EDEN: A Solid Pick Among Europe ETFs - ETF News And Commentary

21 January 2014 - 4:00AM

Zacks

The Euro zone

finally emerged from the 18-month long recession last year, but

other economic problems still loom large over the region. The

economy is now running the risk of stagnation. (read:

European ETFs

in Focus on Standard and Poor's Downgrade)

It is

expected that GDP growth for this region dipped to ~0.4%-0.5%

in 2013. Also, unemployment stands out like a sore thumb at a

record high of 12.1%.

Moreover,

there are risks that the Euro zone might suffer from deflation, a

condition in which prices fall, thus arresting growth within the

economy. The current inflation figure of 0.8% is well below

European Central Bank’s target inflation level of a tad under

2%.

Even the

record low interest rate of 0.25% seems to be insufficient to

bolster demand.

Is There Any

Gem In this Region?

While

currently things are not so bright for the Euro zone and its

economy is expected to grow at a moderate 1.1% in 2014, one country

that stands out in this region is Denmark.

After four

long years of stagnation, this country within the Euro zone also

managed to come out of recession last year. (read:

3

Top Ranked Europe ETFs to Buy Now)

Though the

country is currently going through record high levels of household

debt, which is hampering consumption growth, the country’s

financial regulator is believed to be working closely to regulate

the credit policies of mortgage banks to prevent another housing

bubble.

The country

has a solid economic model which constantly strives to look for new

ways to tackle problems. The country has stable employment levels

thanks to its policy of encouraging employers to provide training

to their employees.

Moreover, the

country has lower budget deficits, less inequality and a high ratio

of working class to total population. The country is witnessing

improving fixed capital investment, and rising exports on the back

of strengthening external demand. Further, the

Nordic region enjoys ample foreign-exchange reserves.

Also, buoyed

by lower interest rates, improving confidence and healthy

employment growth, Denmark is expected to grow at the rate of 1.6%

in 2014.

Based on

these strong fundamentals, the Danish economy is expected to

continue outpacing other Southern European nations.

Thus, a look

at this top-ranked Danish ETF could be a good idea to capture the

surge in the space, especially based on the Zacks ETF Ranking

system.

About the

Zacks ETF Rank

This

technique provides a recommendation for the ETF in the context of

our outlook on the underlying industry, sector, style box or asset

class. Our proprietary methodology also takes into account the risk

preferences of investors.

The aim of our model is to select the best ETFs within each risk

category. We assign each ETF one of five ranks within each risk

bucket. Thus, the Zacks ETF Rank reflects the expected return of an

ETF relative to other ETFs with a similar level of risk.

Using this strategy, we have found one Danish ETF – the iShares

MSCI Denmark Capped Investable Market Index Fund

(EDEN) –

which has a Zacks ETF Rank of 2 or ‘Buy’ rating (read: all the Top

Ranked ETFs). EDEN

is the only

ETF available, offering investors an exposure to

Denmark.

EDEN

in

Focus

Though rather

unpopular with just $18.5 million in AUM, the fund has returned a

stellar 39.53% in 2013, ranking among the top three best performing

funds in the Europe equities ETF space. In fact, the fund is one of

the best performing global ETFs of 2013.

The Danish

ETF uses a passive strategy and seeks to match the price and yield

performance of the MSCI Denmark IMI 25/50 Index, before fees and

expenses. The index uses a capping methodology to limit the weight

of any single component to a maximum of 25% of the

index.

Holding 38

securities in its basket, the product does not offer wide

diversification to its investors, as it allocates nearly 65% of the

assets in the top 10 holdings.

However, the

fund is comparatively less volatile because it primarily invests in

large caps (63%), while 17% of the fund is allocated to mid caps.

(see all European Equity ETFs here)

Novo Nordisk

– the top spot in the basket – alone captures more than one fifth

of total portfolio assets, while the next two spots – Danske Bank

and AP Moeller-Maersk– make for a combined 14% share.

From a sector

look, the fund is skewed towards the healthcare sector with a

38.54% share, followed by industrials (26%) and financials

(15.80%).

The fund has

returned around 10% in the past month.

Want the

latest recommendations from Zacks Investment Research? Today, you

can download 7 Best Stocks for the Next 30 Days. Click to

get this free report >>

ISHARS-MS DNMRK (EDEN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

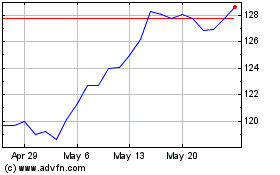

iShares MSCI Denmark ETF (AMEX:EDEN)

Historical Stock Chart

From Nov 2024 to Dec 2024

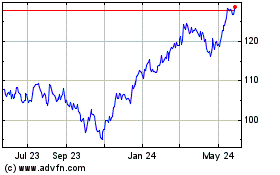

iShares MSCI Denmark ETF (AMEX:EDEN)

Historical Stock Chart

From Dec 2023 to Dec 2024