TIDMTHG

RNS Number : 9057M

THG PLC

17 January 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

17 January 2023

THG PLC ( "THG" or the "Group")

Trading statement for the period ended 31 December 2022

Record sales in FY 2022 with comprehensive cost action taken to

increase profitability

H2 2022 cash generation driving strong balance sheet

THG PLC ("THG" or the "Group"), the proprietary technology

platform specialising in taking brands direct to consumers ("D2C")

globally, announces its trading update for the period ended 31

December 2022 ("FY 2022").

-- Record sales of GBP2.25 billion in FY 2022, with +9.4% growth

in THG Beauty and THG Nutrition primary territories(1) .

-- Significant investment in price strategy through 2022 to

support long-term customer retention, alongside new customer growth

in established and emerging markets.

-- Cost base well positioned following completion of divisional

reorganisation, with c. GBP100 million of cost savings and

efficiencies identified and implemented in FY 2022. A further GBP30

million of savings targeted for delivery during FY 2023.

-- Free cash generation2 of c. GBP50 million in H2 2022, driving

strong balance sheet and liquidity with c. GBP640 million of cash

and available facilities at year end.

-- THG Ingenuity gaining momentum following the pivot to focus

on higher value and higher margin contracts, with further major

contracts close to agreement, building upon the recent expansion of

the Matalan strategic partnership.

-- Simplification of the Group leading to a strategic review of

loss-making categories and territories within the THG OnDemand

division, underpinning FY 2023 profitability improvements.

-- Expected adjusted EBITDA for FY 2022 on a continuing basis in

line with current market expectations. Medium-term adjusted EBITDA

margin guidance of >9.0% reiterated.

FY 2022 Group trading performance

GBPm FY 2022 FY 2021 YoY Growth YoY 2 Year

(excl Growth Growth

Russia)

THG Beauty 1,185.6 1,117.8 +6.1% +57.7%

THG Nutrition 672.4 659.5 +2.0% +19.6%

THG Ingenuity 208.1 194.3 +7.1% +51.6%

------- ------- ---------- ------- -------

Core Divisional

Revenue 2,066.1 1,971.6 +4.8% +42.4%

------- ------- ---------- ------- -------

THG OnDemand (under

review) 106.4 128.1 -16.9% +5.0%

Other (under review) 80.1 80.2 -0.1% +31.2%

------- ------- ---------- ------- -------

Group Revenue 2,252.6 2,179.9 +4.1% +3.3% +39.6%

------- ------- ---------- ------- -------

Ingenuity Commerce

Revenue 46.9 45.4 +3.3% +142.9%

---------------------- ------- ------- ---------- ------- -------

FY 2022 highlights

-- FY 2022 Group revenue growth of +4.1% (+3.3% reported), with

+9.4% growth in THG Beauty and THG Nutrition primary territories

supported by localised infrastructure.

-- The full-year Group outturn reflects:

o the proactive decision to discontinue a proportion of

loss-making OnDemand sales, primarily across international markets,

using the peak trading period to reduce residual inventory

impacting revenue and profitability;

o lengthier onboarding of higher revenue and margin Ingenuity

partnerships; and

o disruption in the UK courier network during December impacting

online gifting demand in Beauty in particular.

-- Key customer indicators including average order values,

repeat rates and active customer numbers all remain in growth vs Q4

2020, demonstrating the resilience of beauty, health, and wellness

categories, and continued adoption of digital channels post

pandemic, particularly in the UK.

-- Successful completion of the Group's divisional

reorganisation driving continued profit progression through greater

divisional cost transparency, the removal of duplicated costs,

procurement and payroll efficiencies. Group-wide headcount

reduction of c. 2,000 employees following elevated investment over

recent years, achieved through managed attrition alongside

continued recruitment of digital talent.

-- Normalisation of inventory levels as expected through H2

2022, with c. GBP75 million reduction in Group stock vs December

2021, supporting free cash generation of c. GBP50 million in H2

2022.

-- Cash on hand at year end of c. GBP470 million, with GBP170

million undrawn revolving credit facility available. Year-end net

debt of c. GBP200 million, reducing to c. GBP160 million upon

receipt of GBP40 million of proceeds from non-core freehold asset

disposals in H1 2023.

THG Ingenuity

-- In Q3 2022, the Group announced a re-positioning of THG

Ingenuity to focus on larger, higher revenue and higher margin

clients with high-quality recurring revenues. Exiting a number of

smaller contracts while pausing additional lower value partnerships

has enabled THG Ingenuity to fully capitalise on larger scale, more

complex, long-term opportunities.

-- This strategy is now delivering tangible results with the

Group confirming that it is in advanced discussions to provide

long-term software solutions for several significant enterprise

clients, in addition to the expansion of its strategic partnership

with UK retailer Matalan.

-- During 2023, the Group expects to add over GBP1 billion

incremental GMV to the Ingenuity platform.

Outlook and guidance

-- Following the Group's divisional reorganisation, the Board

has commenced a strategic review of trading activities outside of

THG Beauty, THG Nutrition and THG Ingenuity. These core divisions

are expected to deliver adjusted EBITDA on a continuing basis of c.

GBP100 million3 for FY 2022, reflecting the removal of c. GBP20

million of losses from discontinued revenues.

-- While the decision to discontinue certain trading activities

has occurred already, the full outcome of the review will complete

in H1 2023.

-- The combined impact of the lower full-year sales outturn, the

dilutive impact of loss-making categories under review, alongside

the timing of impending new Ingenuity contracts results in an

expected adjusted EBITDA outturn range of GBP70 million to GBP80

million(4) for FY 2022.

-- Margin recovery confidence in FY 2023 and beyond supported by:

o the full year effect of the GBP100 million cost savings

actioned, including exiting loss-making categories;

o US warehouse automation live in Q1 2023; and

o substantially lower raw material buying costs (principally

whey), with reduced buying prices YoY confirmed for Q1 2023.

-- A dedicated focus on high-margin categories and relatively

low maintenance capital expenditure supports the Group's

expectation of being broadly free cash flow neutral in FY 2023, and

significantly free cash flow positive in FY 2024.

Matthew Moulding, CEO commented:

"In a year that presented numerous challenges across the world,

I'm proud that the THG team has delivered another record revenue

performance at GBP2.25 billion. Amongst many highlights, I'm

especially pleased with the progress of Ingenuity, successfully

competing with major global technology giants to transform digital

operations for global retailers and brands.

"With the completion of the divisional reorganisation, and

around GBP100 million of annual efficiency savings already

delivered, the Group enters 2023 with strong momentum to achieve

substantial margin expansion. Core commodity prices used within our

Nutrition division have seen significant deflation since their

record highs in 2022, giving us confidence in significant profit

progression as we move through the year ahead, against a much

reduced Group cost base. We remain highly confident of delivering

adjusted EBITDA margins in excess of 9.0% over the medium-term.

"Our delivery of c. GBP50 million free cashflow in H2 2022,

coupled with c. GBP640 million of cash and facilities at year end,

mean we are well positioned for further operational and strategic

progress, notwithstanding the continued macroeconomic

uncertainty."

For further information please contact:

Investor enquiries:

Kate Grimoldby, Head of Investor Relations Investor.Relations@thg.com

Media enquiries:

Powerscourt - Financial PR adviser Tel: +44 (0) 20 7250

1446

Victoria Palmer-Moore/Nick Dibden/Nick thg@powerscourt-group.com

Hayns

THG PLC

Viki Tahmasebi Viki.tahmasebi@thg.com

S

Notes to editors

THG is a vertically integrated, digital-first consumer brands

group, retailing its own brands in beauty and nutrition, plus

third-party brands, via its proprietary, end-to-end, e-commerce

technology, infrastructure and brand-building platform (THG

Ingenuity) to an online and global customer base. THG's business is

operated through the following businesses:

THG Beauty : The globally pre-eminent digital-first brand owner,

retailer and manufacturer in the prestige beauty market, combining

its prestige portfolio of eight owned brands across skincare,

haircare and cosmetics, the provision of a global route to market

for over 1,300 third-party beauty brands through its portfolio of

websites, including Lookfantastic, Dermstore, Cult Beauty and

Mankind and the beauty subscription box brand GLOSSYBOX.

THG Nutrition : A group of digital-first Nutrition brands, which

includes the world's largest online sports nutrition brand

Myprotein, and its family brands (Myvegan, Myvitamins, MP

Activewear and MyPRO), with a vertically-integrated business model,

supported by global THG production facilities.

THG Ingenuity: Ingenuity Commerce provides an end-to-end direct

to consumer e-commerce solution for consumer brand owners under

'Software as a Service' (SaaS) licences. The wider Ingenuity

division provides stand-alone digital services, including hosting,

studio content, translation services and beauty product development

and manufacturing.

THG OnDemand : Personalisation and customisation is a key

offering within THG OnDemand, enabling brands to offer unique

products to a vast range of consumers across THG's global

territories through websites including Zavvi, IWOOT and Pop in a

Box.

Other : Luxury D2C websites including Coggles, AllSole and

MyBag, in addition to THG Experience. The latter comprises prestige

events locations at Hale Country Club & Spa, King Street

Townhouse Hotel and Great John Street Hotel, providing deeply

experiential brand building environments, most notably in support

of THG Society, the Group's proprietary influencer marketing

platform.

Cautionary Statement

Certain statements included within this announcement may

constitute "forward-looking statements" in respect of the group's

operations, performance, prospects and/or financial condition.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words and

words of similar meaning as "anticipates", "aims", "due", "could",

"may", "will", "should", "expects", "believes", "intends", "plans",

"potential", "targets", "goal" or "estimates". By their nature,

forward-looking statements involve a number of risks, uncertainties

and assumptions and actual results or events may differ materially

from those expressed or implied by those statements. Accordingly,

no assurance can be given that any particular expectation will be

met and reliance should not be placed on any forward-looking

statement. Additionally, forward-looking statements regarding past

trends or activities should not be taken as a representation that

such trends or activities will continue in the future. No

responsibility or obligation is accepted to update or revise any

forward-looking statement resulting from new information, future

events or otherwise. Nothing in this announcement should be

construed as a profit forecast. This announcement does not

constitute or form part of any offer or invitation to sell, or any

solicitation of any offer to purchase any shares or other

securities in the Company, nor shall it or any part of it or the

fact of its distribution form the basis of, or be relied on in

connection with, any contract or commitment or investment decisions

relating thereto, nor does it constitute a recommendation regarding

the shares or other securities of the Company. Past performance

cannot be relied upon as a guide to future performance and persons

needing advice should consult an independent financial adviser.

Statements in this announcement reflect the knowledge and

information available at the time of its preparation.

[1] Includes the UK, US and key international territories with

attractive market sizes and THG localised product, digital content

and physical infrastructure (accounting for over 50% of Group FY

2022 revenue)

[2] Group free cash generation is calculated after working

capital, capital expenditure, adjusting items, tax and financing

(prior to debt capital repayments)

[3] Prior to SaaS cost reclassification

[4] Prior to SaaS cost reclassification now expected to be c.

GBP10 million for FY 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKZGMMMVRGFZZ

(END) Dow Jones Newswires

January 17, 2023 02:00 ET (07:00 GMT)

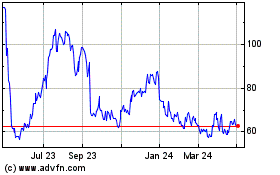

Thg (LSE:THG)

Historical Stock Chart

From Oct 2024 to Nov 2024

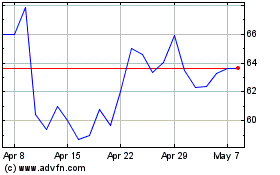

Thg (LSE:THG)

Historical Stock Chart

From Nov 2023 to Nov 2024