SRT Marine Systems PLC Result of Placing (7872D)

24 June 2023 - 12:47AM

UK Regulatory

TIDMSRT

RNS Number : 7872D

SRT Marine Systems PLC

23 June 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED WITHIN IT (THIS

"ANNOUNCEMENT") IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR FROM THE

UNITED STATES (INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE

OF THE UNITED STATES AND THE DISTRICT OF COLUMBIA, COLLECTIVELY THE

"UNITED STATES") OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE PROHIBITED BY LAW ("RESTRICTED

JURISDICTION").

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

DOES NOT CONSTITUTE AN OFFER IN ANY RESTRICTED JURISDICTION.

Capitalised terms not otherwise defined herein shall have the

meanings given to them in the announcement made by SRT Marine

Systems plc on 23 June 2023 at 07:00 a.m. (the "Launch

Announcement"), unless the context requires otherwise.

For immediate release

23 June 2023

SRT Marine Systems plc

Result of Placing

SRT Marine Systems plc (AIM: SRT), a global provider of

integrated maritime surveillance systems and digital navigation

safety transceivers ("SRT" or the "Company"), is pleased to

announce that further to the Launch Announcement, the Bookbuild has

closed and the Company has conditionally raised gross proceeds of

approximately GBP4.61 million, through the successful placing of

9,220,000 Placing Shares at the Issue Price of 50 pence per New

Ordinary Share, a significant increase to the minimum size of the

Placing described in the Launch Announcement following strong

investor demand.

In addition to the Placing, the Company is also providing Retail

Investors with the opportunity to subscribe for an aggregate of up

to 1,500,000 Retail Shares at the Issue Price on the PrimaryBid

platform, to raise up to approximately GBP0.75 million (before

expenses). The Retail Offer is due to close on 26 June and the

results of the Retail Offer will be announced separately

thereafter.

As a result the gross proceeds from the Fundraising are expected

to be up to GBP5.36 million (before expenses) through the issuance

of up to 10,720,000 New Ordinary Shares.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2023

Announce Close of the Placing 23 June

-------------------

Announce Close of Retail Offer 26 June

-------------------

Commencement of dealings in the New Ordinary Shares 08:00 a.m.

on AIM 30 June

-------------------

Admission of New Ordinary Shares in uncertificated 30 June

form expected to be credited to accounts in CREST

(uncertificated holders only)

-------------------

Expected date of despatch of definitive share certificates Within 10

for the New Ordinary Shares in certificated form business

(certificated holders only) days of Admission

-------------------

Notes

1. Each of the times and dates in the above timetable is subject

to change at the absolute discretion of the Company (with the

agreement of finnCap). If any of the above times and/or dates

change, the revised times and/or dates will be notified to

Shareholders by way of an announcement through a Regulatory

Information Service.

2. References to time in this document are to London time.

Director Participation

Simon Tucker, CEO of the Company, has confirmed that his

participation in the Fundraising will now take place through the

Retail Offer. A further announcement will be made when the results

of the Retail Offer are announced.

Admission

The Placing and Retail Offer are conditional upon, inter alia,

Admission becoming effective.

The New Ordinary Shares will, when issued, be credited as fully

paid and rank pari passu with the Existing Ordinary Shares.

Application will be made to the London Stock Exchange for the

New Ordinary Shares to be admitted to trading on AIM and, subject

to the Placing Agreement not having been terminated in accordance

with its terms, it is expected that Admission will become effective

and trading in the New Ordinary Shares will commence at 8.00 a.m.

on 30 June 2023.

The total voting rights as of Admission will be announced

separately with the results of the Retail Offer.

Enquiries:

SRT Marine Systems plc www.srt-marine.com

+44 (0) 20 7036 1400

Simon Tucker (CEO) simon.tucker@srt-marine.com

Louise Coates (Marketing Manager) louise.coates@srt-marine.com

finnCap Ltd (Nominated Adviser & Broker)

Jonny Franklin-Adams / Teddy Whiley (Corporate Finance)

Tim Redfern / Charlotte Sutcliffe (ECM) +44 (0) 20 7220 0500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIZXLFLXQLZBBZ

(END) Dow Jones Newswires

June 23, 2023 10:47 ET (14:47 GMT)

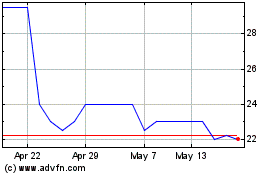

Srt Marine Systems (LSE:SRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

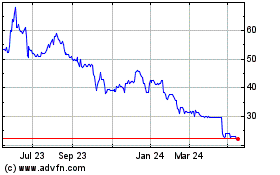

Srt Marine Systems (LSE:SRT)

Historical Stock Chart

From Feb 2024 to Feb 2025