false

0000946563

0000946563

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

| Date

of Report (Date of earliest event reported) |

November 14, 2024 |

Retractable

Technologies, Inc.

(Exact name of registrant

as specified in its charter)

| Texas |

001-16465 |

75-2599762 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 511

Lobo Lane, Little

Elm, Texas |

75068-5295 |

| (Address of principal executive

offices) |

(Zip Code) |

| Registrant's

telephone number, including area code |

(972)

294-1010 |

None

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock |

RVP |

NYSE

American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging

growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On November 14, 2024,

the Company issued a press release, a copy of which is attached to this Form 8-K as Exhibit 99, announcing results for the periods

ended September 30, 2024.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| 104 | Cover Page Interactive Date File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| DATE: November 14, 2024 |

RETRACTABLE TECHNOLOGIES, INC. |

| |

(Registrant) |

| |

|

|

| |

BY: |

/s/ John W. Fort III |

| |

|

JOHN W. FORT III |

| |

|

VICE PRESIDENT, CHIEF FINANCIAL OFFICER, AND CHIEF ACCOUNTING OFFICER |

Exhibit 99

RETRACTABLE TECHNOLOGIES, INC. RESULTS

FOR THE PERIODS ENDED SEPTEMBER 30, 2024

LITTLE

ELM, TEXAS, November 14, 2024 — Retractable Technologies, Inc. (NYSE American: RVP) reports total net sales of $10.3

million for the third quarter of 2024 and an operating loss of $5.1 million for the period, as compared to total net sales for the

same period last year of $10.3 million and an operating loss of $936 thousand. For the first nine months of the year, net

sales were $24.0 million and operating losses were $13.9 million as compared to 2023 net revenues of $29.3 million and operating

losses of $8.7 million. The decline in gross profit in the third quarter of 2024 was primarily due to a decrease in the average

selling price, a drop in international sales, and rising production costs. The decline in international sales had a material impact

on lower net revenues in the nine-month period ended September 30, 2024.

In September 2024, a new 100% tariff on syringes

and needles imported from China became effective. No tariffs were incurred during the periods ended September 30, 2024. However,

to date, the Company has incurred $568 thousand in tariff expenses and, due to existing orders from the Company’s Chinese manufacturers,

the Company expects to incur a total of approximately $1.5 million in tariff expenses through February 2025. The Company is working

to lessen the financial impact of the tariffs, including shifting a larger portion of manufacturing of 1mL, 3mL, and EasyPoint® needles

to its domestic manufacturing facility, but while these actions would decrease tariff expenses, they would lead to an increase in compensation

expense as it hires additional manufacturing personnel. Certain products must be purchased from third party suppliers as the Company does

not currently have the machinery to manufacture its entire product line in its U.S. facility. When equipment was added to the U.S. facility

pursuant to the Technology Investment Agreement (“TIA”), it was strictly for product lines typically used in the administration

of vaccines, as required by the TIA.

The Company has sued the United States

Trade Representative and other defendants involved in the issuance of the recent tariff adjustment seeking an injunction and,

ultimately, a decision that the tariffs be set aside, as well as certain costs, fees, and other relief. Some of the requests for

injunctions were denied and therefore the Company is currently subject to the tariffs during the pendency of the case.

A material portion of the net losses of $15.7

million for the nine months ended September 30, 2024 is comprised of the approximately $8.4 million change in valuation allowance

on the deferred tax asset which occurred in the second quarter of 2024. Based on current information, it is more likely than not that

the Company will not be in a position to use loss carryforwards against future taxable net income based on a variety of factors and accounting

guidelines. The implementation of tariffs on imported syringes from China was one of the factors considered in this determination.

Retractable reports the following results of operations

for the three and nine months ended September 30, 2024 and 2023, respectively. Further details concerning the results of operations,

as well as other matters, are available in Retractable’s Form 10-Q filed on November 14, 2024 with the U.S Securities

and Exchange Commission.

Comparison of Three Months Ended September 30,

2024 and September 30, 2023

Domestic

sales accounted for 93.1% and 90.9% of the revenues for the three months ended September 30, 2024 and 2023, respectively. Domestic

revenues were essentially flat while domestic unit sales increased 29.6%. Domestic unit sales were 92.4% of total unit sales for the three

months ended September 30, 2024. The increase in unit sales not contributing to domestic revenues was primarily driven by a decrease

in the average selling price, largely due to higher sales of EasyPoint® needles, which typically have a lower average

selling price. International revenues decreased approximately 23.8%. The decrease in international revenues is primarily due to the timing

of international shipments. Overall unit sales increased 22%. There is uncertainty as to the timing of future international orders.

Cost

of manufactured product increased 81.6% principally due to a rise in the volume of units sold, higher period costs associated with

increased sales, and additional period costs related to increased domestic production activities. Royalty expense increased 11.4% primarily

due to the increase in gross sales and royalties received from sublicenses.

The gross profit margin decreased from 41.8% to

(0.1%) for the three months ended September 30, 2024. This decline was primarily driven by a decrease in the average selling price,

a drop in international sales, and rising production costs. Despite the increase in unit sales, these factors contributed to the overall

reduction in gross profit.

Operating

expenses were essentially flat, with a slight decrease of 2.6% compared to the three months ended September 30, 2023.

The loss from operations was $5.1 million compared

to a loss of $936 thousand for the same period last year. The increased loss was due to lower gross profit for the current period.

The unrealized gain on debt and equity securities

was $1.5 million due to the increased market values of those securities.

The benefit for income taxes was $31 thousand

for the third quarter of 2024 as compared to a benefit for income taxes of $1.2 million in the third quarter of 2023. This change is primarily

due to the increase in valuation allowance on the deferred tax asset in the second quarter of 2024.

Tariffs are expected to materially increase costs

in future periods.

Comparison of Nine Months Ended September 30,

2024 and September 30, 2023

Domestic

sales accounted for 88.8% and 75.5% of the revenues for the nine months ended September 30, 2024 and 2023, respectively. Domestic

unit sales increased 10.7% while domestic revenues decreased 3.8% primarily due to the mix of products sold. This decline in revenues

was largely driven by a decrease in the average selling price, mainly resulting from increased sales of EasyPoint®

needles, which typically have a lower average selling price. Domestic unit sales were 87.6% of total unit sales for the nine months ended

September 30, 2024. International revenues decreased approximately 62.6% predominately due to fewer international vaccination-related

sales. Overall unit sales decreased 16.1%. There is uncertainty as to the timing of future international orders.

Cost

of manufactured product remained largely consistent, with a slight increase of 4.4%. This change was primarily driven by a decrease

in the volume of units sold, partially offset by higher period costs associated with increased domestic production activities.

Operating

expenses decreased 5.7% from the prior year. This is substantially due to a reduction of property tax expense as a result of newly enacted

property tax exemption legislation relating to medical device property. The decrease was partially offset by an increase in sales

and marketing expenses.

The loss from operations was $13.9 million compared

to a loss of $8.7 million for the same period last year. The increased loss was due to lower gross profit for the current period.

The unrealized gain on debt and equity securities

was $1.4 million due to the increased market values of those securities.

The provision for income taxes was $8.4 million

for the first nine months of 2024 as compared to a benefit for income taxes of $1.9 million in the first nine months of 2023. The year-to-date

income tax provision is primarily related to fully reserving the deferred tax asset in the second quarter of 2024.

Tariffs are expected to materially increase costs

in future periods.

ABOUT RETRACTABLE

Retractable manufactures and markets VanishPoint®

and Patient Safe® safety medical products and the EasyPoint® needle. The VanishPoint® syringe,

blood collection, and IV catheter products are designed to prevent needlestick injuries and product reuse by retracting the needle directly

from the patient, effectively reducing exposure to the contaminated needle. Patient Safe® syringes are uniquely designed

to reduce the risk of bloodstream infections resulting from catheter hub contamination. The EasyPoint® is a retractable

needle that can be used with luer lock syringes, luer slip syringes, and prefilled syringes to give injections. The EasyPoint®

needle also can be used to aspirate fluids and for blood collection. Retractable's products are distributed by various specialty and general

line distributors.

For

more information on Retractable, visit its website at www.retractable.com.

Forward-looking statements in this press release

are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 and reflect Retractable's current

views with respect to future events. Retractable believes that the expectations reflected in such forward-looking statements are accurate.

However, Retractable cannot assure you that such expectations will materialize. Actual future performance could differ materially from

such statements.

Factors that could cause or contribute to such

differences include, but are not limited to: material changes in demand, tariffs, Retractable's ability to maintain liquidity; Retractable's

maintenance of patent protection; Retractable's ability to maintain favorable third party manufacturing and supplier arrangements and

relationships; foreign trade risk; Retractable's ability to access the market; production costs; the impact of larger market players in

providing devices to the safety market; and other risks and uncertainties that are detailed from time to time in Retractable's periodic

reports filed with the U.S. Securities and Exchange Commission.

Retractable Technologies, Inc.

John W. Fort III, 888-806-2626 or 972-294-1010

Vice President, Chief Financial Officer, and Chief

Accounting Officer

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

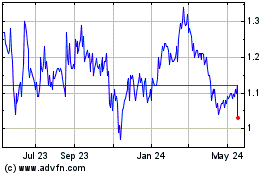

Retractable Technologies (AMEX:RVP)

Historical Stock Chart

From Nov 2024 to Dec 2024

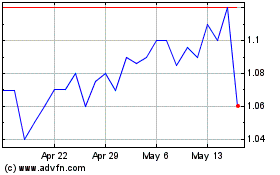

Retractable Technologies (AMEX:RVP)

Historical Stock Chart

From Dec 2023 to Dec 2024