false

0001513525

0001513525

2025-03-04

2025-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (date of earliest event reported):

March 4, 2025

Adial Pharmaceuticals, Inc.

(Exact name of registrant as specified in charter)

| Delaware |

|

001-38323 |

|

82-3074668 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

4870 Sadler Road, Ste 300

Glen Allen, VA 23060

(Address of principal executive offices and zip

code)

(804) 487-8196

(Registrant’s telephone number including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ADIL |

|

The Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On March 4, 2025, Adial Pharmaceuticals, Inc.,

a Delaware corporation (the “Company”), issued a press release that included financial information for the fiscal year ended

December 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and in the press

release attached as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2)

of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the press release attached as Exhibit 99.1

to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission

made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following

exhibits are furnished with this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: March 4, 2025 |

ADIAL PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Cary J. Claiborne |

| |

Name: |

Cary J. Claiborne |

| |

Title: |

President and Chief Executive Officer |

2

Exhibit 99.1

Adial Pharmaceuticals

Reports 2024 Fiscal Year Financial Results

and Provides Business Update

Glen Allen, VA – March 4, 2025 –

Adial Pharmaceuticals, Inc. (NASDAQ: ADIL) (“Adial” or the “Company”), a clinical-stage biopharmaceutical

company focused on developing therapies for the treatment and prevention of addiction and related disorders, today provided a business

update and reported its financial results for the 2024 fiscal year ended December 31, 2024.

Key Highlights

| ● | Successful completion of AD04-103 pharmacokinetics

(PK) study of AD04, corroborating bioavailability, dose proportionality, no food effect, and safety profile consistent with the use of

Ondansetron. |

| ○ | Advancement towards pivotal Phase 3 trial design supportive of ongoing partnership discussions. |

| ● | FDA confirmation of proposed 505(b)(2) bridging strategy leveraging

the results from AD04-103—a relative bioavailability food-effect study—along with in vitro dissolution data demonstrating

equivalence between the reference product and the planned commercial formulation of AD04. |

| ○ | FDA positive response confirms that design of data package would meet the requirements necessary to allow

for the progression of AD04 into Phase 3 clinical trials. |

| ● | With FDA confirmation, Adial is commencing

manufacturing of clinical supplies for Phase 3 clinical program in 2025. |

| ● | Secured several foundational patents, strengthening

IP portfolio in support of commercialization of AD04, including: |

| ○ | New U.S. patent granted expanding coverage

of Adial’s genetic-based approach to treating and diagnosing Alcohol Use Disorder (AUD) and other drug dependencies. |

| ○ | New U.S. Patent granted covering genotype-specific treatment of opioid-related disorders. |

| ○ | New U.S. Patent granted for the treatment of alcohol and drug dependence based on expanded genotype

combinations. |

“We achieved meaningful milestones in 2024,

leading to positive feedback from the U.S. Food and Drug Administration (FDA) regarding our proposed 505(b)(2) bridging strategy and the

initiation of clinical supply manufacturing for our upcoming Phase 3 trial this year,” said Cary Claiborne, CEO of Adial Pharmaceuticals.

“A key achievement was the completion of our pharmacokinetics (PK) study evaluating AD04, our investigational drug for the treatment

of Alcohol Use Disorder (AUD). This study assessed the PK profile, bioavailability, and food effect of AD04 near-micro doses compared

to marketed Ondansetron in healthy volunteers. The findings enabled the FDA to confirm the bridging requirements for our 505(b)(2) registration

pathway and support our planned micro-dosing regimen for the upcoming registrational trials.”

“In addition to the key highlights mentioned,

we strengthened our regulatory strategy by partnering with Boudicca Dx to advance the development of our companion diagnostic genetic

test for AD04. Boudicca Dx, a global leader in precision medicine testing, has been instrumental in ensuring our test meets FDA technical

and clinical validation standards. This collaboration played an important role in our discussions with the FDA and further solidified

our regulatory pathway.”

“With these foundational steps in place,

we are well-positioned to initiate our Phase 3 clinical trials in 2025. Our focus remains on advancing AD04 as efficiently as possible

to provide a much-needed treatment option for individuals struggling with addiction,” concluded Mr. Claiborne.

Other Developments

Management

On November 5, 2024, Adial announced the appointment

of Vinay Shah as the Company’s Chief Financial Officer. Mr. Shah is an accomplished Chief Financial Officer with over 25 years of

experience in the pharmaceutical, biopharmaceutical, and healthcare sectors, specializing in financial strategy, investor relations, and

operational efficiency.

Intellectual Property

On February 19, 2025, Adial announced patent number

12,226,401 was issued on February 18, 2025, by the United States Patent and Trademark Office (USPTO). The patent covers claims that focus

on a method for identifying genetic markers in patients with alcohol or opioid-related disorders including the AC genotype of rs17614942

in the HTR3B gene and the AG genotype of rs1150226 in the HTR3A gene.

On February 12, 2025, Adial announced patent number

12,221,654 was issued on February 11, 2025, by the USPTO. This patent expands the covered methods of identifying patients with specific

genetic markers linked to substance use disorders and treating them with AD04. The treatment approach involves detecting the TT genotype

of rs1042173 in the serotonin transporter gene (SLC6A4) and administering AD04.

On December 3, 2024, Adial announced patent number

12,150,931 was issued on November 26, 2024, by the USPTO. The patent covers a broader range of genotype combinations identified by the

Company’s proprietary genetic diagnostic for targeted treatment of alcohol use disorder (AUD) with AD04. These genotype combinations

include the HTR3A, HTR3B, and SLC6A4 receptor sites.

Commendation

On October 15, 2024, Adial applauded the National

Institute on Alcohol Abuse and Alcoholism (NIAAA) for its newly updated definition of recovery. The new definition, outlined and emphasized

in NIAAA’s 2025 Professional Judgement Budget (PJB) as reported to the U.S. Congress following an original introduction in an NIAAA

PJB, emphasizes a broader, non-abstinence approach to recovery, which aligns directly with Adial’s AD04 program, which has the potential

to offer patients the flexibility of reducing drinking and, or abstinence.

Fiscal Year 2024 Financial Results

| ● | Cash and cash equivalents were $3.8 million as of December 31, 2024, compared to $2.8 million as of December

31, 2023. The Company believes that its existing cash and cash equivalents will fund its operating expenses into the second half of 2025

based on currently committed development plans. |

| ● | Research and development expenses increased by approximately $1.9 million (155%) during the year ended

December 31, 2024, compared to the year ended December 31, 2023. The key drivers of this increase were an increase of approximately $1.4

million of direct clinical trial expenses associated with the PK study initiated in 2024, and an increase of approximately $813 thousand

of chemistry, manufacturing, and controls (CMC) expenses, as stability testing took place to support the PK study in 2024, and drug product

manufacturing was initiated to support the upcoming Phase 3 clinical program. |

| ● | General and administrative expenses decreased by approximately $491 thousand (9%) during the year ended

December 31, 2024, compared to the year ended December 31, 2023. This decrease was the result of lower corporate legal expenses of approximately

$269 thousand and a decrease in compensation of approximately $215 thousand, including equity-based compensation of G&A personnel. |

| ● | Net Loss was $13.2 million for the year ended December 31, 2024, compared to a net loss of $5.1 million

for the year ended December 31, 2023. The increase in net loss was primarily driven by non-cash charges of $4.5 million for an inducement

expense and $0.6 million loss on our equity method investment along with increases in R&D spending offset by a decrease in G&A

spending. |

About Adial Pharmaceuticals, Inc.

Adial Pharmaceuticals is a clinical-stage biopharmaceutical

company focused on the development of therapies for the treatment and prevention of addiction and related disorders. The Company’s

lead investigational new drug product, AD04, is a genetically targeted, serotonin-3 receptor antagonist, therapeutic agent for the treatment

of Alcohol Use Disorder (AUD) in heavy drinking patients and was recently investigated in the Company’s ONWARD™ pivotal Phase

3 clinical trial for the potential treatment of AUD in subjects with certain target genotypes identified using the Company’s proprietary

companion diagnostic genetic test. ONWARD showed promising results in reducing heavy drinking in heavy drinking patients, and no overt

safety or tolerability concerns. AD04 is also believed to have the potential to treat other addictive disorders such as Opioid Use Disorder,

gambling, and obesity. Additional information is available at www.adial.com.

If you are interested in exploring partnership

opportunities with Adial, we invite you to reach out to us (BD@adialpharma.com) to discuss how our joint efforts can bring about positive

change to the millions of patients who are struggling with addiction.

Forward-Looking Statements

This communication contains certain “forward-looking

statements” within the meaning of the U.S. federal securities laws. Such statements are based upon various facts and derived utilizing

numerous important assumptions and are subject to known and unknown risks, uncertainties and other factors that may cause actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such

forward-looking statements. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,”

“anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or

future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are

generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing. The forward-looking

statements include statements regarding being well-positioned to initiate Phase 3 clinical trials in 2025, advancing AD04 as efficiently

as possible to provide a much-needed treatment option for individuals struggling with addiction, existing cash and cash equivalents funding

operating expenses into the second half of 2025 and the potential of AD04 to treat other addictive disorders such as opioid use disorder,

gambling, and obesity. Any forward-looking statements included herein reflect our current views, and they involve certain risks and uncertainties,

including, among others, our ability to pursue our regulatory strategy, our ability to advance ongoing partnering discussions, our ability

to obtain regulatory approvals for commercialization of product candidates or to comply with ongoing regulatory requirements, our ability

to develop strategic partnership opportunities and maintain collaborations, our ability to obtain or maintain the capital or grants necessary

to fund our research and development activities, our ability to complete clinical trials on time and achieve desired results and benefits

as expected, regulatory limitations relating to our ability to promote or commercialize our product candidates for specific indications,

acceptance of our product candidates in the marketplace and the successful development, marketing or sale of our products, our ability

to maintain our license agreements, the continued maintenance and growth of our patent estate and our ability to retain our key employees

or maintain our Nasdaq listing. These risks should not be construed as exhaustive and should be read together with the other cautionary

statement included in our Annual Report on Form 10-K for the year ended December 31, 2023, subsequent Quarterly Reports on Form 10-Q and

current reports on Form 8-K filed with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date

on which it was initially made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result

of new information, future events, changed circumstances or otherwise, unless required by law.

Contact:

Crescendo Communications, LLC

David Waldman / Alexandra Schilt

Tel: 212-671-1020

Email: ADIL@crescendo-ir.com

v3.25.0.1

Cover

|

Mar. 04, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 04, 2025

|

| Entity File Number |

001-38323

|

| Entity Registrant Name |

Adial Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001513525

|

| Entity Tax Identification Number |

82-3074668

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4870 Sadler Road

|

| Entity Address, Address Line Two |

Ste 300

|

| Entity Address, City or Town |

Glen Allen

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23060

|

| City Area Code |

(804)

|

| Local Phone Number |

487-8196

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ADIL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

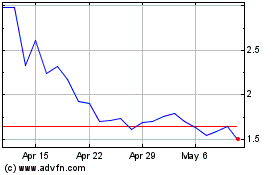

Adial Pharmaceuticals (NASDAQ:ADIL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Adial Pharmaceuticals (NASDAQ:ADIL)

Historical Stock Chart

From Mar 2024 to Mar 2025