false

0001599407

0001599407

2024-05-16

2024-05-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 16, 2024

| 1847 Holdings LLC |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-41368 |

|

38-3922937 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 590 Madison Avenue, 21st Floor, New York, NY |

|

10022 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (212) 417-9800 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Shares |

|

EFSH |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 16, 2024, 1847 Holdings LLC issued

a press release regarding its financial results for the quarter ended March 31, 2024. A copy of the press release is furnished as

Exhibit 99.1 to this report.

The information furnished with this Item 2.02,

including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing

under Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, except as expressly set forth by specific

reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: May 16, 2024 |

1847 HOLDINGS LLC |

| |

|

| |

/s/ Ellery W. Roberts |

| |

Name: |

Ellery W. Roberts |

| |

Title: |

Chief Executive Officer |

- 2 -

Exhibit 99.1

1847 Reports 15.0% Increase in Revenue to $14.9

Million

for the First Quarter of 2024

Gross profit increases 13.3% in Q1 2024 vs Q1 2023

NEW

YORK, NY / ACCESSWIRE / May 16, 2024 / 1847

Holdings LLC ("1847" or the "Company") (NYSE

American: EFSH), a holding company specializing in identifying over-looked, deep value investment opportunities in middle market businesses,

today provided a business update and reported financial results for the first quarter ended March 31, 2024.

Q1 2024 Key Highlights

| · | Total Revenue was $14.9M in Q1 2024 compared to $13.0M in Q1 2023, a 15.0% year-over-year increase |

| · | Gross profit was $5.6M in Q1 2024 compared to $4.9M in Q1 2023, a 13.3% year-over-year increase |

| · | Executed Letter of Intent to Sell 1847 Cabinets Inc. for $27.6 Million |

| · | Executed non-binding LOI to acquire a large, established millwork, cabinetry and door manufacturer based

in Las Vegas, NV with revenues of $28.6 million, with a purchase price of $16.75 million which represents approximately 3.2x 2023 EBITDA |

| · | Announced ICU Eyewear subsidiary diversified manufacturing to reduce production costs and fortify supply

chain |

| · | Announced ICU Eyewear subsidiary’s strategic expansion of partnerships, adding 300 new locations

with leading US retailer |

| · | Completed refinancing and upsizing of $15 million revolving credit facility for ICU Eyewear subsidiary |

| · | Expanded Wolo Manufacturing Corp subsidiary into India through supply chain diversification program |

| · | Restructured promissory notes to non-dilutive debt instruments |

| · | Divested Asien’s Appliance business, significantly enhancing balance sheet |

Mr. Ellery W. Roberts, CEO of 1847 Holdings, commented,

“I am pleased to report we achieved a 15.0% year-over-year increase in revenue and a 13.3% year-over-year increase in gross profit.

Additionally, revenues from the automotive supply segment increased by 41.1% to $1.8 million. This growth can be attributed to strategic

initiatives begun in Q4 2023, coupled with a new credit facility established in late January 2024, further empowering the acceleration

of this business segment's expansion. This achievement reaffirms the substantial value that 1847 delivers to our subsidiaries, both financially

and operationally. During the quarter, we successfully divested of our Asien’s Appliance, significantly enhancing our balance sheet.

This resulted in a $1.1 million gain for Q1 2024. By strategically divesting of Asien’s, we anticipate a reduction in 1847 Holdings'

expenses by approximately $10.9 million annually, which should positively impact margins across our primary business lines. The divestiture

of Asien’s enables us to streamline operations, optimize resource allocation, and position 1847 Holdings for sustained growth and

profitability. This underscores our commitment to delivering shareholder value, as we continue to pursue opportunities for growth and

enhanced profitability, in alignment with our long-term strategic goals.”

Mr. Ellery continued, “We're maintaining a strong

acquisition pipeline, focusing on companies offering value and positive cash flow, while minimizing dilution for shareholders. Recently,

we announced a non-binding LOI to acquire a prominent millwork, cabinetry, and door manufacturer headquartered in Las Vegas, NV. This

target boasts revenues of $28.6 million, with a purchase price of $16.75 million which represents approximately 3.2x 2023 EBITDA. This

acquisition presents an attractive opportunity for 1847, with favorable negotiated terms and the potential to complete the transaction

without equity-based funding at this time.”

“Additionally, we executed a non-binding LOI

to sell all of the assets of 1847 Cabinets Inc. Under the terms of the LOI, the buyer has proposed an enterprise value of $27.6 million

for the acquisition of all of the assets of 1847 Cabinets, including $11.5 million in earn-out payments over a three-year period, representing

a 5.91x multiple of 2023 EBITDA of approximately $4.7 million. We are advancing this transaction and anticipate closing within 90 days.

Proceeds from the sale will be utilized to repay senior secured debt and other liabilities, allocate funds for working capital and future

acquisitions, and potentially initiate a share repurchase program. This strategic move validates our ability to purchase, operate, and

enhance asset value, thereby strengthening our financial position and enabling strategic resource reallocation to capitalize on emerging

opportunities within our portfolio and beyond,” concluded Mr. Roberts.

Q1 2024 Financial Highlights

Total revenues were $14,913,497 for the three months

ended March 31, 2024, as compared to $12,965,603 for the three months ended March 31, 2023.

| · | Revenues from the retail and eyewear segment were $3,896,167 for the three months ended March 31, 2024

and $2,792,712 for the period from February 9, 2023 (date of acquisition) to March 31, 2023. |

| · | Revenues from the construction segment increased by $326,244, or 3.7%, to $9,238,969 for the three months

ended March 31, 2024 from $8,912,725 for the three months ended March 31, 2023. The increase in revenues was primarily attributed to an

increase in new multi-family projects and an increase in the average customer contract value. |

| · | Revenues from the automotive supplies segment increased by $518,195, or 41.1%, to $1,778,361 for the three

months ended March 31, 2024 from $1,260,166 for the three months ended March 31, 2023. The increase in revenues was primarily attributed

to an improved supply chain with manufacturers and heightened customer demand. |

Total cost of revenues was $9,325,561 for the three

months ended March 31, 2024, as compared to $8,032,294 for the three months ended March 31, 2023.

| · | Cost of revenues for the retail and eyewear segment was $2,998,933, or 77.0% of retail and eyewear revenues,

for the three months ended March 31, 2024, and $1,947,011, or 69.7% of retail and eyewear revenues, for the period from February 9, 2023

(date of acquisition) to March 31, 2023. |

| · | Cost of revenues for the construction segment decreased by $216,761, or 4.0%, to $5,158,266 for the three months ended March 31, 2024

from $5,375,027 for the three months ended March 31, 2023. |

| · | Cost of revenues for the automotive supplies segment increased by $458,106, or 64.5%, to $1,168,362 for the three months ended March

31, 2024 from $710,256 for the three months ended March 31, 2023. |

Total general and administrative expenses were $2,132,600

for the three months ended March 31, 2024, as compared to $1,501,639 for the three months ended March 31, 2023.

Total professional fees were $3,025,149 for the three

months ended March 31, 2024, as compared to $387,821 for the three months ended March 31, 2023.

Total operating expenses were $18,023,128 for the

three months ended March 31, 2024, as compared to $12,922,180 for the three months ended March 31, 2023, resulting in a loss from operations

of $3,109,631 for the three months ended March 31, 2024, as compared to income from operations of $43,423 for the three months ended March

31, 2023.

Net loss from continuing operations was $11,156,579

for the three months ended March 31, 2024, as compared to a net income of $1,152,096 for the three months ended March 31, 2023. Such change

was primarily due to an increase of amortization of debt discounts by $3,262,939 and losses on change in fair value of warrant liabilities

of $1,902,200, on change in fair value of derivative liabilities of $612,462 and on extinguishment of debt of $421,875 in the 2024 period.

Additionally, the net income for the 2023 period included a preliminary gain on bargain purchase of $2,639,861.

About 1847 Holdings LLC

1847 Holdings LLC (NYSE American: EFSH), a publicly

traded diversified acquisition holding company, was founded by Ellery W. Roberts, a former partner of Parallel Investment Partners, Saunders

Karp & Megrue, and Principal of Lazard Freres Strategic Realty Investors. 1847 Holdings' investment thesis is that capital market

inefficiencies have left the founders and/or stakeholders of many small business enterprises or lower-middle market businesses with limited

exit options despite the intrinsic value of their business. Given this dynamic, 1847 Holdings can consistently acquire businesses it views

as "solid" for reasonable multiples of cash flow and then deploy resources to strengthen the infrastructure and systems of those

businesses in order to improve operations. These improvements may lead to a sale or IPO of an operating subsidiary at higher valuations

than the purchase price and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to 1847 Holdings' ability

to pay regular and special dividends to shareholders. For more information, visit.

For the latest insights, follow 1847 on Twitter.

Forward-Looking Statements

This press release

may contain information about 1847 Holdings' view of its future expectations, plans and prospects that constitute forward-looking statements.

All forward-looking statements are based on our management's beliefs, assumptions and expectations of our future economic performance,

taking into account the information currently available to it. These statements are not statements of historical fact. Forward-looking

statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause our

actual results, performance or financial condition to be materially different from the expectations of future results, performance or

financial position. Our actual results may differ materially from the results discussed in forward-looking statements. Factors that might

cause such a difference include but are not limited to the risks set forth in "Risk Factors" included in our SEC filings.

Contact:

Crescendo Communications, LLC

Tel: +1 (212) 671-1020

Email: EFSH@crescendo-ir.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

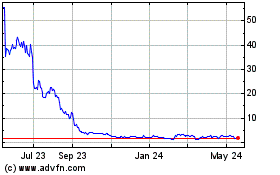

1847 (AMEX:EFSH)

Historical Stock Chart

From Nov 2024 to Dec 2024

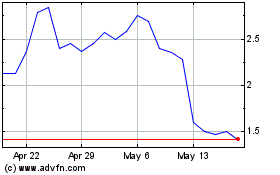

1847 (AMEX:EFSH)

Historical Stock Chart

From Dec 2023 to Dec 2024