Tradeweb Markets Inc. (Nasdaq: TW), a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets has announced that FTSE Russell will make a price source

change to include Tradeweb FTSE benchmark closing prices for U.S.

Treasuries, European Government Bonds and UK Gilts in FTSE’s global

fixed income indices, including its premiere World Government Bond

Index (WGBI).

FTSE Russell disclosed this change during its semi-annual

country classification announcement on October 8th, 2024. The WGBI,

which was launched 40 years ago, measures the performance of

fixed-rate, local currency, investment-grade bonds and comprises

sovereign debt from over 25 countries, denominated in a variety of

currencies, and with a market value of more than $30 trillion. The

inclusion of Tradeweb FTSE Closing Prices is expected to go into

effect in March 2025.

These benchmark prices are administered by FTSE Russell in

accordance with the EU and UK Benchmark Regulation and the IOSCO

Principles for Financial Benchmarks and can be used in index

construction, as well as reference rates for a broad range of use

cases, including trade-at-close transactions and derivatives

contracts.

Lisa Schirf, Global Head of Data & Analytics at Tradeweb,

said: “The World Government Bond Index is FTSE’s flagship global

index and a leading global benchmark for fixed income markets. The

inclusion of Tradeweb’s benchmark closing prices in FTSE’s indices

validates our continued commitment to develop the next generation

of fixed income pricing and index trading products for traders and

investors worldwide.”

The existing partnership between Tradeweb and FTSE Russell was

announced in October 2023 and included the development of benchmark

closing prices, which would be administered by FTSE Russell and

derived from trading activity on Tradeweb’s platform. In June 2024,

Tradeweb announced the launch of Tradeweb FTSE U.S. Treasury

closing prices, utilizing an enhanced methodology, which also

facilitates the calculation of bid and offer prices. Most recently,

this methodology was extended to UK Gilts and European Government

Bonds and is available for clients today.

Scott Harman, Head of Fixed Income, Currencies and Commodities

at FTSE Russell, said: “We’re pleased to announce the price source

change within our global fixed income indices to include Tradeweb

FTSE closing prices for these significant global rates markets. It

ensures our indices continue to incorporate transparent,

representative data sets across the diverse universe of fixed

income markets that they track. Additionally, FTSE Russell’s

benchmark administration of these prices brings a new level of

transparency and rigorousness to the valuation of fixed income

markets and our indices.”

In addition to providing benchmark closing prices, Tradeweb

plans to expand and enhance electronic trading functionality for

FTSE Russell Fixed Income indices and customized baskets through

tools and protocols such as RFQ (request-for-quote), AiEX

(Automated Intelligent Execution tool) and Portfolio Trading,

offering trade-at-market close, trade-at-month-end and other

features conducive to index rebalancing trades. For clients seeking

to efficiently express a view on FTSE Russell indices and baskets,

providing enhanced trading functionality can help efficiently

manage what are often their largest and most critical trades.

FTSE Russell is a business owned by the London Stock Exchange

plc (“LSEG”). LSEG is the controlling shareholder of Tradeweb.

About Tradeweb Markets:

Tradeweb Markets Inc. (Nasdaq: TW) is a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets. Founded in 1996, Tradeweb provides access to markets, data

and analytics, electronic trading, straight-through-processing and

reporting for more than 50 products to clients in the

institutional, wholesale, retail and corporates markets. Advanced

technologies developed by Tradeweb enhance price discovery, order

execution and trade workflows while allowing for greater scale and

helping to reduce risks in client trading operations. Tradeweb

serves more than 2,800 clients in more than 70 countries. On

average, Tradeweb facilitated more than $1.9 trillion in notional

value traded per day over the past four fiscal quarters. For more

information, please go to www.tradeweb.com.

Forward-Looking Statements:

This release contains forward-looking statements within the

meaning of the federal securities laws. Statements related to,

among other things, our outlook and future performance, the

industry and markets in which we operate, our expectations,

beliefs, plans, strategies, objectives, prospects and assumptions

and future events are forward-looking statements.

We have based these forward-looking statements on our current

expectations, assumptions, estimates and projections. While we

believe these expectations, assumptions, estimates and projections

are reasonable, such forward-looking statements are only

predictions and involve known and unknown risks and uncertainties,

many of which are beyond our control. These and other important

factors, including those discussed under the heading “Risk Factors”

in the documents of Tradeweb Markets Inc. on file with or furnished

to the SEC, may cause our actual results, performance or

achievements to differ materially from those expressed or implied

by these forward-looking statements. In particular, preliminary

average variable fees per million dollars of volume traded are

subject to the completion of management’s final review and our

other financial closing procedures and therefore are subject to

change. Given these risks and uncertainties, you are cautioned not

to place undue reliance on such forward-looking statements. The

forward-looking statements contained in this release are not

guarantees of future events or performance and future events, our

actual results of operations, financial condition or liquidity, and

the development of the industry and markets in which we operate,

may differ materially from the forward-looking statements contained

in this release. In addition, even if future events, our results of

operations, financial condition or liquidity, and events in the

industry and markets in which we operate, are consistent with the

forward-looking statements contained in this release, they may not

be predictive of events, results or developments in future

periods.

Any forward-looking statement that we make in this release

speaks only as of the date of such statement. Except as required by

law, we do not undertake any obligation to update or revise, or to

publicly announce any update or revision to, any of the

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241014818230/en/

Media contact: Daniel Noonan, Tradeweb +1 646 767 4677

Daniel.Noonan@Tradeweb.com Investor contacts: Ashley Serrao,

Tradeweb +1 646 430 6027 Ashley.Serrao@Tradeweb.com Sameer

Murukutla, Tradeweb +1 646 767 4864

Sameer.Murukutla@Tradeweb.com

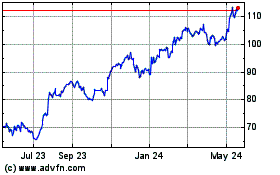

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Nov 2024 to Dec 2024

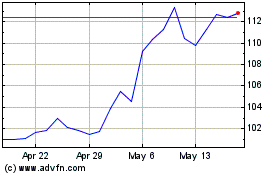

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Dec 2023 to Dec 2024