TIDMDIS

RNS Number : 0229W

Distil PLC

13 April 2023

DISTIL PLC

Trading Update

Distil plc (AIM: DIS), owner of premium drinks brands RedLeg

Spiced Rum, Blackwoods Gin and Vodka, Blavod Black Vodka, TRØVE

Botanical Spirit and Diva Vodka, is pleased to provide an update on

trading following the end of its financial year on 31 March

2023.

Unaudited year-on-year Q4 (January - March 2023) highlights:

-- Volumes decreased 40%

-- Revenues decreased 37%

-- Investment into advertising and promotions decreased 66%

-- Cash reserves of GBP515k at 31 March

Don Goulding, Executive Chairman of Distil, said:

"Although fourth quarter results are down year-on-year, the

quarter has delivered the strongest trading performance during the

financial year. Unaudited full year revenue sits slightly below

market expectations at GBP1.32M (FY2022: GBP2.94M (audited)),

whilst unaudited full year loss before tax is higher at GBP0.71M

(FY2022: GBP95K (audited)).

Quarterly performance was suppressed due to reduced promotional

activity in UK major grocery as a result of the transition away

from distributor management. The quarter also saw us lapping

particularly strong export sales last year, as we opened

significant new markets and saw the benefit of associated pipe-fill

sales.

Despite this, the outlook for the coming financial year is

positive. Q4 delivered the strongest revenues of the financial

year, indicating that we are successfully rebuilding following the

business remodel in the first half of the year. It has been a

transitional year for the business - there was a bigger job to be

done than anticipated due to larger volumes of stock available in

the trade than reported, however we are now through the issues that

this has caused in previous quarters, and trading well with direct

customers. We are confident that we will continue to build on this

success and begin to see the benefits of the remodel from Q1

FY23/24.

Driving growth through export has remained a focus this quarter,

and we're pleased to have opened new markets in Europe, with

interest from markets further afield being nurtured across the

portfolio. Expanding and strengthening our global brand footprint

will play a pivotal role for the business going forward into

FY23/24, both in terms of revenues and margin.

Management of operations and cost of goods also remains a

priority across our brands as we're faced with double-digit price

increases from suppliers in reaction to inflation. The team is

working hard to mitigate these increases and reduce our costs

moving forward.

Alongside building programmes to strengthen our existing brands,

the quarter has seen us lay the groundwork on which to create

innovative new-to-world products in response to consumer trends,

including a blended malt whisky in accordance with our partnership

with Ardgowan, which has a H2 target launch. The team will be

working diligently over the coming months to bring the new brands

to market, and we look forward to sharing more detail with

shareholders in due course.

Progress remains positive at the Ardgowan site, with internal

renovation works to the gin building complete, and the still due

for installation in May. The team is working closely with Ardgowan

to design the visitor experience, with plans to invite trade later

this year once works have progressed further across the wider

site.

This year has been challenging due to the short-term effect of

the business remodel, taking control of the major retailers

internally, and moving our UK on-trade business to Marussia

Beverages. This decision was carefully considered by the Board, and

we remain confident that the decision will yield significant

revenue upside from the next financial year onwards.

We are entering the new financial year in a good cash position,

with reserves of GBP515K. We will continue to focus on driving

revenue and reinvesting profits into building our brands and have a

strong promotional plan in place with UK grocers, as well as an

additional programme of multi-channel marketing activity in the UK

and key export markets to accelerate sales.

The business is well positioned to build and grow value for

customers, shareholders, and other stakeholders in the next

financial year and beyond. Market guidance for FY23/24 will be

issued at the time of our final results announcement in June."

For further information:

Distil PLC

Don Goulding, Executive Chairman Tel +44 (0)203 405 0475

Shaun Claydon, Finance Director

------------------------

SPARK Advisory Partners Limited

(NOMAD)

------------------------

Neil Baldwin Tel +44 20 3368 3550

Mark Brady

------------------------

Turner Pope Investments (TPI)

Ltd (Broker)

------------------------

Andy Thacker Tel +44 20 3657 0050

James Pope

------------------------

About Distil

Distil Plc is quoted on the AIM market of the London Stock

Exchange. It owns drinks brands in a number of sectors of the

alcoholic drinks market. These include premium spiced rum, vodka,

gin, vodka vanilla cream liqueur and are called RedLeg Spiced Rum.

Blackwoods Vintage Gin, Blackwoods Vodka, TRØVE Botanical Vodkas,

Blavod Original Black Vodka and Diva Vodka.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTELLFFXZLEBBL

(END) Dow Jones Newswires

April 13, 2023 02:00 ET (06:00 GMT)

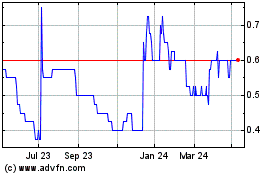

Distil (LSE:DIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

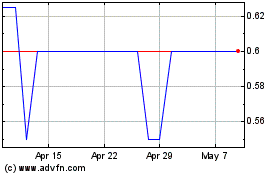

Distil (LSE:DIS)

Historical Stock Chart

From Dec 2023 to Dec 2024