TIDMPCA

RNS Number : 1951R

Palace Capital PLC

19 September 2017

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN, IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA,

CANADA, AUSTRALIA, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR NEW

ZEALAND OR INTO ANY OTHER JURISDICTION WHERE TO DO SO WOULD BREACH

ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT, IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR

CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION, OFFER OR ADVICE

TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE OF ANY

SECURITIES OF PALACE CAPITAL PLC OR INTO ANY OTHER JURISDICTION

WHERE TO DO SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

Palace Capital plc

("Palace Capital" or the "Company")

Further re. Placing and Open Offer to raise GBP70 million

Notice of General Meeting

Further to the announcement made earlier today, Palace Capital,

the property investment company that focuses on commercial property

outside London, is pleased to announce a conditional placing (the

"Placing") of 20,588,236 new ordinary shares (the "Placing Shares")

to raise a total of GBP70 million (before expenses). 1,257,534 of

the Placing Shares have been subscribed for subject to clawback

under an open offer to raise GBP4.3 million (the "Open Offer"). The

Placing has been conducted at a price of 340 pence per Placing

Share (the "Placing Price"). The Placing Price represents an

approximate 12 per cent. discount to the closing middle market

price of 385 pence per Existing Ordinary Share on 18 September

2017, the last business day before the announcement of the Placing

and Open Offer.

Certain of the Directors of the Company have participated in the

Placing, details of which are included in the table below.

In addition, the Company will today allocate the LTIP Shares for

awards made under the LTIP in 2014, following the Sequel

acquisition in 2013. Today's grants will total 66,352 Ordinary

Shares. To make the allocations of the LTIP Shares, the Company

will transfer 100,000 Ordinary Shares out of treasury to The Palace

Capital Employee Benefit Trust.

Changes to the interests of Directors and PDMRs in the share

capital of the Company following the Placing and issue of the LTIP

Shares will, on Admission, be as follows:

At the date

of this announcement On Admission

------------------------ ------------------------

Number % of LTIP Placing Number % of

of Ordinary issued Shares Shares of Ordinary issued

Director/PDMR Shares share issued being Shares share

capital acquired capital

Neil Sinclair 183,767 0.73 39,811 8,824 232,402 0.51

Richard Starr 82,258 0.33 19,906 29,411 131,575 0.29

Stephen Silvester 2,148 0.01 - - 2,148 0.005

Anthony Dove 80,000 0.32 - 5,000 85,000 0.19

Kim Taylor-Smith - - - 10,000 10,000 0.02

Stanley Davis 1,565,287 6.20 - - 1,565,287 3.41

David Kaye

(PDMR) - - 6,635 - 6,635 0.01

The Company will be allocating options to certain Directors

pursuant to the Company's deferred bonus plan. The value of options

to be issued in lieu of bonus entitlements will total GBP127,895,

representing 35% of the Directors' bonuses for the year ended 31

March 2017, as detailed in the Company's report and accounts for

the year ended 31 March 2017. The number of options granted will be

calculated based on the average closing mid-market price of an

Ordinary Share on the five business days ending 25 September 2017.

Further details of these option grants will be announced in due

course.

Total voting rights

Following the transfer of the 100,000 Ordinary Shares out of

treasury, Palace Capital will have (excluding the total of 549,587

ordinary shares that will be held in treasury) 25,250,692 ordinary

shares in issue.

The above figure of 25,250,692 Ordinary Shares may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the FCA's

Disclosure and Transparency Rules.

Notice of General Meeting

The Placing and Acquisition are conditional on, inter alia, the

passing of certain resolutions at the General Meeting, to be held

at the offices of CMS Cameron McKenna Nabarro Olswang LLP, Cannon

Place, 78 Cannon Street, London EC4N 6AF at 10.00 a.m. on 6 October

2017 and notice of which is today being posted to Shareholders. The

Resolutions to be proposed at the General Meeting, are, inter alia,

to provide the Company with the authority to issue and allot the

Placing Shares.

A copy of the Circular, which includes notice of the General

Meeting, will be posted to shareholders shortly and will be

available from the Company's website www.palacecapitalplc.com.

Capitalised terms used in this Announcement shall have the

meanings given to such terms in the Company's announcement this

morning.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this Announcement this inside information is now

considered to be within the public domain.

Neil Sinclair, Chief Executive of Palace Capital, commented:

"We are delighted with the support that we have received for the

fundraising and are very pleased to welcome a substantial number of

new institutional shareholders to our register."

KEY STATISTICS

Number of Existing Ordinary Shares

(excluding treasury shares) 25,250,692

Number of Firm Placing Shares 19,330,702

Number of Conditional Placing and Offer

Shares 1,257,534

Aggregate number of New Ordinary Shares

expected to be issued pursuant to the

Placing and Open Offer 20,588,236

Issue Price 340 pence

Open Offer Entitlements under the Open

Offer 1,257,534

Percentage of the Enlarged Share Capital 44.9 per

represented by the Placing Shares and cent.

Offer Shares

Estimated gross proceeds of the Placing GBP70.0

million

Estimated net proceeds of the Placing GBP66.4

million

Enlarged Share Capital immediately

following the Placing 45,838,928

Market capitalisation of the Company GBP155.9

immediately following the Placing at million

the Issue Price

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date for entitlements under 15 September

the Open Offer 2017

Announcement of the Placing and 7.00 a.m. on

Open Offer 19 September

2017

Publication and posting of the 19 September

Circular, the Application Form 2017

and Form of Proxy

Ex-entitlement Date for the Open 8.00 a.m. on

Offer 19 September

2017

Open Offer Entitlements and Excess As soon as practical

CREST Open Offer after 8.00 a.m.

Entitlements credited to stock on 20 September

accounts of Qualifying CREST 2017

Shareholders in CREST

Recommended latest time and date 4.30 p.m. on

for requesting withdrawal 29 September

of Open Offer Entitlements and 2017

Excess CREST Open Offer

Entitlements from CREST

Recommended latest time for depositing 3.00 p.m. on

Open Offer 2 October 2017

Entitlements and Excess CREST

Open Offer Entitlements into

CREST

Latest time and date for splitting 3.00 p.m. on

Application Forms (to satisfy 3 October 2017

bona fide market claims only)

Latest time and date for receipt 10.00 a.m. on

of completed Forms of Proxy 4 October 2017

and receipt of electronic proxy

appointments via the CREST

system

Latest time and date for receipt 11.00 a.m. on

of the completed Application 5 October 2017

Form and appropriate payment in

respect of Offer Shares or

Excess Shares or settlement of

relevant CREST instruction

General Meeting 10.00 a.m. on

6 October 2017

Announcement of result of General 6 October 2017

Meeting and Open Offer

8.00 a.m. on

Admission and commencement of 9 October 2017

dealings in the

New Ordinary Shares on AIM

CREST members' accounts credited from 8.00 a.m.

in respect of on

New Ordinary Shares in uncertificated 9 October 2017

form

Completion of the Acquisition 9 October 2017

Despatch of definitive share certificates by 16 October

for New Ordinary 2017

Shares in certificated form

For further information please contact:

Palace Capital plc

Neil Sinclair, Chief Executive

Stephen Silvester, Finance Director

Tel. +44 (0)20 3301 8331

Allenby Capital Limited (Nominated Adviser and Joint Broker)

Nick Naylor / James Reeve / Asha Chotai

Tel. +44 (0)20 3328 5656

Arden Partners plc (Lead Bookrunner and Joint Broker)

Chris Hardie / Ciaran Walsh

Tel. +44 (0)207 614 5900

Capital Access Group (Financial PR)

Scott Fulton

Tel. +44 (0)20 3763 3400

About Palace Capital plc (www.palacecapitalplc.com):

Palace Capital is a UK property investment company admitted to

trading on the AIM Market of the London Stock Exchange (LSE: PCA).

The Company is not sector specific and looks for opportunities

where it can enhance the long-term income and capital value through

asset management and strategic capital development in locations

outside London. In its last reported financial year, Palace Capital

produced a 20.0% increase in adjusted profit before tax, a 7.0%

uplift in EPRA NAV per share and a 16.0% increase in dividends.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FUROKCDKQBKDCCD

(END) Dow Jones Newswires

September 19, 2017 10:11 ET (14:11 GMT)

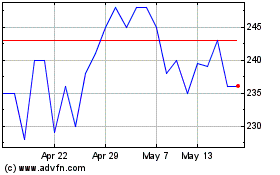

Palace Capital (LSE:PCA)

Historical Stock Chart

From Mar 2024 to May 2024

Palace Capital (LSE:PCA)

Historical Stock Chart

From May 2023 to May 2024