Ameristar Casinos' Stockholders Approve Acquisition by Pinnacle Entertainment

26 April 2013 - 1:55AM

Marketwired

Ameristar Casinos, Inc. (NASDAQ: ASCA) announced that at its

special meeting of stockholders held today, the stockholders

approved the acquisition of Ameristar by Pinnacle Entertainment,

Inc. (NYSE: PNK).

Approximately 99.8 percent of the shares voting at today's

meeting voted in favor of the agreement and plan of merger. These

shares represented approximately 81.6 percent of the total

outstanding shares of Ameristar common stock as of the March 22,

2013 record date for the meeting.

As previously announced, on Dec. 20, 2012, Pinnacle agreed to

acquire Ameristar in an all-cash transaction valued at $26.50 per

Ameristar share, or total consideration of $2.8 billion including

assumed debt. Ameristar owns and operates casino facilities in St.

Charles near St. Louis, Mo.; Kansas City, Mo.; Council Bluffs,

Iowa; Black Hawk, Colo.; Vicksburg, Miss.; East Chicago, Ind.; the

Jackpot, Nev., properties; and a casino resort under construction

in Lake Charles, La.

Completion of the transaction remains subject to the expiration

or termination of the waiting period under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976, customary closing conditions

and receipt of required regulatory approvals. Pinnacle and

Ameristar continue to expect the transaction to close during the

second or third quarter of 2013.

About Ameristar Casinos Ameristar Casinos

is an innovative casino gaming company featuring the newest and

most popular slot machines. Our 7,100 dedicated team members pride

themselves on delivering consistently friendly and appreciative

service to our guests. We continuously strive to increase the

loyalty of our guests through the quality of our slot machines,

table games, hotel, dining and other leisure offerings. Our eight

casino hotel properties primarily serve guests from Colorado,

Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi,

Missouri, Nebraska and Nevada. We began construction on our ninth

property, a casino resort in Lake Charles, La., in July 2012, which

we expect will open in the third quarter of 2014. We have been a

public company since 1993, and our stock is traded on the Nasdaq

Global Select Market. We generate more than $1 billion in net

revenues annually.

Visit Ameristar Casinos' website at www.ameristar.com (which

shall not be deemed to be incorporated in or a part of this news

release).

About Pinnacle Entertainment Pinnacle

Entertainment, Inc. owns and operates seven casinos, located in

Louisiana, Missouri and Indiana, and a racetrack in Ohio. In

addition, Pinnacle is redeveloping River Downs in Cincinnati, Ohio,

into a gaming entertainment facility, owns a minority equity

interest in Asian Coast Development (Canada) Ltd., an international

development and real estate company currently developing Vietnam's

first large-scale integrated resort near Ho Chi Minh City, and

holds a 75.5 percent equity interest in the racing license owner,

as well as a management contract to manage the day-to-day

operations, for Retama Park Racetrack near San Antonio, Texas

Important Information Regarding Forward-Looking

Statements

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements are based on Pinnacle's and

Ameristar's current expectations and are subject to uncertainty and

changes in circumstances. These forward-looking statements include,

among others, statements regarding the expected synergies and

benefits of a potential combination of Pinnacle and Ameristar,

including the expected accretive effect of the merger on Pinnacle's

financial results and profile (e.g., free cash flow, earnings per

share and Consolidated Adjusted EBITDA); the anticipated benefits

of geographic diversity that would result from the merger and the

expected results of Ameristar's gaming properties; expectations

about future business plans, prospective performance and

opportunities; required regulatory approvals; the expected timing

of the completion of the transaction; and the anticipated financing

of the transaction. These forward-looking statements may be

identified by the use of words such as "expect," "anticipate,"

"believe," "estimate," "potential," "should," "could," "would,"

"will," or similar words intended to identify information that is

not historical in nature. The inclusion of such statements should

not be regarded as a representation that such plans, estimates or

expectations will be achieved. There is no assurance that the

potential transaction will be consummated, and there are a number

of risks and uncertainties that could cause actual results to

differ materially from the forward-looking statements made herein.

These risks and uncertainties include (a) the timing to consummate

a potential transaction between Pinnacle and Ameristar; (b) the

ability and timing to obtain required regulatory approvals

(including approval from gaming regulators) and satisfy or waive

other closing conditions; (c) the possibility that the merger does

not close when expected or at all, or that the companies may be

required to modify aspects of the merger to achieve regulatory

approval; (d) Pinnacle's ability to realize the synergies

contemplated by a potential transaction; (e) Pinnacle's ability to

promptly and effectively integrate the business of Pinnacle and

Ameristar; (f) the requirement to satisfy closing conditions to the

merger as set forth in the merger agreement, including expiration

of the waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976; (g) uncertainties in the global economy

and credit markets and its potential impact on Pinnacle's ability

to finance the transaction; (h) the outcome of legal proceedings

instituted in connection with the transaction; (i) the ability to

retain certain key employees of Ameristar; (j) that there may be a

material adverse change affecting Pinnacle or Ameristar, or the

respective businesses of Pinnacle or Ameristar may suffer as a

result of uncertainty surrounding the transaction; (k) Pinnacle's

ability to obtain financing on the terms expected, or at all; and

(l) the risk factors disclosed in Pinnacle's most recent Annual

Report on Form 10-K, which Pinnacle filed with the Securities and

Exchange Commission on March 1, 2013, and the risk factors

disclosed in Ameristar's most recent Annual Report on Form 10-K,

which Ameristar filed with the Securities and Exchange Commission

on Feb. 28, 2013, and in all reports on Forms 10-Q and 8-K filed

with the Securities and Exchange Commission by Pinnacle and

Ameristar subsequent to the filing of their respective Forms 10-K

for the year ended Dec. 31, 2012. This list of factors is not

intended to be exhaustive. Forward-looking statements reflect

Pinnacle's and Ameristar's management's analysis as of the date of

this report. Pinnacle and Ameristar do not undertake to revise

these statements to reflect subsequent developments, except as

required under the federal securities laws. Readers are cautioned

not to place undue reliance on any of these forward-looking

statements.

CONTACT: Tom Steinbauer Senior Vice President, Chief

Financial Officer Ameristar Casinos, Inc. 702-567-7000

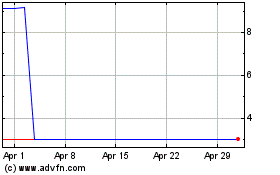

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jan 2025 to Feb 2025

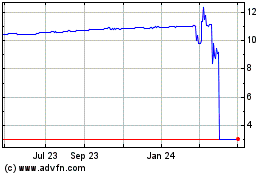

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Feb 2024 to Feb 2025