the statutory

rights of any person to whom this Announcement is issued, no

representation or warranty, express or implied, is made by SCM

Advisory as to any of the contents or the completeness of this

Announcement and SCM Advisory does not accept responsibility for

this Announcement and accordingly disclaims all and any liability,

whether arising in tort, contract or otherwise, which it might

otherwise be found to have in respect of this Announcement. SCM

Advisory's responsibilities as the Company's nominated adviser

under the aIM Rules for Nominated Advisers are owed solely to the

London Stock Exchange and are not owed to the Company or to any

director or to any other person.

Certain statements in this Announcement are forward-looking

statements, which include all statements other than statements of

historical fact and which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which may use

words such as "aim", "anticipate", "believe", "could", "may",

"intend", "estimate", "expect" and words of similar meaning,

include all matters that are not historical facts. These

forward-looking statements involve risks, assumptions and

uncertainties that could cause the actual results of operations,

financial condition, liquidity and dividend policy and the

development of the industries in which the Company's businesses

operate to differ materially from the impression created by the

forward-looking statements. These statements are not guarantees of

future performance and are subject to known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements. Given those risks and uncertainties,

prospective investors are cautioned not to place undue reliance on

forward-looking statements. Forward-looking statements speak only

as of the date of such statements and, except as required by the

FCA, the London Stock Exchange or applicable law, the Company,

Singer Capital Markets and their respective Affiliates undertakes

no obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

No statement in this Announcement is intended to be a profit

forecast and no statement in this Announcement should be

interpreted to mean that earnings per share of the Company for the

current or future financial years would necessarily match or exceed

the historical published earnings per share of the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOENKPBBPBDDCDD

(END) Dow Jones Newswires

November 15, 2023 10:31 ET (15:31 GMT)

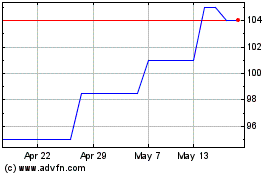

Aurrigo (LSE:AURR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aurrigo (LSE:AURR)

Historical Stock Chart

From Jan 2024 to Jan 2025