0001366868FALSE00013668682024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2024

GLOBALSTAR, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-33117 | 41-2116508 |

| (State or Other Jurisdiction of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

| 1351 Holiday Square Blvd. | |

| Covington, | LA | 70433 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (985) 335-1500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock, par value $0.0001 per share | GSAT | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Services Agreements

As previously disclosed, Globalstar, Inc. (the “Company” or “Globalstar”) is party to a terms agreement (as amended, the “Terms Agreement”) with its customer, Apple Inc. (together with its Related Entities (as defined in the Terms Agreement), “Customer”), which Terms Agreement (together with certain related ancillary agreements, the “Services Agreements”) contains terms and conditions governing the development, launch and operation of Satellite Services (as defined in the Terms Agreement).

Reference is made to the prior disclosures with respect to the Services Agreements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024 and the Company’s Current Reports on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2023 and September 7, 2022 (collectively, the “Prior Disclosures”).

Extended MSS Network

On October 29, 2024, the Company and Customer agreed to make certain amendments to the Services Agreements and entered into other related agreements (collectively, the “Updated Services Agreements”) for Globalstar to deliver expanded services to Customer over a new mobile satellite services (“MSS”) network, including a new satellite constellation, expanded ground infrastructure, and increased global MSS licensing (the “Extended MSS Network”). The Extended MSS Network will be owned by Globalstar Licensee, LLC, together with its subsidiaries (collectively, the “Globalstar SPE”), and operated by the Company.

As set forth below, Customer will prepay for certain services to be delivered by the Company to Customer’s end users utilizing the Extended MSS Network and will be a passive equity holder in Globalstar SPE.

The Globalstar SPE will hold certain network assets necessary for the Extended MSS Network and will not have commercial operations.

The Company will retain control of the board of managers of the Globalstar SPE and continue to operate and maintain the assets owned by and licenses granted to the Globalstar SPE. Globalstar will retain 100% of all terrestrial, MSS and other revenue and will continue to allocate 85% of its network capacity to render the Satellite Services to Customer across existing and new satellites as well as use the remaining capacity to service its other MSS customers.

Network Assets and Funding

The Updated Services Agreements provide that Customer will make cash prepayments to the Company, including for approved capital expenditures in connection with the Extended MSS Network. These prepayments consist of: (1) an infrastructure prepayment (the “Infrastructure Prepayment”) of up to $1.1 billion as further described under Item 2.03 below, which is to be funded over the construction period on a quarterly basis, the proceeds of which the Globalstar SPE will use, together with the proceeds from the sale of the Customer Class B Units described below to pay amounts due for the Extended MSS Network (including, but not limited to, construction and launch costs) and (2) an amount necessary for the Company to retire at closing its outstanding 13.00% Senior Notes due 2029 (the “2029 Notes”) as further described under Item 1.02 below (the “Current Debt Repayment”). The Infrastructure Prepayment and the funds used for the Current Debt Repayment are contained within one prepayment agreement (the “2024 Prepay Agreement”), as further detailed below.

Customer has agreed to purchase 400,000 Class B Units in the Globalstar SPE (the “Customer Class B Units”), representing a 20% equity interest, for $400 million to be paid upon the closing which is currently expected to occur on or about November 5, 2024, subject to satisfaction of closing conditions.

Service Fees

As consideration for the Satellite Services as set forth in the Updated Services Agreements, the incremental service fees due from Customer to the Company include fees tied to the cost of the Extended MSS Network, fees for providing additional related services, fees tied to expenses incurred for the provision of such services, and performance bonuses. A portion of these payments is subject to the satisfaction of certain licensing, service levels and milestone achievements. Additionally, the Updated Services Agreements also provide for certain service fees of $30 million annually to be accelerated.

Certain Obligations of Globalstar

Refer to Item 2.03 below for a discussion of the repayment of amounts due under the 2024 Prepay Agreement.

The parties have agreed to certain equity repurchase provisions with respect to the Customer Class B Units, including the right of the Company to call the Customer Class B Units, and the right of Customer to cause the Company or the Globalstar SPE to purchase or redeem, as applicable, a portion of the Customer Class B Units on a quarterly basis beginning in the first full quarter following recovery by Customer of all amounts due under the 2024 Prepay Agreement. Redemption may occur earlier in the event of certain Company breaches as described in Item 2.03 below, in each case subject to the terms and conditions of the Updated Services Agreements.

In addition, the parties agreed to certain amendments to the 2023 Funding Agreement (as defined in Prior Disclosures) and certain related agreements, including: (1) elimination of cash sweeps; (2) relaxation of certain covenant levels; (3) a one-year deferral of the start of the repayment period from the third quarter of 2025 to the third quarter of 2026; and (4) an amendment to the existing security agreement to provide first lien security with respect to the Company’s obligations under the 2024 Prepay Agreement.

Termination and Breaches

The Updated Services Agreements may be terminated by either party subject to certain notice requirements and, in some cases, other conditions and, depending on the type of termination, certain limitations on the Company’s ability to take certain actions, in each case as further set forth in Item 2.03 below. In the event of a breach by the Company of certain material obligations, the Updated Services Agreements provide for certain remedies for Customer, including, among other things, additional rights until a cure is effected.

The information set forth in Item 2.03 below is incorporated in this Item 1.01 by reference.

The descriptions of the Terms Agreement, the 2024 Prepay Agreement and the other Updated Services Agreements are qualified in their respective entireties by reference to such agreements which the Company expects to file with its Form 10-K for the year ending December 31, 2024.

Item 1.02 Termination of a Material Definitive Agreement.

The Company will use a portion of the cash proceeds received from Customer, as described in Item 1.01 above, for the Current Debt Repayment, consisting of the aggregate principal amount outstanding of the 2029 Notes of $219 million plus make-whole fees of $13 million, pursuant to the terms of the 2029 Notes, and to discharge the related Indenture, dated as of March 31, 2023, by and among the Company, the subsidiary guarantors party thereto and Wilmington Trust, National Association, as trustee.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 above with respect to the 2024 Prepay Agreement is incorporated in this Item 2.03 by reference.

Globalstar will use the proceeds from the Infrastructure Prepayment and sale of the Customer Class B Units to fund the capital requirements for the Extended MSS Network. As the Company receives proceeds from the Infrastructure Prepayment, the Company will record a liability on its balance sheet for its obligation to perform future services to Customer. In addition to other service fees, as Globalstar provides the new services, the Company will receive additional service fees and will use these fees to fully pay down the Infrastructure Prepayment liability as well as to repurchase or redeem all Customer Class B Units over time.

The full paydown of the 2024 Prepay Agreement and the redemption of the Customer Class B Units are expected to be completed within the design useful life of the new satellites. The Company expects that such amounts payable to Customer will be set off with amounts payable by Customer. The Current Debt Repayment and a portion of the Infrastructure Prepayment may accrue annual fees, as provided in the 2024 Prepay Agreement. Such fees payable to Customer will be reduced or eliminated entirely if the Company meets certain defined milestones.

Subject to certain conditions, if the Company fails to perform certain obligations under the Updated Services Agreements or if Customer terminates the Updated Services Agreements under certain scenarios, the Company would be required to repay amounts advanced under the 2024 Prepayment Agreement and to redeem the Customer Class B Units. Depending on the nature of termination, such repayment and redemption could include paying a percentage of revenue attributable to the Company’s utilization of the Extended MSS Network after such termination, paying a portion of total cash flow, in accordance with the mechanisms set forth in the Updated Services Agreements, or immediate repayment and redemption. During any post-termination repayment and redemption period, the Company may be subject to certain limitations, including, among others, with respect to the incurrence of indebtedness, the payment of dividends and capital expenditures.

Item 3.02 Unregistered Sales of Equity Securities.

If the Company or the Globalstar SPE, as applicable, either does not have sufficient cash or accounts receivable from Customer to timely consummate, or does not otherwise timely consummate, the purchase or redemption of Customer Class B Units from Customer after full repayment of the Infrastructure Prepayment, Customer will be entitled, upon notice to the Company, to require the Company to purchase all (or a portion) of such Customer Class B Units in exchange for shares of common stock of the Company based on a five day average volume weighted price ending on the trading day immediately prior to the date of such notice. The issuance of such shares of Company common stock to Customer would not be registered under the Securities Act of 1933 (the “Securities Act”), in reliance on the exemption from registration pursuant to Section 4(a)(2) of the Securities Act. The information set forth in Item 1.01 above is incorporated in this Item 3.02 by reference.

Item 7.01 Regulation FD Disclosure.

In the first annual period following the launch of the expanded Satellite Services, the Company estimates that its total annual revenue is expected to be more than double 2024 annualized levels with an improved EBITDA margin. Excluded from these numbers is upside from, among other areas, terrestrial spectrum and XCOM RAN, which, by their nature are difficult to precisely forecast. The Company remains focused on successfully executing on terrestrial opportunities in addition to driving growth through the monetization of available satellite capacity.

There is no assurance that the Company will receive all of the revenue estimated or expected under the Updated Services Agreements. The assumptions and estimates of the Company’s future performance, financial condition and liquidity are necessarily subject to uncertainty and risk due to a variety of factors, including, without limitation, those described under Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in the Company’s other filings with the SEC and as further described under “Forward-Looking Statements” below.

The Company will host an in-person investor day in December 2024 to provide additional details and updates on its competitive strengths and business strategy and answer questions from investors and analysts.

The information in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any Company filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

Certain statements contained in or incorporated by reference into this Current Report on Form 8-K, other than purely historical information, including, but not limited to, statements regarding the Satellite Services and other terms, conditions and matters under the Terms Agreement, the 2024 Prepay Agreement and the other Services Agreements and Updated Services Agreements, expectations and timing regarding the Satellite Services (and the related construction and launch agreements), expectations regarding sources or set off of payment of obligations, and expectations regarding future revenue, financial performance, financial condition, liquidity, projections, estimates and guidance, and the assumptions upon which those statements are based, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements involve predictions and are based on current expectations and assumptions that are subject to risks and uncertainties. We caution readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Risks and uncertainties that could cause or contribute to such differences include, without limitation, those described under Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in the Company’s other filings with the SEC. The Company undertakes no obligation to update any of the forward-looking statements after the date of this Current Report to reflect actual results, future events or circumstances or changes in our assumptions, business plans or other changes.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| GLOBALSTAR, INC. |

|

|

| /s/ Rebecca S. Clary |

| Rebecca S. Clary |

| Chief Financial Officer (Principal Financial Officer) |

Date: November 1, 2024

v3.24.3

Cover

|

Oct. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 29, 2024

|

| Entity Registrant Name |

GLOBALSTAR, INC.

|

| Entity Address, City or Town |

Covington,

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33117

|

| Entity Tax Identification Number |

41-2116508

|

| Entity Address, Address Line One |

1351 Holiday Square Blvd.

|

| Entity Address, State or Province |

LA

|

| Entity Address, Postal Zip Code |

70433

|

| City Area Code |

985

|

| Local Phone Number |

335-1500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

GSAT

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001366868

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

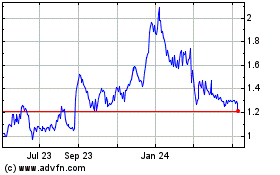

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Dec 2024 to Jan 2025

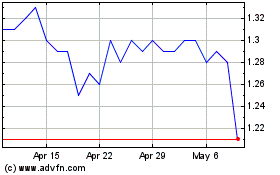

Globalstar (AMEX:GSAT)

Historical Stock Chart

From Jan 2024 to Jan 2025