Claranova: Pursuing Debt Reduction

27 May 2024 - 4:00PM

Business Wire

Reimbursement of Euro PP bond for almost

€20m

Regulatory News:

Claranova (Euronext Paris : FR0013426004 - CLA) announces that

on Friday, May 24, it reimbursed the holders of the Euro PP bond

for a total amount of €19.7m, thus continuing to reduce its debt.

As announced1, this reimbursement was made from the Group's own

funds.

In accordance with its commitments, the Group is pursuing the

strengthening of its financial structure and the improvement of its

operational flexibility. By the end of the current financial year,

ending June 30, 2024, Claranova will have reimbursed more than €55m

of its debt (excluding interests) from its own funds. These

repayments include the €29m in ORNANE bonds, €19.7m in Euro PP

bond, and €7m in amortizations of other existing loans. Over the

same period, the Group also refinanced its OCEANE debt, extending

its maturity by 4 years1.

These operations have significantly reduced the Group's level of

debt, lowered the associated financial charges, and allowed to get

closer to a net debt/EBITDA ratio of 3x. They also demonstrate the

Group's ability to efficiently allocate cash and strengthen its

balance sheet to ensure sustainable growth and seize new market

opportunities.

Eric Gareau, CEO of Claranova commented: "After the refinancing

of our OCEANE debt, the repayment of the Euro PP bond marks a new

step in our debt reduction policy and demonstrates our

determination to optimize our financial structure. We will continue

our efforts in this direction, and expect a large proportion of our

debt, excluding OCEANE refinancing, to be reimbursed within a year.

With a reconfigured, leaner debt structure, we will be able to

invest more in our business, with a focus on improving

profitability and creating shareholder value”.

Breakdown of the Group’s financial debt on

May 24, 2024

In €m

Total Debt

Euro PP bond

Other flows(2)

Total Debt

Of which short-term

post refinancing(1)

on May 24, 2024

ORNANE bonds

0

0

Euro PP bond

19.7

-19.7

0

0

OCEANE bonds

0

0

Bonds

19.7

-19.7

0

0

New loan(1)

108

108

Existing borrowings

31.1

4

35.1

19.9

Interest not yet due

2

2

2

Total gross financial debt

160.7

-19.7

4

145.1

21.9

(1) Cf. Press release April 2, 2024

(2) (i) Amortization of existing loans for

more than €2m (PGE, BPI, Cathay) and (ii) short-term revolving

credit facility of €6m.

Financial calendar: August 1, 2024: FY

2023-2024 revenue October 30, 2024: FY 2023-2024 results

About Claranova:

As a diversified global technology company, Claranova manages

and coordinates a portfolio of majority interests in digital

companies with strong growth potential. Supported by a team

combining several decades of experience in the world of technology,

Claranova has acquired a unique know-how in successfully turning

around, creating and developing innovative companies.

Claranova has proven its capacity to turn a simple idea into a

worldwide success in just a few short years. Present in 15

countries and leveraging the technology expertise of its 800+

employees across North America and Europe, Claranova is a truly

international group, with 95% of its revenue derived from

international markets.

Claranova’s portfolio of companies is organized into three

unique technology platforms operating in all major digital sectors.

As an e-commerce leader in personalized objects, Claranova also

stands out for its technological expertise in software publishing

and the Internet of Things, through its businesses PlanetArt,

Avanquest and myDevices. These three technology platforms share a

common vision: empowering people through innovation by providing

simple and intuitive digital solutions that facilitate everyday

access to the very best of technology.

For more information on Claranova Group:

https://www.claranova.com

Disclaimer:

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements.

____________________________ 1 Press Release April 2, 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240526422500/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 68

ir@claranova.com

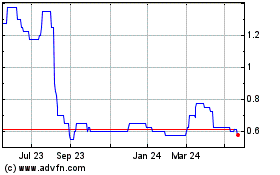

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Dec 2024 to Jan 2025

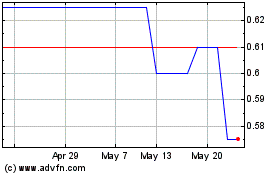

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jan 2024 to Jan 2025