Q4 2024 Production Report and 2025 Guidance

Kenmare Resources plc

(“Kenmare” or the “Company” or “the Group”)

20 January 2025

Q4 2024 Production Report and 2025

Guidance

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of

the leading global producers of titanium minerals and zircon, which

operates the Moma Titanium Minerals Mine (the "Mine" or "Moma") in

northern Mozambique, is pleased to provide a trading update for the

full year 2024 and the fourth quarter ending 31 December 2024 (“Q4

2024”) and production and operating cost guidance for 2025.

Statement from Tom Hickey, Managing

Director:

“Kenmare delivered a strong finish to 2024,

exceeding the midpoint of our production guidance for ilmenite and

the upper end of the guidance ranges for all other products. We

also passed the milestone of two million hours worked without a

Lost Time Injury in late December. These achievements are testament

to the hard work and commitment of our team at site during a

challenging period.

In 2024 we paid $48 million in dividends and

invested over $140 million in capital programmes, primarily for the

upgrade and transition of our largest mining plant to Nataka. Our

balance sheet remains strong and we expect our full year 2024

dividend to be towards the upper end of our payout policy of 20-40%

of profit after tax.”

Overview

- Lost Time Injury Frequency Rate (“LTIFR”) of 0.06 per 200,000

hours worked to 31 December 2024 (31 December 2023: 0.15), with

zero Lost Time Injuries (“LTIs”) in Q4 2024

- Kenmare exceeded the midpoint of production guidance for

ilmenite and the upper end of the guidance range for primary

zircon, rutile and concentrates in 2024

- Heavy Mineral Concentrate (“HMC”) production of 1,446,600

tonnes in 2024, broadly in line with 2023, due to record excavated

ore tonnes offset by lower ore grades

- Ilmenite production of 1,008,900 tonnes in 2024, a 2% increase

year-on-year (“YoY”), due to higher ilmenite content in the HMC and

stronger recoveries

- Shipments of finished products of 1,088,600 tonnes in 2024, up

4% YoY. Shipments in H2 2024 were significantly stronger than in

H1, as expected, with 611,000 tonnes shipped

- Interim 2024 dividend of USc15.0 per share paid in October 2024

and full year 2024 dividend expected to be at the upper end of the

payout ratio of 20-40% of profit after tax

- Net debt of $24.8 million (2023: $20.7 million net cash) due to

on-going development capital expenditure

- Demand for all of Kenmare’s products remained robust in 2024

and sales are expected to continue to exceed production in

2025

- Ilmenite production guidance for 2025 is 930,000 to 1,050,000

tonnes

- Expenditure on development projects and studies is expected to

be approximately $155 million in 2025. The Wet Concentrator Plant

(“WCP”) A project remains on budget, with a total cost estimate of

$341 million

- The process for the renewal of Moma’s Implementation Agreement

(“IA”) continues to progress and the Government of Mozambique has

confirmed that Kenmare’s rights under the IA remain in place until

the renewal is completed

- As previously announced, James McCullough has been appointed as

Chief Financial Officer and he will join Kenmare on 1 May 2025

Operations update

Operational results for the Moma Mine in Q4 and

full year 2024 were as follows:

|

|

Q4 2024 |

vs Q4 2023 |

vs Q3 2024 |

2024 |

vs 2023 |

|

tonnes |

% change |

% change |

tonnes |

% change |

|

Excavated ore1 |

10,333,000 |

11% |

-7% |

41,248,000 |

7% |

|

Grade1 |

4.96% |

3% |

31% |

4.17% |

-5% |

|

Production |

|

|

|

|

|

|

HMC produced |

432,300 |

8% |

22% |

1,446,600 |

0% |

|

HMC processed |

442,100 |

11% |

24% |

1,449,200 |

0% |

|

Ilmenite |

307,400 |

14% |

19% |

1,008,900 |

2% |

|

Primary zircon |

14,700 |

5% |

1% |

50,500 |

-1% |

|

Rutile |

2,900 |

38% |

0% |

9,800 |

17% |

|

Concentrates2 |

11,200 |

7% |

-17% |

46,100 |

1% |

|

Shipments |

308,300 |

-5% |

2% |

1,088,600 |

4% |

- Excavated ore and grade prior

to any floor losses.

- Concentrates include secondary

zircon, mineral sands concentrate and a new concentrates

product.

Kenmare passed the milestone of two million

hours worked without an LTI in early January 2025. There were no

LTIs in Q4. Two LTIs were recorded in the 12 months to 31 December

2024, compared to five in 2023, resulting in an improved rolling

12-month LTIFR of 0.06 per 200,000 hours worked (31 December 2023:

0.15).

HMC production in Q4 2024 was 432,300 tonnes, an

8% increase YoY. This was due to a 11% increase in excavated ore

tonnes as a result of excellent throughputs and operating time at

WCP B and C, and a 3% increase in ore grades, however partially

offset by increased mining losses, as a result of higher slimes at

WCP A. This issue is expected to be resolved by the new WCP A

upfront desliming circuit, which is currently under construction.

As expected, Q4 was the strongest quarter of the year for ore

grades, up 31% compared to Q3 2024, due to WCP B mining an area of

higher grade material.

HMC production in 2024 was 1,446,600 tonnes,

broadly in line with 2023, although with significantly improved

production in H2 (787,600 tonnes versus 659,000 tonnes in H1 2024).

2024 represents a new annual record for excavated ore volumes,

which were up 7% YoY. This partially offset the 5% decrease in ore

grades YoY, as WCP A approaches the end of its mine path in

Namalope.

Kenmare delivered significantly stronger

production of all finished products in Q4 2024 compared to Q4 2023.

Ilmenite production was up 14% to 307,400 tonnes, benefitting from

the 11% increase in HMC processed and higher ilmenite content in

the HMC. Primary zircon production was up 5% due to the higher HMC

processed partially offset by a build-up in intermediate stocks.

Rutile production was up 38% YoY, with December representing a new

monthly record for rutile production. Improvements through 2024

were due to circuit upgrades, which have enabled increased

recoveries. Concentrates production was up 7%, with the increased

HMC processed partially offset by the previously mentioned stock

build and stronger recovery to primary products.

Kenmare exceeded the midpoint of production

guidance for ilmenite in 2024 and the upper end of the guidance

range for primary zircon, rutile and concentrates. Total production

of finished products was 1,115,300 tonnes, up 2% YoY (2023:

1,091,500 tonnes), despite flat HMC processed.

Ilmenite production was 1,008,900 tonnes in

2024, up 2% YoY, benefitting from improved recoveries and higher

ilmenite content in the HMC processed. Primary zircon production

was down 1% YoY due to a build-up of non-magnetic intermediate

stock in Q4, expected to be drawn down in 2025. Rutile production

was up 17% YoY due to improved recoveries following circuit

improvements and concentrates production was up 1%, benefitting

from the production of a new concentrates product that was sold on

a trial basis in Q3. This product will be sold on a commercial

basis in 2025.

Q4 2024 was the strongest quarter of the year

for shipments, with volumes of 308,300 tonnes. Shipments were down

5% YoY, although H2 2024 (611,000 tonnes) was significantly

stronger than H1 2024 (477,600 tonnes). Shipment volumes in Q4 2024

comprised 261,300 tonnes of ilmenite, 30,300 tonnes of primary

zircon, 3,700 tonnes of rutile and 13,000 tonnes of

concentrates.

The product mix was higher value in H2 than H1,

with 42,800 tonnes of primary zircon shipped in H2 (H1: 8,800

tonnes) and 7,400 tonnes of rutile (H1: 0). The product mix in H1

2024 was impacted by two high value zircon shipments being delayed

from June into July and no rutile was shipped in the first half of

the year.

Total shipments in 2024 were 1,088,600 tonnes,

up 4% compared to 2023, supported by increased production of

finished products and benefitting from consistently strong customer

demand. Shipments during the year comprised 989,000 tonnes of

ilmenite, 51,600 tonnes of primary zircon, 7,400 tonnes of rutile

and 40,600 tonnes of concentrates.

Closing stock of HMC at the end of 2024 was

14,100 tonnes, compared with 16,700 tonnes at the start of the

year, due to a small amount of HMC in stock being drawn down for

processing during the year. Closing stock of finished products at

the end of 2024 was 287,200 tonnes, compared with 259,100 tonnes at

the end of 2023. Due to strong production in H2 2024 and high

levels of finished product stock at the end of the first half,

Kenmare had higher than usual levels of finished product stock at

year-end. Shipments are expected to exceed production in 2025 and

drive a reduction in finished product stock levels.

Capital projects update

WCP A upgrade and transition to Nataka

The WCP A project remains on budget, with

upgrade works continuing to advance, thereby progressively

derisking the project. At the end of Q4, 75% of the project budget

had been committed, in line with expectations. WCP A is currently

mining an area 750 metres from the staging pond, which is on track

with the schedule for it to connect with the new module in Q3

2025.

The fabrication of the two new dredges continues

to progress with the project contractor in the Netherlands.

The dredges are expected to be launched into the water at the

contractor’s docks over the coming weeks, with all fabrication

anticipated to complete in Q2. They will then be transported to

Moma by sea for commissioning in Q3.

All of the principal components of the new

module for WCP A, which incorporates 42 pontoons, a surge bin, an

upfront desliming circuit, major steelwork and screens, are now on

site and construction is advancing to schedule, with commissioning

expected in Q3.

Construction of the Tailings Storage Facility

has been impacted by permitting delays associated with the

Mozambique general election. Construction commenced in mid-January,

with commissioning scheduled for Q4. Management of slimes in the

interim period of Q3 has been accommodated within the mine

plan.

Selective Mining Operation (“SMO”)

The introduction of a new small-scale

dredge-mining and concentrating operation, or SMO, will enable

mining in peripheral areas of Mineral Resources in the Pilivili

high dunes and Namalope Flats at the Mine. These areas are low in

slimes, above average grade and not accessible by the larger WCPs

or existing dry mining operations that are limited by groundwater

levels, which prevent the extraction of ore below the water table.

The SMO is expected to produce approximately 50,000 tonnes of HMC

per annum.

The SMO construction process is well advanced at

Moma, with commissioning of the first module of the plant expected

to commence in late January and the second part in February. The

capital expenditure is anticipated to be less than $6 million

and the project remains on budget.

The introduction of the SMO supports Kenmare’s

ability to deliver ilmenite production in 2025 that is broadly in

line with 2023 and 2024 levels, despite the planned downtime for

WCP A required to facilitate the replacement of the dredges and the

upgrade of the plant.

Finance and corporate update

Dividends and year-end cash and debt

On 11 October 2024, Kenmare paid its interim

2024 dividend of USc15.0 per share, representing a total interim

distribution of $13.4 million. The Company expects total dividends

in respect of 2024 to be at the upper end of Kenmare’s dividend

policy payout ratio of 20-40% of profit after tax.

Cash and cash equivalents were $56.9

million at year-end (2023: $71.0 million).

Gross bank loans, including accrued interest, were $80.4 million

(2023: $48.8 million) and lease liabilities were $1.3 million

(2023: $1.5 million). As a result, the Company had net debt of

$24.8 million at year-end (2023: $20.7 million net cash). Supported

by on-going cash generation, available current assets and its

Revolving Credit Facility, Kenmare remains well-capitalised to fund

the WCP A capital project and its dividend programme.

Implementation Agreement

Kenmare has agreed in principle to certain

modifications to the applicable investment regime in connection

with the renewal of rights under the IA and the renewal and

modifications are awaiting consideration at Ministerial level. In

the meantime, the Ministry of Industry and Commerce has

provided confirmation that Kenmare’s existing rights and benefits

remain in full force and effect pending conclusion of the

process.

The original renewal date was 21 December 2024.

However, due to delays associated with the recent Mozambique

general election, the renewal, along with others of a similar

nature, will be matters to be dealt with by the incoming

Government.

A further update on the renewal of the IA will

be provided in due course.

Appointment of Chief Financial

Officer

As announced on 20 December 2024, James

McCullough has been appointed as Kenmare’s Chief Financial Officer

and he will join the Company on 1 May 2025. James brings extensive

mining, strategic and financial experience to Kenmare, having

served for 14 years with Rio Tinto Plc, most recently as

General Manager - Group Strategy. James succeeds Tom Hickey,

who was previously Finance Director before being appointed as

Managing Director in August 2024.

Market update

Kenmare’s shipments increased by 4% in 2024,

reflecting consistently strong customer demand for Kenmare’s

products. However, the average price received decreased compared to

2023, as expected, due to increased supply outweighing demand.

Despite this, the Company believes the fundamentals for its

products are strong, due primarily to medium- and long-term supply

constraints within the titanium feedstocks industry and the

favourable characteristics of its products. Kenmare’s average price

received was stronger in H2 than H1 due to a higher value product

mix in the second half as a result of two zircon shipments being

delayed from June to July.

Global demand for titanium feedstocks reached a

record high during the year, supported by strong demand from

emerging markets such as South America and Asia (excluding China).

The titanium metal market also continued to consume significant

quantities of titanium feedstocks due to its growing

production.

However, supply grew more strongly, with

increased exports of Heavy Mineral Concentrate to China from

Mozambique, Sierra Leone, and Indonesia. This new supply also more

than compensated for the reduced production from mines nearing the

end of their lives.

Kenmare is well-positioned due to the flexible

nature of its ilmenite product suite and its ability to sell its

products into multiple market segments. The Company is a preferred

supplier to the beneficiation market due to the high quality, low

impurity nature of its ilmenite, which achieves a premium in the

market. Most new supply is not suitable for this market segment,

which supports demand for Kenmare’s ilmenite, and it is growing

faster than the global titanium feedstocks market.

Pigment production in China continued at high

levels in 2024, despite proposed anti-dumping duties from the

European Commission. While these regulations reduced Chinese

exports to Europe, China increased its exports to other regions,

such as other Asian countries, largely offsetting this impact.

Pigment production in Europe increased significantly in 2024, as

producers responded to the reduced availability of Chinese pigment.

Both trends also supported demand for Kenmare’s ilmenite during the

year.

2024 was a challenging year for the global

zircon market, impacting Kenmare’s received prices. Although there

was a partial recovery in Q1, underlying demand remained weak due

to softness in China’s construction sector.

2025 guidance

2025 guidance for production and operating costs

is as follows:

|

|

Unit |

2025 Guidance |

2024 Actual |

|

Production |

|

|

|

|

Ilmenite |

tonnes |

930,000-1,050,000 |

1,008,900 |

|

Primary zircon |

tonnes |

47,500-54,000 |

50,500 |

|

Rutile |

tonnes |

9,000-10,000 |

9,800 |

|

Concentrates1 |

tonnes |

63,000-69,000 |

46,100 |

|

Costs |

|

|

|

|

Total cash operating costs |

$m |

228-252 |

N/R2 |

|

Cash costs per tonne of finished product |

$/t |

206-228 |

N/R2 |

- Concentrates include secondary

zircon, mineral sands concentrate and 25,000 tonnes of a new

concentrates product

- To be reported in full year

financial statements.

Ilmenite production in 2025 is expected to be

between 930,000 and 1,050,000 tonnes, with HMC production at a

consistent level throughout the year. Grades are expected to be

higher in H1 than H2, however excavated ore volumes are expected to

increase in H2, largely due to the commissioning of the new higher

capacity dredges at WCP A, offsetting the weaker grade. Finished

product production is expected to be boosted by the addition of

25,000 tonnes of a new concentrates product, which is included in

concentrates production guidance.

Shipments are forecast to exceed production in

2025, supported by high levels of finished product stock.

Total cash operating costs for 2024 are

anticipated to be towards the upper end of guidance ($219-243

million). Full details of 2024 costs will be provided with the 2024

Preliminary Results. Total cash operating costs in 2025 are

anticipated to be broadly in line with 2024 at $228-252

million.

Expenditure on development projects and studies

is expected to be approximately $155 million in 2025, with $150

million relating to the WCP A project. Kenmare guided in July 2024

that capital expenditure on the WCP A project would be $128 million

in 2025. The Company incurred less capital expenditure than

expected in 2024 so a portion of this was deferred to 2025. The WCP

A project remains on budget, with a total cost estimate of $341

million.

Improvement projects are expected to cost $7

million in 2025 and relate to a number of initiatives, including

studies relating to a potential Enterprise Resource Planning system

and upgrades to the Mineral Separation Plant.

Sustaining capital costs in 2025 are expected to

be approximately $38 million. Sustaining capital is typically

approximately $30 million per annum but it is elevated in 2025 due

to the planned five-yearly dry dock of the Peg, one of Kenmare’s

transshipment vessels, and the anticipated purchase of a second

Selective Mining Operation.

Notice of 2024 Preliminary

Results

Kenmare plans to release its 2024 Preliminary

Results on Wednesday, 26 March 2025.

For further information, please contact:

Kenmare Resources plc

Jeremy Dibb / Katharine Sutton

Investor Relations

ir@kenmareresources.com

Tel: +353 1 671 0411

Mob: +353 87 943 0367 / +353 87 663 0875

Murray (PR advisor)

Paul O’Kane

pokane@murraygroup.ie

Tel: +353 1 498 0300

Mob: +353 86 609 0221

About Kenmare Resources

Kenmare Resources plc is one of the world's

largest producers of mineral sands products. Listed on the London

Stock Exchange and the Euronext Dublin, Kenmare operates the Moma

Titanium Minerals Mine in Mozambique. Moma's production accounts

for approximately 7% of global titanium feedstocks and the Company

supplies to customers operating in more than 15 countries. Kenmare

produces raw materials that are ultimately consumed in everyday

quality-of life items such as paints, plastics and ceramic

tiles.

All monetary amounts refer to United States

dollars unless otherwise indicated.

Forward Looking Statements

This announcement contains some forward-looking

statements that represent Kenmare's expectations for its business,

based on current expectations about future events, which by their

nature involve risks and uncertainties. Kenmare believes that its

expectations and assumptions with respect to these forward-looking

statements are reasonable. However, because they involve risk and

uncertainty, which are in some cases beyond Kenmare's control,

actual results or performance may differ materially from those

expressed or implied by such forward-looking information.

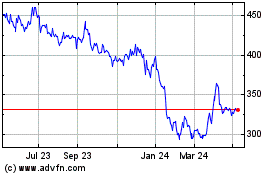

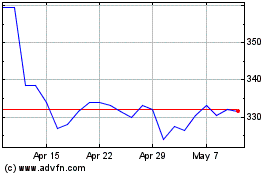

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Feb 2025 to Mar 2025

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Mar 2024 to Mar 2025