Catalyst Pharmaceuticals, Inc. (“Catalyst” or “Company”)

(Nasdaq: CPRX) today reported financial results for the fourth

quarter and full year 2024 and provided a business update.

“Our record 2024 performance is a reflection of

Catalyst’s successful launch of AGAMREE and our continued

outstanding commercial capabilities that fuel the momentum of our

existing products,” said Richard J. Daly, President and CEO of

Catalyst. “Achieving total revenues for 2024 of $491.7 million

demonstrates the strength of our scalable business model and the

dedication of our teams to patient care. In 2025, we

intend to not only seek to continue successfully growing our

revenues from sales of our existing products, but also to continue

our robust business development efforts, our efforts to protect

FIRDAPSE’s intellectual property, and our efforts to increase the

geographical availability of FIRDAPSE for LEMS patients.”

Financial Highlights

|

For the Years Ended December 31, |

2024 |

2023 |

% Change |

|

(in thousands, except per share data) |

|

|

|

|

Product Revenue, Net |

$489,327 |

$396,502 |

23.4% |

|

FIRDAPSE Product Revenue, Net |

$306,035 |

$258,426 |

18.4% |

|

FYCOMPA Product Revenue, Net |

$137,251 |

$138,076 |

(0.6%) |

|

AGAMREE Product Revenue, Net |

$46,041 |

N/A |

N/A |

|

GAAP Net Income |

$163,889 |

$71,410 |

129.5% |

|

Non-GAAP Net Income** |

$276,288 |

$141,642 |

95.1% |

|

GAAP Net Income Per Share – Basic |

$1.38 |

$0.67 |

106.0% |

|

Non-GAAP Net Income Per Share – Basic** |

$2.33 |

$1.33 |

75.2% |

|

GAAP Net Income Per Share – Diluted |

$1.31 |

$0.63 |

107.9% |

|

Non-GAAP Net Income Per Share – Diluted** |

$2.21 |

$1.25 |

76.8% |

| |

|

|

|

|

Cash and Cash Equivalents (as of December 31) |

$517,553 |

$137,636 |

276.0% |

**Statements made in this press release include

non-GAAP financial measures. Such information is provided as

additional information and not as an alternative to Catalyst's

financial statements presented in accordance with

U.S. generally accepted accounting principles (“GAAP”). These

non-GAAP financial measures are intended to enhance an overall

understanding of Catalyst's current financial performance. Catalyst

believes that the non-GAAP financial measures presented in this

press release provide investors and prospective investors with an

alternative method for assessing Catalyst's operating results in a

manner that Catalyst believes is focused on the performance of

ongoing operations and provides a more consistent basis for

comparison between periods. Non-GAAP financial measures should not

be considered in isolation or as a substitute for comparable GAAP

accounting. Further, non-GAAP measures of net income used by

Catalyst may be different from and not directly comparable to

similarly titled measures used by other companies.

Beginning with the third quarter of 2024,

Catalyst no longer includes acquisition in-process research and

development ("IPR&D") in its non-GAAP financial measures.

Reported non-GAAP net income for the year ended December 31, 2023,

included $81.5 million in acquisition IPR&D relating to

Catalyst's acquisition, during the third quarter of 2023, of the

North American license for AGAMREE, which had not yet been approved

by the U.S. Food and Drug Administration (“FDA”) at the time of the

acquisition. The commercialization was subsequently approved by the

FDA during the fourth quarter of 2023. Prior period amounts have

been revised to conform to the current period presentation.

Catalyst has made this change to its presentation following

discussions with the Staff of the Division of Corporation Finance

of the U.S. Securities and Exchange Commission.

Full Year 2024 Financial Highlights:

Full year 2024 financial results underscore

robust revenue expansion, supported by sustained organic momentum,

a successful product launch, and strong portfolio performance.

- Full year 2024 total revenues were

$491.7 million, a 23.5% YoY increase.

- FIRDAPSE® full year 2024 product

revenue, net was $306.0 million, an 18.4% YoY increase.

- AGAMREE® 2024 product revenue, net

was $46.0 million, reflecting the strong commercial launch of the

product.

- FYCOMPA® full year product revenue,

net was $137.3 million, despite differences in variable

consideration (gross-to-net) in 2024 compared to the 2023 period,

during which product revenue, net for FYCOMPA was booked under

EISAI's more favorable cost arrangements with distributors and

government authorities.

- License and other revenue for 2024

of $2.4 million, consisted primarily of a $2.1 million milestone

payment earned upon DyDo Pharma, Catalyst's sub-licensee for

FIRDAPSE in Japan, receiving product approval to commercialize the

product for the treatment of Lambert-Eaton myasthenic syndrome

(“LEMS”) patients in Japan.

Fourth Quarter 2024 Financial

Highlights: Fourth-quarter 2024 financial performance was

driven by ongoing organic product growth and the accelerating

market uptake of AGAMREE.

- Fourth quarter 2024 total revenues were $141.8 million, a 28.3%

YoY increase.

- FIRDAPSE Q4 2024 product revenue, net was $82.5 million, an

18.3% YoY increase.

- AGAMREE Q4 2024 product revenue, net was $21.1 million.

- FYCOMPA Q4 2024 product revenue, net was $38.2 million.

2024 Commercial and Regulatory Highlights:

- Successfully launched AGAMREE (vamorolone) oral suspension in

the U.S. on March 13, 2024, for the treatment of Duchenne muscular

dystrophy in patients ages two years and older.

- Received FDA approval on May 30, 2024, of an increased maximum

daily dose of FIRDAPSE to 100 mg, enhancing treatment flexibility

for healthcare providers treating LEMS patients.

- Initiated the SUMMIT study in August 2024, an open-label,

five-year follow-up study which seeks to further demonstrate the

clinical value of AGAMREE and evaluate its use as a monotherapy and

in combination with other treatment options. Also, Catalyst

initiated work to support the evaluation of AGAMREE as a treatment

for additional diseases.

Notable Strategic Partnerships and

Agreements:

- On January 8, 2025, announced that

the Company had entered into a settlement agreement with Teva

Pharmaceuticals USA, Inc. and Teva Pharmaceuticals, Inc.,

(collectively Teva), which resolves the patent litigation brought

by Catalyst and SERB in response to Teva’s Abbreviated New Drug

Application seeking approval to market a generic version of

FIRDAPSE prior to the expiration of the applicable patents.

Pursuant to the terms of the agreement, Teva will not market its

generic version of FIRDAPSE in the U.S. any earlier than February

25, 2035, absent the occurrence of other conditions. The two

remaining ANDA litigations regarding FIRDAPSE continue.

- DyDo Pharma, Catalyst’s

sub-licensee for FIRDAPSE in Japan, received Japanese Ministry of

Health, Labour and Welfare (MHLW) approval to commercialize

FIRDAPSE in Japan on September 24, 2024. The product was launched

in Japan on January 21, 2025. Catalyst anticipates generating

future revenues through potentially receiving additional milestone

payments and sales of FIRDAPSE at a transfer price on the product

supplied to DyDo Pharma, in lieu of royalties.

- On July 24, 2024, the Company

entered into an exclusive sub-license agreement with KYE

Pharmaceuticals (KYE) for the commercial rights to AGAMREE in

Canada, in an effort to potentially increase patient access to

AGAMREE.

2024 Industry Recognitions:

- Recognized in the Deloitte Technology Fast 500™ as one of North

America's Fastest-Growing Companies.

- Ranked 5th on Forbes' 2025 list of America's Most Successful

Mid-Cap Companies.

- Recognized among BioSpace’s 2025 Best Places to Work.

Fourth Quarter 2024 and Full Year 2024

Financial ResultsTotal

revenues: Total revenues for the fourth quarter of

2024 were $141.8 million, compared to $110.6

million for the fourth quarter of 2023, representing an

increase of approximately 28.3% YoY. Full year 2024 total revenues

were $491.7 million, compared to $398.2 million for

full year 2023, representing an increase of approximately 23.5%

YoY.

Product revenue, net: Product

revenue, net for the fourth quarter of 2024, was $141.8

million, compared to $109.1 million for the fourth

quarter of 2023, representing an increase of approximately 30.0%

YoY. Full year 2024 product revenue, net was $489.3 million,

compared to $396.5 million for full year 2023,

representing an increase of approximately 23.4% YoY.

Research and development

expenses: In the fourth quarter of 2024, research and

development expenses were $3.8 million, compared

to $2.0 million in the fourth quarter of 2023. Research

and development expenses for full year 2024 were $12.6

million, compared to $93.2 million for full year 2023, which

included an $81.5 million IPR&D expense related to the

acquisition of a North American license for AGAMREE in the third

quarter of 2023.

Selling, general, and administrative

expenses: Selling, general, and administrative

expenses for the fourth quarter of 2024 were $44.2

million, compared to $42.0 million in the fourth quarter

of 2023. Selling, general, and administrative expenses for

full year 2024 were $177.7 million, compared to $133.7

million for full year 2023.

Amortization of intangible

assets: Amortization of intangible assets was $9.3

million in the fourth quarter of 2024, compared to $9.1

million in the fourth quarter of 2023. Amortization of

intangible assets was $37.4 million in full year 2024,

compared to $32.6 million for full year 2023.

Operating

income: Operating income for the fourth quarter of

2024 was $62.8 million, compared to $41.7 million in

the fourth quarter of 2023, representing an increase of

approximately 50.7%. Full year 2024 operating income

was $195.1 million, compared

to $86.8 million for full year 2023, representing an

increase of approximately 124.8%.

GAAP net income: GAAP net

income for the fourth quarter of 2024 was $55.9

million ($0.47 per basic and $0.44 per diluted

share), compared to GAAP net income of $34.8

million ($0.33 per basic and $0.31 per diluted

share) for the fourth quarter of 2023. GAAP net income for full

year 2024 was $163.9 million ($1.38 per basic

and $1.31 per diluted share), compared to full year 2023

GAAP net income of $71.4 million ($0.67 per basic

and $0.63 per diluted share).

Non-GAAP net

income: Non-GAAP net income for the fourth quarter of

2024 was $88.8 million ($ 0.74 per basic

and $0.70 per diluted share), compared to non-GAAP net

income of $60.1 million ($0.56 per basic

and $0.53 per diluted share) for the fourth quarter of

2023. Non-GAAP net income for full year 2024 was $276.3

million ($2.33 per basic and $2.21 per diluted

share), compared to full year 2023 non-GAAP net income

of $141.6 million ($1.33 per basic

and $1.25 per diluted share). Non-GAAP net income in all

periods excludes from net income stock-based compensation,

depreciation, amortization of intangible assets, and the income tax

provision.

Cash and cash equivalents: Cash and cash

equivalents were $517.6 million as of December 31,

2024.

More detailed financial information and analysis

of our financial condition and results of operations can be found

in our Annual Report on Form 10-K for fiscal year 2024, which was

filed with the U.S. Securities and Exchange

Commission on February 26, 2025.

2025 OutlookFor full year 2025,

the Company expects total revenues to be between $545 million and

$565 million, reflecting continued growth in product revenue, net

from FIRDAPSE and AGAMREE.

The Company expects FIRDAPSE’s product revenue,

net for fiscal 2025 to range between $355 million and $360 million.

The Company anticipates an increase in Q1 2025 product revenue, net

compared to Q1 2024 due to the temporary market dynamics following

the Change Healthcare disruption in February 2024, which led to

short-term shifts in prescription fulfillment patterns. These

effects are expected to normalize in Q2 2025, with revenue trends

aligning with longer-term projections for the remainder of the

year.

AGAMREE’s product revenue, net for 2025 is

expected to be between $100 million and $110 million, reflecting

its continued market adoption and commercial momentum. As a

reminder, the Company commercially launched AGAMREE on March 13,

2024.

FYCOMPA’s product revenue, net is forecasted to

be between $90 million and $95 million, driven by ongoing market

demand ahead of the anticipated loss of patent exclusivity at the

end of May 2025, for FYCOMPA tablets, and December 2025, for

FYCOMPA oral suspension, with expected entry of generic competition

following each loss of exclusivity.

Cost of sales: AGAMREE

royalties paid to the product licensor increase when AGAMREE

product revenue, net exceeds $100 million in any calendar year.

Further, the Company will be required to make a $12.5 million

milestone payment to the product licensor once AGAMREE product

revenue for the calendar year reaches $100 million. Further, the

Company is required to pay royalties, based on net product revenue,

to the product licensor for FYCOMPA following the loss of

exclusivity.

Research and development

expenses: Due to anticipated activities relating to

the SUMMIT study and efforts seeking to begin the development of

additional indications for AGAMREE, the Company anticipates

research and development expenses in 2025, absent another

acquisition, to be between $15.0 and $20.0 million. Further, if the

Company completes an acquisition, its R&D expenses may become

more significant.

Selling, general, and administrative

expenses: The Company anticipates an increase in

selling, general and administrative expenses in 2025 compared to

2024, primarily driven by increased headcount, including full year

costs for individuals hired throughout 2024 in certain functional

areas to support the growth of its business and its overall

strategy as the Company focuses on expanding its product portfolio,

including the separate commercial and medical field forces for

FIRDAPSE and AGAMREE which is scheduled to commence at the

beginning of the 2025 second quarter.

Tax rate: The Company

anticipates that its effective tax rate will be relatively

consistent for 2025 compared to 2024 and 2023.

| Conference Call & Webcast

Details |

| Date: |

February 27,

2025 |

| Time: |

8:30 AM ET |

| US/Canada Dial-in Number: |

(877) 407-8912 |

| International Dial-in Number: |

(201) 689-8059 |

About Catalyst Pharmaceuticals

Catalyst Pharmaceuticals, Inc. (Nasdaq: CPRX) is

a biopharmaceutical company committed to improving the lives of

patients with rare diseases. With a proven track record of bringing

life-changing treatments to the market, we focus on in-licensing,

commercializing, and developing innovative therapies. Guided by our

deep commitment to patient care, we prioritize accessibility,

ensuring patients receive the care they need through a

comprehensive suite of support services designed to provide

seamless access and ongoing assistance. Catalyst maintains a

well-established U.S. presence while actively seeking to

expand its global commercial footprint through strategic

partnerships. Catalyst, headquartered in Coral Gables, Fla., was

recognized on the Forbes 2025 list as one of America's Most

Successful Mid-Cap Companies and on the 2024 Deloitte Technology

Fast 500™ list as one of North America’s Fastest-Growing

Companies.

For more information, please visit Catalyst's website

at www.catalystpharma.com.

Forward-Looking StatementsThis

press release contains forward-looking statements, as that term is

defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements involve known and unknown risks and

uncertainties, which may cause Catalyst's actual results in future

periods to differ materially from forecasted results. A number of

factors, including (i) whether Catalyst's revenue forecasts for

2025 that are included in this press release will prove to be

accurate, (ii) whether Catalyst will continue to be profitable and

cash flow positive in 2025 and beyond, (iii) whether Catalyst will

complete any acquisitions of additional products, and the timing of

any such acquisitions, (iv) the impact of the pending Paragraph IV

litigation relating to FIRDAPSE if the results of these litigation

matters are adverse, and (v) those factors described in Catalyst's

Annual Report on Form 10-K for the 2024 fiscal year and its

subsequent filings with the U.S. Securities and Exchange Commission

(“SEC”), could adversely affect Catalyst. Copies of Catalyst's

filings with the SEC are available from the SEC, may be found on

Catalyst's website, or may be obtained upon request from Catalyst.

Catalyst does not undertake any obligation to update the

information contained herein, which speaks only as of this

date.

|

|

|

CATALYST PHARMACEUTICALS, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(in thousands, except share and per share

data) |

| |

| |

(Unaudited)For the Three

MonthsEnded December 31, |

|

For the YearsEnded December

31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Product revenue, net |

$ |

141,809 |

|

$ |

109,104 |

|

$ |

489,327 |

|

$ |

396,502 |

| License and other revenue |

|

11 |

|

|

1,464 |

|

|

2,407 |

|

|

1,702 |

|

Total revenues |

|

141,820 |

|

|

110,568 |

|

|

491,734 |

|

|

398,204 |

| |

|

|

|

|

|

|

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

| Cost of sales (a) |

|

21,643 |

|

|

15,809 |

|

|

68,845 |

|

|

51,967 |

|

Research and development |

|

3,798 |

|

|

1,972 |

|

|

12,648 |

|

|

93,150 |

|

Selling, general and administrative (a) |

|

44,192 |

|

|

42,036 |

|

|

177,740 |

|

|

133,710 |

|

Amortization of intangible assets |

|

9,344 |

|

|

9,059 |

|

|

37,377 |

|

|

32,565 |

|

Total operating costs and expenses |

|

78,977 |

|

|

68,876 |

|

|

296,610 |

|

|

311,392 |

| Operating income |

|

62,843 |

|

|

41,692 |

|

|

195,124 |

|

|

86,812 |

| Other income, net |

|

11,338 |

|

|

5,015 |

|

|

21,139 |

|

|

7,699 |

|

Net income before income taxes |

|

74,181 |

|

|

46,707 |

|

|

216,263 |

|

|

94,511 |

| Income tax provision |

|

18,245 |

|

|

11,863 |

|

|

52,374 |

|

|

23,101 |

|

Net income |

$ |

55,936 |

|

$ |

34,844 |

|

$ |

163,889 |

|

$ |

71,410 |

| |

|

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.47 |

|

$ |

0.33 |

|

$ |

1.38 |

|

$ |

0.67 |

|

Diluted |

$ |

0.44 |

|

$ |

0.31 |

|

$ |

1.31 |

|

$ |

0.63 |

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

119,892,062 |

|

|

106,714,944 |

|

|

118,457,673 |

|

|

106,279,736 |

|

Diluted |

|

126,280,116 |

|

|

113,755,677 |

|

|

124,943,603 |

|

|

113,753,154 |

(a) exclusive of

amortization of intangible assets

|

|

|

CATALYST PHARMACEUTICALS, INC. |

|

RECONCILIATION OF NON-GAAP METRICS

(unaudited) |

|

(in thousands, except share and per share

data) |

| |

| |

For the Three MonthsEnded December

31, |

|

For the YearsEnded December

31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

GAAP net income: |

$ |

55,936 |

|

$ |

34,844 |

|

$ |

163,889 |

|

$ |

71,410 |

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

| Stock-based

compensation expense |

|

5,171 |

|

|

4,250 |

|

|

22,251 |

|

|

14,250 |

|

Depreciation |

|

114 |

|

|

84 |

|

|

397 |

|

|

316 |

|

Amortization of intangible assets |

|

9,344 |

|

|

9,059 |

|

|

37,377 |

|

|

32,565 |

| Income tax

provision |

|

18,245 |

|

|

11,863 |

|

|

52,374 |

|

|

23,101 |

|

Non-GAAP net income |

$ |

88,810 |

|

$ |

60,100 |

|

$ |

276,288 |

|

$ |

141,642 |

| Non-GAAP net income

per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.74 |

|

$ |

0.56 |

|

$ |

2.33 |

|

$ |

1.33 |

|

Diluted |

$ |

0.70 |

|

$ |

0.53 |

|

$ |

2.21 |

|

$ |

1.25 |

| |

|

|

|

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

119,892,062 |

|

|

106,714,944 |

|

|

118,457,673 |

|

|

106,279,736 |

|

Diluted |

|

126,280,116 |

|

|

113,755,677 |

|

|

124,943,603 |

|

|

113,753,154 |

| |

|

|

|

|

|

|

|

|

CATALYST PHARMACEUTICALS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands) |

|

|

|

|

December 31,2024 |

|

December 31, 2023 |

|

Assets |

|

|

|

|

Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

517,553 |

|

$ |

137,636 |

|

Accounts receivable, net |

|

65,476 |

|

|

53,514 |

|

Inventory |

|

19,541 |

|

|

15,644 |

|

Prepaid expenses and other current assets |

|

21,039 |

|

|

12,535 |

|

Total current assets |

|

623,609 |

|

|

219,329 |

|

Operating lease right-of-use asset, net |

|

2,230 |

|

|

2,508 |

|

Property and equipment, net |

|

1,354 |

|

|

1,195 |

|

License and acquired intangibles, net |

|

156,672 |

|

|

194,049 |

|

Deferred tax assets, net |

|

45,982 |

|

|

36,544 |

|

Investment in equity securities |

|

21,564 |

|

|

16,489 |

|

Total assets |

$ |

851,411 |

|

$ |

470,114 |

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

16,593 |

|

$ |

14,795 |

|

Accrued expenses and other liabilities |

|

104,085 |

|

|

61,268 |

|

Total current liabilities |

|

120,678 |

|

|

76,063 |

|

Operating lease liability, net of current portion |

|

2,786 |

|

|

3,188 |

|

Other non-current liabilities |

|

315 |

|

|

2,982 |

|

Total liabilities |

|

123,779 |

|

|

82,233 |

|

Total stockholders’ equity |

|

727,632 |

|

|

387,881 |

|

Total liabilities and stockholders’ equity |

$ |

851,411 |

|

$ |

470,114 |

Source: Catalyst Pharmaceuticals, Inc.

Contact information:

Investor Contact

Mary Coleman, Catalyst Pharmaceuticals, Inc.

(305) 420-3200

IR@catalystpharma.com

Media Contact

David Schull, Russo Partners

(858) 717-2310

david.schull@russopartnersllc.com

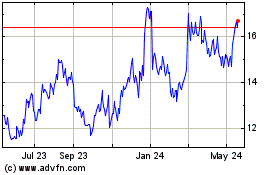

Catalyst Pharmaceuticals (NASDAQ:CPRX)

Historical Stock Chart

From Feb 2025 to Mar 2025

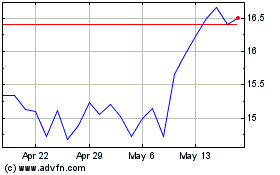

Catalyst Pharmaceuticals (NASDAQ:CPRX)

Historical Stock Chart

From Mar 2024 to Mar 2025