DIVIDEND DECLARATIONS

Ares Capital Corporation (“Ares Capital”) (NASDAQ: ARCC)

announced that its Board of Directors has declared a third quarter

2024 dividend of $0.48 per share. The third quarter 2024 dividend

is payable on September 30, 2024 to stockholders of record as of

September 13, 2024.

JUNE 30, 2024 FINANCIAL RESULTS

Ares Capital also announced financial results for its second

quarter ended June 30, 2024.

OPERATING RESULTS

Q2-24(1)

Q2-23(1)

(dollar amounts in millions, except per

share data)

Total Amount

Per Share

Total Amount

Per Share

GAAP net income per share(2)(3)

$

0.52

$

0.61

Core EPS(4)

$

0.61

$

0.58

Dividends declared and payable

$

0.48

$

0.48

Net investment income(2)

$

358

$

0.58

$

314

$

0.57

Net realized gains (losses)(2)

$

12

$

0.02

$

(81)

$

(0.15)

Net unrealized (losses) gains(2)

$

(48)

$

(0.08)

$

98

$

0.19

GAAP net income(2)(3)

$

322

$

0.52

$

331

$

0.61

As of

(dollar amounts in millions, except per

share data)

June 30, 2024

December 31, 2023

Portfolio investments at fair value

$

24,973

$

22,874

Total assets

$

26,092

$

23,800

Stockholders’ equity

$

12,364

$

11,201

Net assets per share

$

19.61

$

19.24

Debt/equity ratio

1.06x

1.07x

Debt/equity ratio, net of available

cash(5)

1.01x

1.02x

____________________________________________

(1)

Net income can vary substantially from

period to period due to various factors, including the level of new

investment commitments, the recognition of realized gains and

losses and unrealized appreciation and depreciation. As a result,

quarterly comparisons of net income may not be meaningful.

(2)

All per share amounts and weighted average

shares outstanding are basic. The basic weighted average shares

outstanding for the three months ended June 30, 2024 and 2023 were

approximately 616 million and 547 million, respectively.

(3)

The basic and diluted weighted average

shares outstanding for the three months ended June 30, 2024 was

approximately 616 million shares. Ares Capital’s diluted GAAP net

income per share for the three months ended June 30, 2023 was

$0.59. The weighted average shares outstanding for the purpose of

calculating the diluted GAAP net income per share for the three

months ended June 30, 2023 was approximately 567 million shares,

which includes approximately 20 million shares related to the

assumed conversion of Ares Capital’s $403 million in aggregate

principal amount of unsecured convertible notes (the “2024

Convertible Notes”).

(4)

Core EPS is a non-GAAP financial measure.

Core EPS is the net increase (decrease) in stockholders’ equity

resulting from operations, and excludes net realized and unrealized

gains and losses, any capital gains incentive fees attributable to

such net realized and unrealized gains and losses and any income

taxes related to such net realized gains and losses, divided by the

basic weighted average shares outstanding for the relevant period.

GAAP net income (loss) per share is the most directly comparable

GAAP financial measure. Ares Capital believes that Core EPS

provides useful information to investors regarding financial

performance because it is one method Ares Capital uses to measure

its financial condition and results of operations. The presentation

of this additional information is not meant to be considered in

isolation or as a substitute for financial results prepared in

accordance with GAAP. Reconciliations of GAAP net income, the most

directly comparable GAAP financial measure, to Core EPS are set

forth in Schedule 1 hereto.

(5)

Computed as total principal debt

outstanding less available cash divided by stockholders’ equity.

Available cash excludes restricted cash as well as cash held for

uses specifically designated for paying interest and expenses on

certain debt.

“We reported another strong quarter with solid year-over-year

growth in both our Core EPS and net asset value per share,” said

Kipp deVeer, Chief Executive Officer of Ares Capital. “Our

performance was driven by increased investment activity and

continued strong credit fundamentals. We believe our deep

origination capabilities and longstanding relationships continue to

support our ability to deliver attractive investment returns for

our shareholders.”

“With over $5 billion of available liquidity and a net debt to

equity ratio of approximately 1.0x, our balance sheet continues to

support our ability to invest in the compelling opportunities we

are seeing,” said Scott Lem, Chief Financial Officer of Ares

Capital. “With the declaration of the upcoming third quarter

dividend, we have now had stable or increasing dividends for 15

consecutive years, which we believe is a testament to our

industry-leading track record.”

PORTFOLIO AND INVESTMENT

ACTIVITY

(dollar amounts in millions)

Q2-24

Q2-23

Portfolio Activity During the Period:

Gross commitments

$

3,857

$

1,218

Exits of commitments

$

1,376

$

1,138

Portfolio Information:

As of

June 30, 2024

December 31, 2023

Portfolio investments at fair value

$

24,973

$

22,874

Fair value of accruing debt and other

income producing securities(6)

$

22,463

$

20,375

Number of portfolio company

investments

525

505

Percentage of floating rate securities at

fair value(7)

69 %

69 %

Weighted average yields on debt and other

income producing securities(8):

At amortized cost

12.2 %

12.5 %

At fair value

12.2 %

12.5 %

Weighted average yields on total

investments(9):

At amortized cost

11.1 %

11.3 %

At fair value

11.0 %

11.2 %

Asset class percentage at fair value:

First lien senior secured loans

50 %

44 %

Second lien senior secured loans

12 %

16 %

Subordinated certificates of the SDLP

5 %

6 %

Senior subordinated loans

6 %

5 %

Preferred equity

11 %

11 %

Ivy Hill Asset Management, L.P.(10)

8 %

9 %

Other equity

8 %

9 %

____________________________________________

(6)

Includes the fair value of Ares Capital’s equity investment in

Ivy Hill Asset Management, L.P. (“IHAM”).

(7)

Includes Ares Capital's investment in the subordinated

certificates of the SDLP (as defined below).

(8)

Weighted average yields on debt and other income producing

securities are computed as (a) the annual stated interest rate or

yield earned plus the net annual amortization of original issue

discount and market discount or premium earned on accruing debt and

other income producing securities (including the annualized amount

of the dividend received by Ares Capital related to its equity

investment in IHAM during the most recent quarter end), divided by

(b) the total accruing debt and other income producing securities

at amortized cost or at fair value (including the amortized cost or

fair value of Ares Capital’s equity investment in IHAM as

applicable), as applicable.

(9)

Weighted average yields on total investments are computed as (a)

the annual stated interest rate or yield earned plus the net annual

amortization of original issue discount and market discount or

premium earned on accruing debt and other income producing

securities (including the annualized amount of the dividend

received by Ares Capital related to its equity investment in IHAM

during the most recent quarter end), divided by (b) total

investments at amortized cost or at fair value, as applicable.

(10)

Includes Ares Capital’s subordinated loan and equity investments

in IHAM, as applicable.

In the second quarter of 2024, Ares Capital made new investment

commitments of approximately $3.9 billion, of which approximately

$2.9 billion were funded. New investment commitments included 23

new portfolio companies and 58 existing portfolio companies. As of

June 30, 2024, 239 separate private equity sponsors were

represented in Ares Capital’s portfolio. Of the approximately $3.9

billion in new commitments made during the second quarter of 2024,

89% were in first lien senior secured loans, 1% were in second lien

senior secured loans, 4% were in senior subordinated loans, 1% were

in Ares Capital’s subordinated loan investment in IHAM, 3% were in

preferred equity and 2% were in other equity. Of the approximately

$3.9 billion in new commitments, 92% were in floating rate debt

securities, of which 87% contained interest rate floors. The

weighted average yield of debt and other income producing

securities funded during the period at amortized cost was 11.2% and

the weighted average yield on total investments funded during the

period at amortized cost was 11.0%. Ares Capital may seek to sell

all or a portion of these new investment commitments, although

there can be no assurance that Ares Capital will be able to do so.

Also in the second quarter of 2024, Ares Capital funded

approximately $375 million related to previously existing unfunded

revolving and delayed draw loan commitments.

Also in the second quarter of 2024, Ares Capital exited

approximately $1.4 billion of investment commitments. Of the

approximately $1.4 billion of exited investment commitments, 68%

were first lien senior secured loans, 19% were second lien senior

secured loans, 1% were subordinated certificates of the Senior

Direct Lending Program (the “SDLP”), 4% were preferred equity and

8% were other equity. Of the approximately $1.4 billion of exited

investment commitments, 68% were floating rate, 6% were fixed rate,

12% were non-income producing and 14% were on non-accrual.

As of June 30, 2024 and December 31, 2023, the weighted average

grade of the portfolio at fair value was 3.1 and 3.1, respectively,

and loans on non-accrual status represented 1.5% of the total

investments at amortized cost (or 0.7% at fair value) and 1.3% at

amortized cost (or 0.6% at fair value), respectively. For more

information on Ares Capital’s portfolio investment grades and loans

on non-accrual status, see “Part I—Item 2. Management’s Discussion

and Analysis of Financial Condition and Results of

Operations—Portfolio and Investment Activity” in Ares Capital’s

Quarterly Report on Form 10-Q for the quarter ended June 30, 2024,

filed with the Securities and Exchange Commission (“SEC”) on July

30, 2024.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2024, Ares Capital had $601 million in cash and

cash equivalents and $13.0 billion in total aggregate principal

amount of debt outstanding ($13.0 billion at carrying value).

Subject to borrowing base and other restrictions, Ares Capital had

approximately $4.5 billion available for additional borrowings

under its existing credit facilities as of June 30, 2024.

In April 2024, Ares Capital amended and restated its senior

secured credit facility (as amended and restated, the “A&R

Credit Facility”). The amendment, among other things, (a) reduced

the total commitment under the A&R Credit Facility from $4.8

billion to $4.5 billion, (b) extended the expiration of the

revolving period for lenders electing to extend their revolving

commitments in an amount equal to approximately $3.0 billion from

April 19, 2027 to April 12, 2028, during which period Ares Capital,

subject to certain conditions, may make borrowings under the

A&R Credit Facility, (c) extended the stated maturity date for

lenders electing to extend their revolving commitments in an amount

equal to approximately $3,005 million from April 19, 2028 to April

12, 2029 and (d) extended the stated maturity date for $968 million

of the lenders electing to extend their term loan commitments from

April 19, 2028 to April 12, 2029. Lenders who elected not to extend

their revolving commitments in an amount equal to approximately

$269 million and $107 million will remain subject to a revolving

period expiration of March 31, 2026 and March 31, 2025,

respectively, and a stated maturity date of March 31, 2027 and

March 31, 2026, respectively. Lenders who elected not to extend

their term loan commitments in an amount equal to $70 million, $41

million and $28 million will remain subject to a maturity date of

April 19, 2028, March 31, 2027 and March 31, 2026,

respectively.

The A&R Credit Facility is composed of a revolving loan

tranche equal to approximately $3,381 million and a term loan

tranche equal to approximately $1,107 million. The A&R Credit

Facility includes an “accordion” feature that allows Ares Capital,

under certain circumstances, to increase the size of the facility

by an amount up to $2,244 million.

In addition, in June 2024, Ares Capital increased the total

commitment under the A&R Credit Facility from approximately

$4,488 million to approximately $4,513 million. The other terms of

the A&R Credit Facility remained unchanged.

In April 2024, Ares Capital and its consolidated subsidiary,

ARCC FB Funding LLC (“AFB”), entered into an agreement to amend

AFB’s revolving funding facility (the “BNP Funding Facility”). The

amendment, among other things, adjusted the interest rate charged

on the BNP Funding Facility from an applicable Secured Overnight

Financing Rate (“SOFR”) or a “base rate” (as defined in the

documents governing the BNP Funding Facility) plus a margin of (i)

2.65% during the reinvestment period and (ii) 3.15% following the

reinvestment period to an applicable SOFR or a “base rate” plus a

margin of (i) 2.50% during the reinvestment period and (ii) 3.00%

following the reinvestment period. The other terms of the BNP

Funding Facility remained materially unchanged.

In May 2024, Ares Capital, through a wholly-owned, consolidated

subsidiary, Ares Direct Lending CLO 1 LLC (“ARCC CLO I”), completed

a $702 million term debt securitization (the “2024 Debt

Securitization”). The 2024 Debt Securitization is also known as a

collateralized loan obligation and is an on-balance sheet financing

incurred by Ares Capital, which is consolidated by Ares Capital for

financial reporting purposes and subject to its overall asset

coverage requirement. The notes offered in the 2024 Debt

Securitization (collectively, the “2024-1 CLO Notes”) were issued

by ARCC CLO I pursuant to the indenture governing the 2024-1 CLO

Notes and include (i) $406 million of Class A Senior Floating Rate

Notes, which bear interest at an applicable SOFR plus 1.80%; (ii)

$70 million Class B Senior Floating Rate Notes, which bear interest

at an applicable SOFR plus 2.20%; and (iii) $226 million of

subordinated notes (the “CLO Subordinated Notes”), which do not

bear interest. Ares Capital retained all of the CLO Subordinated

Notes, which are unsecured obligations of ARCC CLO I. The 2024-1

CLO Notes mature on April 25, 2036.

In May 2024, Ares Capital issued $850 million in aggregate

principal amount of unsecured notes, which bear interest at a rate

of 5.95% per annum and mature on July 15, 2029 (the “July 2029

Notes”). The July 2029 Notes pay interest semi-annually and all

principal is due upon maturity. The July 2029 Notes may be redeemed

in whole or in part at any time at Ares Capital’s option at a

redemption price equal to par plus a “make whole” premium, if

applicable, as determined pursuant to the indenture governing the

July 2029 Notes, and any accrued and unpaid interest. The July 2029

Notes were issued at a discount to the principal amount. In

connection with the July 2029 Notes, Ares Capital entered into an

interest rate swap agreement for a total notional amount of $850

million that matures on July 15, 2029. Under the interest rate swap

agreement, Ares Capital receives a fixed interest rate of 5.95% and

pays a floating interest rate of one-month SOFR plus 1.64%.

In June 2024, Ares Capital repaid in full the $900 million

aggregate principal amount outstanding of its unsecured notes which

bore interest at a rate of 4.200% per annum, payable

semi-annually.

During the three months ended June 30, 2024, Ares Capital issued

and sold approximately 21.6 million shares of common stock under

its equity distribution agreements, with net proceeds totaling

approximately $448.7 million, after giving effect to sales agents’

commissions and certain estimated offering expenses.

SECOND QUARTER 2024 DIVIDENDS PAID

On May 1, 2024, Ares Capital announced that its Board of

Directors declared a second quarter 2024 dividend of $0.48 per

share for a total of approximately $300 million. The second quarter

2024 dividend was paid on June 28, 2024 to stockholders of record

as of June 14, 2024.

RECENT DEVELOPMENTS

On July 25, 2024, Ares Capital and its consolidated subsidiary,

AFB, entered into an agreement to amend the BNP Funding Facility.

The amendment, among other things, (a) increased the total

commitment under the BNP Funding Facility from $865 million to

$1,265 million, (b) extended the end of the reinvestment period

from April 20, 2026 to July 26, 2027, (c) extended the stated

maturity date from April 20, 2028 to July 26, 2029 and (d) adjusted

the interest rate charged on the BNP Funding Facility from an

applicable SOFR or a “base rate” (as defined in the document

governing the BNP Funding Facility) plus a margin of (i) 2.50%

during the reinvestment period and (ii) 3.00% following the

reinvestment period to an applicable SOFR or a “base rate” plus a

margin of (i) 2.10% during the reinvestment period and (ii) 2.60%

following the reinvestment period. The other terms of the BNP

Funding Facility remained materially unchanged.

From July 1, 2024 through July 24, 2024, Ares Capital made new

investment commitments of approximately $682 million, of which

approximately $532 million were funded. Of the approximately $682

million in new investment commitments, 93% were in first lien

senior secured loans, 5% were in senior subordinated loans and 2%

were in Ares Capital’s subordinated loan investment in IHAM. Of the

approximately $682 million in new investment commitments, 95% were

floating rate and 5% were fixed rate. The weighted average yield of

debt and other income producing securities funded during the period

at amortized cost was 10.6% and the weighted average yield on total

investments funded during the period at amortized cost was 10.6%.

Ares Capital may seek to sell all or a portion of these new

investment commitments, although there can be no assurance that it

will be able to do so.

From July 1, 2024 through July 24, 2024, Ares Capital exited

approximately $493 million of investment commitments. Of the

approximately $493 million of exited investment commitments, 82%

were first lien senior secured loans, 9% were second lien senior

secured loans, 7% were Ares Capital’s subordinated loan investment

in IHAM, 1% were preferred equity and 1% were other equity. Of the

approximately $493 million of exited investment commitments, 98%

were floating rate, 1% were fixed rate and 1% were non-income

producing. The weighted average yield of debt and other income

producing securities exited or repaid during the period at

amortized cost was 11.4% and the weighted average yield on total

investments exited or repaid during the period at amortized cost

was 11.2%. Of the approximately $493 million of investment

commitments exited from July 1, 2024 through July 24, 2024, Ares

Capital recognized total net realized gains of approximately $2

million.

In addition, as of July 24, 2024, Ares Capital had an investment

backlog and pipeline of approximately $2.9 billion and $40 million,

respectively. Investment backlog includes transactions approved by

Ares Capital’s investment adviser’s investment committee and/or for

which a formal mandate, letter of intent or a signed commitment

have been issued, and therefore Ares Capital believes are likely to

close. Investment pipeline includes transactions where due

diligence and analysis are in process, but no formal mandate,

letter of intent or signed commitment have been issued. The

consummation of any of the investments in this backlog and pipeline

depends upon, among other things, one or more of the following:

satisfactory completion of Ares Capital due diligence investigation

of the prospective portfolio company, Ares Capital’s acceptance of

the terms and structure of such investment and the execution and

delivery of satisfactory transaction documentation. In addition,

Ares Capital may sell all or a portion of these investments and

certain of these investments may result in the repayment of

existing investments. Ares Capital cannot assure you that it will

make any of these investments or that Ares Capital will sell all or

any portion of these investments.

WEBCAST / CONFERENCE CALL

Ares Capital will host a webcast/conference call on Tuesday,

July 30, 2024 at 10:00 a.m. (Eastern Time) to discuss its quarter

ended June 30, 2024 financial results. PLEASE VISIT ARES CAPITAL’S

WEBCAST LINK LOCATED ON THE HOME PAGE OF THE INVESTOR RESOURCES

SECTION OF ARES CAPITAL’S WEBSITE FOR A SLIDE PRESENTATION THAT

COMPLEMENTS THE EARNINGS CONFERENCE CALL.

All interested parties are invited to participate via telephone

or the live webcast, which will be hosted on a webcast link located

on the Home page of the Investor Resources section of Ares

Capital’s website at www.arescapitalcorp.com. Please visit the

website to test your connection before the webcast. Domestic

callers can access the conference call toll free by dialing +1

(800) 225-9448. International callers can access the conference

call by dialing +1 (203) 518-9708. All callers are asked to dial in

10-15 minutes prior to the call so that name and company

information can be collected and to reference the conference ID

ARCCQ224. For interested parties, an archived replay of the call

will be available approximately one hour after the end of the call

through August 30, 2024 at 5:00 p.m. (Eastern Time) to domestic

callers by dialing toll free +1 (800) 839-2398 and to international

callers by dialing +1 (402) 220-7208. An archived replay will also

be available through August 30, 2024 on a webcast link located on

the Home page of the Investor Resources section of Ares Capital’s

website.

ABOUT ARES CAPITAL CORPORATION

Founded in 2004, Ares Capital is a leading specialty finance

company focused on providing direct loans and other investments in

private middle market companies in the United States. Ares

Capital’s objective is to source and invest in high-quality

borrowers that need capital to achieve their business goals, which

oftentimes can lead to economic growth and employment. Ares Capital

believes its loans and other investments in these companies can

help generate attractive levels of current income and potential

capital appreciation for investors. Ares Capital, through its

investment manager, utilizes its extensive, direct origination

capabilities and incumbent borrower relationships to source and

underwrite predominantly senior secured loans but also subordinated

debt and equity investments. Ares Capital has elected to be

regulated as a business development company (“BDC”) and was the

largest publicly traded BDC by market capitalization as of June 30,

2024. Ares Capital is externally managed by a subsidiary of Ares

Management Corporation (NYSE: ARES), a publicly traded, leading

global alternative investment manager. For more information about

Ares Capital, visit www.arescapitalcorp.com.

FORWARD-LOOKING STATEMENTS

Statements included herein or on the webcast/conference call may

constitute “forward-looking statements,” which relate to future

events or Ares Capital’s future performance or financial condition.

These statements are not guarantees of future performance,

condition or results and involve a number of risks and

uncertainties. Actual results and conditions may differ materially

from those in the forward-looking statements as a result of a

number of factors, including those described from time to time in

Ares Capital’s filings with the SEC. Ares Capital undertakes no

duty to update any forward-looking statements made herein or on the

webcast/conference call.

ARES CAPITAL CORPORATION AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions,

except per share data)

As of

June 30, 2024

December 31, 2023

ASSETS

(unaudited)

Total investments at fair value (amortized

cost of $24,707 and $22,668, respectively)

$

24,973

$

22,874

Cash and cash equivalents

601

535

Restricted cash

80

29

Interest receivable

285

245

Receivable for open trades

46

16

Other assets

99

91

Operating lease right-of-use asset

8

10

Total assets

$

26,092

$

23,800

LIABILITIES

Debt

$

12,960

$

11,884

Base management fee payable

91

84

Income based fee payable

93

90

Capital gains incentive fee payable

100

88

Interest and facility fees payable

153

132

Payable to participants

37

29

Payable for open trades

10

7

Accounts payable and other liabilities

237

234

Secured borrowings

33

34

Operating lease liabilities

14

17

Total liabilities

13,728

12,599

STOCKHOLDERS’ EQUITY

Common stock, par value $0.001 per share,

1,000 common shares authorized; 630 and 582 common shares issued

and outstanding, respectively

1

1

Capital in excess of par value

11,721

10,738

Accumulated undistributed earnings

642

462

Total stockholders’ equity

12,364

11,201

Total liabilities and stockholders’

equity

$

26,092

$

23,800

NET ASSETS PER SHARE

$

19.61

$

19.24

ARES CAPITAL CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENT OF OPERATIONS (in

millions, except per share data) (unaudited)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2024

2023

2024

2023

INVESTMENT INCOME

Interest income from investments

$

539

$

476

$

1,052

$

946

Capital structuring service fees

58

21

86

31

Dividend income

143

123

290

244

Other income

15

14

28

31

Total investment income

755

634

1,456

1,252

EXPENSES

Interest and credit facility fees

174

141

333

280

Base management fee

91

79

178

158

Income based fee

93

79

181

155

Capital gains incentive fee

(13)

4

12

(2)

Administrative fees

3

3

6

6

Other general and administrative

8

8

15

15

Total expenses

356

314

725

612

NET INVESTMENT INCOME BEFORE INCOME

TAXES

399

320

731

640

Income tax expense, including excise

tax

41

6

48

8

NET INVESTMENT INCOME

358

314

683

632

REALIZED AND UNREALIZED GAINS (LOSSES) ON

INVESTMENTS, FOREIGN CURRENCY AND OTHER TRANSACTIONS:

Net realized gains (losses)

12

(81)

(6)

(131)

Net unrealized (losses) gains

(48)

98

108

108

Net realized and unrealized (losses) gains

on investments, foreign currency and other transactions

(36)

17

102

(23)

REALIZED LOSS ON EXTINGUISHMENT OF

DEBT

—

—

(14)

—

NET INCREASE IN STOCKHOLDERS’ EQUITY

RESULTING FROM OPERATIONS

$

322

$

331

$

771

$

609

NET INCOME PER COMMON SHARE:

Basic

$

0.52

$

0.61

$

1.28

$

1.13

Diluted

$

0.52

$

0.59

$

1.28

$

1.10

WEIGHTED AVERAGE SHARES OF COMMON STOCK

OUTSTANDING:

Basic

616

547

603

541

Diluted

616

567

603

561

SCHEDULE 1

Reconciliations of GAAP net income per share

to Core EPS

Reconciliations of GAAP net income per share, the most directly

comparable GAAP financial measure, to Core EPS for the three and

six months ended June 30, 2024 and 2023 are provided below.

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

GAAP net income per share(1)(2)

$

0.52

$

0.61

$

1.28

$

1.13

Adjustments:

Net realized and unrealized losses

(gains)(1)

0.06

(0.04)

(0.15)

0.04

Capital gains incentive fees attributable

to net realized and unrealized gains and losses(1)

(0.02)

0.01

0.02

—

Income tax expense (benefit) related to

net realized gains and losses(1)

0.05

—

0.05

(0.02)

Core EPS(3)

$

0.61

$

0.58

$

1.20

$

1.15

____________________________________________

(1)

All per share amounts and weighted average shares outstanding

are basic. The basic weighted average shares outstanding for the

three and six months ended June 30, 2024 were approximately 616

million and 603 million, respectively, and approximately 547

million and 541 million, respectively, for the comparable periods

in 2023.

(2)

The basic and diluted weighted average shares outstanding for

the three and six months ended June 30, 2024 was approximately 616

million shares and 603 million shares, respectively. Ares Capital’s

diluted GAAP net income per share for the three and six months

ended June 30, 2023 was $0.59 and $1.10, respectively. The weighted

average shares outstanding for the purpose of calculating the

diluted GAAP net income per share for the three and six months

ended June 30, 2023 were approximately 567 million shares and 561

million shares, respectively, which includes approximately 20

million shares for each period related to the assumed conversion of

the 2024 Convertible Notes.

(3)

Core EPS is a non-GAAP financial measure. Core EPS is the net

increase (decrease) in stockholders’ equity resulting from

operations, and excludes net realized and unrealized gains and

losses, any capital gains incentive fees attributable to such net

realized and unrealized gains and losses and any income taxes

related to such net realized gains and losses, divided by the basic

weighted average shares outstanding for the relevant period. GAAP

net income (loss) per share is the most directly comparable GAAP

financial measure. Ares Capital believes that Core EPS provides

useful information to investors regarding financial performance

because it is one method Ares Capital uses to measure its financial

condition and results of operations. The presentation of this

additional information is not meant to be considered in isolation

or as a substitute for financial results prepared in accordance

with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240729274196/en/

INVESTOR RELATIONS Ares Capital Corporation John Stilmar

or Carl Drake (888) 818-5298 irarcc@aresmgmt.com

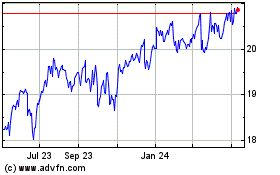

Ares Capital (NASDAQ:ARCC)

Historical Stock Chart

From Nov 2024 to Dec 2024

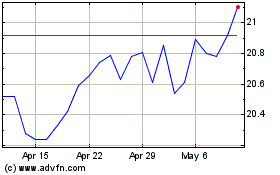

Ares Capital (NASDAQ:ARCC)

Historical Stock Chart

From Dec 2023 to Dec 2024