iSpecimen Inc. (Nasdaq: ISPC) (“iSpecimen” or the “Company”),

an online global marketplace that connects scientists requiring

biospecimens for medical research with a network of healthcare

specimen providers, today reported its financial and operating

results for the three-month period ended March 31, 2024.

“iSpecimen made tremendous progress during the

first quarter advancing our most promising operational initiative,

Next Day Quotes, a program that expedites the biospecimen

transaction process, which has helped elevate our market position

and is expected to contribute meaningfully to our growth in 2024

and beyond,” said Tracy Curley, CEO of iSpecimen. “To transition

our suppliers to Next Day Quotes, we have strategically refined our

supplier network, deeply aligning and effectively engaging with our

strongest suppliers to maximize their operational capabilities,

while terminating relationships with suppliers unable to support

the needs of our expanding customer base.”

“In the first quarter of 2024, 40% of all quotes

provided to customers qualified as Next Day Quotes, compared to 34%

in the fourth quarter of 2023 and 25% in the third quarter of 2023.

This favorable quarter-over-quarter increase in Next Day Quotes was

directly correlated to growth across all of our business lines.

During the first quarter of 2024, 91% of prospective Next Day

Quotes dollars converted to purchase orders, compared to 32% in the

fourth quarter of 2023. As we continue to refine and strengthen our

supplier network, I am confident transitioning a majority of our

business into Next Day Quotes will result in stronger positioning

for iSpecimen and result in greatly improved top- and bottom-line

results over time,” concluded Ms. Curley.

First Quarter 2024

Highlights

- As of March 31, 2024, iSpecimen had

over 140 unique supplier organizations under contract, a reduction

of 103 from 243 suppliers at December 31, 2023, a planned reduction

related to the Company’s focus on building a higher quality of our

supplier network;

- As of March 31, 2024, over 600

unique customer organizations purchased from iSpecimen, an increase

of 66 from 534 at the end of the first quarter 2023;

- iSpecimen Marketplace had nearly

7,564 registered research and supplier users as of March 31, 2024,

up approximately 9% from 6,918 as of March 31, 2023.

Recent Corporate Updates

- iSpecimen and TriMetis Life

Sciences Announce Strategic Partnership to help Transform

Tissue-Based Research

Financial Results for First Quarter

2024For the quarter ended March 31, 2024, revenue was

approximately $2.29 million, compared to approximately $2.95

million for the quarter ended March 31, 2023. The reduction was

primarily due to a decrease of 3,388 specimens, or approximately

39%, in specimen count, from 8,629 specimens during the quarter

ended March 31, 2023 to 5,241 specimens during the quarter ended

March 31, 2024. The effect of the decrease in specimen count was

partially offset by an increase in the average selling price per

specimen by approximately $95, or approximately 28%, from $342 in

the first quarter of 2023 to approximately $437 in the first

quarter of 2024.

For the quarter ended March 31, 2024, cost of

revenue decreased by approximately $147,000, or approximately 13%,

to approximately $1 million, compared to approximately $1.15

million for the quarter ended March 31, 2023. The decrease in cost

of revenue was attributable to a 39% decrease in the number of

specimens accessioned for the current period, compared to the same

period in the prior year, partially offset by a $58, or 44%,

increase in the average cost per specimen.

For the quarter ended March 31, 2024, general

and administrative expenses increased by approximately $286,000 or

approximately 16%, to approximately $2.10 million, compared to

approximately $1.82 million for the quarter ended March 31, 2023.

The increase was attributable to increases in professional fees of

approximately $329,000, taxes and insurance of approximately

$267,000, and bad debt expense of approximately $45,000, which were

partially offset by decreases in compensation costs of

approximately $250,000, general operating expenses of approximately

$78,000, depreciation and amortization of approximately $23,000,

and utilities and facilities expenses of approximately $4,000.

For the quarter ended March 31, 2024, the net

loss was approximately $2.90 million, or ($0.32) per share,

compared to a net loss of approximately $2.43 million, or ($0.27)

per share, for the same period the prior quarter.

As of March 31, 2024, cash and cash equivalents,

along with available-for-sale securities, were approximately $2.56

million, compared to approximately $5.01 million as of December 31,

2023.

On March 5, 2024, iSpecimen entered into an At

the Market Offering Agreement, under which iSpecimen may issue and

sell shares of its common stock from time to time for an aggregate

offering price of up to $1.5 million, which shares, when issued,

will be registered pursuant to its shelf registration statement.

The Company may seek additional funding through public equity or

other sources to fund further capital investments or for general

corporate purposes.

Conference Call and Webcast

Information

The Company will host a conference call and

audio webcast on Tuesday, May 7, 2024, at 8:30 a.m. Eastern Time

featuring remarks by Tracy Curley, CEO.

| Event: |

iSpecimen

First Quarter 2024 Results Conference Call |

| Date: |

Tuesday, May 7, 2024 |

| Time: |

8:30 a.m. Eastern Time |

| Dial in: |

1-800-717-1738 (U.S. Toll Free) or 1-646-307-1865

(International) |

| Webcast: |

https://viavid.webcasts.com/starthere.jsp?ei=1666705&tp_key=0ac1c8e17f |

| |

|

For interested individuals unable to join the

conference call, a replay will be available through May 21, 2024,

at +1-844-512-2921 (U.S. Toll Free) or +1-412-317-6671

(International). Participants must use the following code to access

the replay of the call: 1170104. An archived version of the webcast

will also be available on iSpecimen’s Investor Relations site:

https://investors.ispecimen.com/presentations/.

About iSpecimeniSpecimen

(Nasdaq: ISPC) offers an online marketplace for human biospecimens,

connecting scientists in commercial and non-profit organizations

with healthcare providers that have access to patients and

specimens needed for medical discovery. Proprietary, cloud-based

technology enables scientists to intuitively search for specimens

and patients across a federated partner network of hospitals, labs,

biobanks, blood centers and other healthcare organizations. For

more information, please visit www.ispecimen.com.

Forward Looking Statements

This press release may contain forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Such forward-looking statements are

characterized by future or conditional verbs such as "may," "will,"

"expect," "intend," "anticipate," “believe," "estimate," "continue"

or similar words. You should read statements that contain these

words carefully because they discuss future expectations and plans,

which contain projections of future results of operations or

financial condition or state other forward-looking information.

Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Many factors could cause actual

future events to differ materially from the forward-looking

statements in this press release, including but not limited to the

risk factors contained in the Company's filings with the U.S.

Securities and Exchange Commission, which are available for review

at www.sec.gov. Forward-looking statements speak only as of the

date they are made. New risks and uncertainties arise over time,

and it is not possible for the Company to predict those events or

how they may affect the Company. If a change to the events and

circumstances reflected in the Company's forward-looking statements

occurs, the Company's business, financial condition and operating

results may vary materially from those expressed in the Company's

forward-looking statements.

Readers are cautioned not to put undue reliance

on forward-looking statements, and the Company assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events or otherwise.

For further information, please contact:

Investor ContactKCSA Strategic

CommunicationsPhil Carlson / Erika Kay iSpecimen@kcsa.com

|

|

|

iSpecimen Inc. |

|

Condensed Balance Sheets |

| |

|

|

|

|

|

|

|

| |

|

March 31, 2024 |

|

December 31, 2023 |

|

|

ASSETS |

|

(Unaudited) |

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,089,891 |

|

|

$ |

2,343,666 |

|

|

|

Available-for-sale securities |

|

|

466,493 |

|

|

|

2,661,932 |

|

|

|

Accounts receivable – unbilled |

|

|

1,978,144 |

|

|

|

2,212,538 |

|

|

|

Accounts receivable, net of allowance for doubtful accounts of

$718,821 and $520,897 at March 31, 2024 and

December 31, 2023, respectively |

|

|

437,424 |

|

|

|

728,388 |

|

|

|

Prepaid expenses and other current assets |

|

|

313,999 |

|

|

|

292,079 |

|

|

|

Total current assets |

|

|

5,285,951 |

|

|

|

8,238,603 |

|

|

|

Property and equipment, net |

|

|

120,873 |

|

|

|

127,787 |

|

|

|

Internally developed software, net |

|

|

6,065,770 |

|

|

|

6,323,034 |

|

|

|

Other intangible assets, net |

|

|

860,366 |

|

|

|

908,255 |

|

|

|

Operating lease right-of-use asset |

|

|

153,340 |

|

|

|

193,857 |

|

|

|

Security deposits |

|

|

27,601 |

|

|

|

27,601 |

|

|

|

Total assets |

|

$ |

12,513,901 |

|

|

$ |

15,819,137 |

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,560,474 |

|

|

$ |

3,925,438 |

|

|

|

Accrued expenses |

|

|

1,710,815 |

|

|

|

1,540,607 |

|

|

|

Operating lease current obligation |

|

|

156,703 |

|

|

|

167,114 |

|

|

|

Deferred revenue |

|

|

272,681 |

|

|

|

415,771 |

|

|

|

Total current liabilities |

|

|

5,700,673 |

|

|

|

6,048,930 |

|

|

| Operating lease long-term

obligation |

|

|

— |

|

|

|

29,130 |

|

|

|

Total liabilities |

|

|

5,700,673 |

|

|

|

6,078,060 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies

(See Note 8) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

Common stock, $0.0001 par value, 200,000,000 shares authorized,

9,501,112 issued and 9,470,112 outstanding at March 31, 2024

and 9,114,371 issued and 9,083,371 outstanding at

December 31, 2023 |

|

|

947 |

|

|

|

908 |

|

|

|

Additional paid-in capital |

|

|

69,079,341 |

|

|

|

69,104,313 |

|

|

|

Treasury stock, 31,000 shares at March 31, 2024 and

December 31, 2023, at cost |

|

|

(172 |

) |

|

|

(172 |

) |

|

|

Accumulated other comprehensive income |

|

|

41 |

|

|

|

840 |

|

|

|

Accumulated deficit |

|

|

(62,266,929 |

) |

|

|

(59,364,812 |

) |

|

|

Total stockholders’ equity |

|

|

6,813,228 |

|

|

|

9,741,077 |

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

12,513,901 |

|

|

$ |

15,819,137 |

|

|

|

iSpecimen Inc. |

|

Condensed Statements of Operations and Comprehensive

Loss |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

| |

|

2024 |

|

2023 |

|

|

Revenue |

|

$ |

2,289,993 |

|

|

$ |

2,950,197 |

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

1,000,006 |

|

|

|

1,146,912 |

|

|

|

Technology |

|

|

911,967 |

|

|

|

834,407 |

|

|

|

Sales and marketing |

|

|

665,941 |

|

|

|

962,169 |

|

|

|

Supply development |

|

|

197,839 |

|

|

|

275,246 |

|

|

|

Fulfillment |

|

|

410,854 |

|

|

|

455,531 |

|

|

|

General and administrative |

|

|

2,103,906 |

|

|

|

1,818,355 |

|

|

|

Total operating expenses |

|

|

5,290,513 |

|

|

|

5,492,620 |

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(3,000,520 |

) |

|

|

(2,542,423 |

) |

|

| |

|

|

|

|

|

|

|

| Other income, net |

|

|

|

|

|

|

|

|

Interest expense |

|

|

(4,465 |

) |

|

|

(3,535 |

) |

|

|

Interest income |

|

|

30,498 |

|

|

|

114,263 |

|

|

|

Other income (expense), net |

|

|

72,370 |

|

|

|

(117 |

) |

|

|

Total other income, net |

|

|

98,403 |

|

|

|

110,611 |

|

|

| |

|

|

|

|

|

|

|

| Net loss |

|

$ |

(2,902,117 |

) |

|

$ |

(2,431,812 |

) |

|

| |

|

|

|

|

|

|

|

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,902,117 |

) |

|

$ |

(2,431,812 |

) |

|

|

Unrealized gain (loss) on available-for-sale securities |

|

|

(799 |

) |

|

|

18,843 |

|

|

|

Total other comprehensive income (loss) |

|

|

(799 |

) |

|

|

18,843 |

|

|

| Comprehensive loss |

|

$ |

(2,902,916 |

) |

|

$ |

(2,412,969 |

) |

|

| |

|

|

|

|

|

|

|

| Net loss per share - basic and

diluted |

|

$ |

(0.32 |

) |

|

$ |

(0.27 |

) |

|

| |

|

|

|

|

|

|

|

| Weighted average shares of

common stock outstanding - basic and diluted |

|

|

9,132,460 |

|

|

|

8,980,898 |

|

|

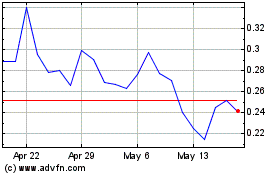

iSpecimen (NASDAQ:ISPC)

Historical Stock Chart

From Dec 2024 to Dec 2024

iSpecimen (NASDAQ:ISPC)

Historical Stock Chart

From Dec 2023 to Dec 2024