FALSE000171127900017112792025-02-192025-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 19, 2025

KRYSTAL BIOTECH, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38210 | | 82-1080209 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification Number) |

2100 Wharton Street, Suite 701

Pittsburgh, Pennsylvania 15203

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (412) 586-5830

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | KRYS | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 19, 2025, Krystal Biotech, Inc., a Delaware corporation (the “Company”), announced its financial results for the quarter and year ending December 31, 2024. A copy of the Company’s press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

The information concerning financial results in this Form 8-K and in Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information concerning financial results in this Form 8-K and in Exhibit 99.1 attached hereto shall not be incorporated into any registration statement or other document filed with the Securities and Exchange Commission by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| |

| 99.1 | | |

| 104 | | Cover Page Interactive Data file (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

Date: February 19, 2025 | | | | KRYSTAL BIOTECH, INC. |

| | | |

| | | | By: | | /s/ Krish S. Krishnan |

| | | | Name: | | Krish S. Krishnan |

| | | | Title: | | Chairman and Chief Executive Officer |

Krystal Biotech Announces Fourth Quarter and Full Year 2024

Financial and Operating Results

Fourth quarter revenues increased 116% to $91.1 million versus fourth quarter of 2023

Full year revenues increased 473% to $290.5 million versus 2023

CFF TDN granted full sanctioning of KB407 Phase 1 protocol

Strong balance sheet, ending the quarter with $749.6 million in cash and investments

PITTSBURGH, February 19, 2025 (GLOBE NEWSWIRE) – Krystal Biotech, Inc. (the “Company”) (NASDAQ: KRYS), a commercial-stage biotechnology company, today reported financial results for the fourth quarter and full year ending December 31, 2024 and provided a business update.

"Last year, our commercial and financial strength allowed us to deliver significant earnings growth, continue to build out a global footprint, and advance multiple clinical stage programs from our industry-leading HSV-1 based gene delivery platform,” said Krish S. Krishnan, Chairman and CEO of Krystal Biotech. “Building on this foundation, our focus in 2025 will be on executing the global launch of VYJUVEK and progressing our rare disease and oncology programs through key milestones to bring our redosable genetic medicines closer to patients.”

VYJUVEK® (beremagene geperpavec-svdt, or B-VEC)

for the Treatment of Dystrophic Epidermolysis Bullosa (DEB)

•The Company recorded $91.1 million and $290.5 million in VYJUVEK net product revenue for the fourth quarter and full year of 2024. Gross margin for the fourth quarter was 95%.

•As of February 2025, the Company has secured over 510 reimbursement approvals for VYJUVEK in the U.S. and continues to maintain strong access nationwide including positive access determinations for 97% of lives covered under commercial and Medicaid plans.

•High patient compliance with weekly treatment while on drug continued at 85% as of the end of 2024.

•The Company expects a Committee for Medicinal Products for Human Use opinion on its European Marketing Authorization Application in 1Q 2025.

•The Pharmaceuticals and Medical Devices Agency’s review of the Company’s Japan New Drug Application is ongoing and on track for a decision in 2H 2025.

Ophthalmology

KB803 for ocular complications of DEB

•The Company has enrolled approximately 50 DEB patients in an ongoing natural history study to prospectively collect data on the frequency of corneal abrasions in patients

with DEB and serve as a run-in period for patients who may be eligible to participate in the Company’s registrational Phase 3 study evaluating KB803 effect on corneal abrasions of DEB. The registrational Phase 3 study, IOLITE, is a single arm, open-label study that is expected to commence in 1H 2025.

Pipeline expansion

•The Company is actively evaluating multiple, internal preclinical-stage genetic medicine candidates for the treatment of diseases of the front and back of the eye.

Respiratory

KB407 for the treatment of cystic fibrosis (CF)

•In January 2025, the Cystic Fibrosis Foundation (CFF) Therapeutic Development Network (TDN) Clinical Research Executive Committee granted full sanctioning of the Company’s KB407 Phase 1 CORAL-1 study protocol.

•In December 2024, the Company announced that single and repeat dosing of KB407 was safe and well-tolerated by patients in both Cohort 1 and Cohort 2 of the ongoing KB407 Phase 1 CORAL-1 study. The Company expects to report interim molecular data for Cohort 3 patients in mid-2025. CORAL-1 is a multi-center, dose escalation study evaluating KB407 in patients with CF, regardless of their underlying genotype. Details of the study can be found at www.clinicaltrials.gov under NCT identifier NCT05504837. KB408 for the treatment of alpha-1 antitrypsin deficiency (AATD) lung disease

•In December 2024, the Company announced successful SERPINA1 gene delivery and functional alpha-1 antitrypsin expression reaching therapeutic levels as part of an interim clinical update for Cohorts 1 and 2 of its ongoing KB408 Phase 1 SERPENTINE-1 study. Inhaled KB408 was safe and well-tolerated at both tested dose levels. Based on this promising initial data, the Company has simultaneously expanded Cohort 2 and opened Cohort 3 of SERPENTINE-1 for more comprehensive molecular assessments at both dose levels and expects to report results from both cohorts in 2H 2025. SERPENTINE-1 is an open label, single dose escalation study in adult patients with AATD with a Pi*ZZ or a Pi*ZNull genotype. Details about the study can be found at www.clinicaltrials.gov under NCT identifier: NCT06049082. Oncology

Inhaled KB707 for the treatment of solid tumors of the lung

•In December 2024, the Company announced an initial clinical update for the monotherapy dose escalation and expansion cohorts of KYANITE-1, an ongoing, Phase 1/2 open label, multi-center, dose escalation and expansion study evaluating inhaled KB707, as monotherapy or in combination, in patients with locally advanced or metastatic solid tumors of the lung. Early clinical evidence of monotherapy activity was observed in heavily pre-treated patients with advanced non-small cell lung cancer treated with inhaled KB707, achieving an objective response rate of 27% and disease control rate of 73% as of data cut-off. Inhaled KB707 was also reported to be safe and generally well tolerated and amenable to administration in an outpatient setting, with

no Grade 4 or 5 adverse events observed. Enrollment in KYANITE-1 is ongoing. Details of the study can be found at www.clinicaltrials.gov under NCT identifier NCT06228326.

Intratumoral KB707 for the treatment of injectable solid tumors

•The Company continues to enroll in OPAL-1, a Phase 1/2 open label, multi-center, dose escalation and expansion study evaluating intratumoral KB707, either as monotherapy or in combination, in patients with locally advanced or metastatic solid tumor malignancies. Details of the study can be found at www.clinicaltrials.gov under NCT identifier NCT05970497.

Aesthetics

KB301 for the treatment of dynamic wrinkles of the décolleté

•Building on the previously reported positive interim safety and efficacy results for KB301 in the treatment of dynamic wrinkles of the décolleté, Jeune Aesthetics, Inc. (“Jeune Aesthetics”), a wholly-owned subsidiary of the Company, has initiated development of a décolleté-specific evaluation scale necessary for advanced clinical development. Jeune Aesthetics expects to complete scale development and dose the first subject in a randomized, placebo-controlled Phase 2 study evaluating KB301 for the treatment of dynamic wrinkles of the décolleté in 2H 2025. KB304 for the treatment of aesthetic indications

•In November 2024, Jeune Aesthetics dosed the first subject in an ongoing, randomized and placebo-controlled Phase 1 study PEARL-2 evaluating its second clinical-stage investigational aesthetic product KB304 for the treatment of wrinkles. KB304 was developed using the Company’s novel replication-defective, non-integrating HSV-1-based vector and is designed to deliver COL3A1 and ELN transgenes following intradermal injection to increase both type III collagen and elastin levels in aging skin. Jeune Aesthetics expects to report top-line results from the study in 2H 2025. Details of the study can be found at www.clinicaltrials.gov under NCT identifier NCT06724900.

Dermatology

The Company is now planning on initiating the Phase 2 portion of its KB105 Phase 1/2 JADE-1 trial evaluating KB105 for the treatment of TGM1-deficient lamellar ichthyosis in pediatric patients in 2026.

Financial Results for the Quarter Ended December 31, 2024:

•Cash, cash equivalents, and investments totaled $749.6 million as of December 31, 2024.

•Product revenue, net totaled $91.1 million and $42.1 million for the quarters ended December 31, 2024 and December 31, 2023, respectively.

•Cost of goods sold totaled $4.9 million and $2.9 million for the quarters ended December 31, 2024 and December 31, 2023, respectively.

•Research and development expenses for the quarter ended December 31, 2024 were $13.5 million, inclusive of $2.3 million of stock-based compensation, compared to $11.4

million, inclusive of stock-based compensation of $2.4 million for the quarter ended December 31, 2023.

•Selling, general, and administrative expenses for the quarter ended December 31, 2024 were $31.3 million, inclusive of stock-based compensation of $11.0 million, compared to $24.8 million, inclusive of stock-based compensation of $7.5 million, for the quarter ended December 31, 2023.

•Net income for the quarter ended December 31, 2024 was $45.5 million, or $1.58 per common share (basic) and $1.52 per common share (diluted). Net income for the quarter ended December 31, 2023 was $8.7 million, or $0.31 per common share (basic) and $0.30 per common share (diluted).

Financial Results for the Twelve Months Ended December 31, 2024:

•Product revenue, net totaled $290.5 million and $50.7 million for the twelve months ended December 31, 2024 and December 31, 2023, respectively.

•Cost of goods sold totaled $20.1 million and $3.1 million for the twelve months ended December 31, 2024 and December 31, 2023, respectively.

•Research and development expenses for the twelve months ended December 31, 2024 were $53.6 million, inclusive of $9.2 million of stock-based compensation, compared to $46.4 million, inclusive of stock-based compensation of $10.1 million for the twelve months ended December 31, 2023.

•Selling, general, and administrative expenses for the twelve months ended December 31, 2024 were $113.7 million, inclusive of stock-based compensation of $39.9 million, compared to $98.4 million, inclusive of stock-based compensation of $29.9 million, for the twelve months December 31, 2023.

•Net income for the twelve months ended December 31, 2024 was $89.2 million, or $3.12 per common share (basic) and $3.00 per common share (diluted). Net income for the twelve months ended December 31, 2023 was $10.9 million, or $0.40 per common share (basic) and $0.39 per common share (diluted).

•For additional information on the Company’s financial results for the twelve months ended December 31, 2024, please refer to the Form 10-K filed with the SEC.

Financial Guidance

| | | | | | | | |

| ($ in millions) | | FY 2025 Guidance |

Non-GAAP Research and Development (“R&D”) and Selling, General and Administrative (“SG&A”) expense(1) | | $150.0 - $175.0 |

(1) Refer to Non-GAAP Financial Measures section below for additional information. Non-GAAP combined R&D and SG&A expense guidance does not include stock-based compensation as we are currently unable to confidently estimate Full Year 2025 stock-based compensation expense. As such, we have not provided a reconciliation from forecasted non-GAAP to forecasted GAAP combined R&D and SG&A Expense in the above. This could materially affect the calculation of forward-looking GAAP combined R&D and SG&A Expense as it is inherently uncertain.

Conference Call

The Company will host an investor webcast on February 19, 2025, at 8:30 am ET.

Investors and the general public can access the live webcast at:

https://www.webcaster4.com/Webcast/Page/3018/51976

For those unable to listen to the live conference call, a replay will be available for 30 days on the Investors section of the Company’s website at www.krystalbio.com.

About VYJUVEK

VYJUVEK is a non-invasive, topical, redosable gene therapy designed to deliver two copies of the COL7A1 gene when applied directly to DEB wounds. VYJUVEK was designed to treat DEB at the molecular level by providing the patient’s skin cells the template to make normal COL7 protein, thereby addressing the fundamental disease-causing mechanism.

Indication

VYJUVEK is a herpes-simplex virus type 1 (HSV-1) vector-based gene therapy indicated for the treatment of wounds in patients six months of age and older with dystrophic epidermolysis bullosa with mutation(s) in the collagen type VII alpha 1 chain (COL7A1) gene.

IMPORTANT SAFETY INFORMATION

Adverse Reactions

The most common adverse drug reactions (incidence >5%) were itching, chills, redness, rash, cough, and runny nose. These are not all the possible side effects with VYJUVEK. Call your healthcare provider for medical advice about side effects.

To report SUSPECTED ADVERSE REACTIONS, contact Krystal Biotech, Inc. at 1-844-557-9782 or FDA at 1-800-FDA-1088 or http://www.fda.gov/medwatch.

Contraindications

None.

Warnings and Precautions

VYJUVEK gel must be applied by a healthcare provider.

After treatment, patients and caregivers should be careful not to touch treated wounds and dressings for 24 hours.

Wash hands and wear protective gloves when changing wound dressings. Disinfect bandages from the first dressing change with a virucidal agent, and dispose of the disinfected bandages in a separate sealed plastic bag in household waste. Dispose of the subsequent used dressings in a sealed plastic bag in household waste.

Patients should avoid touching or scratching wound sites or wound dressings.

In the event of an accidental exposure flush with clean water for at least 15 minutes.

For more information, see full U.S. Prescribing Information.

About Krystal Biotech, Inc.

Krystal Biotech, Inc. (NASDAQ: KRYS) is a commercial-stage biotechnology company focused on the discovery, development and commercialization of genetic medicines to treat diseases with high unmet medical needs. VYJUVEK® is the Company’s first commercial product, the first-ever redosable gene therapy, and the first medicine approved by the FDA for the treatment of dystrophic epidermolysis bullosa. The Company is rapidly advancing a robust preclinical and clinical pipeline of investigational genetic medicines in respiratory, oncology, dermatology, ophthalmology, and aesthetics. Krystal Biotech is headquartered in Pittsburgh, Pennsylvania. For more information, please visit http://www.krystalbio.com, and follow @KrystalBiotech on LinkedIn and X (formerly Twitter).

About Jeune Aesthetics, Inc.

Jeune Aesthetics, Inc., a wholly-owned subsidiary of Krystal Biotech, Inc., is a biotechnology company leveraging a clinically validated gene delivery platform to develop products to fundamentally address – and reverse – the biology of aging and/or damaged skin. For more information, please visit http://www.jeuneinc.com.

Forward-Looking Statements

Any statements in this press release about future expectations, plans and prospects for Krystal Biotech, Inc. or Jeune Aesthetics, Inc., including statements about the commercial launch of VYJUVEK in the United States; potential marketing authorizations for B-VEC in Europe and Japan, including timing of regulatory approvals; the Company’s expectations regarding reporting interim molecular data from Cohort 3 of the Company’s KB407 clinical trial; the Company’s expectations regarding reporting results from Cohort 2 and Cohort 3 of the Company’s KB408 clinical trial; the timing of scale development and dosing the first subject in a randomized, placebo-controlled Phase 2 study evaluating KB301; the expected timing of reporting top-line results from Jeune Aesthetics’ KB304 study; the expected timing of initiation of the Phase 2 portion of the KB105 Phase 1/2 study; and other statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “likely,” “will,” “would,” “could,” “should,” “continue,” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: uncertainties associated with regulatory review of clinical trials and applications for marketing approvals; the availability or commercial potential of VYJUVEK or product candidates; and such other important factors as are set forth under the caption “Risk Factors” in the Company’s annual and quarterly reports on file with the U.S. Securities and Exchange Commission. In addition, the forward-looking statements included in this press release represent the Company’s views as of the date of this press release. The Company anticipates that subsequent events and developments will cause its views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this press release.

Non-GAAP Financial Measures

This press release includes forward-looking combined R&D and SG&A expense guidance that is not required by, or presented in accordance with, U.S. GAAP and should not be considered as

an alternative to R&D and SG&A expense or any other performance measure derived in accordance with GAAP. The Company defines non-GAAP combined R&D and SG&A expense as GAAP combined R&D and SG&A expense excluding stock-based compensation. The Company cautions investors that amounts presented in accordance with its definition of non-GAAP combined R&D and SG&A expense may not be comparable to similar measures disclosed by competitors because not all companies calculate this non-GAAP financial measure in the same manner. The Company presents this non-GAAP financial measure because it considers this measure to be an important supplemental measure and believes it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in the Company’s industry. Management believes that investors’ understanding of the Company’s performance is enhanced by including this forward-looking non-GAAP financial measure as a reasonable basis for comparing the Company’s ongoing results of operations. Management uses this non-GAAP financial measure for planning purposes, including the preparation of the Company’s internal annual operating budget and financial projections; to evaluate the performance and effectiveness of the Company’s operational strategies; and to evaluate the Company’s capacity to expand its business. This non-GAAP financial measure has limitations as an analytical tool, and should not be considered in isolation, or as an alternative to, or a substitute for R&D and SG&A expense or other financial statement data presented in accordance with GAAP in the Company’s consolidated financial statements. The Company has not provided a quantitative reconciliation of forecasted non-GAAP combined R&D and SG&A expense to forecasted GAAP combined R&D and SG&A expense because the Company is unable, without making unreasonable efforts, to calculate the reconciling item, stock-based compensation expenses, with confidence. This item, which could materially affect the computation of forward-looking GAAP combined R&D and SG&A expense, is inherently uncertain and depends on various factors, some of which are outside of the Company’s control.

CONTACT

Investors and Media:

Stéphane Paquette, PhD

Krystal Biotech

spaquette@krystalbio.com

Condensed Consolidated Balance Sheet Data:

| | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 |

| (in thousands) | (unaudited) | | |

| Balance sheet data: | | | |

| Cash and cash equivalents | $ | 344,865 | | | $ | 358,328 | |

| Short-term investments | 252,652 | | | 173,850 | |

| Long-term investments | 152,114 | | | 61,954 | |

| Total assets | 1,055,838 | | | 818,355 | |

| Total liabilities | 109,458 | | | 39,714 | |

| Total stockholders’ equity | $ | 946,380 | | | $ | 778,641 | |

Condensed Consolidated Statements of Operations:

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | |

| 2024 | | 2023 | | Change |

| (in thousands, except per share data) | (unaudited) | | |

| Revenue | | | | | |

Product revenue, net | $ | 91,139 | | | $ | 42,143 | | | $ | 48,996 | |

| Expenses | | | | | |

| Cost of goods sold | 4,949 | | | 2,871 | | | 2,078 | |

| Research and development | 13,523 | | | 11,370 | | | 2,153 | |

| Selling, general, and administrative | 31,288 | | | 24,764 | | | 6,524 | |

| Total operating expenses | 49,760 | | | 39,005 | | | 10,755 | |

| Income (loss) from operations | 41,379 | | | 3,138 | | | 38,241 | |

| Other income | | | | | |

| | | | | |

| Interest and other income, net | 7,231 | | | 7,519 | | | (288) | |

| | | | | |

| Income before income taxes | 48,610 | | | 10,657 | | | 37,953 | |

Income tax expense | (3,131) | | | (1,965) | | | (1,166) | |

| Net income | $ | 45,479 | | | $ | 8,692 | | | $ | 36,787 | |

| | | | | |

| Net income per common share: | | | | | |

| Basic | $ | 1.58 | | | $ | 0.31 | | | |

| Diluted | $ | 1.52 | | | $ | 0.30 | | | |

| | | | | |

| Weighted-average common shares outstanding: | | | | | |

| Basic | 28,755 | | | 28,169 | | | |

| Diluted | 29,883 | | | 28,818 | | | |

| | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, | | |

| 2024 | | 2023 | | Change |

| (in thousands, except per share data) | (unaudited) | | |

| Revenue | | | | | |

Product revenue, net | $ | 290,515 | | | $ | 50,699 | | | $ | 239,816 | |

| Expenses | | | | | |

| Cost of goods sold | 20,061 | | | 3,094 | | | 16,967 | |

| Research and development | 53,573 | | | 46,431 | | | 7,142 | |

| Selling, general, and administrative | 113,686 | | | 98,401 | | | 15,285 | |

| Litigation settlement | 37,500 | | | 12,500 | | | 25,000 | |

| Total operating expenses | 224,820 | | | 160,426 | | | 64,394 | |

| Income (loss) from operations | 65,695 | | | (109,727) | | | 175,422 | |

| Other income | | | | | |

| | | | | |

| Gain from Sale of Priority Review Voucher | — | | | 100,000 | | | (100,000) | |

| Interest and other income, net | 29,661 | | | 22,624 | | | 7,037 | |

| | | | | |

| Income before income taxes | 95,356 | | | 12,897 | | | 82,459 | |

Income tax expense | (6,197) | | | (1,965) | | | (4,232) | |

| Net income | $ | 89,159 | | | $ | 10,932 | | | $ | 78,227 | |

| | | | | |

| Net income per common share: | | | | | |

| Basic | $ | 3.12 | | | $ | 0.40 | | | |

| Diluted | $ | 3.00 | | | $ | 0.39 | | | |

| | | | | |

| Weighted-average common shares outstanding: | | | | | |

| Basic | 28,592 | | | 27,154 | | | |

| Diluted | 29,740 | | | 27,752 | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

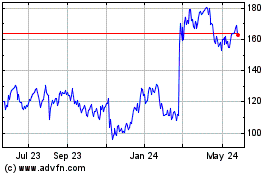

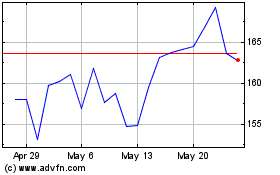

Krystal Biotech (NASDAQ:KRYS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Krystal Biotech (NASDAQ:KRYS)

Historical Stock Chart

From Feb 2024 to Feb 2025