Bitcoin Traders Fearful For First Time Since October: Buying Signal?

04 February 2025 - 8:30AM

NEWSBTC

Data shows the sentiment among Bitcoin traders has plunged into the

fear territory following the crash in the cryptocurrency’s price.

Bitcoin Fear & Greed Index Has Plummeted During The Past Day

The “Fear & Greed Index” refers to an indicator devised by

Alternative that tells us about the average sentiment that’s

currently present in the Bitcoin and wider cryptocurrency markets.

This metric makes use of a numerical scale that runs from zero to

hundred for representing the market mentality. All values above the

53 mark correlate to the investors sharing a sentiment of greed,

while those under 47 suggest the presence of fear in the sector.

The region in-between these cutoffs corresponds to a net neutral

sentiment. Related Reading: Stablecoins See Positive Momentum: Will

This Lead To New Bitcoin All-Time High? Besides these three main

regions, there are also two special zones known as the extreme fear

and extreme greed. The former occurs below 25 and the latter above

75. Now, here is how the latest market sentiment has looked

according to the Bitcoin Fear & Greed Index: As is visible

above, the indicator has a value of 44, which suggests the traders

in the sector are being fearful at the moment. This is a drastic

change from how the market has been recently, as the below chart

displays. On the 31st of last month, the Bitcoin Fear & Greed

Index had a value of 76, meaning that the market sentiment was

inside the extreme greed territory. Just three days later, the

trader’s opinion has completely flipped. The rapid deterioration in

sentiment is a result of the bearish price action that the asset

has witnessed this month, which has culminated in a crash during

the past day. If history is to go by, though, the skepticism that

has developed among the investors may actually be a positive sign

for BTC’s price. Bitcoin and other digital assets often tend to

move in a direction that’s opposite to what the crowd is expecting.

The probability of such a contrary move taking place only rises the

stronger the investors’ belief becomes. Related Reading: Bitcoin

HODLer Selloff Extends To 1.1 Million BTC As Profit-Taking

Continues Extreme greed and extreme fear are where this likelihood

is the strongest, so major tops and bottoms have historically

formed when the Fear & Greed Index has been in these regions.

The top last month, for instance, also occurred alongside extreme

greed. Traders who follow an investing philosophy called contrarian

trading exploit this fact to time their moves. Warren Buffet‘s

famous quote sums up the idea: “Be fearful when others are greedy,

and greedy when others are fearful.” While the market sentiment

hasn’t quite worsened into extreme fear yet, the fact that the

metric is at its lowest value since October could still be a sign

that a contrarian trader may be looking for. It now remains to be

seen whether the current level of fear would be enough for Bitcoin

to bottom out, or if a further drop will happen first. BTC Price At

the time of writing, Bitcoin is floating around $95,200, down

around 4% in the last 24 hours. Featured image from Dall-E,

Alternative.me, chart from TradingView.com

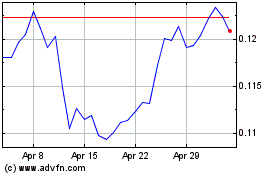

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025