false

0001410098

0001410098

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 30, 2024

CORMEDIX INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-34673 |

|

20-5894890 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

300 Connell Drive, Suite 4200

Berkeley Heights, NJ |

|

07922 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (908) 517-9500

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2, below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, $0.001 par value |

|

CRMD |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition

On October 30, 2024, CorMedix Inc. (the “Company”)

issued a press release announcing its financial results for the third quarter ended September 30, 2024. A copy of the press release is

furnished as Exhibit 99.1 to this report.

The information in this Item 2.02 (including Exhibit

99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CORMEDIX INC. |

| |

|

|

| Date: October 30, 2024 |

By: |

/s/ Joseph Todisco |

| |

Name: |

Joseph Todisco |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

CorMedix

Inc. Reports THIRD Quarter AND NINE MONTH 2024 Financial Results and Provides Business Update

‒

Q3 2024 Net Revenue of $11.5 million ‒

‒

Commercializing DefenCath with Four of Top Five US Dialysis Providers ‒

‒

Conference Call Scheduled for Today at 8:30 a.m. Eastern Time ‒

Berkeley Heights,

NJ – October 30, 2024 – CorMedix Inc. (Nasdaq: CRMD), a biopharmaceutical company focused on developing and commercializing

therapeutic products for life-threatening diseases and conditions, today announced financial results for the third quarter and nine months

ended September 30, 2024 and provided an update on its business.

Recent Corporate Highlights:

| ● | CorMedix today reports its first full quarter of DefenCath sales since commencing outpatient launch in

July 2024. The Company reported net sales of $11.5 million for the third quarter, largely driven by successful implementation by an initial

anchor customer, a mid-sized dialysis operator. |

| ● | During the third quarter, CorMedix announced commercial agreements with a large dialysis operator and

two new mid-sized dialysis operators and now has commercial agreements providing access to roughly 60% of outpatient dialysis centers

in the US. CorMedix is actively working with these customers to initiate DefenCath utilization in the 4th quarter of 2024. |

| ● | The Company has started to see pull-through of units to inpatient facilities as health systems begin to

complete P&T reviews and provide patients access to DefenCath. CorMedix remains focused on building brand advocacy with key opinion

leaders in this setting of care. |

| ● | • Following FDA feedback, the Company is in the final stages of amending the clinical study protocol for Total Parenteral Nutrition,

or TPN, and anticipates FDA submission by mid-November to align with our plans to operationalize the study in the first half of 2025.

In addition, CorMedix remains on track with a real-world evidence study, the pediatric hemodialysis study, and the expanded access program

for DefenCath. |

| ● | Cash and short-term investments, excluding restricted cash, at September 30, 2024 amounted to $46.0 million. |

Joe Todisco, CorMedix

CEO, commented, “I am excited about the Company’s recent progress as we execute on our launch objectives and increase patient

access to DefenCath across settings of care. Having established patient access at roughly 60% of outpatient dialysis clinics in the US,

I’m optimistic about the opportunity for DefenCath as we shift focus toward 2025. We have several important clinical initiatives

commencing early next year aimed at expanding indications for DefenCath beyond adult hemodialysis, providing an important catalyst for

future growth.”

Third Quarter and Nine Months 2024 Financial

Highlights

For the third quarter of 2024, CorMedix recorded

$11.5 million in net revenue from sales of DefenCath for the first full quarter sales since DefenCath was launched in 2024. For the third

quarter of 2024, CorMedix recorded a net loss of $2.8 million, or $0.05 per share, compared with a net loss of $9.7 million, or $0.17

per share, in the third quarter of 2023, a decrease of $6.9 million or 72%. The decrease in net loss was driven primarily by the launch

of DefenCath and net sales in the period.

Operating expenses in the third quarter 2024 were

$14.1 million, compared with $10.5 million in the third quarter of 2023, an increase of approximately 34%. The increase was driven

by higher selling and marketing (S&M) and general and administrative (G&A) expenses which increased approximately 66% and 76%,

respectively. These increases were partially offset by a decrease in research and development (R&D) expenses of approximately 73%.

The increases in S&M and G&A were primarily driven by increased marketing efforts and the hiring of sales force, medical affairs

and marketing personnel in support of the commercial launch of DefenCath. Additionally, as a result of the post FDA approval commercial

operations, costs related to medical affairs and certain personnel expenses that supported R&D efforts prior to the FDA approval of

DefenCath have been recognized primarily in G&A expense during the three months ended September 30, 2024.

For the nine months ended September 30, 2024,

CorMedix recorded a net loss of $31.4 million, or $0.54 per share, compared with a net loss of $31.6 million, or $0.65 per share, in the

same period in 2023, a decrease of $0.2 million, or 0.6%, driven primarily by $12.3 million in net revenue and proceeds received from

the sale of our unused New Jersey net operating losses, offset by an increase in operating expenses.

Operating expenses in the first nine months of

2024 were $45.5 million, compared to $33.3 million during the comparative period in 2023, an increase of approximately 37%. This

increase was primarily due to costs related to marketing and commercial activities in support of the launch activities of DefenCath, partially

offset by a decrease in R&D expenses, attributable to the marketing approval of DefenCath.

The Company reported cash and short-term investments

of $46.0 million as of September 30, 2024, excluding restricted cash. The Company believes that it has sufficient resources to fund operations

for at least twelve months from the issuance of the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30,

2024.

Conference Call Information

The management team of

CorMedix will host a conference call and webcast today, October 30, 2024, at 8:30AM Eastern Time, to discuss recent corporate developments

and financial results. Call details and dial-in information are as follows:

Wednesday, October 30th @ 8:30am ET

| Domestic: |

1-844-481-2557 |

| International: |

1-412-317-0561 |

| Webcast: |

Webcast Link |

About CorMedix

CorMedix

Inc. is a biopharmaceutical company focused on developing and commercializing therapeutic products for the prevention and treatment of

life-threatening conditions and diseases. The Company is focused on commercializing its lead product DefenCath® (taurolidine

and heparin) which was approved by the FDA on November 15, 2023. CorMedix commercially launched DefenCath in inpatient settings in April

2024 and in outpatient settings in July 2024. CorMedix also intends to develop DefenCath as a catheter lock solution for use in other

patient populations. For more information visit: www.cormedix.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. Forward-looking

statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “will,”

“plan,” “project,” “seek,” “should,” “target,” “will,” “would,”

and similar expressions or variations intended to identify forward-looking statements. All statements, other than statements of historical

facts, regarding management’s expectations, beliefs, goals, plans or CorMedix’s prospects should be considered forward-looking

statements. Readers are cautioned that actual results may differ materially from projections or estimates due to a variety of important

factors, and readers are directed to the Risk Factors identified in CorMedix’s filings with the SEC, including its Annual Report

on Form 10-K and its Quarterly Reports on Form 10-Q, copies of which are available free of charge at the SEC’s website at www.sec.gov

or upon request from CorMedix. CorMedix may not actually achieve the goals or plans described in its forward-looking statements, and such

forward-looking statements speak only as of the date of this press release. Investors should not place undue reliance on these statements.

CorMedix assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Investor Contact:

Dan Ferry

Managing Director

LifeSci Advisors

daniel@lifesciadvisors.com

(617) 430-7576

CorMedix

Inc. and SubsidiarIES

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

AND COMPREHENSIVE LOSS

(Unaudited)

| | |

For the Three Months Ended September 30, | | |

For

the Nine Months Ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

| | |

| | |

| | |

| |

| Revenue, net | |

$ | 11,456,115 | | |

$ | - | | |

$ | 12,262,234 | | |

$ | - | |

| Cost of revenues | |

| (686,598 | ) | |

| - | | |

| (2,014,975 | ) | |

| - | |

| Gross profit (loss) | |

| 10,769,517 | | |

| - | | |

| 10,247,259 | | |

| - | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| (727,119 | ) | |

| (2,663,976 | ) | |

| (2,215,551 | ) | |

| (10,866,236 | ) |

| Selling and marketing | |

| (6,748,900 | ) | |

| (4,058,428 | ) | |

| (20,472,961 | ) | |

| (9,955,651 | ) |

| General and administrative | |

| (6,580,834 | ) | |

| (3,744,879 | ) | |

| (22,851,144 | ) | |

| (12,467,157 | ) |

| Total operating expenses | |

| (14,056,853 | ) | |

| (10,467,283 | ) | |

| (45,539,656 | ) | |

| (33,289,044 | ) |

| Loss from Operations | |

| (3,287,336 | ) | |

| (10,467,283 | ) | |

| (35,292,397 | ) | |

| (33,289,044 | ) |

| Other Income (Expense) | |

| | | |

| | | |

| | | |

| | |

| Total other income | |

| 510,524 | | |

| 722,929 | | |

| 2,503,203 | | |

| 1,703,846 | |

| Net Loss Before Income Taxes | |

| (2,776,812 | ) | |

| (9,744,354 | ) | |

| (32,789,194 | ) | |

| (31,585,198 | ) |

| Tax benefit | |

| - | | |

| - | | |

| 1,394,770 | | |

| - | |

| Net Loss | |

| (2,776,812 | ) | |

| (9,744,354 | ) | |

| (31,394,424 | ) | |

| (31,585,198 | ) |

| Other Comprehensive Income (Loss) | |

| | | |

| | | |

| | | |

| | |

| Total other comprehensive income (loss) | |

| 3,389 | | |

| (6,298 | ) | |

| (4,988 | ) | |

| 1,656 | |

| Other Comprehensive (Loss) Income | |

$ | (2,773,423 | ) | |

$ | (9,750,652 | ) | |

$ | (31,399,412 | ) | |

$ | (31,583,542 | ) |

| Net Loss Per Common Share – Basic and Diluted | |

$ | (0.05 | ) | |

$ | (0.17 | ) | |

$ | (0.54 | ) | |

$ | (0.65 | ) |

| Weighted Average Common Shares Outstanding – Basic and Diluted | |

| 58,825,221 | | |

| 56,553,174 | | |

| 57,986,190 | | |

| 48,715,585 | |

CORMEDIX INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET DATA

| | |

September 30,

2024 | | |

December 31,

2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| Cash, cash equivalents and restricted cash | |

$ | 35,391,222 | | |

$ | 43,823,192 | |

| Short-term investments | |

$ | 10,743,562 | | |

$ | 32,388,130 | |

| Total Assets | |

$ | 77,586,194 | | |

$ | 82,059,957 | |

| | |

| | | |

| | |

| Total Liabilities | |

$ | 18,873,926 | | |

$ | 11,917,528 | |

| Accumulated deficit | |

$ | (353,094,437 | ) | |

$ | (321,700,013 | ) |

| Total Stockholders’ Equity | |

$ | 58,712,268 | | |

$ | 70,142,429 | |

CORMEDIX INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

For the Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash Flows from Operating Activities: | |

| | |

| |

| Net loss | |

$ | (31,394,424 | ) | |

$ | (31,585,198 | ) |

| Net cash used in operating activities | |

| (45,000,117 | ) | |

| (27,663,786 | ) |

| Cash Flows Used in Investing Activities: | |

| | | |

| | |

| Net cash provided by (used in) investing activities | |

| 21,534,874 | | |

| (17,659,477 | ) |

| Cash Flows from Financing Activities: | |

| | | |

| | |

| Net cash provided by financing activities | |

| 15,033,751 | | |

| 55,449,154 | |

| Net (Decrease) Increase in Cash and Cash Equivalents | |

| (8,431,970 | ) | |

| 10,126,276 | |

| Cash and Cash Equivalents and Restricted Cash - Beginning of Period | |

| 43,823,192 | | |

| 43,374,745 | |

| Cash and Cash Equivalents and Restricted Cash - End of Period | |

$ | 35,391,222 | | |

$ | 53,501,021 | |

6

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

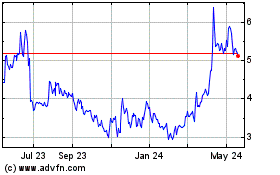

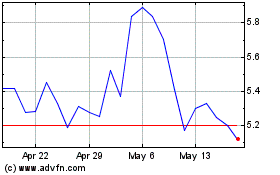

CorMedix (NASDAQ:CRMD)

Historical Stock Chart

From Dec 2024 to Dec 2024

CorMedix (NASDAQ:CRMD)

Historical Stock Chart

From Dec 2023 to Dec 2024