false

0001043186

0001043186

2025-02-03

2025-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2025

Stabilis Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

Florida

|

|

001-40364

|

|

59-3410234

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

11750 Katy Freeway Suite 900

Houston, Texas

|

|

77079

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 832-456-6500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $.001 par value

|

|

SLNG

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Stabilis Solutions, Inc. (the “Company”) announced that it has appointed the Company’s Chairman of the Board, J. Casey Crenshaw, age 50, as its Executive Chairman, and interim President and Chief Executive Officer, effective January 31, 2025. Mr. Crenshaw will replace Westervelt T. “Westy” Ballard, Jr., who has mutually agreed with the Company to terminate his employment as the Company’s President and Chief Executive Officer and to resign his position as a director. In his new role, Mr. Crenshaw will assume day-to-day operations leadership responsibilities and will also participate in the Board of Directors’ search for a Chief Executive Officer. Mr. Ballard will assist the Company by remaining in a consulting role for the Company through the end of 2025.

Mr. Crenshaw, alongside his wife Stacey Crenshaw, co-founded the Company in 2013 and both have remained actively involved in the Company since its inception. Mr. Crenshaw is also the President and Chief Executive Officer of The Modern Group, Ltd., a privately-owned conglomerate of diversified manufacturing, parts and distribution, rental, leasing and finance businesses headquartered in Beaumont, Texas. Additional information regarding Mr. Crenshaw’s background is set forth in the Company’s definitive proxy statement filed with the Securities and Exchange Commission (“SEC”) on June 28, 2024.

There is no arrangement or understanding between Mr. Crenshaw and any other person pursuant to which Mr. Crenshaw was appointed to his positions with the Company. Mr. Crenshaw’s wife, Stacey Crenshaw, is a director of the Company. Otherwise, there is no family relationship between Mr. Crenshaw and any director or executive officer of the Company, or nominee for election as a director of the Company. Except as disclosed in Note 9 to the Company’s condensed, consolidated financial statements set forth in its Form 10-Q filed with the SEC on November 7, 2024, there are no transactions in which Mr. Crenshaw has an interest requiring disclosure under Item 404(a) of Regulation S-K.

In connection with Mr. Crenshaw’s position as Executive Chairman, the Company’s Board of Directors and Compensation Committee have approved annual cash compensation of $500,000 to Mr. Crenshaw. Mr. Crenshaw will not receive additional compensation for his roles as interim President and Chief Executive Officer.

Mr. Ballard’s resignation as a director is not as a result of any disagreement with the Company.

Separation Arrangements for Mr. Ballard

On February 2, 2025, the Company entered into a Release and Consulting Agreement with Mr. Ballard (the “Agreement”) pursuant to which the Company and Mr. Ballard mutually agreed, effective as of January 31, 2025, to terminate his employment as President and Chief Executive Officer with the Company and transition to a consultant of the Company. Additionally, Mr. Ballard voluntarily resigned as a member of the Company’s Board of Directors, effective January 31, 2025. Under the Agreement, the Company will pay Mr. Ballard separation pay of $1,000,000 paid in equal or nearly equal installments over a twelve month period, and additional pay of $41,095.89 representing an amount equal to a prorated bonus at “target” performance that Mr. Ballard would have received for his 2025 performance. Additionally, Mr. Ballard will receive a payment of $48,600 per month for the remainder of 2025 for his consulting services. The Company and Mr. Ballard agreed that 7,765 unvested restricted stock units and 147,525 unvested stock options granted under the Company’s long-term incentive plan would vest as of the date of his separation of employment, and that the period during which all of Mr. Ballard’s stock options may be exercised shall expire December 31, 2025. Under the Agreement, Mr. Ballard provided a customary general release to the Company, has agreed to ratify and renew that release as of the end of the consulting period on December 31, 2025, and has also agreed to certain confidentiality, non-disclosure, non-competition, non-solicitation, non-disparagement, and cooperation covenants in favor of the Company, including the extension of his non-competition and non-solicitation covenants until December 31, 2026.

The foregoing summary of the Agreement is a summary only and is qualified in its entirety by reference to the Release and Consulting Agreements, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On February 3, 2025, the Company issued a press release describing the appointment of Mr. Crenshaw and separation of Mr. Ballard. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act, as amended, or otherwise subject to liabilities of that Section.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

|

Exhibit

No.

|

|

Description

|

|

10.1

|

†

|

|

|

99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

STABILIS SOLUTIONS, INC.

|

| |

By: /s/Andrew L. Puhala

|

| |

Andrew L. Puhala

|

| |

Chief Financial Officer

|

| |

|

|

|

Date: February 3, 2025

|

|

|

Exhibit 10.1

RELEASE AND CONSULTING AGREEMENT

This Release and Consulting Agreement (the “Agreement”) is between Westervelt T. Ballard, Jr. (the “Individual”) and Stabilis Solutions, Inc. (the “Company”).

RECITALS

WHEREAS, the Company has employed the Individual as its President and Chief Executive Officer pursuant to that certain Employment Agreement between the parties dated August 23, 2021 (the “Employment Agreement”).

WHEREAS, the Company and the Individual have mutually decided to terminate the Employment Agreement and transition the Individual from an employee to a consultant of the Company.

WHEREAS, the parties desire to enter into this Agreement to reflect their mutual undertakings, promises, and agreements concerning the termination of the Employment Agreement and the transition of the Individual’s role with the Company from an employee to a consultant, and the payments and benefits to be provided to the Individual upon or by reason of such transition.

NOW THEREFORE, in exchange for the valuable consideration paid or given under this Agreement, the receipt, adequacy, and sufficiency of which is acknowledged, the parties knowingly and voluntarily agree to the following terms:

TERMS

|

1.

|

Separation Date and Effect of Separation. Pursuant to the parties’ mutual agreement, the Individual’s employment with the Company shall terminate effective as of January 31, 2025 (the “Separation Date”) Accordingly, the Individual was and shall be relieved of all duties as an employee of the Company and its affiliates as of the Separation Date. Effective as of the Separation Date, the Individual shall and hereby does voluntarily resign without further action from all other offices and positions, if any, he held with the Company and its affiliates, including from his position on the Company’s Board of Directors (the “Board”), except as expressly provided below. For purposes of this Agreement, “affiliate” means, with respect to the person or entity, or issue, any person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, such person or entity. As of the Separation Date, the Individual incurred a separation from service from the Company within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”).

|

|

2.

|

Termination of Employment Agreement; Continuing Obligations. In consideration of the mutual promises and undertakings in this Agreement, the parties agree that the Employment Agreement shall be terminated as of the Separation Date. The parties further agree that, as of the Separation Date, the Company and the other Released Parties (as defined below) shall have no further liabilities, obligations, or duties to the other Individual, and the Individual shall forfeit all rights and benefits, under the Employment Agreement except as provided below. Notwithstanding the previous two sentences or any other provision of this Agreement, the parties further agree the following post-termination rights and obligations of the parties under the Employment Agreement shall continue in full force and effect according to their terms notwithstanding the separation of the Individual’s employment with the Company, the termination of the Employment Agreement, or the execution of this Agreement: Section 11 (Confidential Information), 12 (Non-Competition and Non-Solicitation Restrictive Covenants), 13 (Inventions), 14 (Duties of Confidentiality and Loyalty Under the Common Law), 15 (Survival and Enforcement of Covenants; Remedies), 16 (Successors and Assigns), 17 (Waiver of Right to Jury Trial), 18 (Attorneys’ Fees and Other Costs), 19 (Entire Agreement), 20 (Inconsistencies), 21 (Amendment), 22 (Waiver), 23 (Severability), 24 (Governing Law; Venue), 25 (Third-Party Beneficiaries), 27 (Code Section 409A), 29 (Representations of Employee), and 30 (Survival) (together, the “Continuing Obligations”). The Individual acknowledges and agrees that he has fully complied with such Continuing Obligations at all times before he signs this Agreement and that he intends to, and shall, fully comply with such Continuing Obligations after he signs this Agreement. In addition, the parties agree that the Individual’s post-termination obligations under Section 12 (Non-Competition and Non-Solicitation Restrictive Covenants) of the Employment Agreement shall continue until December 31, 2026 and shall also constitute Continuing Obligations for purposes of this Agreement. Further, for purposes of this Section 12, the “Business” of the Company shall be defined as an energy transition company that provides turnkey clean energy production, storage, transportation, and fueling solutions primarily using liquefied natural gas (“LNG”) to multiple end markets, including aerospace, agriculture, energy, industrial, marine bunkering, mining, pipeline, remote power and utility markets.

|

|

3.

|

Final Pay and Benefits. The Individual has received or shall receive the following payments and benefits in accordance with the existing policies of the Company and pursuant to his employment with the Company and his participation in the employee benefit plans available to its employees or other arrangements with the Company.

|

| |

a.

|

Final Pay. The Individual shall be entitled to his regular base salary through the Separation Date. This payment is subject to applicable taxes and shall be delivered to the Individual on or before the Company’s first regularly scheduled payday following the Separation Date. Other than as provided in the previous sentence and as expressly set forth below, the Individual shall not receive any base salary, pay for accrued unused vacation or other paid time off, pay or benefits in lieu of notice of termination, commissions, bonuses, or other forms or remuneration or compensation in connection with his employment with the Company or any other arrangement with the Company or its affiliates after the Separation Date.

|

| |

b.

|

Right to Continue Certain Insurance Benefits. The Individual shall have the right to apply to continue after the Separation Date his group health, dental, and vision insurance benefits, if any, for himself and his dependents, at his own expense except as provided below in accordance with applicable law. The Individual should complete an insurance continuation election form, which will be furnished to him under separate cover, and timely return it if he wishes to apply to continue his insurance coverage under such law.

|

| |

c.

|

Reimbursement of Business Expenses. The Individual shall be entitled to receive reimbursement of reasonable business expenses properly incurred by him in accordance with Company policy on or before the Separation Date. Any such reimbursement must be based on substantiating documentation provided by the Individual to the Company on or before the date he signs this Agreement.

|

| |

d.

|

Retention of Vested Restricted Stock Units and Stock Options. The parties agree that, pursuant to, and subject to the terms and conditions of, the Employment Agreement, the Company’s 2019 Long Term Incentive Plan (as it may be amended, the “Plan”), and the applicable award agreements, the Company provided the Individual with awards of 500,000 restricted stock units (“RSUs”) for 2021 (the “2021 RSUs”), 23,293 RSUs for 2022 (the “2022 RSUs”), 1,300,000 stock options (the “Options”) for 2021 (the “2021 Options”), and 442,574 Options for 2022 (the “2022 Options”). The parties agree that, after disposition of the RSUs necessary to account for applicable taxes on the 2021 RSUs and 2022 RSUs as they vested, the Individual shall retain the following interests which were fully vested as of the Separation Date: (i) 394,714 shares of common stock in the Company attributable to the 2021 RSUs, (ii) 13,563 shares of common stock in the Company attributable to the 2022 RSUs, (iii) 1,300,000 of the 2021 Options, and (iv) 295,049 of the 2022 Options (together, the “Vested Equity”). The parties further agree that the Individual shall continue to retain the Vested Equity notwithstanding the termination of the Employment Agreement, the separation of the Individual’s employment with the Company, or the execution of this Agreement. The Individual further acknowledges and agrees that, other than the Vested Equity, he does not own, or claim to own, any other equity or similar interest in the Company or its affiliates. Except as set forth below in this Agreement, the Vested Equity shall remain subject to the terms and conditions of the Employment Agreement, the Plan, and the award agreements.

|

|

4.

|

Separation Benefits. Contingent upon the Individual’s timely execution, return to the Company, and non-revocation of this Agreement and timely acceptance and non-revocation of the Renewal and Ratification of Release attached as Exhibit A to this Agreement and incorporated here by reference (the “Ratification”), the Company shall provide to the Individual, or cause the Individual to receive, the separation benefits described in this paragraph (the “Separation Benefits”).

|

| |

a.

|

Separation Pay. The Company shall pay the Individual separation pay in an amount equal to $1,000,000.00, minus applicable withholdings and taxes (the “Separation Pay”), in equal or nearly equal installments over a 12-month period on the Company’s customary paydays beginning with the first regularly scheduled payday after the Effective Date (as defined below) and continuing for 12 months until paid in full.

|

| |

b.

|

Additional Pay. The Company shall pay the Individual in an amount equal to $41,095.89, minus applicable withholdings and taxes (the “Additional Pay”). The parties acknowledge and agree that this amount is approximately equal to a prorated Target Bonus at “Target” performance the Individual would have received for his 2025 performance had his employment not terminated based on the number of days in 2025 that the Individual was employed by the Company. The parties further agree that the Additional Pay shall be paid at the same time as Annual Bonus Plan (as defined in the Employment Agreement) awards are paid to other similar situated executive officers of the Company and that, therefore, the Additional Pay shall be paid to the Individual on or before March 15, 2026.

|

| |

c.

|

Consulting Services. From the Separation Date until December 31, 2025 (the “Consulting Term”), the Individual shall as an independent contractor provide consulting and transition services to the Company (the “Services”) as requested, with reasonable notice, by the Executive Chairman of the Company’s Board of Directors (the “Executive Chairman”). During the Consulting Term, the Services shall require the Individual to cooperate fully and completely with the Company, at its request, in all matters relating to the transition of his duties, responsibilities, and authorities for the Company and its affiliates, as well as all matters related to his Vested Equity ownership to the extent his holdings need to be referenced in the Company’s public filings for 2025. This Services include but are not limited to the Individual promptly responding to telephone calls, e-mails, text messages, and other communications from the Company and its employees at reasonable times and meeting with employees of the Company at a mutually agreeable location at reasonable times upon their request. This obligation to provide the Services shall also be considered part of the Continuing Obligations (as defined above) for purposes of this Agreement. The Individual shall perform the Services from his home office or any other location reasonably requested by the Company, and shall be permitted to continue to use in the ordinary course of business the technology and equipment of the Company during the Consulting Term for the limited purposes of properly performing the Services in good faith. During the Consulting Term, the Individual shall owe the Company a duty to act in its best interests in all matters related to the Service and shall not, directly or indirectly, without prior written permission from the Company’s Executive Chairman (i) retain his current title or position or previous responsibilities or authorities on behalf of the Company or its affiliates which he enjoyed as of immediately before the Separation Date or purport to make any statements on behalf of the Company or its affiliates, (ii) authorize any expenditure on behalf of the Company or its affiliates, (iii) have any authority to bind, commit, or make warranties for or on behalf of any of the Company or its affiliates to any third party, or to otherwise act as an agent of the Company or its affiliates, (iv) incur any business expenses, or (v) remove from the Company’s premises or delete, as applicable, any physical or electronic documents or Confidential Information (as defined in the Employment Agreement) or copies of same (the “Consulting Service Limitations”). In exchange for the Services and subject to the Consulting Service Limitations, the Company shall pay the Individual the Consulting Pay set forth below and shall issue a Form 1099 to the Individual for the Consulting Pay.

|

| |

d.

|

Consulting Pay. In exchange for the Services and subject to the Consulting Service Limitations, the Company shall pay the Individual a monthly payment of $48,600.00 (the “Consulting Fee”), beginning on February 28, 2025 and continuing on the last day of each month during the Consulting Term. The Individual shall be solely responsible for the payment of any taxes arising from the payment of the Consulting Pay, including without limitation all income tax withholding and FICA and Medicare payments.

|

| |

e.

|

Reimbursement of COBRA Premiums. In addition, if the Individual timely elects to continue coverage under the applicable plans for himself and/or his dependents under COBRA following the Separation Date, the Company shall reimburse him for the monthly premium costs he incurs under COBRA for continued group health, dental, and vision insurance coverage, if any, provided that he notifies the Company in writing within five days after he become eligible for group health, dental, or vision insurance coverage, if any, through subsequent employment or otherwise on or before July 31, 2026, and provided further that such reimbursement shall be limited to the difference between the amount Individual pays to effect and continue such coverage under COBRA and the employee contribution amount that active employees of the Company pay for the same or similar coverage. The Company shall reimburse the monthly amounts just described from February 2025 through July 2026 or until the Individual becomes eligible for group health insurance coverage due to subsequent employment or otherwise, whichever is sooner. The Individual shall send monthly invoices to the Company reflecting premiums paid by him. Reimbursements due under this subparagraph shall be made by the last day of the month following the month in which the applicable premiums were paid by the Individual.

|

| |

f.

|

Retention of Company-Provided Computer. The Company shall permit the Individual to retain after the Separation Date the Company-provided computer issued to him during his employment with the Company; provided, however, that the Individual shall (i) before the end of the Consulting Term or sooner if requested by the Company, permit the Company or its designee to permanently delete all Confidential Information (as defined in the Employment Agreement) and any other information related to the Company and its affiliates (and all copies, photographs, reports, summaries, lists, and reproductions of same) contained or stored in such computer and upon request permit the Company to conduct all inspections reasonably necessary to ensure such deletions.

|

| |

g.

|

Extension of Period to Exercise 2021 Options and Acceleration of Period to Exercise 2022 Options. Notwithstanding any contrary provision in the Plan or the applicable award agreement, the Company shall extend the period during which the Individual may exercise the 2021 Options which are Vested Equity until December 31, 2025. In exchange, and notwithstanding any contrary provision of the Plan or the applicable award agreement, the Individual agrees that the period during which he may exercise the 2022 Options which are Vested Equity shall be accelerated to December 31, 2025.

|

| |

h.

|

Accelerated Vesting of 2022 RSUs and Stock Options. Notwithstanding any contrary provision in the Plan or the applicable award agreements, the Company shall accelerate the vesting of the 7,765 2022 RSUs and 147,525 2022 Options which were unvested as of immediately before the Separation Date such that they shall be vested as of the Separation Date and considered Vested Equity for purposes of this Agreement.

|

|

5.

|

Return of Property and Information. On or before the end of the Consulting Term or sooner if requested by the Company, the Individual shall return to the Company or the other Released Parties (as defined below) any and all items of its or their property, including without limitation keys, all copies of Confidential Information (as defined in the Employment Agreement), intellectual property, badge/access cards, computers, software, cellular telephones, iPhones, iPads, androids, blackberries, other personal digital assistants, equipment, credit cards, forms, files, manuals, correspondence, business records, personnel data, lists of employees, salary and benefits information, investor files, lists of investor, contracts, contract information, investor plans, brochures, catalogs, training materials, computer tapes and diskettes or other portable media, computer-readable files and data stored on any hard drive or other installed device, and data processing reports, and any and all other documents or property which he has had possession of or control over during his employment with the Company. The Individual also consents to permitting the Company to remove (either directly or via remote wiping) Confidential Information, intellectual property, and other data belonging to the Company or the other Released Parties from any mobile telephone, computer, or other computing device or storage account owned by him or otherwise in his possession or under his control. The Individual’s obligations under this paragraph are in addition to and supplement, rather than supplant or supersede, his post-termination obligations under the common law and the Continuing Obligations. The Individual’s obligations under this paragraph shall not apply to, and the Individual may retain copies of, personnel, benefit, or payroll documents concerning only him, as well as copies of documentation related to his continued ownership of the Vested Equity.

|

|

6.

|

General Release and Covenant not to Sue by the Individual.

|

| |

a.

|

Full and Final Release by Releasing Parties. The Individual, on behalf of himself and his spouse, other immediate family members, heirs, successors, and assigns (collectively, the “Releasing Parties”), hereby voluntarily, completely, and unconditionally to the maximum extent permitted by applicable law releases, acquits, waives, and forever discharges any and all claims, demands, liabilities, and causes of action of whatever kind or character, whether known, unknown, vicarious, derivative, direct, or indirect (individually a “Claim” and collectively the “Claims”), that he or they, individually, collectively, or otherwise, may have or assert against the Released Parties (as defined below).

|

| |

b.

|

Claims Included. This release includes without limitation any Claim arising out of or relating in any way to (i) the Individual’s employment or the termination of his employment with the Company or with the employment practices of any of the Released Parties and any compensation or benefits due from the Company or its affiliates or employees in connection with his employment with the Company or the other Released Parties not provided for in this Agreement; (ii) any federal, state, or local statutory or common law or constitutional provision that applies, or is asserted to apply, directly or indirectly, to the formation, continuation, or termination of the Individual’s employment relationship with the Company or the Released Parties, including without limit the Age Discrimination in Employment Act (“ADEA”); (iii) any contract, agreement, or arrangement between, concerning, or relating to the Individual and any of the Released Parties, including without limitation, the Plan, the Employment Agreement, and any other agreement or arrangement or alleged agreement or arrangement; (iv) the Individual’s relationship with the Released Parties; and (v) any other alleged act, breach, conduct, negligence, gross negligence, or omission of any of the Released Parties, including without limitation any breach of fiduciary duty or fraudulent inducement to enter into this Agreement by or on behalf of any of the Releasing Parties.

|

| |

c.

|

Claims Excluded. Notwithstanding any other provision of this Agreement, this release does not (i) waive or release any Claim for breach or enforcement of this Agreement or right or Claim related to the Individual’s continued ownership of the Vested Equity; (ii) waive or release any right or Claim that may not be waived or released by applicable law, including any right or Claim that may arise under the ADEA after the date this Agreement is signed by the Individual and any right to receive an award or bounty for information provided to any governmental agency in connection with protected whistleblowing activity; (iii) prevent the Individual from pursuing any administrative Claim for unemployment compensation or workers’ compensation benefits; or (iv) waive or release any right or Claim the Individual may have for indemnification under state or other law or the bylaws or other governing documents of the Company, or under any insurance policy providing directors’ and officers’ coverage for any lawsuit or Claim relating to the period when the Individual was an employee of the Company (if any); provided, however, that (A) the Individual’s execution of this Agreement is not a concession or guaranty that the Individual has any such right or Claim to indemnification, (B) this Agreement does not create any additional rights to indemnification, and (C) the Company retains any and all defenses they may have to such indemnification or coverage.

|

| |

d.

|

Definition of Released Parties. The “Released Parties” include (i) the Company; (ii) any parent, subsidiary, or affiliate of the Company; (iii) any past or present officer, director, member, manager, or employee of the entities just described in (i)-(ii), in their individual and official capacities; and (iv) any past or present predecessors, parents, subsidiaries, affiliates, owners, shareholders, members, managers, benefit plans, operating units, divisions, agents, representatives, officers, directors, partners, employees, fiduciaries, insurers, attorneys, successors, assigns, equity holders, unit holders, warrant holders, debt holders, and other security holders of the entities just described in (i)-(iii).

|

| |

e.

|

Renewal and Ratification of General Release. In further consideration of the mutual promises and undertakings in this Agreement, the Individual shall sign the Ratification on the last day of the Consulting Term, not revoke the Ratification between the date he signs it and seven days thereafter, and immediately return a signed copy of the Ratification to the Company.

|

| |

f.

|

Permitted Activities. Notwithstanding any other provision of this Agreement but subject to the Individual’s waiver in subparagraph 9(a) below, nothing in this Agreement (or any Company policy or procedure) is intended to, or does, preclude the Individual from (i) contacting, reporting to, communicating with, responding truthfully to an inquiry from, providing truthful information to, filing a charge or complaint with, cooperating with, making truthful statements under oath, or otherwise testifying or participating in any investigation, hearing, or other proceeding being conducted by or before, any federal or state law enforcement, governmental, or regulatory agency or body (such as the Equal Employment Opportunity Commission, the U.S. Department of Labor, the Occupational Safety & Health Administration, the National Labor Relations Board, the Occupational Safety and Health Administration, the U.S. Department of Justice, the Securities Exchange Commission (“SEC”), or any other federal, state, or local governmental agency, commission, or regulatory body) regarding possible or alleged violations of law or unlawful acts in the workplace; (ii) making statements or disclosures regarding any sexual assault or sexual harassment dispute in compliance with the Speak Out Act; (iii) giving truthful testimony or making statements under oath in response to valid legal process (such as a subpoena) in any legal or regulatory proceeding; (iv) engaging in any other legally protected activities; or (v) pursuant to 18 U.S.C. § 1833(b), disclosing a trade secret in confidence to a governmental official, directly or indirectly, or to an attorney, if the disclosure is made solely for the purpose of reporting or investigating a suspected violation of law, or if the disclosure is made in a document filed under seal in a lawsuit or other proceeding, and a party cannot be held criminally or civilly liable under any federal or state trade secret law for such a disclosure. In accordance with applicable law and notwithstanding any other provision of this Agreement, nothing in this Agreement or any of the Company’s policies, procedures, or agreements applicable to the Individual (i) impedes his right to communicate with the SEC or any other any federal or state law enforcement, governmental, or regulatory agency or body about possible violations of federal securities or other laws or regulations or (ii) requires him to provide any prior notice to the Company or obtain the Company’s prior approval before engaging in any such communications.

|

| |

g.

|

Covenant not to Sue. Except as permitted above or by law that may supersede the terms of this Agreement, to the maximum extent permitted by applicable law, the Individual covenants not to sue or to file or cause to be filed any Claim released by this Agreement in any court. The Individual represents and warrants that he does not have any charge, complaint, other proceeding against the Company or any of the other Released Parties pending before court or any federal, state, or local regulatory or fair employment practices agency as of the date he signs this Agreement.

|

|

7.

|

Release of Claims by the Company. In consideration of the promises and mutual undertakings in this Agreement, the Company releases and forever discharges the Individual, and any and all his affiliates, agents, attorneys, and representatives, of and from Claims which are based upon, arise out of, concern, or relate to the Individual’s employment by the Company and the positions he held with the Company and its affiliates during such employment. Notwithstanding the previous sentence, this release does not waive or release any Claim (i) for breach or enforcement of this Agreement; (ii) for failure to comply with the Continuing Obligations; (iii) relating to or arising from any fraud, illegal or criminal acts or omissions, intentional or willful misconduct, reckless misconduct, or gross negligence of the Individual; (iv) relating to or arising from the Individual’s actions or omissions which were not known by the Board (not including the Individual) as of the Separation Date; or (v) for breach or enforcement of any pre- or post-termination non-disclosure, non-competition, non-solicitation or similar continuing obligation owed by Employee to Company before or after the Separation Date (whether under any prior Employment Agreement between the Company and the Individual or any other agreement between them).

|

|

8.

|

Confidentiality; Non-Disparagement; and Cooperation.

|

| |

a.

|

Confidentiality. Except as requested by the Company or the other Released Parties, as permitted above or by law that may supersede the terms of this Agreement, or as compelled by valid legal process, the Individual shall not disclose any material, non-public information regarding this Agreement to any party other than his spouse, attorney, and accountant or tax advisor, if such persons have agreed to keep such information confidential. The Individual’s obligations under this subparagraph are in addition to and supplement, rather than supplant or supersede, his Continuing Obligations.

|

| |

b.

|

Non-Disparagement and Waiver of Related Rights. Except as requested by any of the Released Parties, as permitted above or by applicable law that may supersede the terms of this Agreement, or as compelled by valid legal process, the Individual shall not, and he shall ensure that the other Releasing Parties do not, make to any other party any statement (whether oral, written, electronic, anonymous, on the Internet, or otherwise), which directly or indirectly impugns the quality or integrity of the Company’s or any of the other Released Parties’ business or employment practices, performance, or any other disparaging or derogatory remarks about the Company, any of the other Released Parties, their officers, directors, managers, shareholders, managerial personnel, or other employees. In executing this Agreement, the Individual acknowledges and agrees that he has knowingly, voluntarily, and intelligently waived any (i) free speech, free association, free press, or First Amendment to the United States Constitution (including, without limitation, any counterpart or similar provision or right under any State Constitution) rights to disclose, communicate, or publish any statements prohibited by this subparagraph, and (ii) right to file a motion to dismiss or pursue any other relief under the Texas Citizens Participation Act or any similar state law in connection with any Claim filed against his by the Company or any of the other Released Parties, including without limitation any Claim arising from any alleged breach of this Agreement or the Continuing Obligations. The Individual’s obligations under this subparagraph are in addition to and supplement, rather than supplant or supersede, his post-termination obligations under the common law and the Continuing Obligations.

|

| |

c.

|

Cooperation. The Individual shall cooperate fully and completely with the Company and the other Released Parties, at their request, in all pending and future litigation, investigations, arbitrations, and/or other fact-finding or adjudicative proceedings, public or private, involving the Company or any of the other Released Parties. This obligation includes but is not limited to the Individual promptly meeting with counsel for the Company or the other Released Parties at reasonable times upon their request, and providing testimony in court, before an arbitrator or other convening authority, or upon deposition that is truthful, accurate, and complete, according to information known to the Individual. If the Individual provides cooperation under this subparagraph (including without limitation if the Individual appears as a witness in any pending or future litigation, arbitration, or other fact-finding or adjudicative proceeding at the request of the Company or any of the other Released Parties), the Company shall reimburse him, upon submission of substantiating documentation, for necessary and reasonable out-of-pocket expenses incurred by him as a result of such cooperation (not including attorneys’ fees). The Individual’s obligations under this subparagraph shall be considered part of the Continuing Obligations.

|

|

9.

|

Waiver of Certain Rights.

|

| |

a.

|

Right to Individual Monetary Relief Not Provided in this Agreement. The Individual waives any right to any individual monetary relief from the Company or the other Released Parties, whether sought directly by him or in the event any administrative agency or other public authority, individual, or group of individuals should pursue any Claim on his behalf; and he shall not request or accept from the Company or the other Released Parties, as compensation or damages related to the termination of his employment with the Company or the Released Parties, any individual monetary relief that is not provided for in this Agreement. Notwithstanding the previous sentence, this Agreement shall not bar or impede in any way the Individual’s ability to seek or receive any monetary award or bounty from any governmental agency or regulatory or law enforcement authority in connection with protected whistleblower activity.

|

| |

b.

|

Right to Class- or Collective-Action Initiation or Participation. The Individual waives the right to initiate or participate in any class or collective action with respect to any Claim against the Company or any of the other Released Parties, including without limitation any Claim arising from the formation, continuation, or termination of his employment relationship with any of the Released Parties.

|

|

10.

|

No Violations. The Individual represents and warrants that he is not aware of any material violations or alleged material violations of the Company’s standards of business conduct or personnel policies, of the Company’s integrity or ethics policies, or any other material misconduct or alleged material misconduct by the Company or any of the other Released Parties, in each case which was not disclosed to the Company before the date he signs this Agreement.

|

|

11.

|

Remedies; After-Acquired Evidence.

|

| |

a.

|

Remedies. Notwithstanding any other provision in this Agreement, the obligation of the Company to provide the Separation Benefits to the Individual is subject to the condition that he materially complies with his obligations under this Agreement and the Continuing Obligations. The Company therefore shall have the right to suspend or cease providing any part of the Separation Benefits if it determines in its sole discretion that the Individual has materially breached any such obligations but all other provisions of this Agreement shall remain in full force and effect.

|

| |

b.

|

After-Acquired Evidence. Notwithstanding any provision of this Agreement, if the Company provides the Separation Benefits to the Individual but subsequently acquires evidence and determines while acting reasonably and in good faith that (i) he has materially breached any of his obligations under this Agreement or the Continuing Obligations, including if he fails to timely sign, return, and not revoke the Ratification; or (ii) a condition existed prior to the provision of the Separation Benefits that, had the Company been fully aware of such condition, would have given the Company the right to terminate his employment for Cause (as defined in the Employment Agreement) before such provision, then the Individual shall promptly return to the Company the payments and reimbursements received by the Individual pursuant to subparagraphs 4(a), 4(b), 4(d), and 4(e) but all other provisions of this Agreement shall remain in full force and effect.

|

| |

c.

|

Non-Exclusive Rights and Remedies. The rights and remedies of the Company under this paragraph shall be in addition to any other available rights and remedies should the Individual breach any applicable obligations or should the Company discover any applicable after-acquired evidence, including without limitations remedies available under the Company’s clawback policies or procedures which may provide for forfeiture and/or recoupment of amounts and benefits paid, payable, or provided under this Agreement.

|

|

12.

|

Insider-Trading Obligations. The Individual acknowledges and agrees that he remains subject to the insider-trading policies and procedures of the Company and its affiliates through the Separation Date and, as such, may not during such period trade in their securities in accordance therewith until any material, non-public information he possesses has become public or is no longer material. The Individual further acknowledges and agrees that he shall remain subject to all federal and state securities laws applicable to the trading of securities of the Company or its affiliates while possessing knowledge of material non-public information regarding the Company and its affiliates.

|

|

13.

|

Nonadmission of Liability or Wrongdoing. The Individual acknowledges that (a) this Agreement shall not in any manner constitute an admission of liability or wrongdoing on the part of the Company or any of the other Released Parties; (b) the Company and the other Released Parties expressly deny any such liability or wrongdoing; and (c) except to the extent necessary to enforce this Agreement, neither this Agreement nor any part of it may be construed, used, or admitted into evidence in any judicial, administrative, or arbitral proceedings as an admission of any kind by the Company or any of the other Released Parties.

|

|

14.

|

Jury-Trial Waiver. THE INDIVIDUAL HEREBY WAIVES THE RIGHT TO TRIAL BY JURY WITH RESPECT TO ANY CLAIM AGAINST THE COMPANY OR ANY OF THE OTHER RELEASED PARTIES ARISING OUT OF OR RELATING TO THIS AGREEMENT, INCLUDING WITHOUT LIMITATION FOR BREACH OR ENFORCEMENT OF THIS AGREEMENT.

|

|

15.

|

Authority to Execute. The Individual represents and warrants that he has the authority to execute this Agreement on behalf of all of the Releasing Parties.

|

|

16.

|

Governing Law; Venue; Severability; Interpretation. This Agreement and the rights and duties of the parties under it shall be governed by the laws of the State of Texas, without regard to any conflict-of-laws principles. Exclusive venue for any Claim between the parties or their affiliates arising out of or related this Agreement is in any state or federal court of competent jurisdiction that regularly conducts proceedings in Harris County, Texas. Nothing in this Agreement, however, precludes either party from seeking to remove a civil action from any state court to federal court. The provisions of this Agreement shall be severable. If any one or more provisions of this Agreement may be determined by a court of competent jurisdiction to be illegal or otherwise unenforceable, in whole or in part, such provision shall be considered separate, distinct, and severable from the other remaining provisions of this Agreement, such a determination shall not affect the validity or enforceability of such other remaining provisions, and in all other respects the remaining provisions of this Agreement shall be binding and enforceable and remain in full force and effect. If any provision of this Agreement is held to be unenforceable as written by a court of competent jurisdiction but may be made to be enforceable by limitation, then such provision shall be enforceable to the maximum limit permitted by applicable law. The language of all parts of this Agreement shall in all cases be construed as a whole, according to its fair meaning, and not strictly for or against any of the parties.

|

|

17.

|

Assignment. The Individual’s obligations, rights, and benefits under this Agreement are personal to the Individual and shall not be assigned to any person or entity without written permission from the Company. This Agreement shall be binding upon and inure to the benefit of the parties and their respective heirs, legal representatives, successors, and permitted assigns.

|

|

18.

|

Nonassignment of Claims and Indemnification. The Individual represents and warrants that he has not assigned or transferred any part of his Claims or rights covered by this Agreement to anyone, including without limitation to his spouse. THE INDIVIDUAL SHALL INDEMNIFY THE COMPANY AND THE OTHER RELEASED PARTIES AND DEFEND AND HOLD THEM HARMLESS FROM AND AGAINST (A) ANY CLAIMS ARISING OUT OF OR RELATED TO ANY SUCH ASSIGNMENT OR TRANSFER, OR ANY SUCH PURPORTED ASSIGNMENT OR TRANSFER, OF ANY CLAIMS OR OTHER MATTERS RELEASED, ASSIGNED, OR TRANSFERRED IN THIS AGREEMENT; AND (B) ANY CLAIMS COVERED AND RELEASED BY THIS AGREEMENT BROUGHT BY ANY RELEASING PARTY AGAINST THE COMPANY OR ANY OF THE OTHER RELEASED PARTIES.

|

|

19.

|

Expiration Date. The offer of this Agreement to the Individual shall expire after a period of 21 days after the date the Individual first received this Agreement for consideration (the “Expiration Date”). Changes to this Agreement, whether material or immaterial, do not restart the running of the consideration period. The Individual may accept the offer at any time before the Expiration Date by signing this Agreement in the space provided below and returning it to the attention of the Company so that the signed Agreement is received no later than the close of business on the Expiration Date.

|

|

20.

|

Limited Revocation Right; Effect of Revocation. After signing this Agreement, the Individual shall have a period of seven days to reconsider and revoke his acceptance of this Agreement if he wishes (the “Revocation Period”). If the Individual chooses to revoke his acceptance of this Agreement, he must do so by providing written notice to the Company before the eighth day after signing this Agreement, in which case this Agreement shall not become effective or enforceable and the Individual shall not receive the Separation Benefits.

|

|

21.

|

Effective Date. This Agreement shall become effective and enforceable upon the expiration of seven days after the Individual signs it (the “Effective Date”), provided that he signs this Agreement on or before the Expiration Date and does not revoke his acceptance of this Agreement during the Revocation Period.

|

|

22.

|

Knowing and Voluntary Agreement; Right to Consult an Attorney. The Individual acknowledges that (a) he has been advised of his right, and encouraged by this paragraph, to consult with an attorney of his choice before signing this Agreement; (b) he has had a reasonable period in which to consider whether to sign this Agreement; (c) he fully understands the meaning and effect of signing this Agreement; and (d) his signing of this Agreement is knowing and voluntary.

|

|

23.

|

Independent Consideration; Common-Law Duties. Whether expressly stated in this Agreement or not, all obligations the Individual assumes and undertakings he makes by signing this Agreement are understood to be in consideration of the mutual promises and undertakings in this Agreement and the Separation Benefits. In addition, the Individual acknowledges and agrees that neither the Company nor any of the other Released Parties has any legal obligation to provide the Separation Benefits to him outside of this Agreement.

|

|

24.

|

Intended Third-Party Beneficiaries. The Released Parties are intended to be third-party beneficiaries of this Agreement and therefore may enforce this Agreement.

|

|

25.

|

Entire Agreement. This Agreement, as amended by the Ratification to be executed and delivered by the Individual on the last day of the Consulting Term, contains and represents the entire agreement of the parties with respect to its subject matters, and supersedes all prior agreements and understandings, written and oral, between the parties with respect to its subject matters. Notwithstanding the preceding sentence, nothing in this Agreement shall be interpreted or construed as superseding or relieving the Individual of his Continuing Obligations. The Individual agrees that neither the Company nor any of the other Released Parties has made any promise or representation to him concerning this Agreement not expressed in this Agreement, and that, in signing this Agreement, he is not relying on any prior oral or written statement or representation by the Company or any of the other Released Parties outside of this Agreement but is instead relying solely on his own judgment and his attorney and tax advisor (if any).

|

|

26.

|

Modification; Waiver. No provision of this Agreement shall be amended, modified, or waived unless such amendment, modification, or waiver is agreed to in writing and signed by the Individual and a duly authorized representative of the Company.

|

|

27.

|

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall be considered one and the same agreement. The delivery of this Agreement in the form of a clearly legible facsimile or electronically scanned version by e-mail shall have the same force and effect as delivery of the originally executed document.

|

|

28.

|

Internal Revenue Code Section 409A. The parties intend for all benefits provided to the Individual under this Agreement to be exempt from or comply with the provisions of Section 409A and not be subject to the tax imposed by Section 409A. The provisions of this Agreement shall be interpreted in a manner consistent with this intent.

|

|

29.

|

Right to Consult a Tax Advisor. Notwithstanding any contrary provision in this Agreement, the Individual shall be solely responsible for any risk that the tax treatment of the benefits under by this Agreement may be affected by Section 409A, which may impose significant adverse tax consequences on him, including accelerated taxation, a 20% additional tax, and interest. Because of the potential tax consequences, the Individual has the right, and is encouraged by this paragraph, to consult with a tax advisor of his choice before signing this Agreement.

|

[Signature Page Follows]

AGREED as of the dates signed below:

|

STABILIS SOLUTIONS, INC.

By: /s/ CASEY CRENSHAW

Casey Crenshaw

Executive Chairman of the Board of Directors

Date Signed: 01/31/2025

|

WESTERVELT T. BALLARD, JR.

By: /S/WESTERVELT T. BALLARD, JR.

Westervelt T. Ballard, Jr.

Date Signed: 02/02/2025

|

RELEASE AND RATIFICATION OF GENERAL RELEASE – PAGE 15

EXHIBIT A

RENEWAL AND RATIFICATION OF RELEASE

IMPORTANT NOTICE: The Individual should sign this Ratification only on the last day of the Consulting Term. The Individual should not sign this Ratification before the last day of the Consulting Term. Upon signing, the Individual should immediately return a signed copy of this Ratification to the Company.

1. The Individual previously entered a Release and Consulting Agreement with the Company (the “Release Agreement”) which is incorporated here by reference. Capitalized terms not defined in this Ratification shall have the same definitions as assigned in the Release Agreement.

2. Paragraph 6 of the Release Agreement contains a General Release. In exchange for the Separation Benefits offered to the Individual under paragraph 4 of the Release Agreement and the other promises and undertakings of the Company in the Release Agreement, the Individual hereby agrees that subparagraph 6(b) of the Release Agreement is hereby modified and amended to read in its entirety as follows:

Claims Included. This release includes without limitation any Claim arising out of or relating in any way to (i) the Individual’s employment or the termination of his employment with the Company or with the employment practices of any of the Released Parties and any compensation or benefits due from the Company or its affiliates or employees in connection with his employment with the Company or the other Released Parties not provided for in this Agreement; (ii) any federal, state, or local statutory or common law or constitutional provision that applies, or is asserted to apply, directly or indirectly, to the formation, continuation, or termination of the Individual’s employment relationship with the Company or the Released Parties, including without limit the Age Discrimination in Employment Act (“ADEA”); (iii) any contract, agreement, or arrangement between, concerning, or relating to the Individual and any of the Released Parties, including without limitation, the Plan, the Employment Agreement, and any other agreement or arrangement or alleged agreement or arrangement; (iv) the Individual’s relationship with the Released Parties; and (v) any other alleged act, breach, conduct, negligence, gross negligence, or omission of any of the Released Parties, including without limitation any breach of fiduciary duty or fraudulent inducement to enter into this Agreement by or on behalf of any of the Releasing Parties. This release also includes without limitation the waiver and release of any Claim the Individual may have on the date the Ratification is signed by him and delivered by him to the Company.

In addition, the Individual ratifies his acceptance of General Release under paragraph 6 of the Release Agreement, as so modified and amended, and acknowledges he is hereby advised of his right to consult with an attorney of his choice before signing this Ratification.

RELEASE AND CONSULTING AGREEMENT

SIGNATURE PAGE

3. This Ratification shall become effective and enforceable upon the eighth (8th) day after the Individual signs and returns it to the Company (the “Effective Date”). At any time before the Effective Date, the Individual may revoke his acceptance of this Ratification by notifying the Company of her revocation in writing.

4. If the Individual does not sign this Ratification, or if he timely revokes his acceptance of this Ratification, he shall not be entitled to receive any part of the Separation Benefits and he shall immediately repay or return to the Company all Separation Benefits previously received by him. If the Individual signs and does not timely revoke his acceptance of this Ratification, the Separation Benefits shall be provided to him in accordance with the Release Agreement’s terms.

5. The Individual fully understands the meaning and effect of his action in signing this Ratification, and her signing of this Ratification is knowing and voluntary.

6. This Ratification does not waive any rights or claims under the Age Discrimination in Employment Act that may arise after the date it is signed by her.

AGREED on the date shown below:

| |

|

|

| |

Westervelt T. Ballard, Jr. |

|

| |

|

|

| |

|

|

| |

Date Signed |

|

RELEASE AND CONSULTING AGREEMENT

SIGNATURE PAGE

Exhibit 99.1

Stabilis Solutions Announces Management Transition

HOUSTON, TX / February 3, 2025 / Stabilis Solutions, Inc. (“Stabilis” or the “Company”) (Nasdaq: SLNG), today announced the departure of President and CEO Westervelt T. “Westy” Ballard, Jr., effective January 31, 2025. This decision reflects a mutual understanding between both the Board of Directors and Mr. Ballard as Stabilis embarks on its next phase of strategic growth. Mr. Ballard will serve in a consulting capacity through the end of 2025 to ensure a smooth transition.

J. Casey Crenshaw, Executive Chairman and a majority shareholder of Stabilis, has been named interim President and CEO. Mr. Crenshaw will assume day-to-day leadership responsibilities and will lead the Board of Directors’ search for the Company’s next Chief Executive Officer.

“During his tenure, Westy optimized the Company’s business and strengthened the foundation for profitable growth, one that further positions Stabilis for long-term value creation,” stated Mr. Crenshaw. “We are grateful for his leadership and wish him great success in his future endeavors.”

Mr. Crenshaw continued “Stabilis has a leading position in the growing small-scale LNG market, and I am excited to lead the Company through this next phase as we accelerate our growth.”

Mr. Crenshaw currently serves as President & CEO of The Modern Group, Ltd., a privately-held conglomerate of diversified manufacturing, parts and distribution, rental, leasing and finance businesses headquartered in Beaumont, Texas. Mr. Crenshaw, together with his wife, Stacey Crenshaw, co-founded Stabilis in 2013.

Stabilis’ Board of Directors remains committed to prioritizing growth and advancing the Company’s existing value creation strategy. Stabilis will continue to deliver last-mile LNG production, storage, transportation and fueling solutions across both established and emerging growth markets, consistent with the Company’s ongoing commitment to its established network of valued customers, partners, and stakeholders.

About Stabilis Solutions

Stabilis Solutions, Inc. is a leading provider of clean fueling, production, storage, and last mile delivery solutions for many of the world’s most recognized, high-performance brands. To learn more, visit www.stabilis-solutions.com.

Investor Contact:

Andrew Puhala

Chief Financial Officer

832-456-6502

ir@stabilis-solutions.com

v3.25.0.1

Document And Entity Information

|

Feb. 03, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Stabilis Solutions, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 31, 2025

|

| Entity, Incorporation, State or Country Code |

FL

|

| Entity, File Number |

001-40364

|

| Entity, Tax Identification Number |

59-3410234

|

| Entity, Address, Address Line One |

11750 Katy Freeway Suite 900

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77079

|

| City Area Code |

832

|

| Local Phone Number |

456-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.001 par value

|

| Trading Symbol |

SLNG

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001043186

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

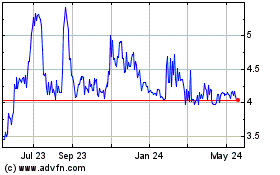

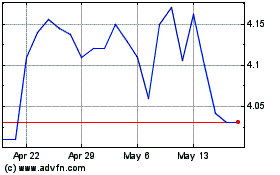

Stabilis Solutions (NASDAQ:SLNG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Stabilis Solutions (NASDAQ:SLNG)

Historical Stock Chart

From Feb 2024 to Feb 2025