As

filed with the Securities and Exchange Commission on August 28, 2024.

Registration

No. 333-281065

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT

NO. 3 to

FORM

F-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

VIVOPOWER

INTERNATIONAL PLC

(Exact

name of Registrant as specified in its charter)

Not

Applicable

(Translation

of Registrant’s name into English)

| England

and Wales |

|

4931 |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

No.) |

VivoPower

International PLC

The

Scalpel, 18th Floor, 52 Lime Street

London

EC3M 7AF

United

Kingdom

+44-794-116-6696

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Corporation

Service Company

251

Little Falls Drive Wilmington, DE 19808

United

States

Telephone:

+1 302 636 5400

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies

to:

Elliott

M. Smith

White

& Case LLP

1221

Avenue of the Americas

New

York, New York 10020

Telephone:

(212) 819-8200 |

Louis

Taubman

Hunter

Taubman Fischer & Li LLC

950

Third Avenue, 19th Floor

New

York, NY 10022

Telephone:

(917) 512-0827 |

Approximate

date of commencement of proposed sale to the public: as and when appropriate after the effective date of this registration statement.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, as amended, check the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth

company ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the U.S. Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY

NOTE

This

Amendment No. 3 to the Registration Statement on Form F-1 (File No. 333-281065) of VivoPower International PLC. is being filed solely

for the purpose of filing revised Exhibit 23.1 and Exhibit 107 to the Registration Statement. Accordingly, this Amendment consists of

the facing page, this explanatory note, Part II of the Registration Statement (including the signature page and the exhibits index) and

the filed exhibits only. The prospectus, constituting Part I of the Registration Statement, is unchanged and has therefore been omitted.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

6. Indemnification of directors and officers

The

Registrant’s articles of association provide that, subject to the Companies Act 2006, every person who is or was of any time a

director of the Registrant or a director of an associated company of the Registrant may be indemnified against losses or liabilities

incurred by him in relation to the Registrant or any associated company of the Registrant.

The

Registrant also maintains directors and officers insurance to insure such persons against certain liabilities.

Item

7. Recent sales of unregistered securities

In

the three years preceding the filing of this registration statement, we have issued the following securities that were not registered

under the Securities Act:

On

July 29, 2022, we issued to an investor in a private placement Series A Warrants exercisable for an aggregate of 423,077 Ordinary Shares

at an exercise price of $13.0 per share. Each Series A Warrant was exercisable on February 2, 2023 and will expire on February 2, 2028.

From

September 1, 2019 through the filing date of this registration statement, we granted to our directors, officers, employees, consultants

and other service providers an aggregate of 207,800 restricted stock units, performance stock units and stock options to be settled in

shares of our Ordinary Stock under our 2017 Omnibus Incentive Plan and award agreements.

The

offers, sales and issuances of the securities described above were deemed to be exempt from registration either under Rule 701 promulgated

under the Securities Act, in that the transactions were under compensatory benefit plans and contracts relating to compensation, or under

Section 4(a)(2) in that the transactions were between an issuer and members of its senior executive management and did not involve any

public offering within the meaning of Section 4(a)(2). The recipients of such securities were our employees, directors, or consultants

and received the securities under our equity incentive plans. Appropriate legends were affixed to the securities issued in these transactions.

None

of the foregoing transactions involved any underwriters, underwriting discounts or commissions, or any public offering. We believe the

offers, sales and issuances of the above securities were exempt from registration under the Securities Act (or Regulation D or Regulation

S promulgated thereunder) by virtue of Section 4(a)(2) of the Securities Act because the issuance of securities to the recipients did

not involve a public offering. The recipients of the securities in each of these transactions represented their intentions to acquire

the securities for investment only and not with a view to or for sale in connection with any distribution thereof, and appropriate legends

were placed upon the stock certificates issued in these transactions. All recipients had adequate access, through their relationships

with us, to information about us. The sales of these securities were made without any general solicitation or advertising.

Item

8. Exhibits

Exhibit

Number

|

|

Description |

| 3.1 |

|

Articles of Association (incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form F-4 (File No. 333-213297), filed with the SEC on November 16, 2016). |

| 4.1 |

|

Form of Specimen Certificate Evidencing Ordinary Shares. (incorporated by reference to Exhibit 4.1 to the Company’s Registration Statement on Form F-4 (File No. 333-213297), filed with the SEC on August 24, 2016). |

| 5.1** |

|

Opinion of Shoosmiths LLP, U.K. counsel to the Registrant, with respect to the legality of securities being registered. |

| 10.1 |

|

Omnibus Incentive Plan, adopted September 5, 2017 and amended July 28, 2023 (incorporated by reference to Exhibit 99.1 to the Registration Statement on Form S-8 (File No. 333-273520), filed with the SEC on July 28, 2023). |

| 10.2 |

|

Equity Distribution Agreement, dated November 12, 2021, between VivoPower International PLC and A.G.P./Alliance Global Partners (incorporated by reference to Exhibit 10.1 to the Current Report on Form 6-K (File No. 001-37974), filed with the SEC on November 21, 2021). |

| 10.3 |

|

Amendment No. 1 to Equity Distribution Agreement, dated July 29, 2022, between VivoPower International PLC and A.G.P./Alliance Global Partners (incorporated by reference to Exhibit 10.1 to the Current Report Form 6-K (File No. 001-37974), filed with the SEC on July 29, 2022). |

| 10.4 |

|

Strategic Direct Investment in Tembo dated June 28, 2023 (incorporated by reference to Exhibit 99.1 to the Current Report on Form 6-K (File No. 001-37974), filed with the SEC on June 28, 2023). |

| 10.5 |

|

Placement Agency Agreement, dated July 29, 2022, between VivoPower International PLC and A.G.P./Alliance Global Partners (incorporated by reference to Exhibit 1.1 to the Current Report on Form 6-K (File No. 001-37974), filed with the SEC on August 2, 2022). |

| 10.6 |

|

Form of Series A Warrant (incorporated by reference to Exhibit 4.1 to the Current Report on Form 6-K (File No. 001-37974), filed with the SEC on August 2, 2022). |

| 10.7 |

|

Form of Pre-Funded Warrant (incorporated by reference to Exhibit 4.2 to the Current Report on Form 6-K (File No. 001-37974), filed with the SEC on August 2, 2022). |

| 10.8 |

|

Form of Securities Purchase Agreement, dated July 29, 2022, between VivoPower International PLC and the purchaser identified therein (incorporated by reference to Exhibit 10.1 to the Current Report on Form 6-K (File No. 001-37974), filed with the SEC on August 2, 2022). |

| 10.9 |

|

Refinancing of Loan Arrangements, dated June 30, 2023, between AWN Holdings Limited and Aevitas O Holdings Pty Ltd. (incorporated by reference to Exhibit 4.9 to the Annual Report on Form 20-F/A, filed with the SEC on March 20, 2024). |

| 10.10 |

|

Advance Subscription Agreement, dated June 23, 2023, between TAG Intl DMCC and Tembo E-LV (incorporated by reference to Exhibit 4.10 to the Annual Report on Form 20-F/A, filed with the SEC on March 20, 2024). |

| 10.11 |

|

Form of Subscription Agreement, dated June 9, 2023, between VivoPower International PLC and ASEAN Foundation (incorporated by reference to Exhibit 10.1 to the Current Report on Form 6-K (File No 001-37974), filed with the SEC on June 13, 2023). |

| 10.12 |

|

Form of Purchase Warrant (incorporated by reference to Exhibit 4.1 to the Current Report on Form 6-K (File No. 001-37974), filed with the SEC on June 13, 2023). |

| 10.13** |

|

Form of Placement Agency Agreement. |

| 10.14** |

|

Form of Securities Purchase Agreement. |

| 21.1** |

|

List of Subsidiaries. |

| 23.1* |

|

Consent of PKF Littlejohn LLP |

| 23.2** |

|

Consent of Shoosmiths LLP (see Exhibit 5.1). |

| 24.1** |

|

Powers of Attorney (See signature page to the initial registration statement). |

| 107* |

|

Fee Filing Table. |

| * |

Filed

herewith. |

| ** |

Previously

filed. |

| (b) |

Financial

Statement Schedules |

All

Schedules have been omitted because the information required to be presented in them is not applicable or is shown in the consolidated

financial statements or related notes.

Item

9. Undertakings

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of

the registrant pursuant to the provisions described in Item 6, or otherwise, the registrant has been advised that in the opinion of the

SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In

the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or

paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication

of such issue.

The

undersigned registrant hereby undertakes:

(a)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(1)

To include any prospectus required by section 10(a)(3) of the Securities Act;

(2)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information in the registration statement.

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered

would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be

reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and

price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement;

(3)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement.

(b)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(c)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(d)

To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A. of Form 20-F

at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by

Section 10(a)(3) of the Act need not be furnished, provided that the registrant includes in the prospectus, by means of a post-effective

amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information

in the prospectus is at least as current as the date of those financial statements.

(e)

That, for the purpose of determining liability under the Securities Act to any purchaser: each prospectus filed pursuant to Rule 424(b)

as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses

filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used

after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify

any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such

document immediately prior to such date of first use.

(f)

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution

of the securities the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

(1)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

(2)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

(3)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(4)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(g)

For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part

of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant pursuant to Rule

424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared

effective.

(h)

For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form F-1 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in City of London, United Kingdom, on August 28, 2024.

| VIVOPOWER

INTERNATIONAL PLC |

|

| |

|

|

| By: |

/s/

Kevin Chin |

|

| Name: |

Kevin

Chin |

|

| Title: |

Chief

Executive Officer, Executive Chairman and Director |

|

POWER

OF ATTORNEY

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities

and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Kevin Chin |

|

Chief

Executive Officer, Executive |

|

|

| Kevin

Chin |

|

Chairman

and Director (Principal Executive Officer) |

|

August

28, 2024 |

| |

|

|

|

|

| /s/

Gary Challinor |

|

Chief

Financial Officer (Principal |

|

|

| Gary

Challinor |

|

Financial

and Accounting Officer) |

|

August

28, 2024 |

| |

|

|

|

|

| /s/

Michael Hui |

|

|

|

|

| Michael

Hui |

|

Director |

|

August

28, 2024 |

| |

|

|

|

|

| /s/

Peter Jeavons |

|

|

|

|

| Peter

Jeavons |

|

Director |

|

August

28, 2024 |

| |

|

|

|

|

| /s/

William Langdon |

|

|

|

|

| William

Langdon |

|

Director |

|

August

28, 2024 |

SIGNATURE

OF AUTHORIZED U.S. REPRESENTATIVE OF THE REGISTRANT

Pursuant

to the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of VivoPower International PLC

has signed this registration statement or amendment thereto on August 28, 2024.

| VIVOPOWER

INTERNATIONAL PLC |

|

| |

|

|

| By: |

/s/

Gary Challinor |

|

| Name: |

Gary

Challinor |

|

| Title: |

Chief

Financial Officer |

|

Exhibit

23.1

VivoPower

International PLC

The

Scalpel

18th

Floor

52

Lime Street

London

EC3M

7AF

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

hereby consent to the use in this Registration Statement on Form F-1 of VivoPower International plc filed with the Securities and Exchange

Commission (the “SEC”) on August 26, 2024, of our report dated October 2, 2023 relating to the financial statements of VivoPower

International plc, which appears in this Registration Statement.

We

also consent to the reference to us under the heading “Experts” in such Registration Statement.

Sincerely,

PKF

Littlejohn LLP

London,

England

August

26, 2024

Exhibit

107

Calculation

of Filing Fee Table

Form

F-1

(Form

Type)

VivoPower

International PLC

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| | |

Security Type | |

Security Class Title | |

Fee Calculation Rule | |

Amount Registered (1) | | |

Proposed Maximum Offering Price Per

Unit (2) | | |

Maximum Aggregate Offering Price (1)(2) | | |

Fee Rate | | |

Amount of Registration Fee | |

| Fees to be Paid | |

Equity | |

Ordinary Shares, par value $0.12 per share | |

Rule 457(a) | |

| 10,000,000 | | |

$ | 2.50 | | |

$ | 25,000,000 | | |

| 0.00014760 | | |

$ | 3,690.00 | |

| | |

| |

Total Offering Amounts | |

| |

| | | |

| | | |

$ | 25,000,000 | | |

| | | |

$ | 3,690.00 | |

| | |

| |

Total Fees Previously Paid | |

| |

| | | |

| | | |

| | | |

| | | |

| 3,690.00 | |

| | |

| |

Total Fee Offsets | |

| |

| | | |

| | | |

| | | |

| | | |

$ | 4,998.33 | |

| | |

| |

Net Fee Due | |

| |

| | | |

| | | |

| | | |

| | | |

$ | 0 | |

| (1) |

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the ordinary shares being

registered hereunder include such indeterminate number of ordinary shares as may be issuable with respect to the ordinary shares

being registered hereunder as a result of stock splits, stock dividends or similar transactions. |

| |

|

| (2) |

Estimated solely for purposes

of calculating the amount of the registration fee pursuant to Rule 457(a) under the Securities Act. |

Table

2: Fee Offset Claims and Sources

| | |

Registrant

or

Filer Name | |

Form

or Filing

Type | |

File

Number | |

Initial

Filing

Date | |

Filing

Date | |

Fee

Offset

Claimed | | |

Security

Type

Associated

with Fee Offset

Claimed | |

Security

Title

Associated

with Fee Offset

Claimed | |

Unsold

Securities

Associated

with Fee Offset

Claimed | |

Unsold

Aggregate

Offering

Amount

Associated

with Fee Offset

Claimed | | |

Fee

Paid with

Fee Offset

Source | |

| | |

Rule

457(p) |

| Fee Offset Claims | |

VivoPower International

PLC | |

F-3 | |

333-251304 | |

December 11,

2020 | |

| |

$ | 7,655.13 | | |

Unallocated (Universal)

Shelf | |

(1) | |

(1) | |

$ | 70,166,176 | | |

|

|

|

| Fees

Offset Sources | |

VivoPower

International PLC | |

F-3 | |

333-251304 | |

| |

December

11, 2020 | |

| | | |

| |

| |

| |

| | | |

$ |

7,655.13 |

(1) |

| (1) |

On December 11, 2020, the

Registrant filed a registration statement on Form F-3 (File No. 333-251304) (the “Prior Registration Statement”) with

the Securities and Exchange Commission registering an indeterminate number of securities with a proposed maximum aggregate offering

price of $80,000,000. Pursuant to Rule 457(p) under the Securities Act, the Registrant is offsetting the registration fee due under

this registration statement by the portion of the registration fee previously paid with respect to $70,166,176 of unsold securities

(the “Unsold Offset Securities”) previously registered on the Prior Registration Statement. On January 12, 2024, the

Registrant filed a registration statement on Form F-3 (File No. 333-276509) with the Securities Exchange Commission registering an

indeterminate number of securities with a proposed maximum aggregate offering price of $18,000,000 (the “January Registration

Statement”). Pursuant to Rule 457(p), the Registrant utilized $2,656.80 of the $7,655.13 registration fee relating to the Unsold

Offset Securities to offset the registration fee on the securities sold on the January Registration Statement. The offering of the

Unsold Offset Securities pursuant to the Prior Registration Statement associated with the claimed fee offset pursuant to Rule 457(p)

have been completed or terminated. |

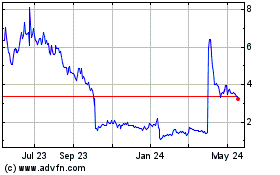

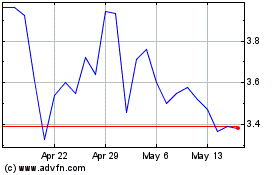

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Nov 2023 to Nov 2024