UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-39446

CureVac N.V.

(Exact Name of Registrant as Specified in Its

Charter)

Friedrich-Miescher-Strasse 15, 72076

Tübingen, Germany

+49 7071 9883 0

(Address of principal executive

office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

On November 12, 2024, CureVac N.V. (the “Company”) issued

a press release announcing the Company’s financial results for the third quarter and first nine months of 2024 and provided a business

update.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CUREVAC N.V. |

| |

|

|

| |

By: |

/s/ Alexander Zehnder |

| |

|

Chief Executive Officer |

Date: November 12, 2024

EXHIBIT INDEX

Exhibit 99.1

CureVac Announces Financial Results for the Third Quarter and First

Nine Months of 2024

and Provides Business Update

Strengthened Cash, Strategic Refocus and Pipeline Progress Define

Transformative Quarter

| • | €400 million upfront payment from restructured GSK collaboration reflected in financials, cash

position increased to €551 million; expected cash runway re-affirmed into 2028 |

| • | CVGBM Phase 1 glioblastoma study showed 77% of patients with antigen-specific T-cell responses; data

presented at ESMO, SITC and SNO |

| • | New off-the-shelf program for squamous non-small cell lung cancer started, expected to enter Phase 1

in H2 2025 |

| • | New preclinical prophylactic vaccine program for urinary tract infections initiated, supported by positive

preclinical data versus protein-based vaccines |

| • | Positive Phase 2 data from seasonal influenza program licensed to GSK demonstrated strong immune responses

against challenging influenza B as well as A strains; program progressing to Phase 3, which will be associated with significant milestone

payment |

| • | Corporate redesign on track with 30% workforce reduction, expected to yield significant annual cost savings from 2025 onwards and

increase operational agility |

| • | Appointment of seasoned industry executive Axel Malkomes as new CFO effective November 11, enhancing

financial leadership and strategic execution |

| • | CureVac to host conference call and webcast

today at 9 a.m. EST / 3 p.m. CET; details below and under https://www.curevac.com/en/newsroom/events/ |

TÜBINGEN, Germany/BOSTON, USA –

November 12, 2024 – CureVac N.V. (Nasdaq: CVAC) (“CureVac”), a global biopharmaceutical company developing

a new class of transformative medicines based on messenger ribonucleic acid (“mRNA”), today announced financial results for

the third quarter and first nine months of 2024 and provided a business update.

Commenting on the quarter Dr. Alexander Zehnder,

Chief Executive Officer of CureVac said:

"The third quarter was truly

transformative for CureVac. By restructuring our collaboration with GSK, we have embarked on a new chapter of growth and innovation, unveiling

new programs that leverage our advanced mRNA technology to tackle critical health challenges. The strategic decisions we've made, combined

with encouraging initial clinical results, have laid a solid foundation for our future success. We are now strategically aligned, more

operationally efficient, and financially empowered to create shareholder value by advancing our portfolio of novel mRNA-based medicines."

Selected Business Updates

Strategic Redesign

CureVac made meaningful

progress in restructuring its operations during the third quarter by implementing significant cost-cutting measures. These include the

previously announced 30% workforce reduction, which is on track to be completed by the end of 2024. The goal of the restructuring is to

reorganize the company for flexibility in executing immediate priorities while maintaining a strong innovation focus and ensuring long-term

value creation. Right-sizing CureVac for future growth allows for continued focused development of a prioritized portfolio, including

high-value mRNA projects in oncology, infectious diseases and other areas.

“With funding secured into

2028, and our operational expenses increasingly streamlined by our ongoing redesign, we are in a strong position to expand our R&D

efforts across several promising areas,” said Dr. Zehnder. “We will be launching new development programs in the

coming quarters and will continue to execute our business and pipeline strategy well into the future.”

Strengthening the

Leadership Team

As of November 11,

2024, CureVac welcomed a new Chief Financial Officer, Axel Sven Malkomes. Mr. Malkomes brings over three decades of senior corporate

and investment banking experience within the biotech and pharmaceutical industries. Most recently, he served as CFO at Cardior Pharmaceuticals,

a private clinical-stage company developing non-coding RNA-based therapeutics for heart disease. During his tenure, he played a crucial

role in strategically and financially preparing the company for capital markets, co-leading financing rounds, and supporting potential

M&A and partnering transactions, culminating in the successful acquisition of Cardior by Novo Nordisk in 2024.

Before Cardior, Mr. Malkomes

was CFO and Chief Business Officer at Medigene AG, a publicly listed cell therapy company. His extensive experience also includes senior

healthcare investment banking roles at Barclays and Société Générale, as well as co-heading European healthcare

investments at 3i Group plc, a UK-listed private equity firm with over $20 billion in assets under management. Earlier in his career,

he held senior leadership positions at Merck KGaA.

Oncology

Expanding oncology

development pipeline

CureVac sees significant opportunities to apply

precision immunotherapy using mRNA vaccines in large patient populations. The company aims to create earlier treatment options for multiple

solid tumor types and is strengthening its clinical development pipeline following two complementary approaches: off-the-shelf cancer

vaccines targeting tumor antigens shared across different patient populations and/or tumor types and fully personalized cancer vaccines

based on a patient’s individual tumor genomic profile.

CureVac is extending its off-the-shelf cancer vaccine pipeline and

has selected an additional clinical candidate for a shared-antigen cancer vaccine targeting squamous non-small cell lung cancer (sqNSCLC).

Investigational New Drug (IND) and Clinical Trial Application (CTA) submissions are being prepared for filing in the first half of 2025.

Additional discovery work aims to deliver further off-the-shelf cancer vaccines and selection of a second clinical candidate is anticipated

in 2026.

In parallel, the program for fully personalized

cancer vaccines is progressing and on track with the planned start of a Phase 1 study expected in the second half of 2026.

Clinical off-the-shelf program in glioblastoma

CureVac presented the first clinical data from

the Phase 1 study of CVGBM, its off-the-shelf mRNA cancer vaccine candidate, in patients with resected glioblastoma in September 2024

at the European Society for Medical Oncology (ESMO) Congress and in November at the Society for Immunotherapy of Cancer (SITC) and

the Society for Neuro-Oncology (SNO) Congresses. Preliminary immunogenicity results in this highly aggressive and challenging cancer indication

demonstrate the potential of CureVac’s proprietary second-generation mRNA backbone to enhance the immune system’s capacity

for a coordinated defense against the disease.

“As our lead oncology program,

CVGBM has demonstrated encouraging initial clinical results in patients with resected glioblastoma,” said Dr. Myriam Mendila,

Chief Scientific Officer of CureVac. “Data presented recently at the ESMO, SITC and SNO congresses showed that 77% of evaluable

patients exhibited sustained immune response induction over a 99-day monitoring period. Importantly, we believe these data are very promising

because the response was led by de novo T-cell generation, which likely plays a crucial role in the success of a cancer vaccine.”

In the fully enrolled

dose-escalation Part A, CVGBM monotherapy induced cancer antigen-specific T-cell responses in 77% of 13 evaluable patients. Notably,

84% of these immune responses were generated de novo, inducing T-cell activity in patients without prior immunity to the encoded

antigens. Among responding patients, 69% showed CD8+ responses, 31% had CD4+ responses, and 23% had both. 67% of

responding patients showed immune responses against multiple antigens. At the recommended 100 µg dose for the expansion part of

the study, responses were sustainable over a 99-day monitoring period. Induction of cellular responses was accompanied by systemic cytokine

and chemokine activation, indicating innate immune response activation.

The treatment was well

tolerated, with no dose-limiting toxicities up to the highest dose of 100 µg. 91% of treatment-related adverse events (TRAEs)

were mild to moderate systemic reactions characteristic of mRNA-based therapeutics, resolving within 1-2 days post-injection. Seven patients

reported nine severe TRAEs, including four serious adverse events; no grade 4 or 5 adverse events occurred.

The dose-expansion Part B

of the study is ongoing at the recommended 100 µg dose. Initial data and a decision on advancing the program to Phase 2 are expected

in the second half of 2025.

More information can

be found at clinicaltrials.gov (NCT05938387).

Prophylactic Vaccines

Initiation of Urinary Tract Infections

Program

CureVac has initiated a new program to address

urinary tract infections (UTIs), which are among the most common bacterial infections. UTIs are most commonly caused by uropathogenic

Escherichia coli (UPEC) bacteria, which can enter the urinary tract, invade and colonize bladder and kidney tissues. These infections

can lead to complications such as kidney damage and urosepsis. UTIs lead to approximately 8-10 million doctor office visits and 1-3

million emergency department visits per year in the U.S. alone.

"Urinary tract infections are

extremely common, affecting millions of people each year—often repeatedly—and are increasingly prone to antibiotic resistance,"

said Dr. Mendila. "Our encouraging preclinical data show that our investigational vaccine candidates targeting uropathogenic

Escherichia coli elicit strong antibody titers and robust T-cell responses, comparing very favorably to recombinant protein-based vaccines.

Based on these promising results, we believe there is a significant commercial opportunity for an mRNA solution that offers meaningful

benefits to individuals suffering from these infections."

mRNA technology is ideally

suited for developing prophylactic vaccines against bacterial targets like UPEC due to its ability to target specific disease antigens

and flexibly combine multiple antigens.

CureVac has conducted

preclinical studies with several UPEC vaccine candidates and selected a lead candidate for further preclinical testing. The promising

data, which compares favorably to recombinant protein-based vaccines, is being presented at the 12th International mRNA Health Conference

in Boston from November 11-14, 2024.

The studies assessed

two mRNA vaccine candidates encoding FimH, an antigen facilitating UPEC adhesion to bladder epithelial cells, in mouse and rat models.

Both candidates induced high levels of binding antibodies in serum and urine, correlating with high serum functional antibodies, and showed

strong induction of antigen-specific CD8+ and CD4+ T-cells. Additionally, both vaccine candidates demonstrated superior

immunogenicity compared to protein-based comparator vaccines.

Based on these encouraging

preclinical results, CureVac expects to select a clinical candidate in the first half of 2025. An IND application filing is planned in

the second half of 2025, aiming to initiate a Phase 1 study in the first half of 2026.

Seasonal Influenza Phase 2 Data –

Program Licensed to GSK

In September 2024, GSK announced positive

Phase 2 headline data from its seasonal influenza mRNA vaccine program based on CureVac’s second-generation mRNA backbone. According

to GSK, the data demonstrated positive immune responses against both influenza A strains as well as historically challenging influenza

B strains compared to the current standard of care.

"For many years, developing

vaccines that elicit strong immune responses against influenza B strains has been a significant challenge," said Dr. Mendila.

"The recent data from our GSK-licensed seasonal influenza mRNA vaccine program are remarkable because they show we are overcoming

one of the greatest hurdles in bringing this type of vaccine to market. This is a significant milestone in seasonal flu vaccine development."

The interim data met all predefined success criteria

in the tested age groups of older and younger adults and suggested an acceptable safety and reactogenicity profile. GSK confirmed that

the program is progressing to Phase 3 in 2025, which will be associated with a significant milestone payment for CureVac.

More information can

be found at clinicaltrials.gov (NCT06431607).

As

previously announced in July 2024, CureVac and GSK restructured their collaboration into a new licensing agreement. Under the new

agreement, GSK has assumed full control of the development, manufacturing and global commercialization of mRNA vaccine candidates against

influenza and COVID-19, including combinations. All vaccine candidates currently in clinical development are based on CureVac’s

proprietary second-generation mRNA backbone.

Financial Update for the Third Quarter and First Nine Months of

2024

Commenting on the financial results, Axel Sven Malkomes, CureVac’s

new Chief Financial Officer, said:

"Joining CureVac at this pivotal

time is incredibly exciting. Our strengthened cash position, supported by our strategic redesign—including a significant reduction

in headcount—provides a solid foundation to execute our strategic objectives. By extending our cash runway into 2028, we can allocate

more resources toward our promising R&D pipeline in oncology and infectious diseases. I am committed to ensuring that we maintain

financial discipline as we drive forward our mission to develop transformative mRNA medicines and create long-term value for our shareholders."

Cash Position

Cash and cash equivalents amounted to €550.9

million at the end of September 2024, increasing from €402.5 million at the end of 2023. The company received the €400

million upfront payment from the new GSK licensing agreement in August 2024. In the first nine months of 2024, cash used in operations

was mainly allocated to payments related to the termination of raw material commitments for the first-generation COVID-19 vaccine, CVnCoV,

amounting to a total of €52 million and the payment of contract manufacturing organization (CMO)-related arbitration awards.

All CMO-related arbitrations are closed, with the last payment made in the third quarter of 2024. Looking forward, there will be no further

payments related to CVnCoV.

The remaining cash spend was mainly related to

ongoing R&D activities. The company reaffirms its expected cash runway into 2028.

Revenues

Revenues amounted to €493.9 million and €520.7

million for the three and nine months ended September 30, 2024, respectively, representing an increase of €477.4 million and

€489.5 million, or 2,897% and 1,569%, from €16.5 million and €31.2 million for the same periods in 2023.

The increase year-on-year was primarily driven

by the new license agreement with GSK, which was closed in July 2024. CureVac received a non-refundable upfront payment of €400 million.

Under the new license agreement, CureVac has no obligation to perform R&D work in connection with the newly granted licenses and GSK

is provided with the right to use CureVac’s intellectual property. As such, the upfront payment was fully recognized in the third

quarter of 2024 as revenue.

Under previous GSK agreements, upfront and milestone

payments were related to R&D activities performed by CureVac over a period of time. Accordingly, related payments were recognized

as contract liabilities and recognized as revenue on a pro rata basis over the period R&D activities were performed.

CureVac and GSK agreed in the new license agreement

that all unfulfilled performance obligations from prior collaborations relating to R&D services had expired. As a result, the remaining

€80.4 million of contract liabilities for prior collaborations were recognized as non-cash revenue in the third quarter of 2024.

€480.4 million of the revenue recognized

in the third quarter of 2024 must therefore be seen as a positive one-time event that will not be repeated in the future.

Additionally, in the third quarter of 2024, CureVac

reached a development milestone of €10.0 million under the previous GSK collaboration for the Phase 2 transition of the pre-pandemic

avian influenza (H5N1) program, which is also fully recognized as revenue in the third quarter of 2024.

The remaining revenues relate to work on the GSK

and CRISPR collaborations.

Operating Result

Operating profit amounted to €368.4 million

and €221.4 million for the three and nine months ended September 30, 2024, respectively, representing an increase of €422.4 million

and €407.6 million from an operating loss of €54.0 million and €186.2 million for the same periods in 2023.

The operating result was affected by several key

drivers partially related to the new strategy and the closing of the first-generation vaccine effort in COVID-19:

| • | Cost of sales increased year-on-year mainly due to higher arbitration costs for CMO activities related to the first-generation COVID-19

vaccine as well as due to higher personnel expenses related to the restructuring of the organization. |

| • | Research and development expenses increased primarily with increased activity in oncology R&D projects. Additionally, the first

nine months of 2024 were impacted by increased expenses related to the litigation to enforce intellectual property rights. |

| • | General and administrative expenses decreased compared to the prior year period mainly driven by lower personnel expenses. |

| • | Other income increased year-on-year due to the sale of raw materials to GSK. |

| • | Other operating expenses increased year-on-year due to a partial impairment of CureVac’s production facility. |

While the production facility was initially planned and set

up for commercial (large scale) production, CureVac no longer has large scale production obligations in addition to the strategic re-focus

on technology innovation, research and development. Most parts of the production process can be scaled down to provide products for clinical

production. Parts of the production process that cannot be scaled down were partially impaired in an amount of €36.6 million.

Financial Result (Finance Income and Expenses)

Net financial result for the three and nine months

ended September 30, 2024, amounted to €2.2 million and €8.0 million, or a decrease of €3.1 million and €4.7

million, from €5.3 million and €12.7 million, respectively, for the same periods in 2023. This decrease was mainly driven

by lower interest income on cash investments.

Pre-Tax Results

Pre-tax profit was €370.6 million and €229.4

million for the three and nine months ended September 30, 2024, compared to a pre-tax loss of €48.7 million and €173.5

million in the same periods of 2023.

Conference call and

webcast details

CureVac

will host a conference call and webcast today at 3 p.m. CET / 9 a.m. EST.

Dial-in numbers to participate in the conference call:

| U.S. Toll-Free: | +1-877-407-0989 |

| International: | +1-201-389-0921 |

| Germany: | 0800-182-0040 (landline access)

/ 0800-184-4713 (cell phone access) |

The

live webcast link can be accessed via the newsroom section of the CureVac website at https://www.curevac.com/en/newsroom/events/

Corresponding

presentation slides will be posted shortly before the start of the webcast.

A replay will be made available at this website after the event.

About CureVac

CureVac (Nasdaq: CVAC) is a pioneering multinational

biotech company founded in 2000 to advance the field of messenger RNA (mRNA) technology for application in human medicine. In more than

two decades of developing, optimizing, and manufacturing this versatile biological molecule for medical purposes, CureVac has introduced

and refined key underlying technologies that were essential to the production of mRNA vaccines against COVID-19, and is currently laying

the groundwork for application of mRNA in new therapeutic areas of major unmet need. CureVac is leveraging mRNA technology, combined with

advanced omics and computational tools, to design and develop off-the-shelf and personalized cancer vaccine product candidates. It also

develops programs in prophylactic vaccines and in treatments that enable the human body to produce its own therapeutic proteins. Headquartered

in Tübingen, Germany, CureVac also operates sites in the Netherlands, Belgium, Switzerland, and the U.S. Further information can

be found at www.curevac.com.

CureVac Media and Investor Relations Contact

Dr. Sarah Fakih,

Vice President Corporate Communications and Investor Relations

CureVac, Tübingen,

Germany

T: +49 7071 9883-1298

M: +49 160 90 496949

sarah.fakih@curevac.com

Forward-Looking Statements of CureVac

This press release contains statements that constitute

“forward looking statements” as that term is defined in the United States Private Securities Litigation Reform Act of 1995,

including statements that express the opinions, expectations, beliefs, plans, objectives, assumptions or projections of CureVac N.V. and/or

its wholly owned subsidiaries CureVac SE, CureVac Manufacturing GmbH, CureVac Inc., CureVac Swiss AG, CureVac Corporate Services GmbH,

CureVac Belgium SA and CureVac Netherlands B.V. (the “company”) regarding future events or future results, in contrast with

statements that reflect historical facts. Examples include discussion of the potential efficacy of the company’s vaccine and treatment

candidates and the company’s strategies, financing plans, cash runway expectations, the timing and impact of restructuring, growth

opportunities and market growth. In some cases, you can identify such forward-looking statements by terminology such as “anticipate,”

“intend,” “believe,” “estimate,” “plan,” “seek,” “project,” “expect,”

“may,” “will,” “would,” “could,” “potential,” “intend,” or “should,”

the negative of these terms or similar expressions. Forward-looking statements are based on management’s current beliefs and assumptions

and on information currently available to the company. However, these forward-looking statements are not a guarantee of the company’s

performance, and you should not place undue reliance on such statements. Forward-looking statements are subject to many risks, uncertainties

and other variable circumstances, including negative worldwide economic conditions and ongoing instability and volatility in the worldwide

financial markets, ability to obtain funding, ability to conduct current and future preclinical studies and clinical trials, the timing,

expense and uncertainty of regulatory approval, reliance on third parties and collaboration partners, ability to commercialize products,

ability to manufacture any products, possible changes in current and proposed legislation, regulations and governmental policies, pressures

from increasing competition and consolidation in the company’s industry, the effects of the COVID-19 pandemic on the company’s

business and results of operations, ability to manage growth, reliance on key personnel, reliance on intellectual property protection,

ability to provide for patient safety, fluctuations of operating results due to the effect of exchange rates, delays in litigation proceedings,

different judicial outcomes or other factors. Such risks and uncertainties may cause the statements to be inaccurate and readers are cautioned

not to place undue reliance on such statements. Many of these risks are outside of the company’s control and could cause its actual

results to differ materially from those it thought would occur. The forward-looking statements included in this press release are made

only as of the date hereof. The company does not undertake, and specifically declines, any obligation to update any such statements or

to publicly announce the results of any revisions to any such statements to reflect future events or developments, except as required

by law.

For further information, please reference the

company’s reports and documents filed with the U.S. Securities and Exchange Commission (the “SEC”). You may get these

documents by visiting EDGAR on the SEC website at www.sec.gov.

Cash and Condensed Consolidated Profit and Loss Data

| | |

| | |

| |

| (in € millions) | |

| December 31,

2023 | | |

| September 30,

2024 | |

| Cash and Cash Equivalents | |

| 402.5 | | |

| 550.9 | |

| | |

Three months ended September 30, | |

| (in € millions) | |

2023 | | |

2024 | |

| Revenue | |

| 16.5 | | |

| 493.9 | |

| Cost of Sales, R&D, SG&A, Other Operating Expenses & Other Operating Income | |

| -70.5 | | |

| -125.5 | |

| Operating Result | |

| -54.0 | | |

| 368.4 | |

| Financial Result | |

| 5.3 | | |

| 2.2 | |

| Pre-Tax Result | |

| -48.7 | | |

| 370.6 | |

| | |

Nine months ended September 30, | |

| (in € millions) | |

2023 | | |

2024 | |

| Revenue | |

| 31.2 | | |

| 520.7 | |

| Cost of Sales, R&D, SG&A, Other Operating Expenses & Other Operating Income | |

| -217.4 | | |

| -299.3 | |

| Operating Result | |

| -186.2 | | |

| 221.4 | |

| Financial Result | |

| 12.7 | | |

| 8.0 | |

| Pre-Tax Result | |

| -173.5 | | |

| 229.4 | |

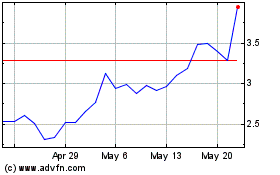

CureVac NV (NASDAQ:CVAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

CureVac NV (NASDAQ:CVAC)

Historical Stock Chart

From Feb 2024 to Feb 2025