Solana DeFi Momentum Soars With $5.7 Billion Locked In Q3

04 November 2024 - 9:00AM

NEWSBTC

Solana continues to prove that it’s one of the top blockchains for

this cycle. After its rally, which gained 35% over the past 60

days, the popular Layer 1 blockchain is back in the news with more

on-chain activities. According to recent data, Solana’s DeFi Total

Value Locked or TVL increased to $5.7 billion in the third quarter,

reflecting a 26% improvement from the previous quarter. Related

Reading: Will Bitcoin Hit $176K? Anthony Scaramucci Lays Out His

High-Stakes Forecast Kamino, a crypto lending service, leads the

count with $1.5 billion in TVL and an impressive 7%

Quarter-on-Quarter growth, helped by jupSOL and PYUSD additions.

Recent data also suggests that Solana’s market cap is now $3.8

billion, an improvement of 23%, boosted by the integration of

PayPal’s PYUSD. DeFI Continues To Drive Growth For Solana Solana

DeFi tops the chain’s activities with a total locked value, worth

$5.7 billion. This latest SOL data reflects a solid 26% growth QoQ,

pushing the blockchain to become third largest in this metric,

surpassing Tron. In a Messari report, Solana’s TVL increased due to

increased activities for Kamino, which accounted for $1.5 billion

of the total contracts locked. Kamino’s recent quarterly figure

represents a 57% rise, thanks to the recent integration of jupSOL

and PYUSD. Aside from Kamino Finance, Solana’s blockchain featured

locked assets for Raydium, with $1.1 billion, and Jupiter, with

$749 million. Kamino Finance’s impressive performance is linked to

its Kamino Lend V2 launch, offering a permissionless vault and

market layer. Analysts expect Kamino Finance to continue its

dominance by adding new projects like the Spot Leverage and Lending

Orderbook. Solana DEX Shows Signs Of Slowing Down Solana’s DEX

activity was down 10% QoQ but rebounded a bit by October. The

average daily volume on the blockchain’s exchange hit $1.7 billion,

largely because of a fall in meme coins. Raydium retains its

dominance on Solana’s DEX, with a 51% market share, although its

daily average volume dipped by 13% to $852 million. The volume

increased by $350 million with the release of Moonshot, a crypto

mobile trading app. Jupiter also stayed at the top, cornering 43%

of the total spot exchange volume. Recent developments, including

the release of Jupiter Mobile and the integration of Google Pay and

Apple Pay, helped the platform. Related Reading: Bitcoin Breaks

$73,000, Yet Google Searches Stay Stagnant—Is Hype Fading? SOL’s

Stablecoins Get Help From PYUSD In the same Messari report,

PayPal’s PYUSD lifts SOL’s stablecoin market. The PYUSD was

launched in May in Solana, which is mainly instrumental in its

market cap growth, which now stands at $3.8 billion. With exciting

features like programmable transfers and transfer hooks, PayPal’s

PYUSD became instantly popular. Aside from PYUSD, USDC also

contributes to Solana’s stablecoins market. Circle’s integration of

Web 3.0 services for SOL provides enterprise functionality features

like fee sponsorship and programmable wallets, allowing developers

to integrate multi-chain solutions quickly. Featured image from

StormGain, chart from TradingView

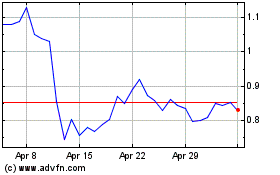

Mina (COIN:MINAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

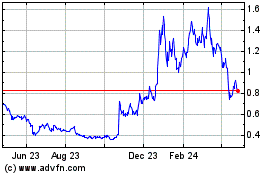

Mina (COIN:MINAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024