Newell Brands Announces Upsized Offering and Pricing of $750 Million 6.375% Notes due 2030 and $500 Million 6.625% Notes due 2032

30 October 2024 - 12:09PM

Business Wire

Newell Brands (NASDAQ: NWL) today announced the launch and

pricing of an upsized public offering of $750 million aggregate

principal amount of 6.375% notes due 2030 (the “2030 Notes”) and

$500 million aggregate principal amount of 6.625% notes due 2032

(the “2032 Notes” and, together with the 2030 Notes, the “Notes”).

The offering of the Notes is expected to close on November 13,

2024, subject to customary closing conditions.

Newell Brands intends to use the net proceeds from the offering

of the Notes to redeem in full its outstanding 4.875% senior notes

due 2025 (the “2025 Notes”) and to redeem in part its outstanding

4.200% senior notes due 2026 (the “2026 Notes”).

On October 29, 2024, Newell Brands instructed the trustee of the

2025 Notes and the 2026 Notes to deliver (i) to the holders of the

2025 Notes, a conditional notice to redeem in full the outstanding

2025 Notes and (ii) to the holders of the 2026 Notes, a conditional

notice to partially redeem the outstanding 2026 Notes

(collectively, the “redemptions”). Each of the redemptions will be

an election to effect an optional redemption, conditioned on the

consummation of the offering of the Notes or an alternative debt

financing satisfactory to Newell Brands and that provides net

proceeds sufficient to pay the applicable redemption price for such

series of notes and all fees and expenses thereto. Neither this

press release nor anything contained herein shall constitute a

notice of redemption or an offer to redeem or purchase any of the

outstanding 2025 Notes or the 2026 Notes.

J.P. Morgan Securities LLC, Goldman Sachs & Co. LLC, BofA

Securities, Inc., Citigroup Global Markets Inc., HSBC Securities

(USA) Inc., Wells Fargo Securities, LLC and RBC Capital Markets,

LLC are serving as the joint book-running managers for the

offering. Barclays Capital Inc., UBS Securities LLC, PNC Capital

Markets LLC, ING Financial Markets LLC, Siebert Williams Shank

& Co., LLC and U.S. Bancorp Investments, Inc. are serving as

the co-managers for the offering of the Notes.

The offering of the Notes is being made under an effective shelf

registration statement on Form S-3 (Registration No. 333-279561)

filed by Newell Brands with the Securities and Exchange Commission

(“SEC”) on May 20, 2024 (effective on May 31, 2024) and only by

means of a prospectus supplement and accompanying prospectus. A

preliminary prospectus supplement and an issuer free writing

prospectus have been filed and a prospectus supplement relating to

the offering of the Notes will be filed, with the SEC, to which

this communication relates. Prospective investors should read the

issuer free writing prospectus, preliminary prospectus supplement

and the accompanying prospectus included in the registration

statement and other documents Newell Brands has filed with the SEC

for more complete information about Newell Brands and the offering.

These documents are available at no charge by visiting EDGAR on the

SEC website at http://www.sec.gov. Alternatively, the prospectus

and the prospectus supplement may be obtained by contacting J.P.

Morgan Securities LLC at (866) 803-9204.

This communication is neither an offer to sell nor a

solicitation of an offer to buy the securities described herein,

nor shall there be any offer, solicitation or sale of these

securities in any jurisdiction in which such an offer, solicitation

or sale would be unlawful prior to the registration or

qualification under the securities laws of any such jurisdiction.

The offering of these securities will be made only by means of the

applicable prospectus supplement and the accompanying prospectus.

The securities being offered have not been approved or disapproved

by any regulatory authority, nor has any such authority passed upon

the accuracy or adequacy of the registration statement, the

prospectus contained therein or the applicable prospectus

supplement.

About Newell Brands

Newell Brands (NASDAQ: NWL) is a leading global consumer goods

company with a strong portfolio of well-known brands, including

Rubbermaid, Sharpie, Graco, Coleman, Rubbermaid Commercial

Products, Yankee Candle, Paper Mate, FoodSaver, Dymo, EXPO,

Elmer’s, Oster, NUK, Spontex and Campingaz. Newell Brands is

focused on delighting consumers by lighting up everyday

moments.

Forward-Looking

Statements

Some of the statements in this press release, particularly those

relating to the offering of the Notes and the use of proceeds

therefrom are forward-looking statements within the meaning of the

Federal securities laws. Actual results could differ materially

from expectations expressed or implied in the forward-looking

statements if one or more of the underlying assumptions or

expectations prove to be inaccurate or are unrealized. Important

factors that could cause actual results to differ materially from

such expectations are and will be detailed in the company’s filings

with the SEC, including but not limited to its Annual Report on

Form 10-K for the year ended December 31, 2023 and its Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2024, June

30, 2024 and September 30, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029740372/en/

Investors: Joanne Freiberger VP, Investor Relations +1

(727) 947-0891 joanne.freiberger@newellco.com

Media: Beth Stellato Chief Communications Officer +1

(470) 580-1086 beth.stellato@newellco.com

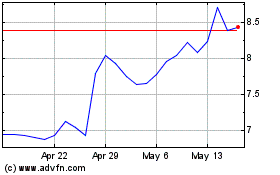

Newell Brands (NASDAQ:NWL)

Historical Stock Chart

From Nov 2024 to Dec 2024

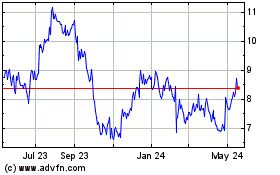

Newell Brands (NASDAQ:NWL)

Historical Stock Chart

From Dec 2023 to Dec 2024