Lantheus Holdings, Inc. (“Lantheus” or the “Company”) (NASDAQ:

LNTH), the leading radiopharmaceutical-focused company committed to

enabling clinicians to Find, Fight and Follow disease to deliver

better patient outcomes, today announced a definitive agreement to

acquire Evergreen Theragnostics, Inc. (“Evergreen”), in an all-cash

transaction consisting of an upfront payment of $250 million and up

to an additional $752.5 million in potential milestone payments.

Evergreen is a clinical-stage radiopharmaceutical company engaged

in Contract Development and Manufacturing (CDMO) services as well

as drug discovery and commercialization of proprietary products.

This transaction is expected to solidify Lantheus’ capabilities

as a fully integrated radiopharmaceutical company. The addition of

Evergreen’s scalable manufacturing capabilities and infrastructure

enhances Lantheus’ ability to meet the complex demands of

radiopharmaceutical development and production. The acquisition

also expands Lantheus’ oncology diagnostic pipeline by adding both

OCTEVY, a registrational-stage PET diagnostic agent for certain

neuroendocrine tumors (NETs) that could complement Lantheus’

therapeutic candidate PNT2003, as well as a number of clinical and

pre-clinical novel theranostic pairs.

“As Lantheus continues to advance its industry leadership, this

transaction, along with the agreement to acquire Life Molecular

Imaging, enhances our operations across the radiopharmaceutical

value chain,” said Brian Markison, CEO of Lantheus. “With

Evergreen’s manufacturing and development capabilities, we become

fully integrated and will ultimately make a difference in the lives

of more patients. We are pleased to welcome Evergreen’s talented

team to Lantheus and are confident that their expertise in

radiopharmaceutical theranostics and culture focused on developing

new solutions for cancer patients will enrich our

organization.”

“Today marks an exciting new chapter for Evergreen as we look to

join the Lantheus team,” said James Cook, CEO of Evergreen.

“Lantheus’ industry expertise and financial strength will help us

bring our innovations to a broad patient population faster and

support our mission to improve options for cancer patients through

theranostic radiopharmaceuticals. We look forward to benefiting

from Lantheus’ experience and resources to further advance our

pipeline and continue developing cutting-edge therapies and

diagnostics that have the potential to transform patient care. I am

very pleased to have our Evergreen team join another

industry-leading company with a shared vision.”

Compelling Strategic and Financial

Rationale

- Enhanced Radiopharmaceutical Manufacturing

Infrastructure: The acquisition advances Lantheus’

capabilities with the addition of Evergreen’s radioligand therapy

(RLT) manufacturing infrastructure, including a revenue-generating

CDMO business. Evergreen’s ability to work with a variety of

diagnostic and therapeutic isotopes will enhance Lantheus’ ability

to address the complexities of radiopharmaceutical development and

production. Internalizing this infrastructure will enable Lantheus

to develop technical and operational expertise, supply its clinical

trials, scale manufacturing for commercial launches, mitigate third

party risk, and support long-term growth.

- Adds Near-Term Revenue with OCTEVY, which Complements

PNT2003 Commercialization: Acquiring OCTEVY, a

registrational-stage diagnostic imaging agent, provides Lantheus

with additional growth potential while expanding its presence in

NETs. Subject to FDA approval, OCTEVY is expected to be indicated

for use with positron emission tomography (PET) for localization of

somatostatin receptor-positive NETs in adult and pediatric

patients. OCTEVY and Lantheus’ PNT2003 could be used as a

theranostic pair.

- Advanced Early Development Capabilities:

Evergreen brings a fully integrated drug discovery and early-stage

clinical development platform, promising early-stage oncology

assets, and a highly skilled team that can generate novel targets

and advance promising radiotherapeutic programs.

Additional Transaction DetailsUnder the terms

of the agreement, Lantheus will pay an upfront amount of $250

million, payable in cash at closing, and up to $752.5 million in

development and sales milestones related to OCTEVY and Evergreen’s

clinical and pre-clinical pipeline. The transaction has been

approved by the Boards of Directors of both companies and is

expected to close in the second half of 2025, subject to customary

closing conditions, including regulatory clearances.

Company Reaffirms Full Year 2024 Financial

Guidance

|

|

Guidance Issued November 6, 2024 |

|

FY 2024 Revenue |

$1.51 billion - $1.52 billion |

|

FY 2024 Adjusted Fully Diluted EPS |

$6.65 - $6.70 |

Advisors Solomon Partners Securities, LLC acted

as financial advisor to Lantheus in this transaction, while Cooley

LLP and Ropes & Gray LLP acted as legal advisors, and Ernst

& Young LLP acted as financial and tax advisor.

Centerview Partners LLC acted as financial advisor to Evergreen,

while Skadden, Arps, Slate, Meagher & Flom LLP and Lowenstein

Sandler LLP acted as legal advisors, and Grant Thornton Advisors

LLC acted as tax advisor.

Conference Call and Webcast DetailsLantheus

will hold a conference call on Tuesday, January 28, 2025, at 8:30

AM ET. To access the live conference via webcast, please register

here. A replay will be available after the conclusion of the call

on Lantheus’ investor website at:

https://investor.lantheus.com/news-events/calendar-of-events.

The conference call may include forward-looking statements. See

the cautionary information about forward-looking statements in the

safe-harbor section of this press release.

About Lantheus Lantheus is the leading

radiopharmaceutical-focused company, delivering life-changing

science to enable clinicians to Find, Fight and Follow disease to

deliver better patient outcomes. Headquartered in Massachusetts

with offices in Canada and Sweden, Lantheus has been providing

radiopharmaceutical solutions for more than 65 years. For more

information, visit www.lantheus.com.

About Evergreen Theragnostics, Inc.Evergreen

Theragnostics is focused on improving the available options for

cancer patients using radiopharmaceuticals. The company is engaged

in Contract Development and Manufacturing (CDMO) services as well

as drug discovery and commercialization of proprietary products.

Evergreen is headquartered in Springfield, NJ in a state-of-the-art

GMP radiopharmaceutical facility. The company was founded in 2019

by a team that brings a strong track record in theranostic

radiopharmaceutical manufacturing, research, and clinical

development. For more information, please visit

www.evergreentgn.com.

Safe Harbor for Forward-Looking and Cautionary

StatementsThis press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, that are subject to risks and

uncertainties and are made pursuant to the safe harbor provisions

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements may be identified by their use of terms

such as "continue,” “may,” “poised,” “potential,” “will,” and other

similar terms and include, among other things, statements about the

potential benefits and results of the acquisition; the anticipated

timing of the closing of the acquisition; the potential regulatory

approval of OCTEVYTM; the potential for OCTEVYTM and PNT2003 to be

used as a theranostic pair; and Evergreen’s ability to generate

novel radiotherapeutic programs. Such forward-looking statements

are based upon current plans, estimates and expectations that are

subject to risks and uncertainties that could cause actual results

to materially differ from those described in the forward-looking

statements. The inclusion of forward-looking statements should not

be regarded as a representation that such plans, estimates and

expectations will be achieved. Readers are cautioned not to place

undue reliance on the forward-looking statements contained herein,

which speak only as of the date hereof. The Company undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future developments or

otherwise, except as may be required by law. Risks and

uncertainties that could cause our actual results to materially

differ from those described in the forward-looking statements

include: Lantheus’ and Evergreen’s ability to

complete the acquisition on the proposed terms or on the

anticipated timeline, or at all, including risks and uncertainties

related to securing the necessary regulatory approvals and

satisfaction of other closing conditions to consummate the

acquisition; the occurrence of any event, change or other

circumstance that could give rise to the termination of the

definitive transaction agreement relating to the proposed

transaction; risks related to diverting the attention

of Evergreen’s and Lantheus’ management from

ongoing business operations; failure to realize the expected

benefits of the acquisition; significant transaction costs and/or

unknown or inestimable liabilities; the risk

that Evergreen’s business will not be integrated

successfully or that such integration may be more difficult,

time-consuming or costly than expected; risks related to future

opportunities and plans for the combined company, including the

uncertainty of expected future regulatory filings, financial

performance and results of the combined company following

completion of the acquisition; pharmaceutical product development

and the uncertainty of clinical success; the regulatory approval

process, including the risks that Evergreen may be unable

to obtain regulatory approval for OCTEVYTM on the timeframe

anticipated, or at all, or that Evergreen may be unable

to obtain regulatory approvals of any of its other product

candidates in a timely manner or at all; disruption from the

proposed acquisition, making it more difficult to conduct business

as usual or maintain relationships with customers, employees or

suppliers; effects relating to the announcement of the acquisition

or any further announcements or the consummation of the acquisition

on the market price of Lantheus’ common stock; the

possibility that, if Lantheus does not achieve the

perceived benefits of the acquisition as rapidly or to the extent

anticipated by financial analysts or investors, the market price

of Lantheus’ common stock could decline; potential

litigation associated with the possible acquisition; and the risks

and uncertainties discussed in our filings with the Securities and

Exchange Commission (including those described in the Risk Factors

section in our most recently filed Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q).

Contacts: Mark Kinarney Vice President,

Investor Relations 978-671-8842 ir@lantheus.com

Melissa Downs Senior Director, External Communications

646-975-2533 media@lantheus.com

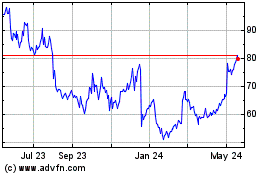

Lantheus (NASDAQ:LNTH)

Historical Stock Chart

From Dec 2024 to Jan 2025

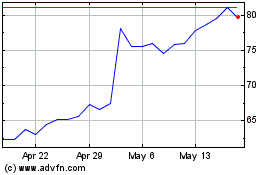

Lantheus (NASDAQ:LNTH)

Historical Stock Chart

From Jan 2024 to Jan 2025