Reabold Resources PLC Response to Media Reporting (3909S)

04 November 2023 - 3:10AM

UK Regulatory

TIDMRBD

RNS Number : 3909S

Reabold Resources PLC

03 November 2023

3 November 2023

Reabold Resources plc

("Reabold" or the "Company")

Response to Media Reporting

Reabold Resources plc, the oil & gas investing company with

a diversified portfolio of exploration, appraisal and development

projects, notes the recent media coverage containing details of a

purported general meeting requisition notice from Kamran Sattar of

Portillion Capital Ltd. ("Portillion"). As a reminder to

shareholders, Reabold's board understands that Kamran Sattar was a

supporter of, and driving force behind the unsuccessful attempt to

gain control of Reabold without paying a premium to shareholders

through a general meeting requisition in October 2022, by a group

of five shareholders with beneficial interests held through

Pershing Nominees Limited. In addition, in March 2023, the Company

announced that it received an unsolicited approach from Kamran

Sattar on behalf of Portillion SPV O&G in respect of a possible

offer for Reabold, and in April 2023, Portillion announced that

Portillion SPV O&G did not intend to make a firm offer for

Reabold.

Despite the media reporting that another requisition notice has

been sent to the Company, Reabold confirms that it has not received

any form of communication with regard to a notice requisitioning a

general meeting, but will make further announcements, as

appropriate, if and when it does.

In the interim, Reabold advises shareholders to take no

action.

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757 4980

Stephen Williams

Strand Hanson Limited - Nominated &

Financial Adviser

James Spinney

James Dance +44 (0) 20 7409 3494

Rob Patrick

Stifel Nicolaus Europe Limited - Joint

Broker

Callum Stewart +44 (0) 20 7710 7600

Simon Mensley

Ashton Clanfield

Cavendish - Joint Broker

Barney Hayward +44 (0) 20 7220 0500

Camarco

Billy Clegg

Rebecca Waterworth

Sam Morris +44 (0) 20 3757 4980

Notes to Editors

Reabold Resources plc has a diversified portfolio of

exploration, appraisal and development oil & gas projects.

Reabold's strategy is to invest in low-risk, near-term projects

which it considers to have significant valuation uplift potential,

with a clear monetisation plan, where receipt of such proceeds will

be returned to shareholders and re-invested into further growth

projects. This strategy is illustrated by the recent sale of the

undeveloped Victory gas field to Shell, the proceeds of which are

being returned to shareholders and re-invested.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFIRLALVIIV

(END) Dow Jones Newswires

November 03, 2023 12:10 ET (16:10 GMT)

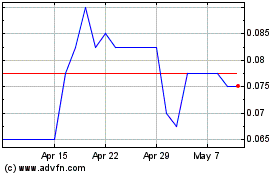

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Jan 2024 to Jan 2025