TIDMMAC

5 December 2023

Marechale Capital plc

("Marechale Capital", "Marechale" or the "Company")

Half-yearly Results

Marechale Capital plc, an established City of London based corporate finance

house with a long-term track record and a strong reputation for advising and

financing high growth consumer brands, leisure, clean energy, mineral extraction

and technology companies, announces its unaudited half-yearly results for the

six months ended 31 October 2023 (the "Period").

Chairman's Statement

Following the announcement with Marechale's full year results released in August

2023, the market continues to remain challenging, particularly in the

hospitality sector. However, the Board remains positive about the outlook for

its investments.

Marechale Capital continues to see interesting corporate finance and advisory

projects where it can take founders shares and warrants as part of its advisory

fees. On a positive note, Marechale has completed transactions during the period

for the European telecommunications technology company, Fast2fibre, Chestnut

Group, the leading East Anglian Inn Group, and for Brewhouse & Kitchen, the

expanding gastro pub business. However, the market remains a difficult

environment in which to raise capital. This has resulted in some advisory

projects that launched in the summer not being completed by the end of the

Period. Marechale continues to look for new funding partners alongside its

traditional investor relationships.

During the six months ended 31 October 2023, the Company generated gross profits

of £93,813 (2022: £72,020) and delivered an operating loss of £155,421 (2022:

loss of £178,995), resulting in an overall loss before tax of £155,803 (2022:

loss of £179,502).

The Company's balance sheet shows a net asset value of £3,340,486 (2022:

£3,456,430), representing 3.15p (2022: 3.62p) of value per share in issue. The

Company remains positive about the investments that it holds in its client

companies. As at 31 October 2023 the Company had £400,000 of cash reserves.

The Board is working on a number of initiatives to create further value for

shareholders over and above its core investment portfolio and corporate finance

projects, including working with Chris Kenning, following his strategic

investment of 9.9% of the Company announced in June 2023. The plan is to

digitise Marechale's activities and continue to develop strategic partnerships

with the objective of enhancing shareholder value.

Marechale also uses its balance sheet to co-invest in its client companies,

along with warrants and founder equity. Furthermore, the Board is hopeful to be

able to announce realisations on some of the Company's investments in the next

six months

Whist the current economic climate is difficult, Marechale Capital remains

diligent and is convinced that there will be good advisory and investment

opportunities in its core hospitality, renewable, clean energy and technology

sectors over the short to medium term.

Mark Warde-Norbury

Chairman

The information communicated in this announcement contains inside information

for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014

For further information please contact:

Marechale CapitalMark Warde Tel: +44 (0)20 7628 5582

-Norbury / Patrick Booth

-Clibborn

Cairn Financial Advisers LLPJo Tel: +44 (0)20 7213 0880

Turner / Sandy Jamieson

Income Statement (unaudited)

6 months ended 31 October 2023 2022

£

Revenue 320,603 168,001

Cost of sales (226,790) (95,981)

Gross profit 93,813 72,020

Administrative expenses (249,235) (251,015)

Operating loss (155,421) (178,995)

Interest paid (382) (507)

(Loss/profit before tax (155,803) (179,502)

Taxation - -

(Loss)/profit after tax (155,803) (179,502)

(Loss)/profit per share

(Pence) (Pence)

- Basic (0.15) (0.19)

- Diluted (0.14) (0.19)

Balance Sheet

(unaudited)

As at 31 October 31 October

2023 2022

Current assets

Available for 2,863,227 3,116,441

sale

investments

Trading 130,076 146,589

investments

Trade and 37,219 54,356

other

receivables

Cash and cash 398,229 246,808

equivalents

3,428,751 3,564,194

Current

liabilities

Trade and (51,278) (59,627)

other payables

(9,487) (10,638)

PAYE

(10,000) (10,000)

Bounce-back

Loan

Total current (70,765) (80,265)

liabilities

Net current 3,357,986 3,483,929

assets

Bounce-back (17,500) (27,500)

Loan - long

-term

Net assets 3,340,486 3,456,429

Equity

Capital and

reserves

attributable

to equity

shareholders

Share capital 847,530 763,023

Share premium 481,290 328,413

Reserve for (50,254) (50,254)

own shares

Retained 1,944,842 2,346,660

profits/

(losses)

Reserve for 117,078 68,587

share based

payments

3,340,486 3,456,429

Cash Flow

Statement

(unaudited)

6 months ended 31 October 31 October

2023 2022

£ £

Net cash from

operating

activities

Loss after tax (155,803) (179,502)

Provision for 33,091 6,275

share based

payments 381 507

Reverse interest

paid

Operating cash (122,331) (172,720)

flows before

movements in

working capital

Movement in

working capital

Decrease/ 38,714 (10,580)

(increase) in

receivables

(Decrease)/ (30,795) 12,895

Increase in

payables

Net movement in 7,919 2,315

working capital

Operating cash (114,412) (170,405)

out-flow

Investment

activities

Expenditure on (572) -

available for

sale investments

Proceeds from - 8,750

sale of

investments

Cash flow from (572) 8,750

investing

activities

Financing 235,800 -

Share Capital (5,000) (5,000)

Bounce-back Loan (381) (507)

repayments

230,419 (5,507)

Interest paid

Net financing

Net increase/ 115,435 (167,162)

(decrease) in

cash and cash

equivalents

Cash and cash 282,794 413,970

equivalents at

start of the

period

Cash and cash 398,229 246,808

equivalents at

end of the

period

Increase/ 115,435 (167,162)

(decrease) in

cash and cash

equivalents

This financial information has been prepared in accordance with IFRS and

International Financial Reporting Interpretations Committee ('IFRIC')

interpretations adopted by the European Union, and with those parts of the

Companies Act 2006 applicable to companies reporting under IFRS, with the prior

period being reported on the same basis.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/marechale-capital-plc/r/half-year-report,c3888029

END

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

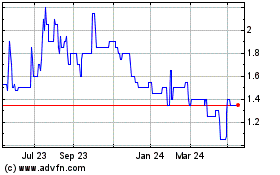

Marechale Capital (LSE:MAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

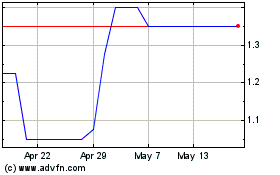

Marechale Capital (LSE:MAC)

Historical Stock Chart

From Nov 2023 to Nov 2024