Northeast Bank Announces Significant Loan Purchase Volume

09 December 2022 - 8:16AM

Northeast Bank (the “Bank”) (NASDAQ: NBN) announced today that

since September 30, 2022, the Bank has purchased or entered into

agreements to purchase primarily commercial real estate loans in

the amount of unpaid principal balance of up to $1.16 billion. The

Bank’s commercial real estate loans totaled $996.8 million at

September 30, 2022. The Bank has funded and intends to fund the

purchase of these loans primarily relying on Federal Home Loan Bank

advances, brokered deposits and non-brokered deposits acquired

through listing services.

“We are very pleased to announce this purchased loan activity,”

said Rick Wayne, Chief Executive Officer. “The current interest

rate and liquidity environment has presented this opportunity to us

and the strength of our balance sheet and operations, including our

strong capital position, has allowed us to be successful in seizing

the opportunities that have arisen recently.”

About Northeast BankNortheast Bank (NASDAQ:

NBN) is a full-service bank headquartered in Portland, Maine. We

offer personal and business banking services to the Maine market

via seven banking centers. Our National Lending Division purchases

and originates commercial loans on a nationwide basis. ableBanking,

a division of Northeast Bank, offers online savings products to

consumers nationwide. Information regarding Northeast Bank can be

found at www.northeastbank.com.

Forward-Looking StatementsThis press release

contains certain “forward-looking statements” within the meaning of

Section 27A of the Securities Act, and Section 21E of the Exchange

Act, such as statements relating to the financial condition,

prospective results of operations, future performance or

expectations, plans, objectives, prospects, loan loss allowance

adequacy, simulation of changes in interest rates, capital

spending, finance sources, and revenue sources of the Bank. These

statements relate to expectations concerning matters that are not

historical facts. Accordingly, statements that are based on

management’s projections, estimates, assumptions, and judgments

constitute forward-looking statements. These forward looking

statements, which are based on various assumptions (some of which

are beyond the Bank’s control), may be identified by reference to a

future period or periods, or by the use of forward-looking

terminology such as “believe”, “expect”, “estimate”, “anticipate”,

“continue”, “plan”, “approximately”, “intend”, “objective”, “goal”,

“project”, or other similar terms or variations on those terms, or

the future or conditional verbs such as “will”, “may”, “should”,

“could”, and “would”.

Such forward-looking statements reflect the Bank’s current views

and expectations based largely on information currently available

to the Bank’s management, and on the Bank’s current expectations,

assumptions, plans, estimates, judgments, and projections about the

Bank’s business and industry, and they involve inherent risks and

uncertainties. Although the Bank believes that these

forward-looking statements are based on reasonable estimates and

assumptions, they are not guarantees of future performance and are

subject to known and unknown risks, uncertainties, contingencies,

and other factors. Accordingly, the Bank cannot give you any

assurance that its expectations will in fact occur or that its

estimates or assumptions will be correct. The Bank cautions you

that actual results could differ materially from those expressed or

implied by such forward-looking statements as a result of, among

other factors: deterioration in employment levels, general business

and economic conditions on a national basis and in the local

markets in which the Bank operates; changes in customer behavior

due to changing business and economic conditions, including

concerns about inflation; the possibility that future credit losses

will be higher than currently expected due to changes in economic

assumptions, customer behavior or adverse economic developments;

turbulence in the capital and debt markets; changes in interest

rates and real estate values; competitive pressures from other

financial institutions; changes in loan defaults and charge-off

rates; changes in the value of securities and other assets,

adequacy of loan loss reserves, or deposit levels necessitating

increased borrowing to fund loans and investments; changing

government regulation; changes in information technology,

cybersecurity incidents, fraud, natural disasters, war, terrorism,

civil unrest, the ongoing COVID-19 pandemic, and future pandemics;

the risk that the Bank may not be successful in the implementation

of its business strategy; and the other risks and uncertainties

detailed in the Bank’s Annual Report on Form 10-K for the fiscal

year ended June 30, 2022 as updated in the Bank’s Quarterly Reports

on Form 10-Q and other filings submitted to the FDIC.

For More Information:Jean-Pierre Lapointe,

Chief Financial OfficerNortheast Bank, 27 Pearl Street, Portland,

ME 04101 207.786.3245 ext. 3220www.northeastbank.com

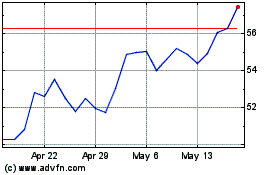

Northeast Bank (NASDAQ:NBN)

Historical Stock Chart

From Nov 2024 to Dec 2024

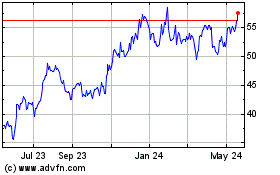

Northeast Bank (NASDAQ:NBN)

Historical Stock Chart

From Dec 2023 to Dec 2024