Crown Receives Merger Proposal from Rival Star; Blackstone Lifts Bid

10 May 2021 - 9:13AM

Dow Jones News

By Mike Cherney

SYDNEY--Australian casino operator Crown Resorts Ltd. said it

received a proposal from rival The Star Entertainment Group Ltd. to

merge the two companies, just as Blackstone Group Inc. increased

its previously announced bid for Crown.

Crown, which operates casinos in Melbourne and Perth and

recently completed a new skyscraper on Sydney's waterfront, said it

has not yet formed a view on the merits of the proposals.

Crown also announced that it has appointed Steve McCann as its

new chief executive. Mr. McCann is currently group chief executive

of real-estate developer Lendlease Group.

Star's merger proposal contemplates a nil-premium share exchange

ratio of 2.68 Star shares for each Crown share. The merger proposal

also includes a cash alternative of 12.50 Australian dollars

(US$9.81) per Crown share, subject to a cap of 25% of Crown's total

shares.

Assuming the cash alternative is fully taken up, the proposal

would result in the merged entity being 59% owned by Crown

shareholders and 41% by Star shareholders. Star said the share

exchange would value Crown shares at more than A$14 per share.

Meanwhile, Blackstone said it would increase its offer to

A$12.35 per share for Crown. That's an increase of 50 Australian

cents per share over its prior offer.

Write to Mike Cherney at mike.cherney@wsj.com

(END) Dow Jones Newswires

May 09, 2021 18:58 ET (22:58 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

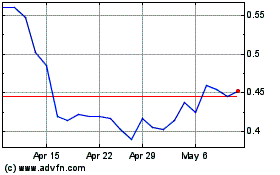

Star Entertainment (ASX:SGR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Star Entertainment (ASX:SGR)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Star Entertainment Group Limited (Australian Stock Exchange): 0 recent articles

More Star Entertainment Group Limited News Articles